Money and Finance

In the last post I spoke to you about my crazy $20 a month buys in 16 stocks technique. Today I will talk about my crazy VIX hoarding technique. This topic was brought to you by Div4Son.

http://div4son.blogspot.com/

This is a long rant. I highlighted the main points for those who hate reading rants.

Here are my rules on using VIX.

What is a market dip vs What is a market recession?

Before we start let's talk a bit about the movers and shakers of the market. I'm no economist nor am I an expert stock broker. (My sister has a PhD in economics but she still thinks only rich people can make money in the market. Just goes to show you never trust experts). I'm just a typical mom and pop investor who finds the market interesting. How a bunch of crazy people doing irrational acts can create wealth is simply fascinating. There have been a lot of talk about "market crashes", "market recession", and "buy the dip." But which one is which one? Today I will discuss with you my novice understanding of what a "dip" is and what a "recession" is in regards to the VIX.

Before we start I would like to talk about the crazy people in the market. In my opinion (and a lot of old investors I speak to), the market is composed of 80% institutional investors (Schwabs, vanguard, state street, etc). These 80% owns your 401ks, etfs, and mutual funds. These people rarely if ever sell anything (most. Some mutual funds trade constantly). They have hearts of steel and veins of lead.

19% of the market is full of speculators. People who want a quick buck. Some are here because voodoo momentum tells them buying when the 20 and 200 crosses equal automatic profit. Some buy with the belief that the stock will eventually rise (me before I became a dividend investor). And some are here because someone told them they could make large amount of money on the market. These people are about principal protection. If they lose even 1 dollar, sell the stock. These people are easily spooked by market noise. For example, when Starbucks revamped their points system (the old was buy 10 cups=1 free cup) CNBC, yahoo finance, and MSN business called it "THE DEATH OF STARBUCKS." The price of SBUX went from the $60s to the low $50s. Now SBUX is near $60 again.

The last 1% are investors. People who will stick with a stock thick and thin even if that's a good or bad thing. Most dividend investors are in this group. (as a side note I try my best to be in this group but every now and then I jump on the 19% bandwagon).

So what does this have to do with dips and recessions? In my opinion those 19%ers control the daily ups and downs of the market. Unless etfs are having a fire sale, the main movers and shakers in the market are those 19%ers.

So how to use the 19%ers to our advantage? In comes the Chicago Board Options Exchange aka CBOE volatility index aka VIX aka the fear and greed index.

So what is the VIX? The VIX is a mathematical formula measuring the volatility of the S&P index for the next 30 days by measuring the puts and calls of the S&P 500. Remember how I told you the 19%ers love quick profits?

All you need to know about the VIX is

What does this tell us? The 19%ers are easily spooked. When they are spooked the VIX goes up. When the VIX goes up the market goes down. When the market goes down, watch the VIX. Watch for a steady increase in the VIX. You should see green days after days meaning volatility is increasing. On the first consecutive red days (meaning volatility is decreasing) I jump into the market and test the waters. If the VIX continues to decrease, I found the bottom. If not I got into a value trap. Good luck finding the bottom though. I still haven't been able to accurately predict the bottom.

- A Great Time To Go Hunting For Dividends

The market downturn this past week -- indeed, over the past month -- has reignited my interest in buying stocks, and particularly dividend payers. Stocks were in general looking a bit expensive earlier in 2012 and I struggled to find many good opportunities....

- Question: Can You Blindly Buy Stocks And Retire?

Here's an interesting question. Let's say you're not a skilled or experienced investor. You don't know all the lingo and still look up words to read balance sheet. But you don't want to pay somebody a good portion of your paycheck...

- B&g Foods, Inc: A Risky Food Company

In my search for safety I found this interesting stock; BGS. B&G Foods Inc & its subsidiaries manufacture, sell & distribute a portfolio of branded shelf-stable foods across the United States, Canada & Puerto Rico. The Company's brands...

- Recent Buy: Wmt & Vfc

Market is going up again. Amazon is trading at 900x PE, Peter Schiff thinks the market is overvalued, and daily hit piece by yahoo calling for an epic crash in December. In other news .... On November 20, 2015, I added $250 at $61.02 per share or 4.0970...

