Money and Finance

IBM is the third stock I added to the Wide Moat Dividend portfolio. Its a company with substantial positives - a 2.4% yield with plenty of room to grow. IBM has a payout ratio of 25% and a five year dividend growth rate of 14.3%. The Return on Equity averages 75% over five years. And the price is right IBM's trailing P/E is 12.

In a market with next to no bargains, why is IBM on sale? The company gets lumped in with the other "old" tech - Cisco, Microsoft, Oracle, et al. aka the IT shop of the 90s-2000s. No one wants to own the next Blackberry tech company that fades away. No doubt they all these players have their challenges with Cloud, Mobile, BYOD and on and on. But I think IBM is unique and in the best position of any of them to survive and thrive. Unlike Blackberry there is no one silver bullet that can take down IBM's franchise. Still the old tech sectors is on sale

(Source: Morningstar)

None of the old tech players are richly valued on conventional metrics. Investors are right to be concerned with how they each navigate the shifting sands of Cloud and Mobile. Cloud and Mobile present real challenges to each but in different ways. In some ways Microsoft is the most exposed here since they have both client and server side franchises. At the same time Microsoft is executing and moving aggressively to defend its turf, with Azure the Pepsi to Amazon/AWS' Coke in the Cloud space. Microsoft has yet to enjoy the same level of success in Mobile.

Cisco in theory is less exposed than Microsoft because Cloud and Mobile drive up demand in networking gear which they sell. However, the knock on effect of Cloud and Mobile is buyer concentration, where the large Cloud providers increasingly build their own systems soup to nuts and do not rely as much on companies like Cisco. Inside the enterprise, the data centers move to the Cloud which eliminates more sales potential from Cisco. On the Mobile side, sure the bandwidth utilization keeps going up, but then Cisco has to deal with entrenched, large scale players with more bargaining power. Oracle is a bit aimless, without many clear wins to point to, however, they are so deep in the backend that many of the new developments will take longer to reach their base. Mobile is a client side technology and Oracle has never had anything cooking there to begin with. Still the shrinking IT shop is a headwind for Oracle's growth.

That brings us to IBM. For a start, IBM is a totally different animal from the above players, for one thing they have a massive services business a la Accenture that the other players do not have. Steve Ballmer joked about why he avoided services saying if you are in the pharma business why would you want to go into the hospital business? Fair enough, and the services margins will never equal a hit software franchsie, but as Accenture proves when services are done well the result can be profitable and evergreen. In IBM's case their estimated services backlog at December 31 was $143 billion. That should see them through a rough patch or two. This is a lower (but not low) margin business than software but way steadier and will help them ride through the vissicitudes of technology churn.

As to Cloud, IBM's core customers are among the least likely to headlong into the Cloud, think banks and other transaction oriented businesses.The Cloud is not going to deliver the control and security that these customers need. There is an old tech saying, if a Unix server goes down you have a bad day, if a mainframe goes down the world stops spinning on its axis.

“Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does,” Ms. Rometty said.

The shortage of growth at IBM is partly by design — and has been for years. Since 2000, the company has sold off businesses that collectively generated $16 billion in sales, including personal computers and disk drives. Since Ms. Rometty became chief executive in 2012, units with $2 billion in revenue have been shed, and when the sale to Lenovo is completed this year, she will have divested operations with revenue of $6 billion.

Profit trumps growth at IBM. “We don’t want empty calories,” Ms. Rometty said. “So when people keep pushing us for growth, that is not the No. 1 priority on my list.”

IBM’s largest single investment in growth is in helping companies exploit the digital data deluge from corporate databases, sensors, smartphones, the web, social networks and elsewhere. That push into the field now called big data began years ago, and Ms. Rometty played a central role in shaping the strategy before she became chief executive.

