Money and Finance

This is a post in continuation with Buying Your First HDB Flat in Singapore

What are the costs involved? Planning your Finances is important.

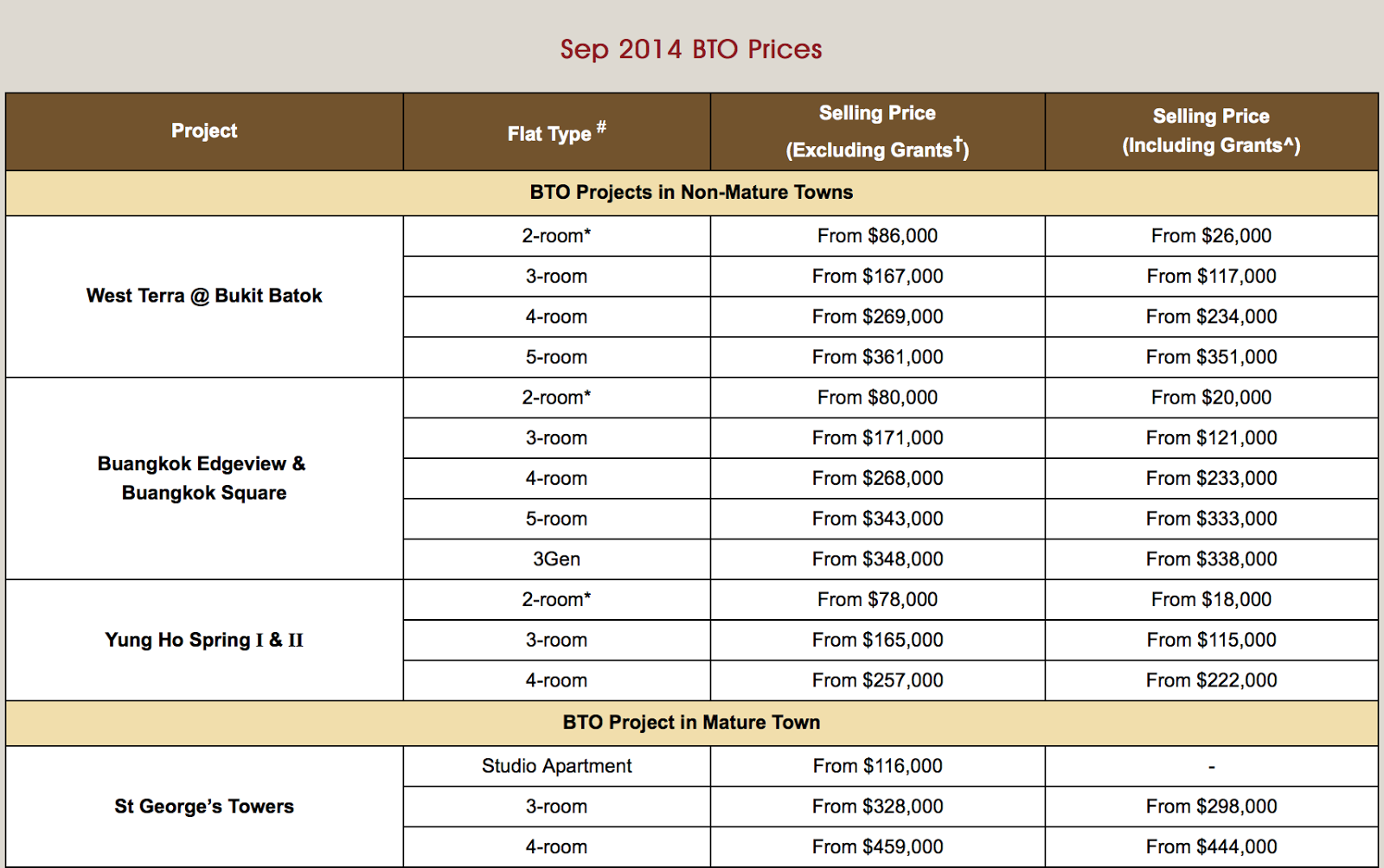

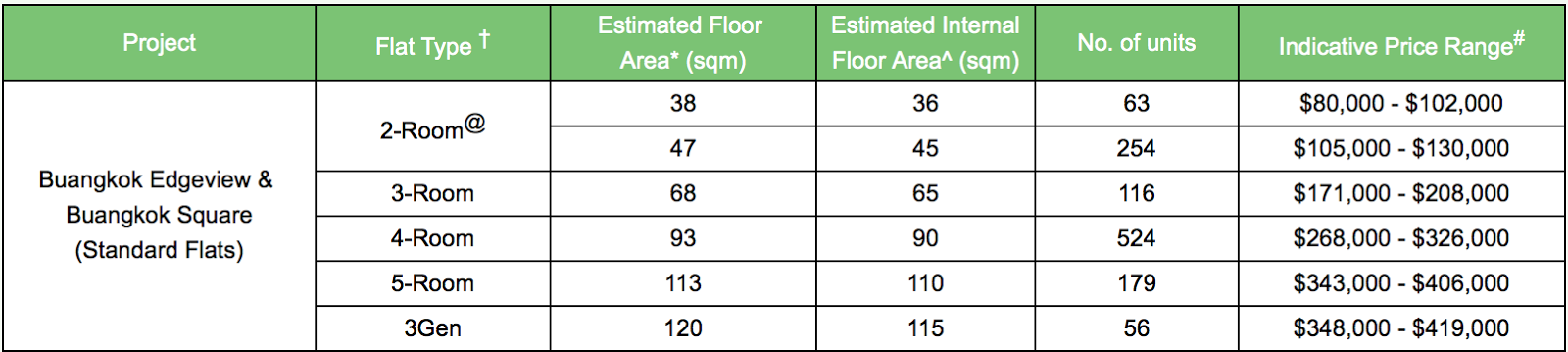

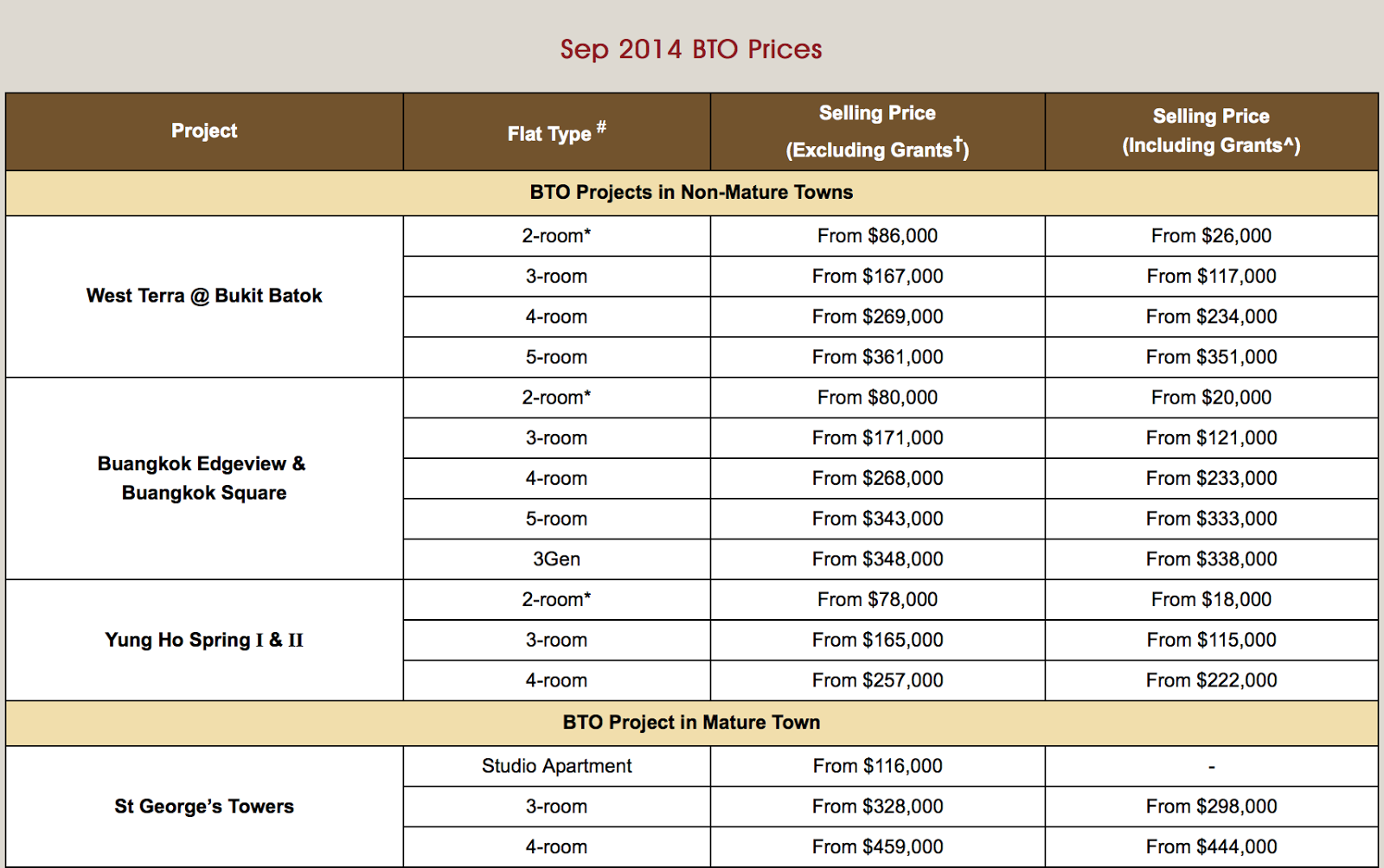

