Money and Finance

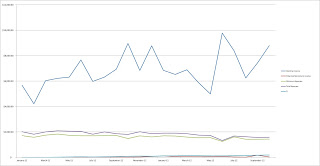

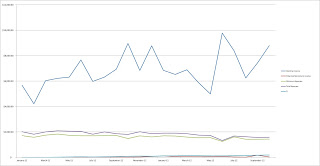

October's spending was right in line with August and September which is good because it hasn't increased but it's still higher that where I would like for it to be. I was hoping to be able to get my spending down to the $1,300 mark but I just don't see that happening. I know if I can cut back on my restaurant spending that I'll be able to make some pretty big strides in the reduction because for the most part my restaurant and grocery spending is the largest portion of my spending that I realistically have room to cut from. My minimum expenses for October ended the month at $1,440.69 which brought my average for 2012 down to $1,519.96. My average total monthly expenses for October ended up right in line with September at $1,578.41. This brought my average monthly total expenditures for 2012 down to $1,691.36. My PRI for October was a pretty disappointing $25.47 which covered only 1.77% of my minimum expenses. This wasn't a total surprise because I knew that October would be a very light month for dividends. However, my FI made yet another move higher totaling $185.98 for the month based on the yield on the 30 year US treasury bond of 2.88%. This covers 12.91% of my minimum expenses for the month. October was a great month from income bringing in my second highest monthly total for the year.

Read more »

- Income Update - May 2013

May has now come and gone. It's hard to believe 5 months of 2013 has already passed us by. It was a solid month as far as budgeting is concerned. Despite not really tracking my expenses as they came during the month, I'm quite satisfied...

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - January 2013

January was a truly awesome month. I ended up bringing home over $2,200 more than my average for 2012 and the best part is that all went straight to savings. I only overshot one category by a lot but that'll start getting in check beginning with...

- Income Update - December 2012

December's income was lower than what I'd averaged through the first 11 months of 2012 but was still great at almost $6,500. It wasn't a great month for expenses but considering how much I went over budget on a few areas I'm happy that...

- Income Update - August 2012

August was a decent month for my spending with it being below my average so far for the year, but it was still higher than it should have been. My minimum expenses in August ended the month at $1,417.13. So far in 2012 my minimum expenses have averaged...

Money and Finance

Income Update - October 2012

October's spending was right in line with August and September which is good because it hasn't increased but it's still higher that where I would like for it to be. I was hoping to be able to get my spending down to the $1,300 mark but I just don't see that happening. I know if I can cut back on my restaurant spending that I'll be able to make some pretty big strides in the reduction because for the most part my restaurant and grocery spending is the largest portion of my spending that I realistically have room to cut from. My minimum expenses for October ended the month at $1,440.69 which brought my average for 2012 down to $1,519.96. My average total monthly expenses for October ended up right in line with September at $1,578.41. This brought my average monthly total expenditures for 2012 down to $1,691.36. My PRI for October was a pretty disappointing $25.47 which covered only 1.77% of my minimum expenses. This wasn't a total surprise because I knew that October would be a very light month for dividends. However, my FI made yet another move higher totaling $185.98 for the month based on the yield on the 30 year US treasury bond of 2.88%. This covers 12.91% of my minimum expenses for the month. October was a great month from income bringing in my second highest monthly total for the year.

Read more »

- Income Update - May 2013

May has now come and gone. It's hard to believe 5 months of 2013 has already passed us by. It was a solid month as far as budgeting is concerned. Despite not really tracking my expenses as they came during the month, I'm quite satisfied...

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - January 2013

January was a truly awesome month. I ended up bringing home over $2,200 more than my average for 2012 and the best part is that all went straight to savings. I only overshot one category by a lot but that'll start getting in check beginning with...

- Income Update - December 2012

December's income was lower than what I'd averaged through the first 11 months of 2012 but was still great at almost $6,500. It wasn't a great month for expenses but considering how much I went over budget on a few areas I'm happy that...

- Income Update - August 2012

August was a decent month for my spending with it being below my average so far for the year, but it was still higher than it should have been. My minimum expenses in August ended the month at $1,417.13. So far in 2012 my minimum expenses have averaged...