IBM's core customers have its technology woven into the fabric of their businesses. In many cases, they have been optimizing and extending the code since the 1970s. This is not going to be replaced by the Cloud. and if anything will look to build their own private clouds with IBM's help and/or use . Then you have the Snowden effect, Ginni Rometty at Mobile World Congress:

"Enterprises will want—and need—to manage their data in the cloud with the same rigor as if it were on-premises. Companies will want to ensure visibility, auditability, security. This will be also be driven by regulation. Roughly 100 nations and territories have adopted data protection laws. In Europe, many countries require that citizens’ data be housed within national borders. This is why IBM is aggressively expanding its global cloud footprint. We currently have 25 data centers globally, and the new $1.2 billion investment announced in January will see the opening of 15 more, in the US, the UK, Australia, Japan, India, Canada, Mexico and China."

Ginni Rometty's speech was the first time an IBM CEO spoke at Mobile World Congress, and that portended a very interesting development in mobile. IBM did not have much going in mobile until recently, the Apple-IBM deal that Ginni Rometty and Tim Cook (an ex-IBMer) put together is still early days but could be a very big win.

Apple has the devices and the mobile platform, but you need servers and mainframes to do something interesting, Apple does not play there, has never played there and IBM has them in spades. Security is a core concern and IBM is a major player there as well. Its a deal right out of Ricardo. Its early days, Apple-IBM could be the Wintel of the Mobile world. If nothing else, the deal shows creativity on IBM's part to go from a bystander to being in the center of the ring in Mobile.

For sure, IBM has any number of challenges, I think the old guard of tech will see one or two of the current players not make the leap into this new world, its just the way of the tech world. I agree that as a group old tech players can fairly be discounted from the market P/E, but in IBM's case its overdone.

I think IBM has a better shot than any of the old guard at getting the next waves right and they have several ways to win - Cloud, data center, services, and mobile partnership with Apple. IBM should not only weather the storm, they have ways to thrive in Cloud and Mobile and continue to innovate.

On top of that an IBM investor gets as shareholder friendly a business as there is, IBM's repurchases and dividend policies are top notch.

IBM is in a solid place on fundamental metrics. It does compete in highly contested spaces, but its unique mix of franchises and R&D (repurchases and dividends) give investors a decent chance of earning solid total returns over the long term.

- Silver Linings: Banks Big And Small Are Embracing Cloud Computing

“I’VE only got one IT guy,” says Segun Akintemi, the chief executive of Renaissance Credit, a Nigerian moneylender that opened for business in October 2012 and signed up about 3,000 customers in its first six months. “Whenever I walk past his...

- International Business Machines (ibm) Dividend Stock Analysis

I'm finally getting back to posting some stock analyses. For some reason I just didn't have the motivation, I'm not sure if it was a bit of a burn out but I think it was mainly just due to laziness. I don't mind compiling the data...

- Intel Stock Analysis

With the recent pullback in the markets and especially in tech I figured I would take a look at Intel Corporation (INTC). I currently own just over 45 shares of Intel and would be interested in adding more at the right price. Intel closed on Thursday...

- Tech Cliffs

Over on Twitter, Joe Magyer asks a great question: I have an answer here. I do not think its about being cool. I think its firstly about admitting one's limitations which I find refreshing. This is unique to value investors. Whereas lots of investors...

- Recent Purchase - Cisco

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already...

Money and Finance

IBM Will Survive and Thrive

IBM is the third stock I added to the Wide Moat Dividend portfolio. Its a company with substantial positives - a 2.4% yield with plenty of room to grow. IBM has a payout ratio of 25% and a five year dividend growth rate of 14.3%. The Return on Equity averages 75% over five years. And the price is right IBM's trailing P/E is 12.

In a market with next to no bargains, why is IBM on sale? The company gets lumped in with the other "old" tech - Cisco, Microsoft, Oracle, et al. aka the IT shop of the 90s-2000s. No one wants to own the next Blackberry tech company that fades away. No doubt they all these players have their challenges with Cloud, Mobile, BYOD and on and on. But I think IBM is unique and in the best position of any of them to survive and thrive. Unlike Blackberry there is no one silver bullet that can take down IBM's franchise. Still the old tech sectors is on sale

| P/E | Yield | |

| IBM | 12 | 2.4% |

| Cisco | 17 | 3% |

| Microsoft | 17 | 2.6% |

| Oracle | 17 | 1.2% |

None of the old tech players are richly valued on conventional metrics. Investors are right to be concerned with how they each navigate the shifting sands of Cloud and Mobile. Cloud and Mobile present real challenges to each but in different ways. In some ways Microsoft is the most exposed here since they have both client and server side franchises. At the same time Microsoft is executing and moving aggressively to defend its turf, with Azure the Pepsi to Amazon/AWS' Coke in the Cloud space. Microsoft has yet to enjoy the same level of success in Mobile.