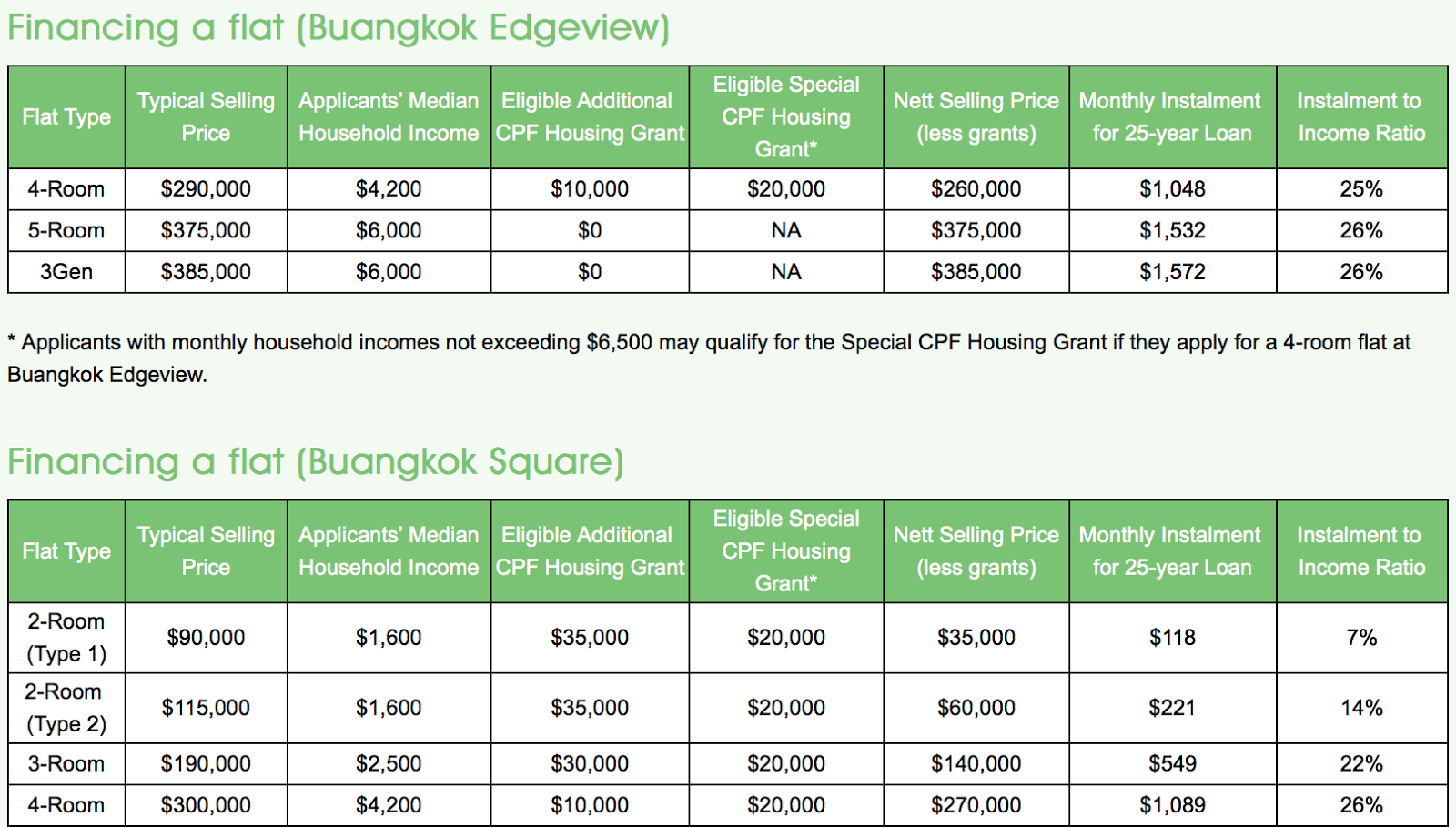

As of Sep 2014, a regular 4 room BTO flat would cost without grant:

Bukit Batok $269,000+++

Buangkok $268,000+++

Therefore, I will round off the amount to $300,000. This price is inclusive of miscellaneous fees including agent fees, option fees etc.

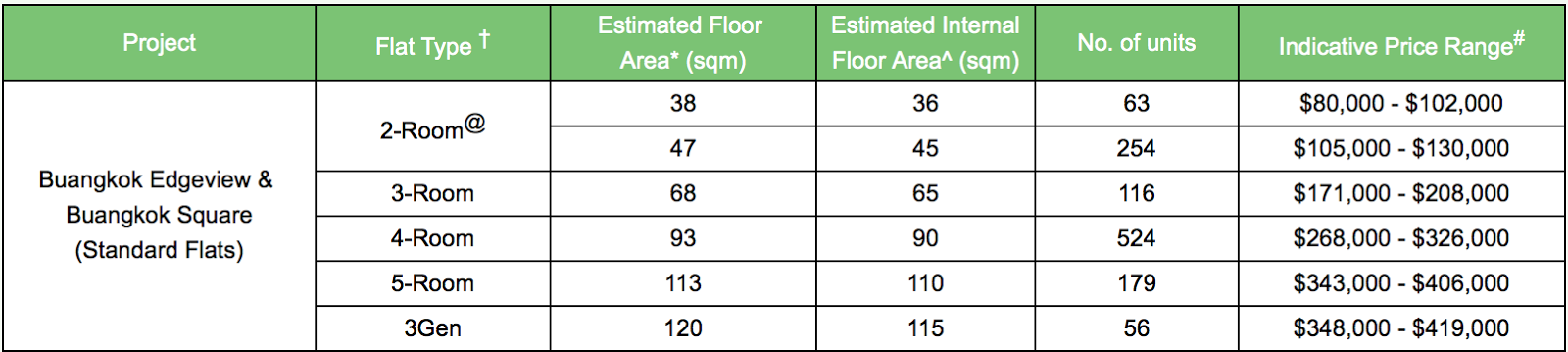

As seen on my previous post,

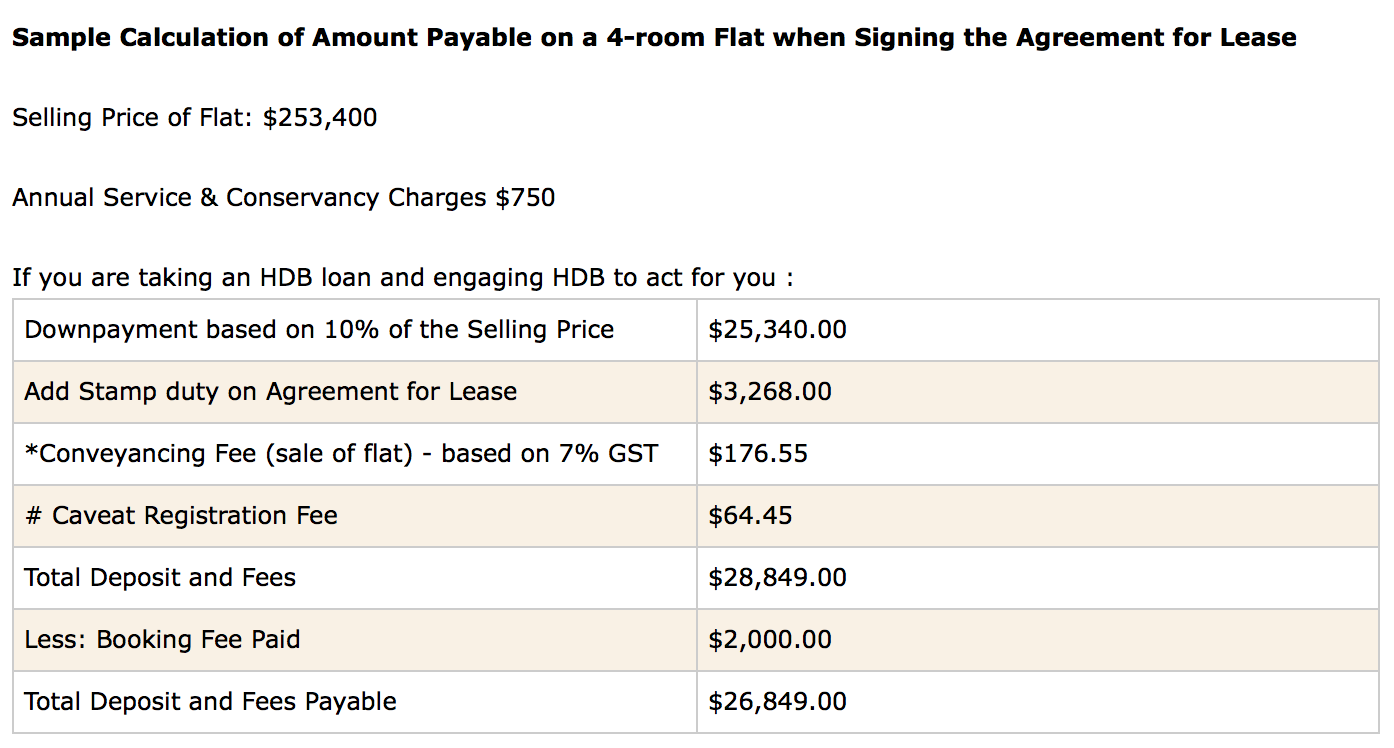

This is a sample calculation. Assuming the total selling price is $253,400, the downpayment would be around $30,000 give or take.

Now this is close to 12% of the total amount.

Assuming the flat costs $300,000, the minimum downpayment would be $36,000! The balance would be paid off with CPF/Cash when you get the keys. This payment could also be done in instalments.

Please note that downpayment based on 10% would be at $30,000.

The $6,000 is an estimate on stamp duty fee, conveyancing fee and caveat registration fee.

Here, I'm assuming it's a 25 year loan payable monthly. That's a total of 300 months, bringing a monthly payment of $900 not including interest.

With interest, the monthly payable amount be around $1500 or lesser.

Do note, that there are two types of insurance you have to take out:

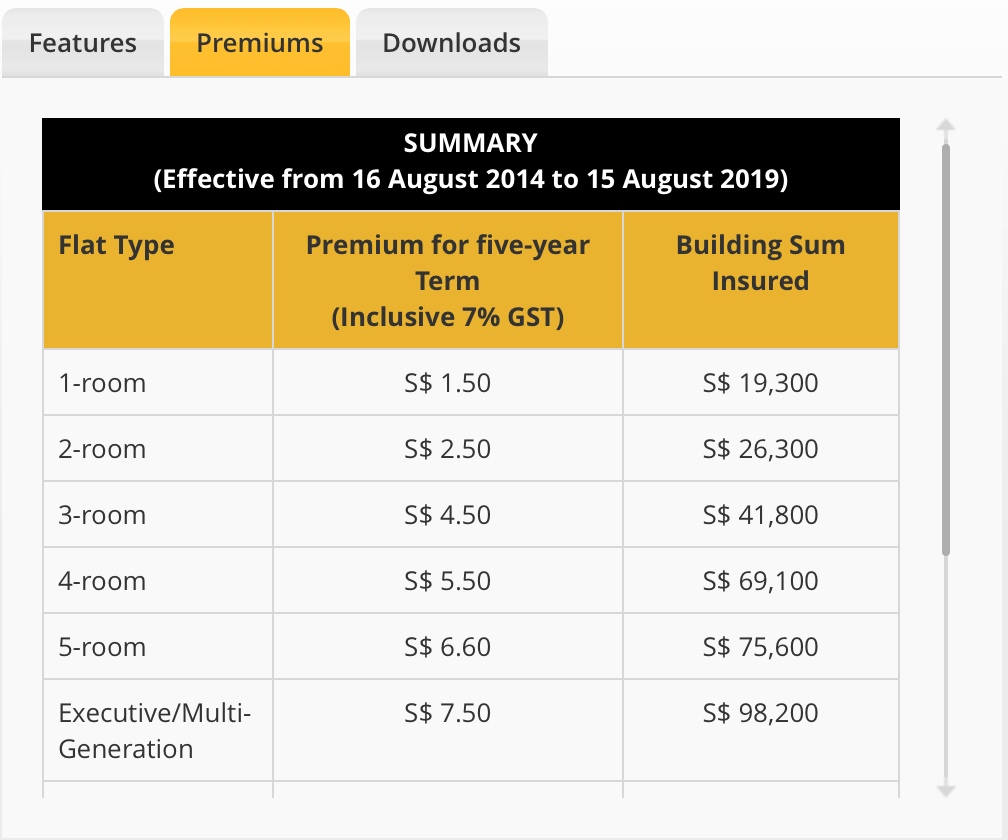

HDB Fire Insurance Policy

If you are taking a loan from HDB, you will have to take out a fire insurance policy from the Insurance Agent appointed by HDB.

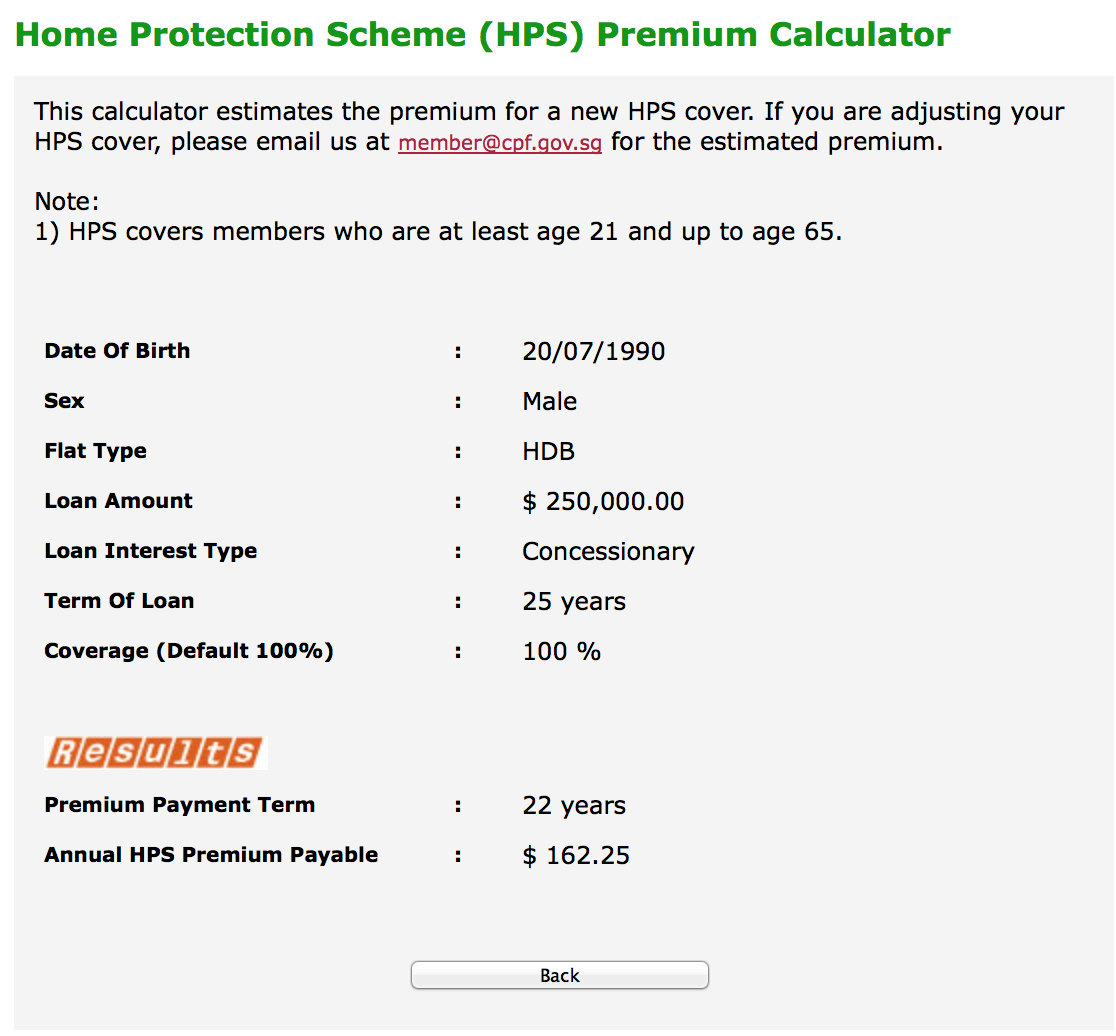

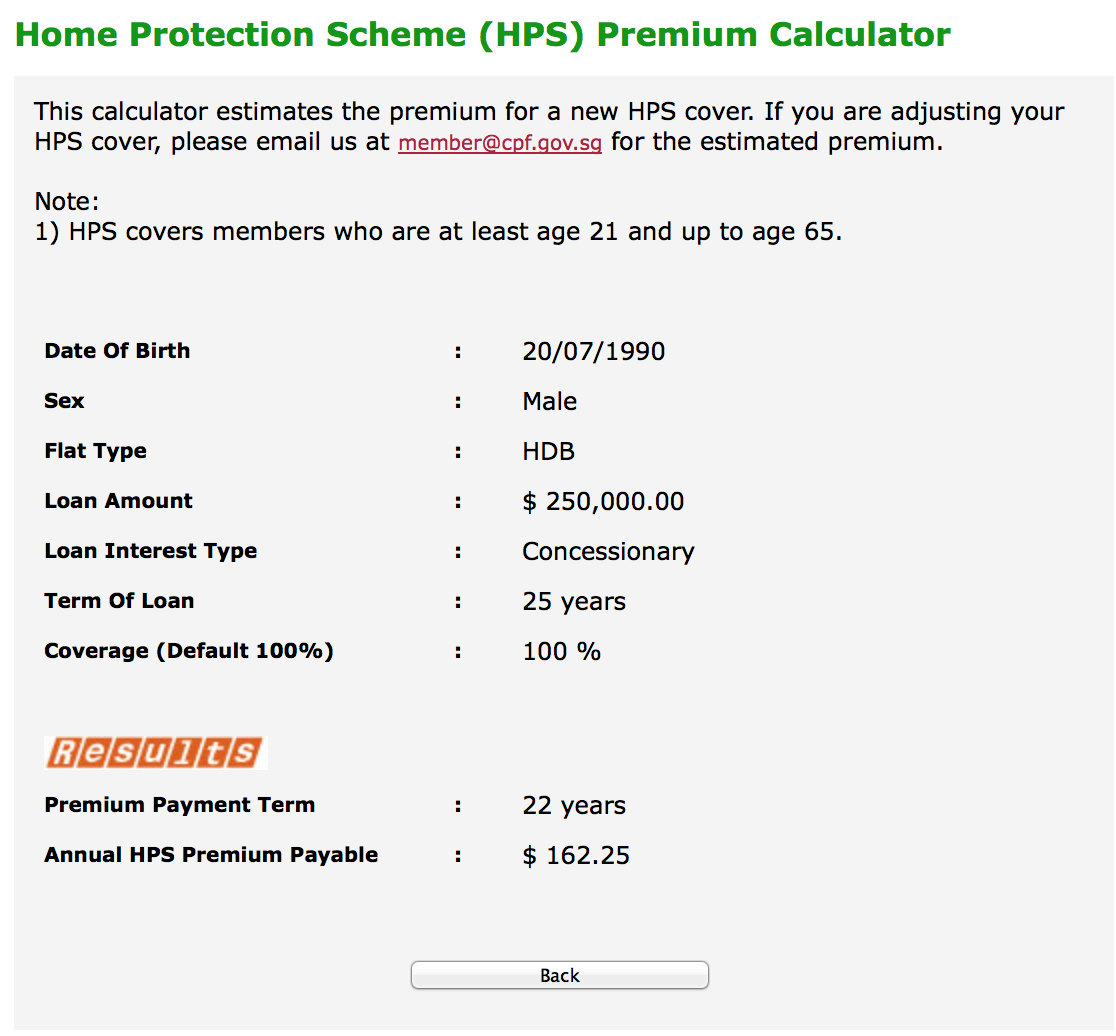

Home Protection Scheme (HPS)

HPS is a mortgage-reducing insurance scheme administered by CPF Board. It insures CPF members and their families against losing their homes should members become permanently incapacitated or pass away before their housing loans are paid up.

If you are using your CPF savings to pay your monthly housing loan instalments, you have to apply for HPS.

For more information on HPS, you can obtain an HPS booklet at HDB Hub or call CPF Board or visit the CPF Board's website.

What can you use to pay for your home?

1. Cash Savings

$10 Adminstration fee.

$2000 Option Fee.

