Money and Finance

In an oped in the FT two years back, Nick Train asks a great question - "what is the right price for quality shares?" That's a deceptively important and potentially difficult problem actually.

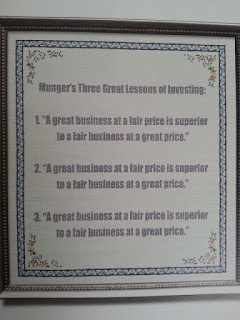

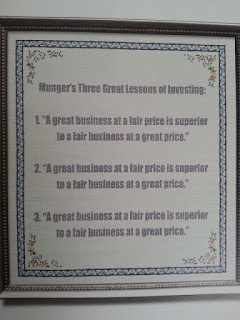

Its important because of Munger's three laws of investing

Its a potentially difficult problem because while most intermediate investors can recognize a bargain price and they can recognize high quality, the intersection of the two is problematic. Take a company like Diageo, its P/E is 20 right now. For a cheapskate like myself that is a bit on the high side. On the other hand, its a high quality franchise. For one example its Return On Equity has ranged between 32-48% for the last decade. But because the market is not generally stupid, it never gets classically cheap. The last time it was in bargain territory was 2008 (when everything was) when the P/E was down to 14.

So what to do? Sit on cash for a decade or two waiting for that one opportunity? Or pay up a bit for higher quality.

- Calling Up Visa For Cash

Step one in the investment decision process lies in identifying companies that are high quality. Whether that's through their moats, their operational excellence, their cash generation, their growth prospects, their credit ratings, their dividend...

- Paying Up For Quality Stocks

Price is what you pay, value is what you get. - Warren BuffettA few years back, my wife and I were shopping around for a leather couch to put in our new home. As we walked around the showroom of a furniture store and had a look at some of the price tags...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- When Second Best Is Better - The Case For Patient Quality Over Bravery (if You Have A Job)

Having a job is great, but its good to have extra income sources as well. A common one is to buy some rental property, but they have always seemed like a hassle to me. For one thing I do not have the handy man skills and for another my friends who do...

- High Yield Reads 3/22/14

Happy Spring. Summary of recents posts and pieces of interest, sometimes enduring, to dividend investors: Jason Zweig: on the downsides of share buybacks. Looking at the Russell 3000 he reports that after the index went up 33.5% and trades at a...

Money and Finance

Dwelling on Quality

In an oped in the FT two years back, Nick Train asks a great question - "what is the right price for quality shares?" That's a deceptively important and potentially difficult problem actually.

Its important because of Munger's three laws of investing

Its a potentially difficult problem because while most intermediate investors can recognize a bargain price and they can recognize high quality, the intersection of the two is problematic. Take a company like Diageo, its P/E is 20 right now. For a cheapskate like myself that is a bit on the high side. On the other hand, its a high quality franchise. For one example its Return On Equity has ranged between 32-48% for the last decade. But because the market is not generally stupid, it never gets classically cheap. The last time it was in bargain territory was 2008 (when everything was) when the P/E was down to 14.

So what to do? Sit on cash for a decade or two waiting for that one opportunity? Or pay up a bit for higher quality.

Nick Train: "...should Diageo’s shares really be trading at 20 times historic earnings?

Any discussion of these issues has to begin with an acknowledgment of the fundamental investment attractions of these shares – which are self-evidently great. I would contend that more investment weight should be placed on the excellence of a business than its valuation.

It is easier to be certain that Diageo is a great business than it is to decide whether or not it is overpriced on 20 times earnings, or still cheap on 15 times. The excellence is not debatable; the valuation discussion is worryingly arbitrary. So, I tend not to worry about valuation unless truly egregious levels are struck – say a price/earnings ratio of 30 times or more. "

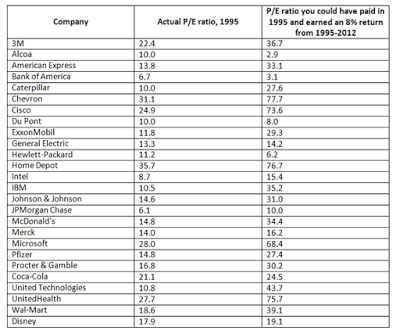

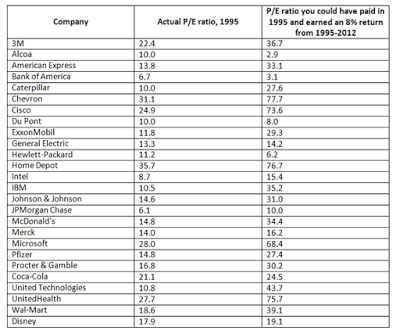

Morgan Housel did some digging on this topic, he went back to 1995 and looked at what P/E would you pay for an 8% return. Interestingly enough, many of the higher priced companies (on a P/E basis) had excellent returns, and many apparently cheap companies just stayed cheap or outright floundered.

In the Adventure of the Copper Beeches, Sherlock Holmes said, "Crime is common. Logic is rare. Therefore, it is upon logic rather than upon the crime that you should dwell." There are plenty of cheap stocks, even today, however the number of great companies that can compound over decades is very small. That kind of quality is rare, but it is knowable with investigation. Therefore, in the case of price and quality, the investor should dwell on quality.

- Calling Up Visa For Cash

Step one in the investment decision process lies in identifying companies that are high quality. Whether that's through their moats, their operational excellence, their cash generation, their growth prospects, their credit ratings, their dividend...

- Paying Up For Quality Stocks

Price is what you pay, value is what you get. - Warren BuffettA few years back, my wife and I were shopping around for a leather couch to put in our new home. As we walked around the showroom of a furniture store and had a look at some of the price tags...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- When Second Best Is Better - The Case For Patient Quality Over Bravery (if You Have A Job)

Having a job is great, but its good to have extra income sources as well. A common one is to buy some rental property, but they have always seemed like a hassle to me. For one thing I do not have the handy man skills and for another my friends who do...

- High Yield Reads 3/22/14

Happy Spring. Summary of recents posts and pieces of interest, sometimes enduring, to dividend investors: Jason Zweig: on the downsides of share buybacks. Looking at the Russell 3000 he reports that after the index went up 33.5% and trades at a...