Money and Finance

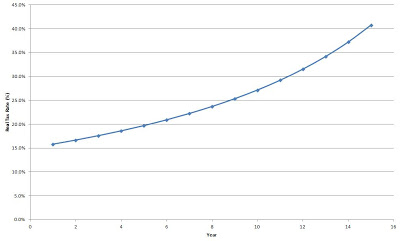

Just for a little perspective I made a quick graph showing the true capital gains tax rate adjusted for inflation. To make the math simple let's assume you invested $100 in a stock and it doubled in value to $200 so the capital gains taxes owed would be 15% * ($200-$100) = $15. If you use a 2.5% inflation rate you're $200 investment is actually only worth $195 after 1 year. You taxes stay the same at $15 but is being taxed in reality on $95 ($195 - $100) meaning your actual capital gains tax rate is 15.8%. If we go out to year 2 your inflation adjusted investment is worth $190.13 but you still pay the $15 in taxes giving you an adjusted capital gains tax rate of 16.6%. See chart below assuming 2.5% inflation rate.

Of course this is assuming just a 2.5% inflation rate, if you're saving to cover college costs or health care costs the actual inflation rate is closer to 7% on the low end. After 2 years you would be paying a 20.6% capital gains tax. So what does this mean? Well I don't have any faith that the government can overhaul the tax code to make it a lot simpler like I would prefer. And they do like to make things complicated so maybe they should add an inflation adjustment to the tax rate. I don't see either of these happening but it does add a new piece of information to help determine sales on stocks that run too far too fast. I have several positions as you'll see in my next portfolio update that have gains of 10-20% over a very short time period. Most of these are financials which I expected to see but nowhere near this fast. I think this is definitely another knock against buy-and-hold investing and another plus for buy-and-monitor.

- Levy, Harkins Q2 Update

Thanks to Ben R. for passing this along. We ended the second quarter of 2011 about where we ended the first; up a little bit and trailing the averages a little bit. We said at the end of our year end letter, “If recent gains come in a fast enough rush,...

- How Inflation Swindles The Equity Investor - By Warren E. Buffett, Fortune May 1977

It is no longer a secret that stocks, like bonds, do poorly in an inflationary environment. We have been in such an environment for most of the past decade, and it has indeed been a time of troubles for stocks. But the reasons for the stock market's...

- Portfolio Management: Considering Closing A Position

In a post last week I discussed our forecast tax situation for 2015. It's a weird place to be in as I don't expect us to normally be in the 15% tax bracket but there's a big benefit to that: qualified dividends and long term capital gains...

- Nominal Vs Real Return

Nominal returns are the total annual return that you received on the investment. Real return accounts for the effects of inflation. Real Return = Nominal Return - Inflation Rate For the purposes of this example I've assumed that $1 is invested at...

- Why Tax Increases Could Lead To More Buybacks

(Note: Since this article was published, dividend tax rates were increased as expected, but in-line with long-term capital gains. This is a more positive outcome than the one described in the article where dividends and capital gains were taxed at different...

Money and Finance

15% Capital Gains Tax Myth

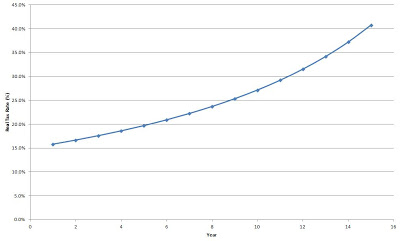

Just for a little perspective I made a quick graph showing the true capital gains tax rate adjusted for inflation. To make the math simple let's assume you invested $100 in a stock and it doubled in value to $200 so the capital gains taxes owed would be 15% * ($200-$100) = $15. If you use a 2.5% inflation rate you're $200 investment is actually only worth $195 after 1 year. You taxes stay the same at $15 but is being taxed in reality on $95 ($195 - $100) meaning your actual capital gains tax rate is 15.8%. If we go out to year 2 your inflation adjusted investment is worth $190.13 but you still pay the $15 in taxes giving you an adjusted capital gains tax rate of 16.6%. See chart below assuming 2.5% inflation rate.

Of course this is assuming just a 2.5% inflation rate, if you're saving to cover college costs or health care costs the actual inflation rate is closer to 7% on the low end. After 2 years you would be paying a 20.6% capital gains tax. So what does this mean? Well I don't have any faith that the government can overhaul the tax code to make it a lot simpler like I would prefer. And they do like to make things complicated so maybe they should add an inflation adjustment to the tax rate. I don't see either of these happening but it does add a new piece of information to help determine sales on stocks that run too far too fast. I have several positions as you'll see in my next portfolio update that have gains of 10-20% over a very short time period. Most of these are financials which I expected to see but nowhere near this fast. I think this is definitely another knock against buy-and-hold investing and another plus for buy-and-monitor.

- Levy, Harkins Q2 Update

Thanks to Ben R. for passing this along. We ended the second quarter of 2011 about where we ended the first; up a little bit and trailing the averages a little bit. We said at the end of our year end letter, “If recent gains come in a fast enough rush,...

- How Inflation Swindles The Equity Investor - By Warren E. Buffett, Fortune May 1977

It is no longer a secret that stocks, like bonds, do poorly in an inflationary environment. We have been in such an environment for most of the past decade, and it has indeed been a time of troubles for stocks. But the reasons for the stock market's...

- Portfolio Management: Considering Closing A Position

In a post last week I discussed our forecast tax situation for 2015. It's a weird place to be in as I don't expect us to normally be in the 15% tax bracket but there's a big benefit to that: qualified dividends and long term capital gains...

- Nominal Vs Real Return

Nominal returns are the total annual return that you received on the investment. Real return accounts for the effects of inflation. Real Return = Nominal Return - Inflation Rate For the purposes of this example I've assumed that $1 is invested at...

- Why Tax Increases Could Lead To More Buybacks

(Note: Since this article was published, dividend tax rates were increased as expected, but in-line with long-term capital gains. This is a more positive outcome than the one described in the article where dividends and capital gains were taxed at different...