- My Stock Picking Strategy

When I describe my stock picking strategy, many people think it's weird. I wrote about my Stock picking strategy before, you can read it here. Here is my updated list: 1. The stock should pay dividends. I added it as a rule. I still...

Money and Finance

Dips, doubling down, recession, and VIX

In the last post I spoke to you about my crazy $20 a month buys in 16 stocks technique. Today I will talk about my crazy VIX hoarding technique. This topic was brought to you by Div4Son.

http://div4son.blogspot.com/

This is a long rant. I highlighted the main points for those who hate reading rants.

Here are my rules on using VIX.

- When the VIX is below 20, I do my ordinary search for cheap stocks. Not really excited about anything.

- When the VIX is above 20 I get greedy but I let the stocks come to me,

- When it breaks 40, I break open the bank and start hoarding equities.

- But if VIX ever breaks 45, I'm back to hoarding cash.

What is a market dip vs What is a market recession?

Before we start I would like to talk about the crazy people in the market. In my opinion (and a lot of old investors I speak to), the market is composed of 80% institutional investors (Schwabs, vanguard, state street, etc). These 80% owns your 401ks, etfs, and mutual funds. These people rarely if ever sell anything (most. Some mutual funds trade constantly). They have hearts of steel and veins of lead.

19% of the market is full of speculators. People who want a quick buck. Some are here because voodoo momentum tells them buying when the 20 and 200 crosses equal automatic profit. Some buy with the belief that the stock will eventually rise (me before I became a dividend investor). And some are here because someone told them they could make large amount of money on the market. These people are about principal protection. If they lose even 1 dollar, sell the stock. These people are easily spooked by market noise. For example, when Starbucks revamped their points system (the old was buy 10 cups=1 free cup) CNBC, yahoo finance, and MSN business called it "THE DEATH OF STARBUCKS." The price of SBUX went from the $60s to the low $50s. Now SBUX is near $60 again.

The last 1% are investors. People who will stick with a stock thick and thin even if that's a good or bad thing. Most dividend investors are in this group. (as a side note I try my best to be in this group but every now and then I jump on the 19% bandwagon).

So what does this have to do with dips and recessions? In my opinion those 19%ers control the daily ups and downs of the market. Unless etfs are having a fire sale, the main movers and shakers in the market are those 19%ers.

So how to use the 19%ers to our advantage? In comes the Chicago Board Options Exchange aka CBOE volatility index aka VIX aka the fear and greed index.

So what is the VIX? The VIX is a mathematical formula measuring the volatility of the S&P index for the next 30 days by measuring the puts and calls of the S&P 500. Remember how I told you the 19%ers love quick profits?

All you need to know about the VIX is

- When the VIX is below 20 it is said that people are greedy. The market is predictable which leads to gains.

- When the VIX is above 30 it is said that people are fearful. The market is unpredictable and traders exit the market for safe havens.

- If the VIX hits 50, expect massive liquidation.

- If the VIX breaks 50, expect people jumping out of windows.

- For me, when the VIX is below 20, I do my ordinary search for cheap stocks. Not really excited about anything.

- When the VIX is above 20 I get greedy.

- When it breaks 40, I break open the bank.

- But if it ever breaks 45, I'm back to hoarding cash. Here's my rational.