Cisco in theory is less exposed than Microsoft because Cloud and Mobile drive up demand in networking gear which they sell. However, the knock on effect of Cloud and Mobile is buyer concentration, where the large Cloud providers increasingly build their own systems soup to nuts and do not rely as much on companies like Cisco. Inside the enterprise, the data centers move to the Cloud which eliminates more sales potential from Cisco. On the Mobile side, sure the bandwidth utilization keeps going up, but then Cisco has to deal with entrenched, large scale players with more bargaining power. Oracle is a bit aimless, without many clear wins to point to, however, they are so deep in the backend that many of the new developments will take longer to reach their base. Mobile is a client side technology and Oracle has never had anything cooking there to begin with. Still the shrinking IT shop is a headwind for Oracle's growth.

That brings us to IBM. For a start, IBM is a totally different animal from the above players, for one thing they have a massive services business a la Accenture that the other players do not have. Steve Ballmer joked about why he avoided services saying if you are in the pharma business why would you want to go into the hospital business? Fair enough, and the services margins will never equal a hit software franchsie, but as Accenture proves when services are done well the result can be profitable and evergreen. In IBM's case their estimated services backlog at December 31 was $143 billion. That should see them through a rough patch or two. This is a lower (but not low) margin business than software but way steadier and will help them ride through the vissicitudes of technology churn.

As to Cloud, IBM's core customers are among the least likely to headlong into the Cloud, think banks and other transaction oriented businesses.The Cloud is not going to deliver the control and security that these customers need. There is an old tech saying, if a Unix server goes down you have a bad day, if a mainframe goes down the world stops spinning on its axis.

“Planes don’t fly, trains don’t run, banks don’t operate without much of what IBM does,” Ms. Rometty said.

The shortage of growth at IBM is partly by design — and has been for years. Since 2000, the company has sold off businesses that collectively generated $16 billion in sales, including personal computers and disk drives. Since Ms. Rometty became chief executive in 2012, units with $2 billion in revenue have been shed, and when the sale to Lenovo is completed this year, she will have divested operations with revenue of $6 billion.

Profit trumps growth at IBM. “We don’t want empty calories,” Ms. Rometty said. “So when people keep pushing us for growth, that is not the No. 1 priority on my list.”

IBM’s largest single investment in growth is in helping companies exploit the digital data deluge from corporate databases, sensors, smartphones, the web, social networks and elsewhere. That push into the field now called big data began years ago, and Ms. Rometty played a central role in shaping the strategy before she became chief executive.

IBM's core customers have its technology woven into the fabric of their businesses. In many cases, they have been optimizing and extending the code since the 1970s. This is not going to be replaced by the Cloud. and if anything will look to build their own private clouds with IBM's help and/or use . Then you have the Snowden effect, Ginni Rometty at Mobile World Congress:

"Enterprises will want—and need—to manage their data in the cloud with the same rigor as if it were on-premises. Companies will want to ensure visibility, auditability, security. This will be also be driven by regulation. Roughly 100 nations and territories have adopted data protection laws. In Europe, many countries require that citizens’ data be housed within national borders. This is why IBM is aggressively expanding its global cloud footprint. We currently have 25 data centers globally, and the new $1.2 billion investment announced in January will see the opening of 15 more, in the US, the UK, Australia, Japan, India, Canada, Mexico and China."

Ginni Rometty's speech was the first time an IBM CEO spoke at Mobile World Congress, and that portended a very interesting development in mobile. IBM did not have much going in mobile until recently, the Apple-IBM deal that Ginni Rometty and Tim Cook (an ex-IBMer) put together is still early days but could be a very big win.

