Money and Finance

Wow the markets have been taking a beating here lately and there's some stocks out there looking pretty cheap. The market volatility coupled with some troubling company headwinds are hitting some stocks extra hard. GSK is certainly not immune to such troubles as the stock has been suffering from slowing sales, job cuts and skepticism about the Novartis deal. Rumors about a takeover are looming but nothing more than rumors at this point. All of this has pulled the stock down to the low $40's and a juicy near 6% yield so I thought I'd average down a bit here.

Wow the markets have been taking a beating here lately and there's some stocks out there looking pretty cheap. The market volatility coupled with some troubling company headwinds are hitting some stocks extra hard. GSK is certainly not immune to such troubles as the stock has been suffering from slowing sales, job cuts and skepticism about the Novartis deal. Rumors about a takeover are looming but nothing more than rumors at this point. All of this has pulled the stock down to the low $40's and a juicy near 6% yield so I thought I'd average down a bit here.

I have a feeling I may make another purchase this month and I have my eye on a few names including IBM, BBL, T, KMI, CVX, and XOM. Hopefully Santa is good to me so I can get some shares while there's a fire sale! :-o

I purchased 29 shares of GlaxoSmithKline (GSK) @ $42.39

GlaxoSmithKline plc (GSK) is a British multinational pharmaceutical, biologics, vaccines and consumer healthcare company which has its headquarters in Brentford, London. As of March 2014, it was the world's sixth-largest pharmaceutical company. GSK is engaged in the creation and discovery, development, manufacture and marketing of pharmaceutical products, including vaccines, over-the-counter (OTC) medicines and health-related consumer products. GSK’s principal pharmaceutical products include medicines in therapeutic areas: respiratory, anti-virals, central nervous system, cardiovascular and urogenital, metabolic, antibacterials, oncology and emesis, dermatology, rare diseases, immuno-inflammation, vaccines and human immunodeficiency virus (HIV). The Company operates in three primary areas of business: Pharmaceuticals, Vaccines and Consumer Healthcare.