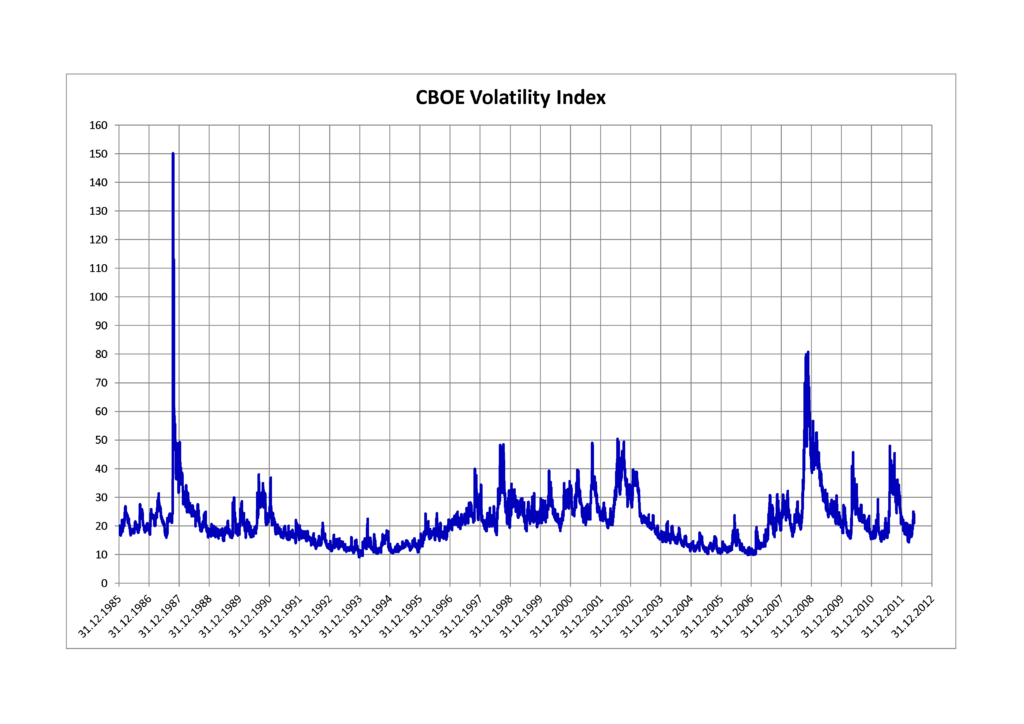

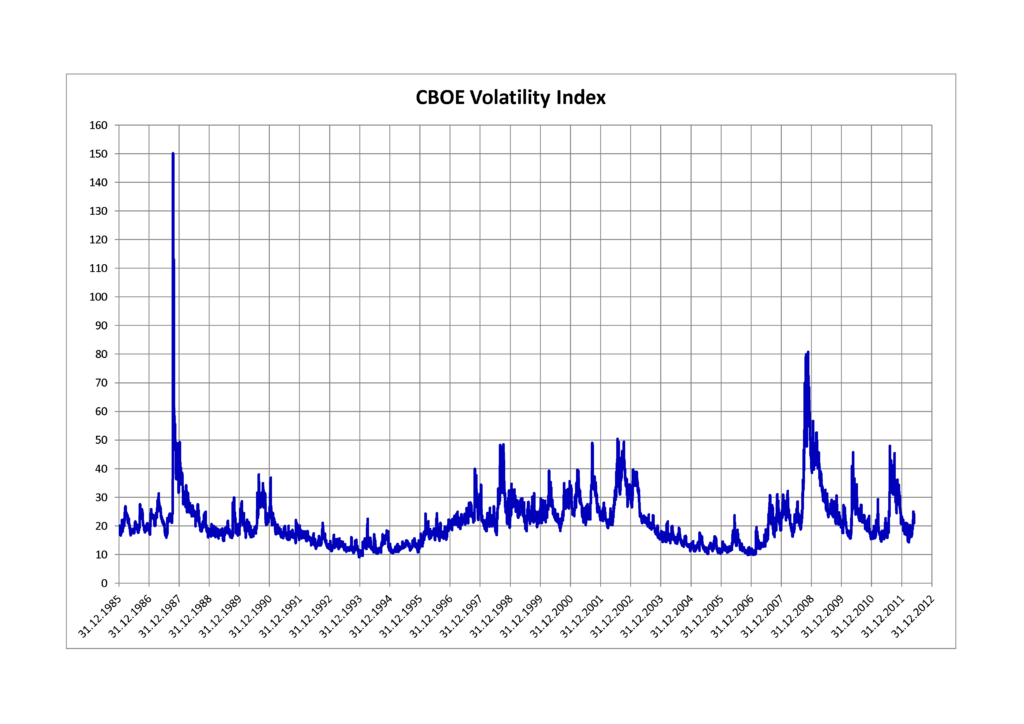

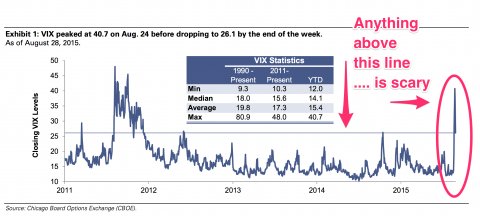

I don't have the software to cut and paste pictures I find online. This is from Wikipedia.

