Money and Finance

One of the main metrics in the Snowball Portfolio is the 5+5 rule, which I learned from Daniel Peris' excellent book - Strategic Dividend Investor (side note- Peris can write and is a man who really loves his dividends). Like most useful rules, its very simple - look for a combination of 5 percentage points of current dividend yield plus 5 percentage points of dividend growth. The total should be at least ten percentage points, so a company with a 3% dividend yield would need at least 7% dividend growth to clear the bar. Likewise a high yielding company with say 8% would only need a tepid 2% growth to get over the 5+5 hurdle.

One of the main metrics in the Snowball Portfolio is the 5+5 rule, which I learned from Daniel Peris' excellent book - Strategic Dividend Investor (side note- Peris can write and is a man who really loves his dividends). Like most useful rules, its very simple - look for a combination of 5 percentage points of current dividend yield plus 5 percentage points of dividend growth. The total should be at least ten percentage points, so a company with a 3% dividend yield would need at least 7% dividend growth to clear the bar. Likewise a high yielding company with say 8% would only need a tepid 2% growth to get over the 5+5 hurdle.

The rule is not about mathematical precision as much as its about orienting your frame of reference for investment selection and ongoing portfolio management - what am i looking for with this investment? What does "good enough" look like?

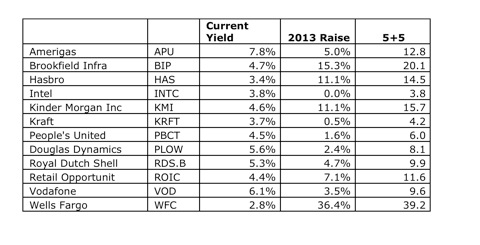

Its not the only metric, and probably not even the most important one, but its handy test that you can run every year to do a checkup based on your goals. Having hurdle rates for each company sets the expectations on what you're looking for for each kind of company. Is it a lower yielding but higher growing company or a high yield, steady as she goes? The Snowball Portfolio has both kinds. Here is the current check up for how many companies have cleared the 5+5 hurdle for 2013.

Overall I am pleased with the progress. Amerigas, Brookfield Infrastructure, Hasbro, Kinder Morgan, Retail Opportunity, and Wells Fargo have all cleared the bar. Royal Dutch Shell and Vodafone are pretty close.

Overall I am pleased with the progress. Amerigas, Brookfield Infrastructure, Hasbro, Kinder Morgan, Retail Opportunity, and Wells Fargo have all cleared the bar. Royal Dutch Shell and Vodafone are pretty close.

The other piece of the analysis is identifying those companies not clearing the bar. When will we see a meaningful dividend increase from Intel, Kraft, People's United, and Douglas Dynamics? Its not something to panic about in any of these cases, in my view, but its good to be aware. So from an ongoing monitoring standpoint the simple 5+5 Rule helps you focus on companies and could signal places where they might stall out.

Its just one way to combine data points, but its a tool I have found it useful both on the selection part f the process as well as on the ongoing monitoring and management part of the process.

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...

Money and Finance

Portfolio Review with the 5+5 Rule

The rule is not about mathematical precision as much as its about orienting your frame of reference for investment selection and ongoing portfolio management - what am i looking for with this investment? What does "good enough" look like?

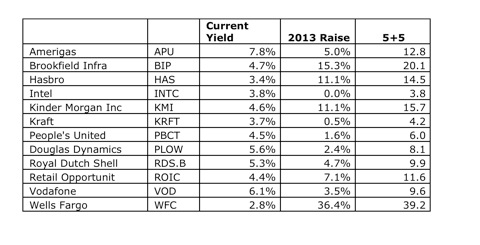

Its not the only metric, and probably not even the most important one, but its handy test that you can run every year to do a checkup based on your goals. Having hurdle rates for each company sets the expectations on what you're looking for for each kind of company. Is it a lower yielding but higher growing company or a high yield, steady as she goes? The Snowball Portfolio has both kinds. Here is the current check up for how many companies have cleared the 5+5 hurdle for 2013.

The other piece of the analysis is identifying those companies not clearing the bar. When will we see a meaningful dividend increase from Intel, Kraft, People's United, and Douglas Dynamics? Its not something to panic about in any of these cases, in my view, but its good to be aware. So from an ongoing monitoring standpoint the simple 5+5 Rule helps you focus on companies and could signal places where they might stall out.

Its just one way to combine data points, but its a tool I have found it useful both on the selection part f the process as well as on the ongoing monitoring and management part of the process.

- Dividend Growth Checkup

As part of my annual review process for my portfolio, I read through the latest quarterly or annual reports for the companies I own, as well as checked up on the organic dividend growth for each position and for the portfolio as a whole. The dividend...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...

- Dividend Compass Match 2 - Exxon Mobil Vs Royal Dutch Shell

In Match 1 of the Dividend Compass Cup, we had Coca Cola narrowly defeating Pepsi. The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing...