Money and Finance

The common belief is that you should just park your money in index mutual funds and annually rebalance. While I believe that's probably good for anyone that doesn't want to take the time to select their own investments, if you are so inclined I'm going to show you how you can save yourself some extra money and end up with a bigger nest egg in the future.

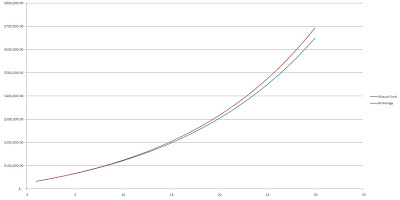

These numbers will work as long as you are comparing the same accounts. I've assumed that you have a $30,000 initial investment amount and that you will contribute an extra $5,000 annually on January 1 of the year and make all mutual fund purchases or 2 invidividual stock purchases. Expenses for the mutual fund are assumed to be taken out at the end of the year with an expense ratio of 0.30% and the commission for the brokerage account is taken out at the time of the purchases. Commission costs are assumed to be $7.95 which is the amount that I pay, although there are cheaper alternatives. I've assumed that all mutual funds are no-load funds since that would be the best way to go, loads would obviously affect the final numbers. The initial $30,000 investment in the brokerage account is split between 4 purchases. The annual return for the calculations is 7%. Below are the results.

Your total expenses are significantly reduced by using a DIY approach and hand selecting stocks high quality stocks. Out of the $175,000 that you invested of your own hard-earned money by using mutual funds you'll pay $22,315.42 in total expenses. While that number sounds like a lot by itself looking at the percentage amount is even more shocking. Over the investing time horizon you would have contributed $175,000 of your money. With the DIY brokerage account you would pay a total of $492.90 in commission charges or 0.28% of your invested capital. The mutual funds would be $22,808.32 or 13.03% of your capital. The biggest drawback to mutual funds is that they will eat away extra capital that could be compounding. By losing that money your nest egg would be $44,374.07 less than the brokerage account.

This is why I've decided to go the brokerage account route. I currently still have some mutual funds in my Rollover IRA mainly because I haven't researched the process of swapping my account over and I don't normally have cell service where I work and errands are the last thing that I want to do whenever I get the chance to be home.

- Dividend Update - July 2012

July wasn't the best of months for dividends with only 2 stocks in my brokerage account and 1 stock in my Roth IRA making payouts. July did bring 1 new position, Emerson, and 1 addition to a current position, in McDonalds. The two purchases will add...

- Dividend Update - April 2012

April was back down to a low month. Once I can start investing money again I'm hoping that there will be some good bargains on stocks that payout on the January, April, July and October schedule because that group is severely lacking for me right...

- Dividend Update - February 2012 *revised

*Well, I didn't check my brokerage account until today and just noticed that some of the dividends that are usually paid out in March were pushed foward to leap day on February 29th. So I've revised my February dividend update. February ended...

- Dividend Update - February 2012

February was a better month than January but still nothing great. Unfortunately since I'm really gungho about paying off debt I haven't been able to add to my brokerage account to increase my dividend income. That on top of work being slow meaning...

- Roth Ira

I originially opened a Roth IRA to invest in mutual funds through Vanguard. I got to thinking about the expense ratios, which Vanguard is usually the lowest, however by purchasing solid dividend paying companies with solid fundamentals you'll pay...

Money and Finance

Mutual Fund vs DIY

The common belief is that you should just park your money in index mutual funds and annually rebalance. While I believe that's probably good for anyone that doesn't want to take the time to select their own investments, if you are so inclined I'm going to show you how you can save yourself some extra money and end up with a bigger nest egg in the future.

