Money and Finance

I bet it's been a while.

Perhaps part of the reason for this is that investors as a group prefer to focus on the quantifiable factors that can be entered into our spreadsheets - earnings, free cash flow, return on equity, etc.. More qualitative factors like culture are often unfairly dismissed as fluff.

Another reason could be that when we hear the term we associate it with the dull and lifeless, Office Space definition of "corporate culture."

Whatever the reasons why we tend to overlook corporate culture in our research process, we're doing ourselves a disservice by ignoring it. That's because, when a vibrant and authentic culture complements a company's durable competitive advantages, it can yield great results for shareholders.

Aligned interests

An example of a company with a great culture in my own portfolio is U.K.-based insurer, Admiral Group (ADM.L), which prides itself on being a low-cost operator. Indeed, in 2013, its U.K. business's expense ratio of 15% was about half the market average. It's true that there are other, more operational factors that anchor the company's low-cost advantage, but Admiral's culture also strengthens it in a number of ways.

For one, Admiral is frequently voted one of the top employers in the U.K. and in other markets in which it operates. By making it a fun place to work, the company attracts top talent and keeps costly employee turnover well below its competitors' attrition rates. Further, each employee - regardless of pay grade - has received £3,000 of free shares each year since the company went public in 2004. All else equal, employee-owners of the business should care more about cutting expenses than employees who only collect a paycheck. No one washes the rental car, after all.

One of my favorite anecdotes about Admiral's low-cost culture is that when it opened its first U.S. office in 2009, employees were required to do a push-up in view of the CEO's desk whenever they used the printer so as to keep paper costs to a minimum and encourage employees to first consider cheaper alternatives.

All adds up

To some, these may seem like nice-but-ultimately-inconsequential items, but as Buffett pointed out in his 2005 letter to Berkshire shareholders, the little things that companies do each day matter over time:

As long-term, business-focused investors ourselves, it's well worth our time to consider culture as part of our regular research process and how it may contribute to - or, in cases of a poor culture, even detract from - the company's ability to create shareholder value for years to come.

Related posts

Stay patient, stay focused.

Best,

Todd

- 6 Key Takeaways From The 2015 Berkshire Conference

Greetings from Omaha! Yesterday, I attended the Berkshire Hathaway Annual Meeting and finally got to see Buffett and Munger answer questions in person. For years I've followed the conference online, but it was definitely worth the seven-hour drive...

- Signs Of A Perfect Stock

Peter Lynch's chapter in One Up on Wall Street describing the signs of a "perfect stock" was one of the most influential to my early investing career because it steered my attention away from the water cooler stocks I'd typically hear about and...

- 5 Signs Of A Good Annual Report

Annual report season is upon us, which presents an opportunity to better understand our current portfolio holdings and watchlist ideas, as well as management's strategy and outlook. Here are five signs of a good annual report -- that is, one that...

- A Fresh Look At The Simple Formula

Earlier this week, a reader* of the blog had a look at the formula I laid out in "A Simple Formula for Investing Success" and cleverly suggested that the formula should be rearranged from: Investment + Good Company + Right Price +...

- The Benefits Of A Focused Investing Approach

When I was working in London a few years ago, I would often hear about a well-regarded investing book called The Zulu Principle by Jim Slater. As an American investor, I'd never come across the book and was curious to figure out what it was all...

Money and Finance

Don't Overlook This Factor in Your Research Process

"Culture is not the most important thing. It's the only thing." - Jim Sinegal, Costco co-founder & former CEOWhen was the last time you read a stock report that included a discussion of the company's culture?

I bet it's been a while.

Perhaps part of the reason for this is that investors as a group prefer to focus on the quantifiable factors that can be entered into our spreadsheets - earnings, free cash flow, return on equity, etc.. More qualitative factors like culture are often unfairly dismissed as fluff.

Another reason could be that when we hear the term we associate it with the dull and lifeless, Office Space definition of "corporate culture."

|

| And remember, next Friday is Hawaiian shirt day |

Aligned interests

An example of a company with a great culture in my own portfolio is U.K.-based insurer, Admiral Group (ADM.L), which prides itself on being a low-cost operator. Indeed, in 2013, its U.K. business's expense ratio of 15% was about half the market average. It's true that there are other, more operational factors that anchor the company's low-cost advantage, but Admiral's culture also strengthens it in a number of ways.

