Nassim Taleb talk at Wharton

People kept telling me I was an idiot for years [because] I didn’t invest in markets.

I don’t invest in the stock market because I think it’s a sucker’s game. I make my money and I put it in a repository [of value]. Or sometimes I just do these bets for entertainment, nothing else, so I can have a conversation with someone once in a while on a train or on a plane. That’s the only reason. So I stayed in cash, for years, and then realized that the value of my cash became monstrously high after the crisis. The last 12 years, the stock market did nothing, and cash yielded 40, 50, 60 percent.

Cash gives you an option when other people go bust. That’s what Kennedy did. Joe Kennedy, the father, got rich not from investments but from negative investments. In other words, he had no investment when other people were busted. [Take] the story of the two brothers [one of whom makes $4 per share a year while carrying no insurance against being wiped out, one of whom makes $2 per share with maximal insurance]. If the $2 brother can survive—without being kicked out by the board and replaced with some short-volatility fellow who doesn’t understand anti-fragility—then when the other brother goes bust, he’ll be able more aggressively to buy his inventory—his refrigerator, his car, everything, even his house—for nothing. You see the idea? So you have to think in terms of dynamics of cash: that it’s not a sissy trade.

There’s something called action bias. People think that doing something is necessary. Like in medicine and a lot of places. Like every time I have an MBA—except those from Wharton, because they know what’s going on!—they tell me, “Give me something actionable.” And when I was telling them, “Don’t sell out-of-the-money options,” when I give them negative advice, they don’t think it’s actionable. So they say, “Tell me what to do.” All these guys are bust. They don’t understand: you live long by not dying, you win in chess by not losing—by letting the other person lose. So negative investment is not a sissy strategy. It is an active one.

………………..

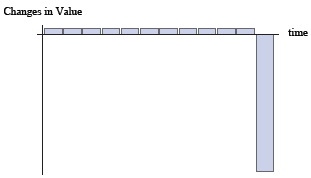

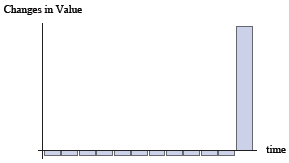

A couple of the graphs from the paper this talk was based on (which he brings up quite a few times in the talk):

Antifragile

- Seth Klarman Quotes On Macro Thinking (1991)

This is from the 1991 Barron’s interview:“One thing I want to emphasize is that, like any human being, we can discuss our view of the economy and the market. Fortunately for our clients, we don't tend to operate based on the view. Our investment...

- Quotes...

Below are some quotes that I thought were good ones on which to end 2013 and keep in mind as we enter 2014. From Ray Dalio:The biggest mistake investors make is to believe that what happened in the recent past is likely to persist.From Howard Marks:If...

- Nassim Taleb Quotes

From Antifragile: Let us introduce the philosopher’s stone back into this conversation. Socrates is about knowledge. Not Fat Tony, who has no idea what it is.For Tony, the distinction in life isn’t True or False, but rather sucker or nonsucker. Things...

- Nassim Taleb And Barbells

The quotes below are from Antifragile(though they may not be exact, as Kindle Highlights don’t pick up on things like italics).What do we mean by barbell? The barbell (a bar with weights on both ends that weight lifters use) is meant to illustrate the...

- Is It Better To Invest Alone Or As A Couple?

It got me thinking for quite some time, if you are a budding investor but your significant other isn't interested or knowledgeable about it, what should you do? Maybe your boyfriend is not aware that you have an existing portfolio. Or your wife is...