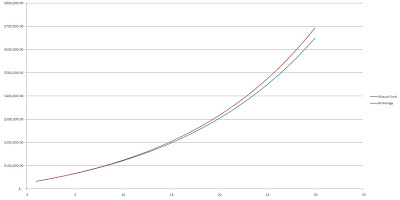

These numbers will work as long as you are comparing the same accounts. I've assumed that you have a $30,000 initial investment amount and that you will contribute an extra $5,000 annually on January 1 of the year and make all mutual fund purchases or 2 invidividual stock purchases. Expenses for the mutual fund are assumed to be taken out at the end of the year with an expense ratio of 0.30% and the commission for the brokerage account is taken out at the time of the purchases. Commission costs are assumed to be $7.95 which is the amount that I pay, although there are cheaper alternatives. I've assumed that all mutual funds are no-load funds since that would be the best way to go, loads would obviously affect the final numbers. The initial $30,000 investment in the brokerage account is split between 4 purchases. The annual return for the calculations is 7%. Below are the results.

| Year | Intial Amount | Expenses | Ending Amount | Cummulative Expenses |

|---|---|---|---|---|

| 1 | $30,000.00 | $96.30 | $32,003.70 | $96.30 |

| 2 | $37,003.70 | $118.78 | $39,475.18 | $215.08 |

| 10 | $112,778.97 | $362.02 | $120,311.47 | $2,177.72 |

| 20 | $283,330.49 | $909.49 | $302,254.13 | $8,519.03 |

| 30 | $608,900.93 | $1,954.57 | $649,569.42 | $22808.32 |

| Year | Intial Amount | Expenses | Ending Amount | Cummulative Expenses |

|---|---|---|---|---|

| 1 | $29,968.20 | $31.80 | $32,065.97 | $31.80 |

| 2 | $37,050.07 | $15.90 | $39,643.58 | $47.70 |

| 10 | $114,794.81 | $15.90 | $122,830.44 | $174.90 |

| 20 | $294,681.32 | $15.90 | $315,309.01 | $333.90 |

| 30 | $648,545.31 | $15.90 | $693,943.49 | $492.90 |

Your total expenses are significantly reduced by using a DIY approach and hand selecting stocks high quality stocks. Out of the $175,000 that you invested of your own hard-earned money by using mutual funds you'll pay $22,315.42 in total expenses. While that number sounds like a lot by itself looking at the percentage amount is even more shocking. Over the investing time horizon you would have contributed $175,000 of your money. With the DIY brokerage account you would pay a total of $492.90 in commission charges or 0.28% of your invested capital. The mutual funds would be $22,808.32 or 13.03% of your capital. The biggest drawback to mutual funds is that they will eat away extra capital that could be compounding. By losing that money your nest egg would be $44,374.07 less than the brokerage account.

This is why I've decided to go the brokerage account route. I currently still have some mutual funds in my Rollover IRA mainly because I haven't researched the process of swapping my account over and I don't normally have cell service where I work and errands are the last thing that I want to do whenever I get the chance to be home.

- Dividend Update - July 2012

July wasn't the best of months for dividends with only 2 stocks in my brokerage account and 1 stock in my Roth IRA making payouts. July did bring 1 new position, Emerson, and 1 addition to a current position, in McDonalds. The two purchases will add...

- Dividend Update - April 2012

April was back down to a low month. Once I can start investing money again I'm hoping that there will be some good bargains on stocks that payout on the January, April, July and October schedule because that group is severely lacking for me right...

- Dividend Update - February 2012 *revised

*Well, I didn't check my brokerage account until today and just noticed that some of the dividends that are usually paid out in March were pushed foward to leap day on February 29th. So I've revised my February dividend update. February ended...

- Dividend Update - February 2012

February was a better month than January but still nothing great. Unfortunately since I'm really gungho about paying off debt I haven't been able to add to my brokerage account to increase my dividend income. That on top of work being slow meaning...

- Roth Ira

I originially opened a Roth IRA to invest in mutual funds through Vanguard. I got to thinking about the expense ratios, which Vanguard is usually the lowest, however by purchasing solid dividend paying companies with solid fundamentals you'll pay...