2. CPF Money

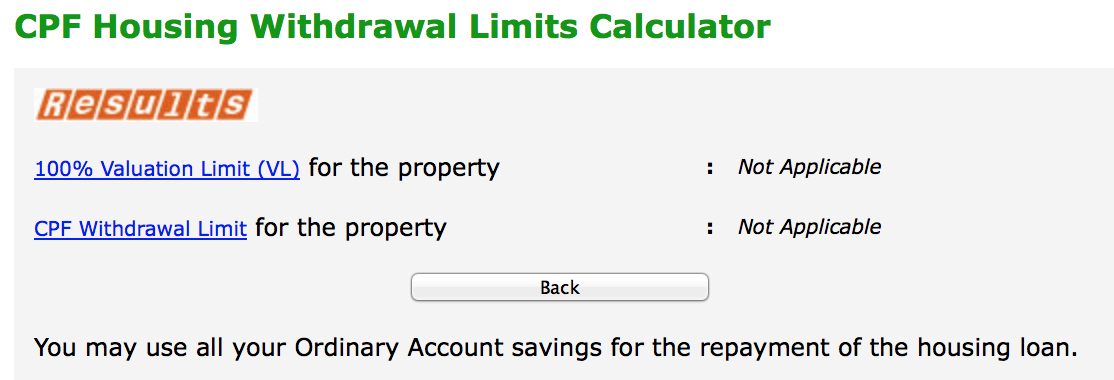

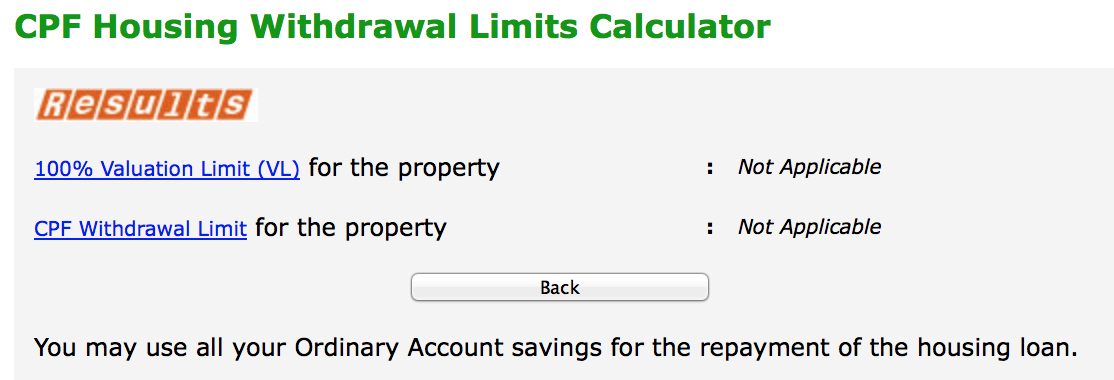

You can use the savings in your CPF Ordinary Account to pay for your flat purchase. However, under the CPF Board's requirements, you are allowed to withdraw only up to a certain limit. Once the CPF withdrawal limit is reached, you will not be allowed to use your CPF money to pay for your flat.

To find out the maximum amount of CPF that can be used for the property, you may log on to the CPF Board'sCPF Housing Withdrawal Limits Calculator (for flats with remaining lease of 60 years or more) (e-Service) or theProperty with less than 60 Years Lease Calculator (for flats with remaining lease of less than 60 years, but at least 30 years) (e-Service).

If you are buying a flat with remaining lease less than 30 years, CPF monies cannot be used. This is applicable to flat applications received on or after 1 July 2013.

For a new HDB flat bought with a concessionary HDB loan,

Use of All CPF Savings

- Wells Fargo And The Rousseau Story

Found via Naked Capitalism. In March 2000, Norman and Oriane Rousseau put 30 percent down to buy a house at 580 Wilshire Place, Newbury Park, CA. In the following years they were solicited to refinance their loan. In October 2007 they met with the loan...

- Hussman Weekly Market Comment: The Second Wave Begins

I should also note some features of the resets we are now beginning to observe. It is tempting to think that with Treasury yields fairly low, mortgage resets might be fairly benign in terms of their impact. The problem is that these Option ARM and Alt-A...

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- Net Worth Update - March 2012

March was another good month. Not quite as good as January and February but an $8k positive move is still good. More than half of that came from debt repayment. I sent an extra $3,350 to service that debt and it's going well to possibly be done with...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....

Money and Finance

How Much Do You Need to Buy Your First Home in Singapore?

This is a post in continuation with Buying Your First HDB Flat in Singapore

What are the costs involved? Planning your Finances is important.

As of Sep 2014, a regular 4 room BTO flat would cost without grant:

Bukit Batok $269,000+++

Buangkok $268,000+++

Therefore, I will round off the amount to $300,000. This price is inclusive of miscellaneous fees including agent fees, option fees etc.

As seen on my previous post,

This is a sample calculation. Assuming the total selling price is $253,400, the downpayment would be around $30,000 give or take.

Now this is close to 12% of the total amount.

Assuming the flat costs $300,000, the minimum downpayment would be $36,000! The balance would be paid off with CPF/Cash when you get the keys. This payment could also be done in instalments.

Please note that downpayment based on 10% would be at $30,000.

The $6,000 is an estimate on stamp duty fee, conveyancing fee and caveat registration fee.