Apple has the devices and the mobile platform, but you need servers and mainframes to do something interesting, Apple does not play there, has never played there and IBM has them in spades. Security is a core concern and IBM is a major player there as well. Its a deal right out of Ricardo. Its early days, Apple-IBM could be the Wintel of the Mobile world. If nothing else, the deal shows creativity on IBM's part to go from a bystander to being in the center of the ring in Mobile.

For sure, IBM has any number of challenges, I think the old guard of tech will see one or two of the current players not make the leap into this new world, its just the way of the tech world. I agree that as a group old tech players can fairly be discounted from the market P/E, but in IBM's case its overdone.

I think IBM has a better shot than any of the old guard at getting the next waves right and they have several ways to win - Cloud, data center, services, and mobile partnership with Apple. IBM should not only weather the storm, they have ways to thrive in Cloud and Mobile and continue to innovate.

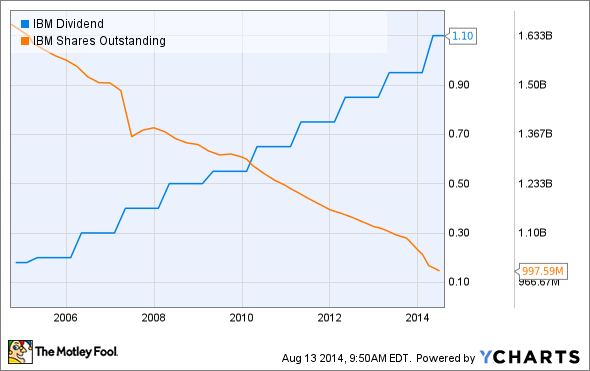

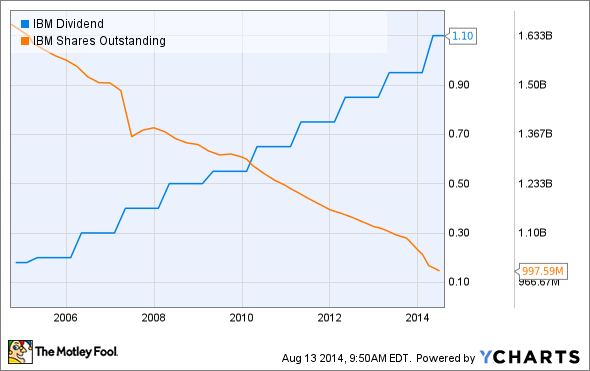

On top of that an IBM investor gets as shareholder friendly a business as there is, IBM's repurchases and dividend policies are top notch.

IBM Dividend data by YCharts

IBM is in a solid place on fundamental metrics. It does compete in highly contested spaces, but its unique mix of franchises and R&D (repurchases and dividends) give investors a decent chance of earning solid total returns over the long term.

- Silver Linings: Banks Big And Small Are Embracing Cloud Computing

“I’VE only got one IT guy,” says Segun Akintemi, the chief executive of Renaissance Credit, a Nigerian moneylender that opened for business in October 2012 and signed up about 3,000 customers in its first six months. “Whenever I walk past his...

- International Business Machines (ibm) Dividend Stock Analysis

I'm finally getting back to posting some stock analyses. For some reason I just didn't have the motivation, I'm not sure if it was a bit of a burn out but I think it was mainly just due to laziness. I don't mind compiling the data...

- Intel Stock Analysis

With the recent pullback in the markets and especially in tech I figured I would take a look at Intel Corporation (INTC). I currently own just over 45 shares of Intel and would be interested in adding more at the right price. Intel closed on Thursday...

- Tech Cliffs

Over on Twitter, Joe Magyer asks a great question: I have an answer here. I do not think its about being cool. I think its firstly about admitting one's limitations which I find refreshing. This is unique to value investors. Whereas lots of investors...

- Recent Purchase - Cisco

I've been looking around for another stock this past week as I knew I'd have the money to make another purchase. I wanted to buy a stock which pays in April so that limited my choices a bit. The first thing I look at are the names that I already...