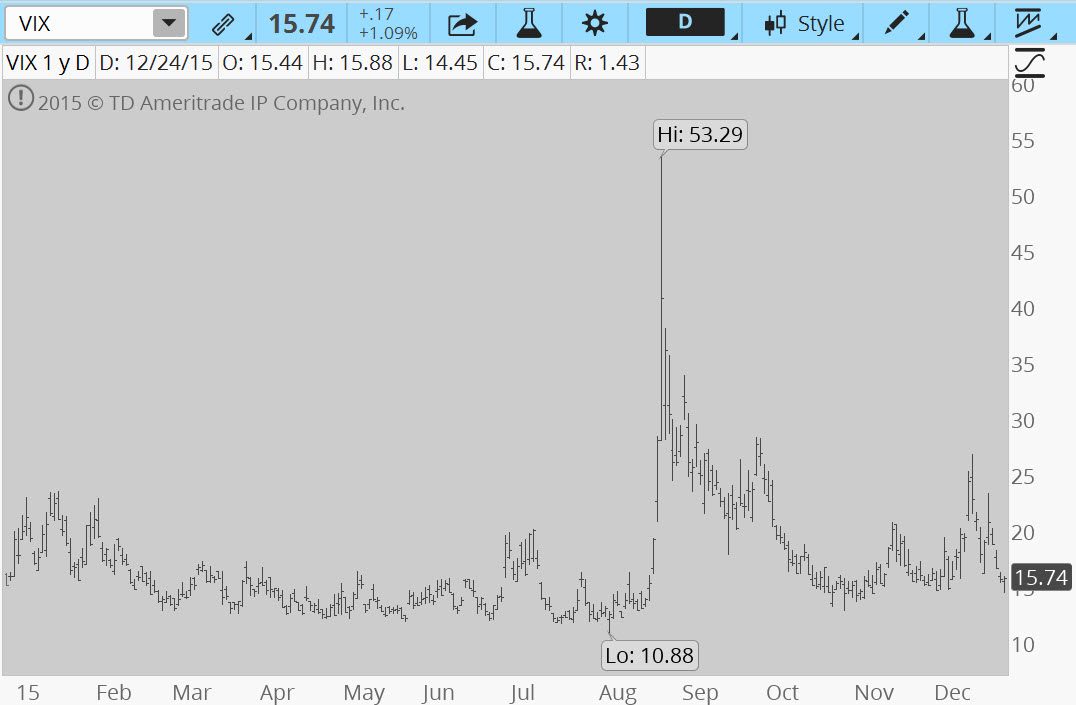

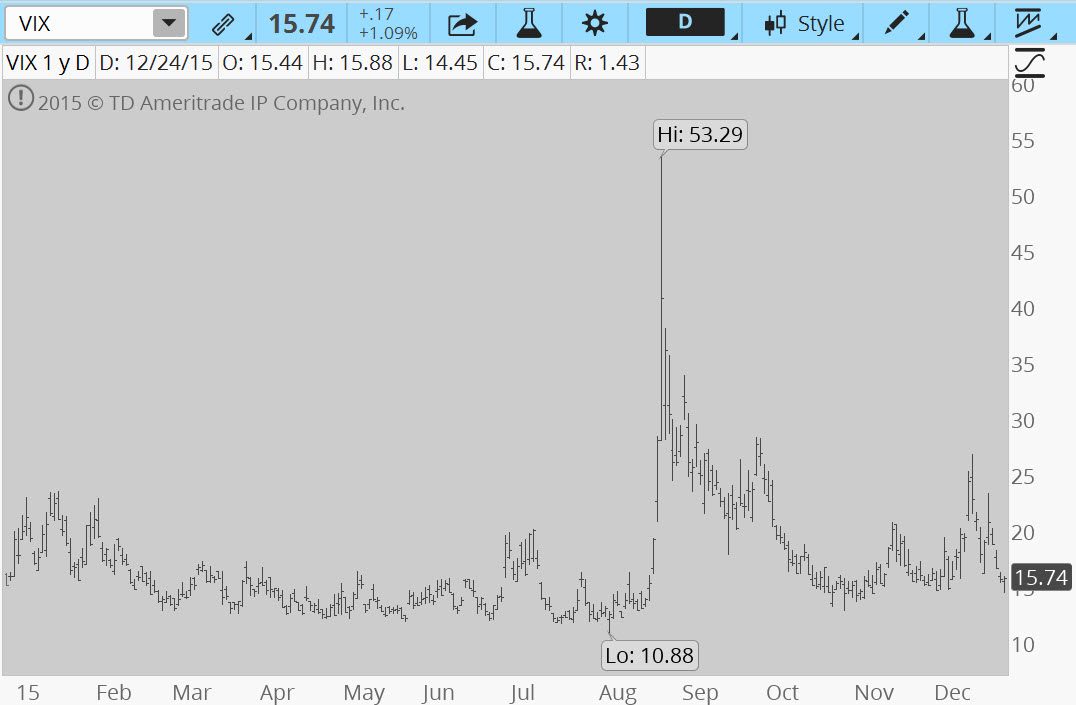

And this is from another website I stole the picture from. https://tickertape.tdameritrade.com/options/2015/12/volatility-year-in-review-46770

What do you notice about the wikipedia picture?

- Besides three times, the VIX touches 50 and then falls back down. If it breaks 50 all hell is broken loose.

- Only three times has the VIX broke 50; Black Monday in 1987, 9/11, and the Recession in 2008-2009. Therefore we can say 50 VIX is the resistance between a dip and absolute mayhem.

Let's take a look at the past 5 years and review the VIX. You can follow with me on yahoo finance.

- In July 2011 until January 2012,

- The VIX went to 20 and hit as high at 42. Cause? First time fed mentioned stopping QE and hiking interest rates.

- May 2012-June 2012,

- Again the feds meeting and interest rate scare

- December 2012,

- again the feds.

- October 2014, December 2014, and January 2015,

- again the feds

- August 2015 until early October 2015

- interest rate threats

- January & February 2016

- china slowing down

What does this tell us? The 19%ers are easily spooked. When they are spooked the VIX goes up. When the VIX goes up the market goes down. When the market goes down, watch the VIX. Watch for a steady increase in the VIX. You should see green days after days meaning volatility is increasing. On the first consecutive red days (meaning volatility is decreasing) I jump into the market and test the waters. If the VIX continues to decrease, I found the bottom. If not I got into a value trap. Good luck finding the bottom though. I still haven't been able to accurately predict the bottom.

Even if you fall for the value trap, the market still rally back in each of these dips and you would have made more money than if you didn't invest.

How to spot a VIX increase?

