Money and Finance

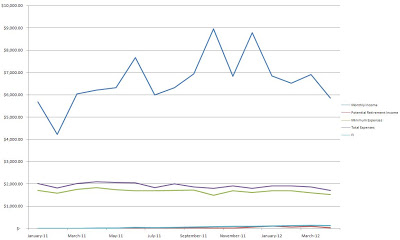

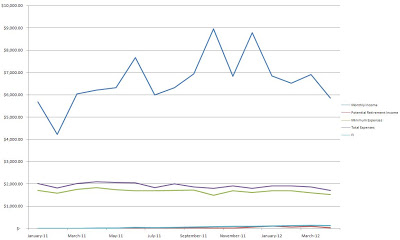

April turned out to be a pretty good month. I did a good job of lowering my expenses. My minimum expenses were down to just $1,541.22 which is really good. This month was $114.59 less than the average through March. My total expenses saw an even better improvement being $139.57 less than the average through March. Total expenses for the month were $1,751.22. Potential Retirement Income for the month totaled only $28.77 and my FI changed to $126.11. These replace, based on my current minimum expenses, 1.87% and 8.18%. The replacement amount is slowly creeping up which is great to see.

*Minimum Expenses are only the expenses related to rent, utilities, car, food, minimum payment on debt and other necessities. In other words, the required amount of replacement income I would need for financial independce.

*Total Expenses are the total monthly outflow of money.

*Potential Retirement Income is income received from dividends, interest, cash back from credit card purchases and any other source of income not related to my job.

*FI is my liquid assets invested at the 30 year treasury bond yield at the end of each month divided by 12 to get monthly income.

- Income Update - December 2012

December's income was lower than what I'd averaged through the first 11 months of 2012 but was still great at almost $6,500. It wasn't a great month for expenses but considering how much I went over budget on a few areas I'm happy that...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - August 2012

August was a decent month for my spending with it being below my average so far for the year, but it was still higher than it should have been. My minimum expenses in August ended the month at $1,417.13. So far in 2012 my minimum expenses have averaged...

- Income Update - July 2012

July was a pretty good month for my spending. My income was up higher than normal again which is great because it just adds to my savings amount. My minimum expenses for July went back up due to me forgetting that I'm paying my wife for things a month...

- Income Update - May 2012

May was right in line with April as far as spending. My minimum expenses and total expenses were pretty much even over the month which is good since they didn't go up but I didn't make a lot of progress on lowering them more. My minimum expenses...

Money and Finance

Income Update - April 2012

April turned out to be a pretty good month. I did a good job of lowering my expenses. My minimum expenses were down to just $1,541.22 which is really good. This month was $114.59 less than the average through March. My total expenses saw an even better improvement being $139.57 less than the average through March. Total expenses for the month were $1,751.22. Potential Retirement Income for the month totaled only $28.77 and my FI changed to $126.11. These replace, based on my current minimum expenses, 1.87% and 8.18%. The replacement amount is slowly creeping up which is great to see.

*Minimum Expenses are only the expenses related to rent, utilities, car, food, minimum payment on debt and other necessities. In other words, the required amount of replacement income I would need for financial independce.

*Total Expenses are the total monthly outflow of money.

*Potential Retirement Income is income received from dividends, interest, cash back from credit card purchases and any other source of income not related to my job.

*FI is my liquid assets invested at the 30 year treasury bond yield at the end of each month divided by 12 to get monthly income.

| Category | Amount |

|---|---|

| Paycheck | $5,074.90 |

| Expense Check | $738.57 |

| TOTAL | $5,813.47 |

| Category | Amount |

|---|---|

| Rent | $480.00 |

| Utilities | $161.55 |

| Gas | $141.09 |

| Car Insurance | $90.00 |

| Groceries | $183.14 |

| Restaurants | $130.91 |

| Entertainment | $56.69 |

| Cell Phone | $75.00 |

| Other | $24.83 |

| Miscellaneous | $142.48 |

| Debt Payment | $265.53 |

| SAVINGS | |

| Extra Debt Payment | $3,350.00 |

| Roth IRA | $450.00 |

| Emergency Fund | $212.25 |

| Gifts | $50.00 |

| TOTAL | $5,813.47 |

- Income Update - December 2012

December's income was lower than what I'd averaged through the first 11 months of 2012 but was still great at almost $6,500. It wasn't a great month for expenses but considering how much I went over budget on a few areas I'm happy that...

- Income Update - November 2012

November's income was higher than my average so far for the year which is great because I'm still able tor reduce my expenses so every extra dollar of income gets to be converted into savings mainly dividend growth investing capital. Not only...

- Income Update - August 2012

August was a decent month for my spending with it being below my average so far for the year, but it was still higher than it should have been. My minimum expenses in August ended the month at $1,417.13. So far in 2012 my minimum expenses have averaged...

- Income Update - July 2012

July was a pretty good month for my spending. My income was up higher than normal again which is great because it just adds to my savings amount. My minimum expenses for July went back up due to me forgetting that I'm paying my wife for things a month...

- Income Update - May 2012

May was right in line with April as far as spending. My minimum expenses and total expenses were pretty much even over the month which is good since they didn't go up but I didn't make a lot of progress on lowering them more. My minimum expenses...