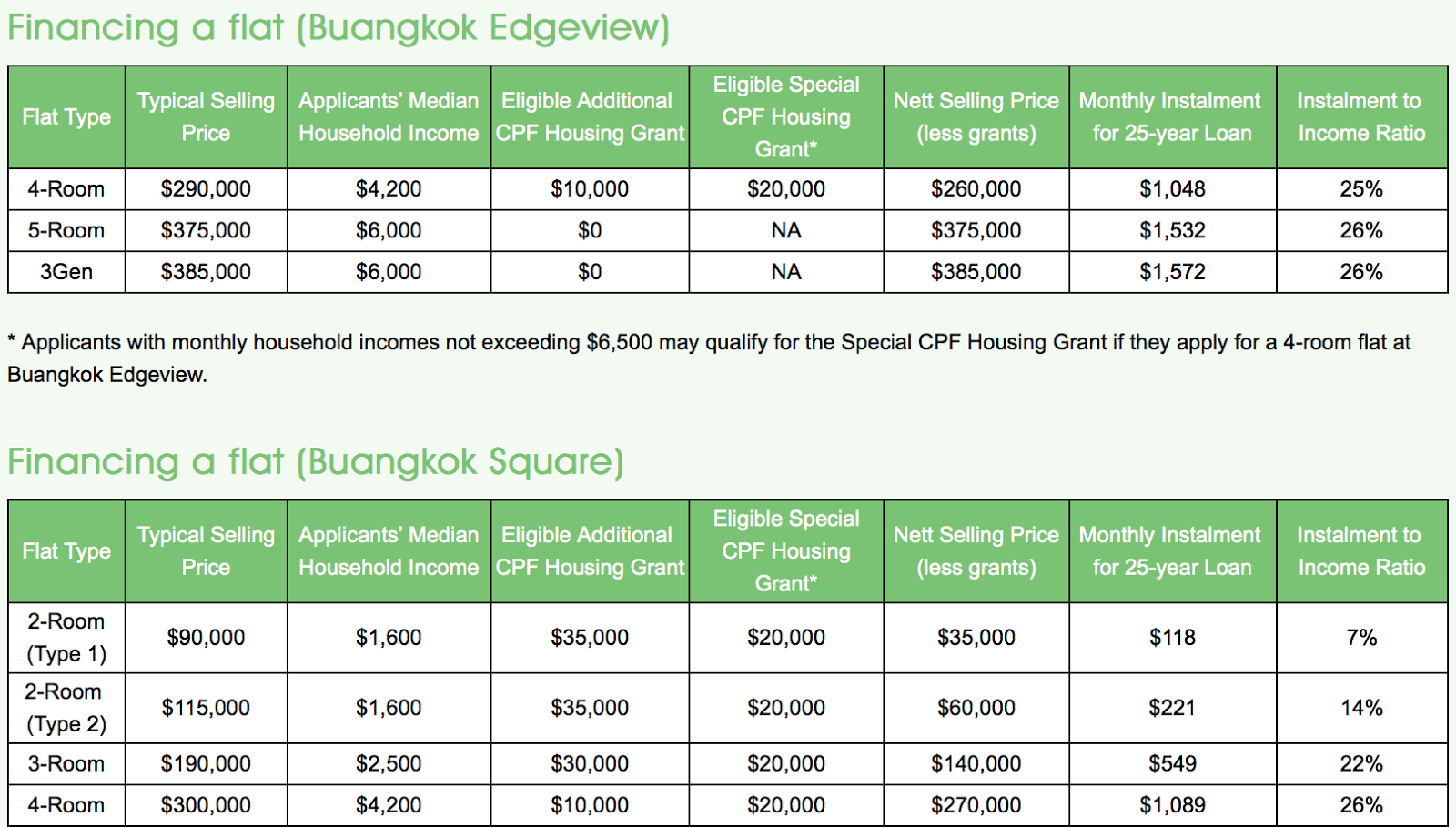

Here, I'm assuming it's a 25 year loan payable monthly. That's a total of 300 months, bringing a monthly payment of $900 not including interest.

With interest, the monthly payable amount be around $1500 or lesser.

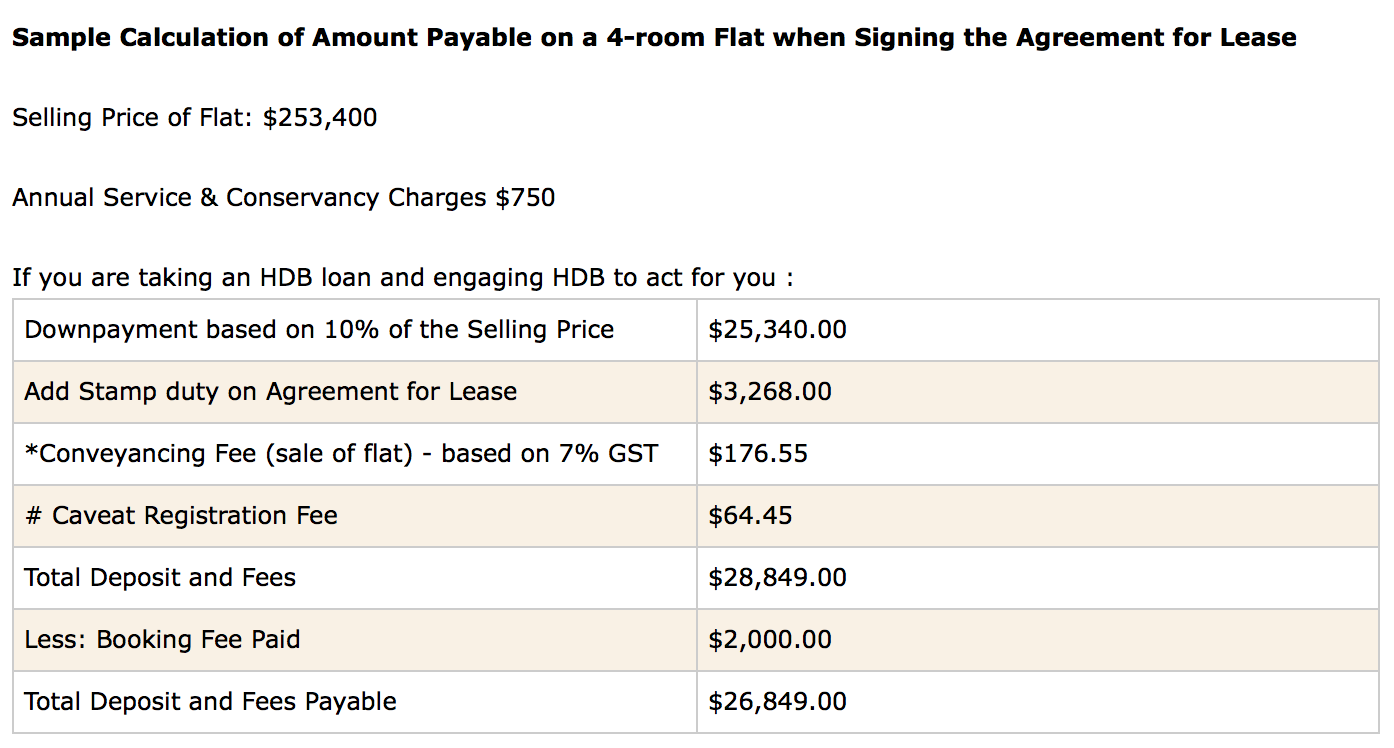

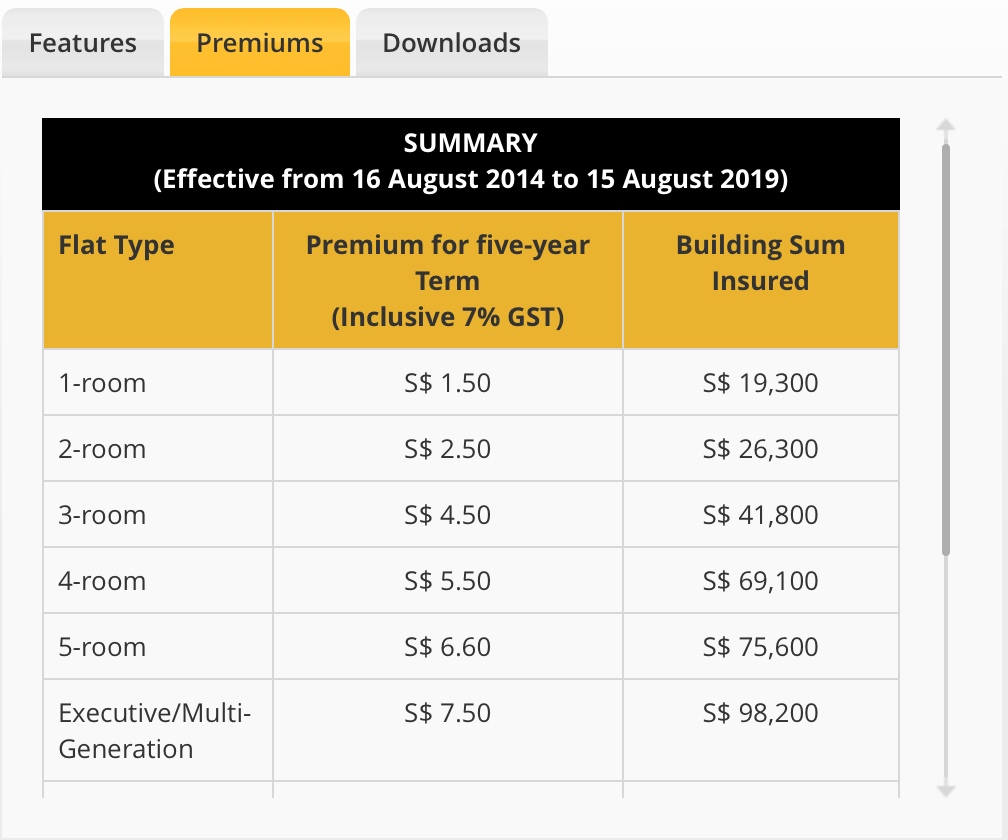

Do note, that there are two types of insurance you have to take out:

HDB Fire Insurance Policy

If you are taking a loan from HDB, you will have to take out a fire insurance policy from the Insurance Agent appointed by HDB.

Home Protection Scheme (HPS)

HPS is a mortgage-reducing insurance scheme administered by CPF Board. It insures CPF members and their families against losing their homes should members become permanently incapacitated or pass away before their housing loans are paid up.