For one, Admiral is frequently voted one of the top employers in the U.K. and in other markets in which it operates. By making it a fun place to work, the company attracts top talent and keeps costly employee turnover well below its competitors' attrition rates. Further, each employee - regardless of pay grade - has received £3,000 of free shares each year since the company went public in 2004. All else equal, employee-owners of the business should care more about cutting expenses than employees who only collect a paycheck. No one washes the rental car, after all.

One of my favorite anecdotes about Admiral's low-cost culture is that when it opened its first U.S. office in 2009, employees were required to do a push-up in view of the CEO's desk whenever they used the printer so as to keep paper costs to a minimum and encourage employees to first consider cheaper alternatives.

All adds up

To some, these may seem like nice-but-ultimately-inconsequential items, but as Buffett pointed out in his 2005 letter to Berkshire shareholders, the little things that companies do each day matter over time:

If we are delighting customers, eliminating unnecessary costs and improving our products and services, we gain strength...On a daily basis, the effects of our actions are imperceptible; cumulatively, though, their consequences are enormous.

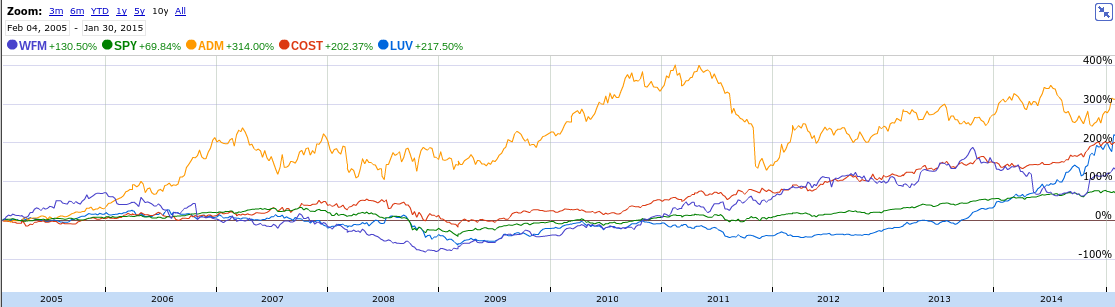

When our long-term competitive position improves as a result of these almost unnoticeable actions, we describe the phenomenon as "widening the moat."Culture matters precisely because it enables these small actions and can thus have a tremendous impact on a company's competitive position. Companies like Costco, Whole Foods, and Southwest Airlines have leveraged their unique corporate cultures to stand apart and build brand loyalty in highly competitive industries. Suffice it to say that patient investors have also done quite well with these companies.

|

| Click to enlarge |

Related posts

- The Difference Between a Good Company and a Great Company

- Philip Fisher's 15 Points to Look for in a Common Stock

- A Simple Formula for Investing Success

- Robert Vinall's latest shareholder letter (always a great read) - RV Capital

- If you can easily name ten of a company's competitors, don't invest in it - Sova Group

- The truth about investing - Mortality Sucks

- Buy low and then buy higher - MicroCapClub

- Keynes: A great investor who probably would have been fired today - A Wealth of Common Sense

- The first casualty of a bear market - Reformed Broker

- Mindfulness, meditation, and investing - Abnormal Returns

- Is active investing a zero sum game? - Monevator

- Pat Dorsey discussing economic moats at Google - YouTube

- Maybe you should invest in boring companies - MarketWatch

The book I'm currently reading:

- The Last Lion: William Spencer Churchill: Visions of Glory (1874-1932)

Best,

Todd

- 6 Key Takeaways From The 2015 Berkshire Conference

Greetings from Omaha! Yesterday, I attended the Berkshire Hathaway Annual Meeting and finally got to see Buffett and Munger answer questions in person. For years I've followed the conference online, but it was definitely worth the seven-hour drive...

- Signs Of A Perfect Stock

Peter Lynch's chapter in One Up on Wall Street describing the signs of a "perfect stock" was one of the most influential to my early investing career because it steered my attention away from the water cooler stocks I'd typically hear about and...

- 5 Signs Of A Good Annual Report

Annual report season is upon us, which presents an opportunity to better understand our current portfolio holdings and watchlist ideas, as well as management's strategy and outlook. Here are five signs of a good annual report -- that is, one that...

- A Fresh Look At The Simple Formula

Earlier this week, a reader* of the blog had a look at the formula I laid out in "A Simple Formula for Investing Success" and cleverly suggested that the formula should be rearranged from: Investment + Good Company + Right Price +...

- The Benefits Of A Focused Investing Approach

When I was working in London a few years ago, I would often hear about a well-regarded investing book called The Zulu Principle by Jim Slater. As an American investor, I'd never come across the book and was curious to figure out what it was all...