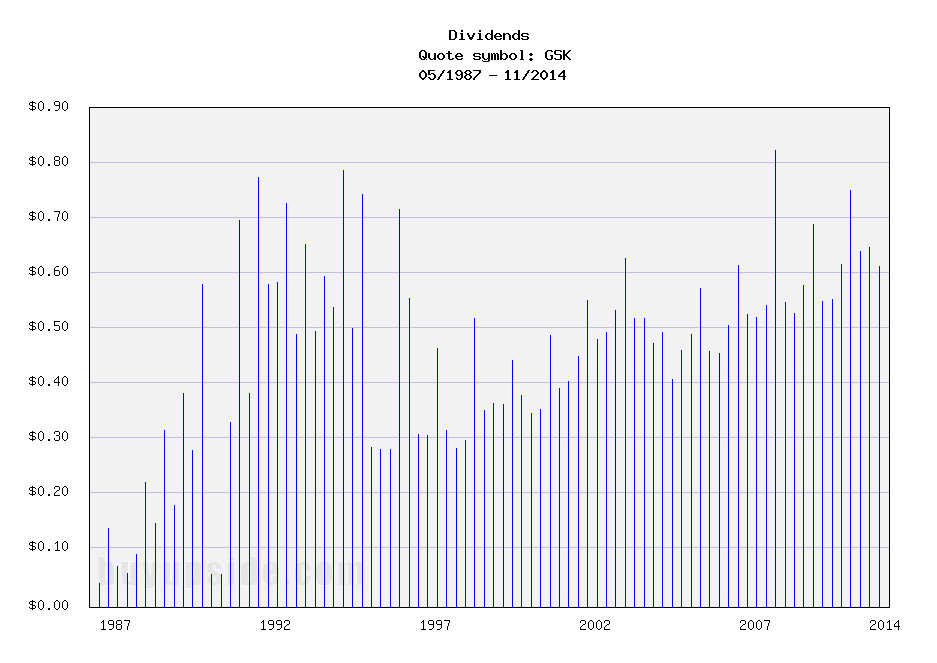

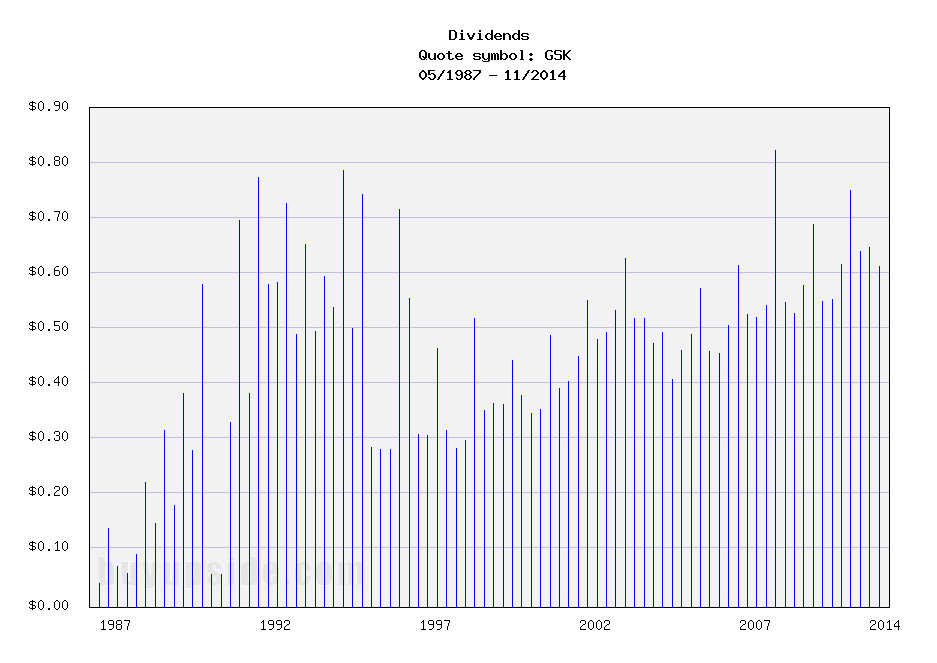

GSK Dividend Growth

Note the crazy dividend is due to currency fluctuations but the trend is upwards at around 6.5% in the past 5 yrs.

- Johnson And Johnson Dividend Stock Analysis

I've been meaning to revisit my analysis on Johnson and Johnson since it's been a year since I first looked at them. I've learned so much more about stock analysis in that time so this will be more thorough and hopefully more insightful....

- High Yield Reads - 8/18/14

Summary of recent stories of interest, sometimes enduring, to investors: The Wide Moat Dividend portfolio (model portfolio) is designed to produce income and total returns, not drama. But there has been fair amount of the latter. There are only...

- Recent Buy - Johnson & Johnson

Earlier this week I purchased shares of Johnson & Johnson. I was having a tough time choosing between a few stocks on my watch list including PG, IBM, PEP and UL but ultimately went with JNJ. This monster of a company will continue to grow earnings...

- Recent Buy - Johnson & Johnson (jnj)

After spending the better part of last night watching the Star Wars trailer over and over I figured I'd better get around to posting about my latest purchase! This time around I was trying to decide which stock to purchase and it came down to three...

- Recent Buy - Johnson & Johnson (jnj)

Hi Everyone, Finally, my last purchase with funds left over from last year. I'm having mixed emotions thinking about writing this post. I'm thrilled to add more income to the portfolio but I'm fresh out of extra capital to invest...

Money and Finance

Recent Buy - GlaxoSmithKline (GSK)

I have a feeling I may make another purchase this month and I have my eye on a few names including IBM, BBL, T, KMI, CVX, and XOM. Hopefully Santa is good to me so I can get some shares while there's a fire sale! :-o

I purchased 29 shares of GlaxoSmithKline (GSK) @ $42.39

GlaxoSmithKline plc (GSK) is a British multinational pharmaceutical, biologics, vaccines and consumer healthcare company which has its headquarters in Brentford, London. As of March 2014, it was the world's sixth-largest pharmaceutical company. GSK is engaged in the creation and discovery, development, manufacture and marketing of pharmaceutical products, including vaccines, over-the-counter (OTC) medicines and health-related consumer products. GSK’s principal pharmaceutical products include medicines in therapeutic areas: respiratory, anti-virals, central nervous system, cardiovascular and urogenital, metabolic, antibacterials, oncology and emesis, dermatology, rare diseases, immuno-inflammation, vaccines and human immunodeficiency virus (HIV). The Company operates in three primary areas of business: Pharmaceuticals, Vaccines and Consumer Healthcare.

GSK Stock Chart

GIS Basic Statistics

- Ticker Symbol: GSK

- PE Ratio: 14.3

- Yield: 5.94%

- Payout Ratio: 90%

- Market cap: $99b

- Beta: 0.86

- Website: http://www.gsk.com

GSK Dividend Growth

Note the crazy dividend is due to currency fluctuations but the trend is upwards at around 6.5% in the past 5 yrs.

- Johnson And Johnson Dividend Stock Analysis

I've been meaning to revisit my analysis on Johnson and Johnson since it's been a year since I first looked at them. I've learned so much more about stock analysis in that time so this will be more thorough and hopefully more insightful....

- High Yield Reads - 8/18/14

Summary of recent stories of interest, sometimes enduring, to investors: The Wide Moat Dividend portfolio (model portfolio) is designed to produce income and total returns, not drama. But there has been fair amount of the latter. There are only...

- Recent Buy - Johnson & Johnson

Earlier this week I purchased shares of Johnson & Johnson. I was having a tough time choosing between a few stocks on my watch list including PG, IBM, PEP and UL but ultimately went with JNJ. This monster of a company will continue to grow earnings...

- Recent Buy - Johnson & Johnson (jnj)

After spending the better part of last night watching the Star Wars trailer over and over I figured I'd better get around to posting about my latest purchase! This time around I was trying to decide which stock to purchase and it came down to three...

- Recent Buy - Johnson & Johnson (jnj)

Hi Everyone, Finally, my last purchase with funds left over from last year. I'm having mixed emotions thinking about writing this post. I'm thrilled to add more income to the portfolio but I'm fresh out of extra capital to invest...