Money and Finance

Greetings from Omaha!

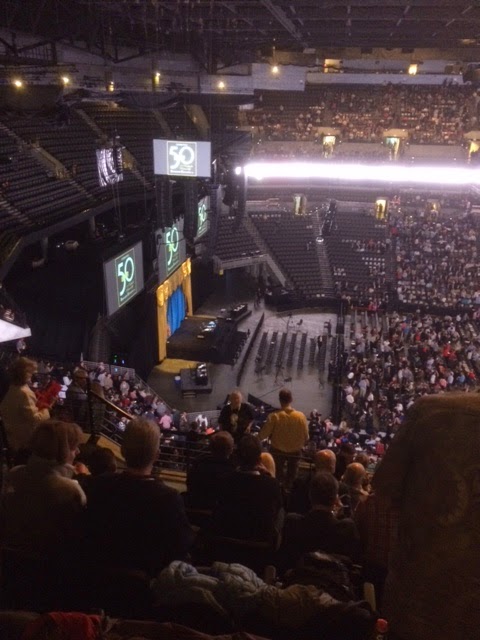

Yesterday, I attended the Berkshire Hathaway Annual Meeting and finally got to see Buffett and Munger answer questions in person. For years I've followed the conference online, but it was definitely worth the seven-hour drive from Chicago to experience it live. If you ever get the chance to make it out here for the conference, I highly recommend it. I've posted some of my pictures below.

As always, there were a ton of great quotes and lessons from the Q&A session, but here are my six key takeaways.

1. When evaluating a company, look for reasons not to buy the stock.

One of the questions from the audience asked Buffett and Munger to list five positive characteristics to look for in an investment. They declined to list five characteristics, saying the scenarios can change with each opportunity, but that they would focus on finding reasons not to keep researching a stock. To me, that means looking for holes in management's capital allocation process, a declining competitive advantage, and negative aspects of a corporate culture.

2. Focus on buying good companies at good prices and let the economy take care of itself.

Charlie had a great quote on investing in uncertain macroeconomic times: "We're swimming all the time and let the tide take care of itself." He also said he couldn't recall turning down an acquisition or deal due to macroeconomic factors. At times, they end up being wrong of course, but they're okay with that since they might have otherwise missed out on good opportunities as well.

3. The key is controlling your emotions.

Another great quote from Charlie was, "Warren, if people weren't so often wrong, we wouldn't be so rich." A number of times, they reinforced the importance of controlling your emotions and being rational so that you can capitalize on other investors' mistakes. Warren commented that business school training was a handicap 20 years ago when all they did was teach efficient market theory. The market will be irrational and it's your job to know when to pounce on the opportunities.

4. Corporate culture matters.

A number of audience members praised Buffett and Munger for creating a company with a sterling reputation. Buffett said that a company's culture and values come from the top (CEO, CFO, etc.), that they need to be written down, be consistently practiced, and that, with time, you'll have created a business with a great reputation. People will always follow what you do and not what you say.

5. Understand the power of incentives.

Buffett said, "Charlie and I really believe in the power of incentives." That is, understanding not just how executives are compensated and incentivized, but also how management's expectations might affect employee behavior. For example, if a CEO has set unrealistically high margin or growth targets, employees may take liberties they wouldn't otherwise to make sure the CEO looks good. These are situations you want to avoid.

6. Think long-term

Buffett commented that no one buys a farm or apartment complex based on how they think it will perform over the next month or so. They think about how it will do over the long-term. It's important that we think of our equity investments in the same way. Be a buyer of businesses, not a trader of tickers.

The six hours of back and forth with Buffett and Munger left a lot for me to think about on the drive back to Chicago today. I'm sure I'll think of something else I wanted to mention somewhere near Des Moines. :)

What did you think of the conference? Let me know in the comments section below or on Twitter @toddwenning.

Related posts:

Best,

Todd

Subscribe to Clear Eyes Investing by Email

- David Winters: Annual Letter To Investors

Found via GuruFocus. I am a success today because I had a friend who believed in me and I didn’t have the heart to let him down. -Abraham Lincoln Perhaps no company is more closely associated with its CEO than Berkshire Hathaway. When people think of...

- Should Long-term Investors Mind The Macro?

One of my key takeaways from the Berkshire Hathaway conference last weekend was that Buffett and Munger don't spend a lot of time, if any, thinking about the direction of the broader economy when they make investment decisions. At one point, Buffett...

