Money and Finance

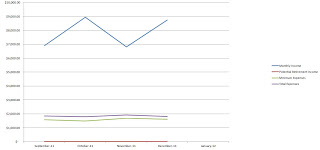

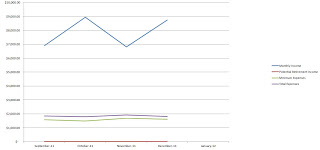

Here is the chart for my income/expenses from December 2011. My expenses came down some but not by any significant amount. My income was way up and the second highest monthly total that I received all year. Because of the high income for December I had a big difference between my income and expenses allowing me to save a lot. Unfortunately there's that debt that I have to pay off so I wasn't able to add to my portfolio. I'm on track to have that finished off between September and November of this year depending on how work goes. My potential retirement income is very low but if you follow this blog you'll see that I'm working on it. I have some lofty goals to receive $1,000 in dividend income in 2012. That will be a huge increase considering that I'm on track to receive around $280 while not accounting for dividend increases and since I won't be contributing much to my portfolio until the last quarter of the year.

- The Intersection Of Dividend Growth Investing And Financial Independence

Tired of working under fluorescent lights day in and day out? Well besides winning the lottery the only way to get away from working 9-5 til 65 is to spend less than you earn and invest the difference. Most of the blogs that I follow are focused...

- Dividend Update - December 2013

What can I say? December has come and gone and with it we close the books on 2013. It's been a great year as far as growth of my FI Portfolio, and most importantly the dividends I received and can expect to receive in 2014. These dividend updates...

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - March 2012

I've added a new line on my chart in "Your Money or Your Life" fashion. I'm calling it my FI for financial independence. The way I'll be calculating it is if I take my net worth less the value in my 401k and Rollover IRA since there's...

Money and Finance

Income Update - December 2011

Here is the chart for my income/expenses from December 2011. My expenses came down some but not by any significant amount. My income was way up and the second highest monthly total that I received all year. Because of the high income for December I had a big difference between my income and expenses allowing me to save a lot. Unfortunately there's that debt that I have to pay off so I wasn't able to add to my portfolio. I'm on track to have that finished off between September and November of this year depending on how work goes. My potential retirement income is very low but if you follow this blog you'll see that I'm working on it. I have some lofty goals to receive $1,000 in dividend income in 2012. That will be a huge increase considering that I'm on track to receive around $280 while not accounting for dividend increases and since I won't be contributing much to my portfolio until the last quarter of the year.

- The Intersection Of Dividend Growth Investing And Financial Independence

Tired of working under fluorescent lights day in and day out? Well besides winning the lottery the only way to get away from working 9-5 til 65 is to spend less than you earn and invest the difference. Most of the blogs that I follow are focused...

- Dividend Update - December 2013

What can I say? December has come and gone and with it we close the books on 2013. It's been a great year as far as growth of my FI Portfolio, and most importantly the dividends I received and can expect to receive in 2014. These dividend updates...

- Income Update - February 2013

February was a great month. I had a higher than normal income and put the difference to straight to savings. I did a pretty good job with controlling expenses for the month. Restaurants and groceries both overshot their budget, but by a combined $14 so...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - March 2012

I've added a new line on my chart in "Your Money or Your Life" fashion. I'm calling it my FI for financial independence. The way I'll be calculating it is if I take my net worth less the value in my 401k and Rollover IRA since there's...