If you are using your CPF savings to pay your monthly housing loan instalments, you have to apply for HPS.

For more information on HPS, you can obtain an HPS booklet at HDB Hub or call CPF Board or visit the CPF Board's website.

What can you use to pay for your home?

1. Cash Savings

$10 Adminstration fee.

$2000 Option Fee.

2. CPF Money

You can use the savings in your CPF Ordinary Account to pay for your flat purchase. However, under the CPF Board's requirements, you are allowed to withdraw only up to a certain limit. Once the CPF withdrawal limit is reached, you will not be allowed to use your CPF money to pay for your flat.

To find out the maximum amount of CPF that can be used for the property, you may log on to the CPF Board'sCPF Housing Withdrawal Limits Calculator (for flats with remaining lease of 60 years or more) (e-Service) or theProperty with less than 60 Years Lease Calculator (for flats with remaining lease of less than 60 years, but at least 30 years) (e-Service).

If you are buying a flat with remaining lease less than 30 years, CPF monies cannot be used. This is applicable to flat applications received on or after 1 July 2013.

For a new HDB flat bought with a concessionary HDB loan,

Use of All CPF Savings

Subject to limits for properties with less than 60 years of remaining lease, buyers must use all the available savings in their CPF Ordinary Accounts for the purchase of or taking over the flat before any housing loan is granted by HDB. You may set aside the amount required for payment of stamp, registration and conveyancing fees and CPF Home Protection Insurance Premium (if applicable).

You can use all the CPF savings in your Ordinary Account to pay up to 100 % Valuation Limit (VL) of the flat. The VL refers to the purchase price or the value of the flat at the time of purchase, whichever is lower. If your HDB loan is still outstanding when the total CPF withdrawals towards payment of the flat reach the VL, you may use additional CPF savings from your Ordinary Account if you have set aside the prevailing Minimum Sum cash component.

For any other options, readers would have to key in the values themselves as it requires information that would be known to the buyers only. Eg: (market value/ CPF money paid)

You can use all the CPF savings in your Ordinary Account to pay up to 100 % Valuation Limit (VL) of the flat. The VL refers to the purchase price or the value of the flat at the time of purchase, whichever is lower. If your HDB loan is still outstanding when the total CPF withdrawals towards payment of the flat reach the VL, you may use additional CPF savings from your Ordinary Account if you have set aside the prevailing Minimum Sum cash component.

For any other options, readers would have to key in the values themselves as it requires information that would be known to the buyers only. Eg: (market value/ CPF money paid)

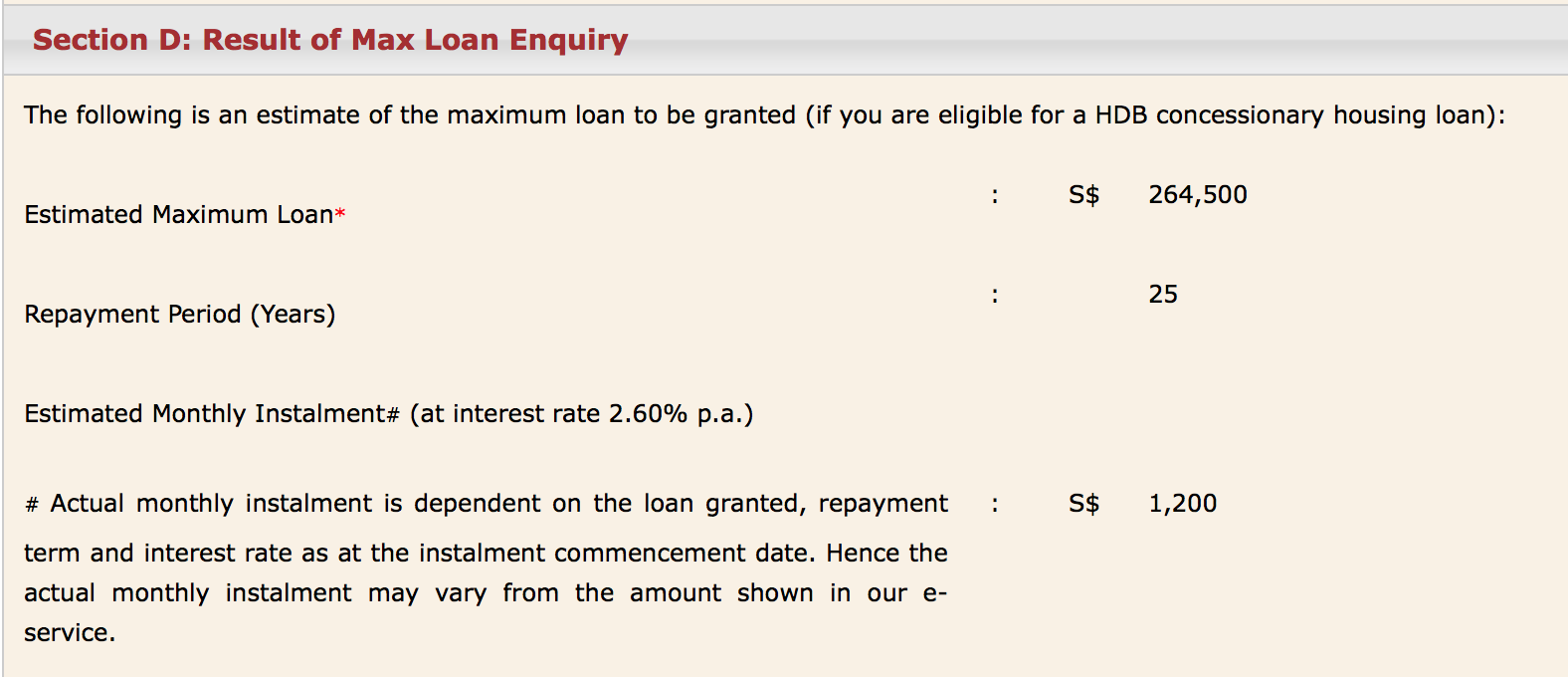

3. Housing Loan

What is the maximum amount loan you're entitled to?

I'm basing this on the assumption that you and your partner are drawing a salary of $2000/month. Because this is the average salary, most diploma holders get. May be more or less, this is just an estimate.