- 5 Signs Of A Good Annual Report

Annual report season is upon us, which presents an opportunity to better understand our current portfolio holdings and watchlist ideas, as well as management's strategy and outlook. Here are five signs of a good annual report -- that is, one that...

- The Difference Between A Good Company And A Great Company

Consider the largest stock holding in your portfolio. If I were to ask you to list ten reasons why you own the stock, what would you say? You might talk about the company's strong competitive position, its attractive profit margins, its solid balance...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...

Money and Finance

6 Key Takeaways from the 2015 Berkshire Conference

Greetings from Omaha!

Yesterday, I attended the Berkshire Hathaway Annual Meeting and finally got to see Buffett and Munger answer questions in person. For years I've followed the conference online, but it was definitely worth the seven-hour drive from Chicago to experience it live. If you ever get the chance to make it out here for the conference, I highly recommend it. I've posted some of my pictures below.

As always, there were a ton of great quotes and lessons from the Q&A session, but here are my six key takeaways.

1. When evaluating a company, look for reasons not to buy the stock.

One of the questions from the audience asked Buffett and Munger to list five positive characteristics to look for in an investment. They declined to list five characteristics, saying the scenarios can change with each opportunity, but that they would focus on finding reasons not to keep researching a stock. To me, that means looking for holes in management's capital allocation process, a declining competitive advantage, and negative aspects of a corporate culture.

2. Focus on buying good companies at good prices and let the economy take care of itself.

Charlie had a great quote on investing in uncertain macroeconomic times: "We're swimming all the time and let the tide take care of itself." He also said he couldn't recall turning down an acquisition or deal due to macroeconomic factors. At times, they end up being wrong of course, but they're okay with that since they might have otherwise missed out on good opportunities as well.

3. The key is controlling your emotions.

Another great quote from Charlie was, "Warren, if people weren't so often wrong, we wouldn't be so rich." A number of times, they reinforced the importance of controlling your emotions and being rational so that you can capitalize on other investors' mistakes. Warren commented that business school training was a handicap 20 years ago when all they did was teach efficient market theory. The market will be irrational and it's your job to know when to pounce on the opportunities.

4. Corporate culture matters.

A number of audience members praised Buffett and Munger for creating a company with a sterling reputation. Buffett said that a company's culture and values come from the top (CEO, CFO, etc.), that they need to be written down, be consistently practiced, and that, with time, you'll have created a business with a great reputation. People will always follow what you do and not what you say.

5. Understand the power of incentives.

Buffett said, "Charlie and I really believe in the power of incentives." That is, understanding not just how executives are compensated and incentivized, but also how management's expectations might affect employee behavior. For example, if a CEO has set unrealistically high margin or growth targets, employees may take liberties they wouldn't otherwise to make sure the CEO looks good. These are situations you want to avoid.

6. Think long-term

Buffett commented that no one buys a farm or apartment complex based on how they think it will perform over the next month or so. They think about how it will do over the long-term. It's important that we think of our equity investments in the same way. Be a buyer of businesses, not a trader of tickers.

The six hours of back and forth with Buffett and Munger left a lot for me to think about on the drive back to Chicago today. I'm sure I'll think of something else I wanted to mention somewhere near Des Moines. :)

What did you think of the conference? Let me know in the comments section below or on Twitter @toddwenning.

Related posts:

- Why corporate culture matters in an investment

- Top quotes from the 2013 Berkshire letter

- Lessons from Buffett's Tesco mistake

Best,

Todd

Subscribe to Clear Eyes Investing by Email

- David Winters: Annual Letter To Investors

Found via GuruFocus. I am a success today because I had a friend who believed in me and I didn’t have the heart to let him down. -Abraham Lincoln Perhaps no company is more closely associated with its CEO than Berkshire Hathaway. When people think of...

- Should Long-term Investors Mind The Macro?

One of my key takeaways from the Berkshire Hathaway conference last weekend was that Buffett and Munger don't spend a lot of time, if any, thinking about the direction of the broader economy when they make investment decisions. At one point, Buffett...

- 5 Signs Of A Good Annual Report

Annual report season is upon us, which presents an opportunity to better understand our current portfolio holdings and watchlist ideas, as well as management's strategy and outlook. Here are five signs of a good annual report -- that is, one that...

- The Difference Between A Good Company And A Great Company

Consider the largest stock holding in your portfolio. If I were to ask you to list ten reasons why you own the stock, what would you say? You might talk about the company's strong competitive position, its attractive profit margins, its solid balance...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...