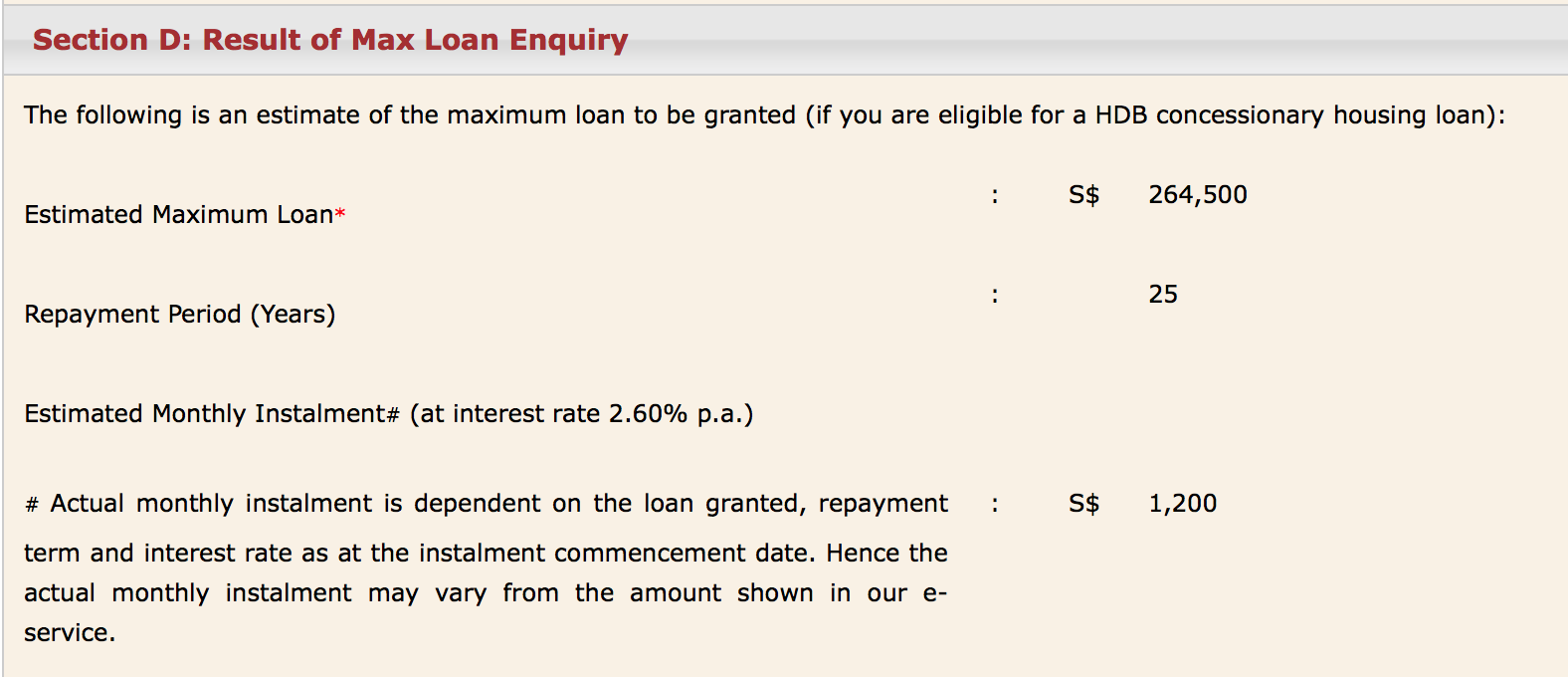

You would be entitled to a maximum loan of $264,500 payable over 25 years.

That would bring your monthly instalment at $1200/month.

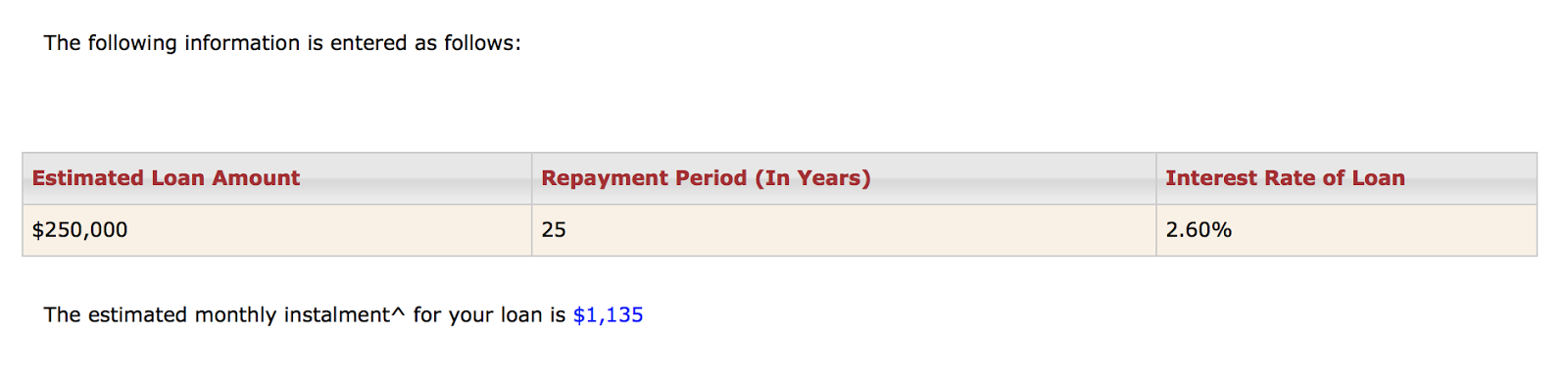

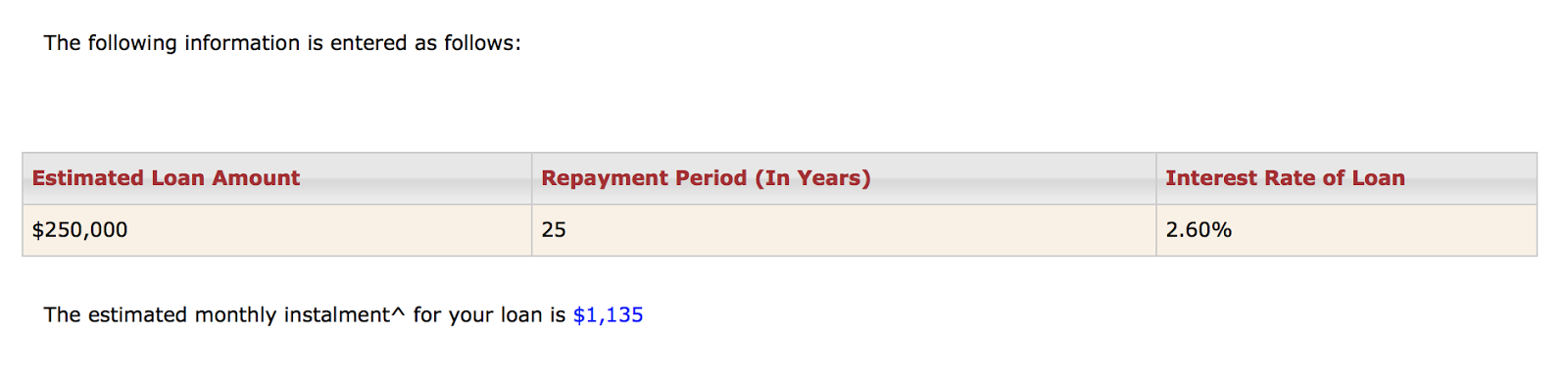

Still, assuming your home costs $300,000 and you pay $50,000 upfront, with the balance of $250,000 to be paid in instalments over 25 years.

If so, your new monthly instalment is calculated at $1,135/month.

So, if my salary is around $2,000/month it may be prudent for me to opt for a smaller home.

Assuming you and your partner pay half, you would have $2865/month to settle other payments and costs of living.

4. Bank Loan

I would not go into too much details here, as different banks offer different loan packages. Do keep in mind however, that bank interest rates tend to increase over the years.

So to sum up, to purchase your first home at costs of $300,000 you would need:

1. $10 Admin Fee

2. $2000 Option Fee.

3. $36,000 Downpayment

4. $5.50 (5 years) HDB Fire Insurance

5. $143/year (Home Protection Scheme)

Average amount needed upfront: $38,158.50 rounded off to $40,000.

Hope the above information have helped you in any way. Would appreciate constructive comments if I have made a mistake anywhere!

Signing Off,

Teenage Investor

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807- Wells Fargo And The Rousseau Story

Found via Naked Capitalism. In March 2000, Norman and Oriane Rousseau put 30 percent down to buy a house at 580 Wilshire Place, Newbury Park, CA. In the following years they were solicited to refinance their loan. In October 2007 they met with the loan...

- Hussman Weekly Market Comment: The Second Wave Begins

I should also note some features of the resets we are now beginning to observe. It is tempting to think that with Treasury yields fairly low, mortgage resets might be fairly benign in terms of their impact. The problem is that these Option ARM and Alt-A...

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- Net Worth Update - March 2012

March was another good month. Not quite as good as January and February but an $8k positive move is still good. More than half of that came from debt repayment. I sent an extra $3,350 to service that debt and it's going well to possibly be done with...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....