Are you spooked yet? The simplest way is to to add VIX to your yahoo portfolio. Another way is to sign up to twitter and link your page to all the major investment sources; MSNBC business, Bloomberg, WSJ, CNBC, CNN money, Yahoo finance, FOX business, etc. Why? Remember when I said the 19%ers are easily spooked? Nothing spooks traders than 20 different websites calling for the death of the stock market.

Take the 2015 VIX chart for example. Last August the feds mentioned the possibility of hiking interest rates. Within a day I saw hundred of articles on numerous websites calling for the death of the market, corrections, recession, and Yahoo Finance calling it the worst recession you will ever see in your lifetime.

For those who are unfamiliar to American politics. Go to any major media website and look at the news. I bet the majority are anti-trump articles. Have you ever noticed that articles are written in such a slant that it's almost like the author wants you to act and feel a certain way? At first it's "OMG Trump did what." Then people regain their senses and start to ignore the media.

Leading up to the interest rate hike of 2015 this was the same thing we saw every single freaking day. Every major financial newspaper called it the worst thing to happen since Hitler. From August to September the market went down. It went back up when everybody regained their senses but then crashed again in November and December coincide with the rush of interest rate mania.

What happened? Interest rates increased. China crashed and took the market with it. Buyers were rewarded handsomely and sellers are still crying.

Leading to November of this year look at the winner of the Trump-Hillary election. If Trump wins, the media will probably attack Apple and companies who make parts overseas. If Hillary wins, the media will probably attack the healthcare industry. (Come on $20 JNJ).

What to take from all of this?

What to take from all of this?

- Markets should be ran by fundamentals but more often than not it's by speculation and fear mongering.

- When you start seeing a flood of negative market articles from every major news organization get ready.

- Don't go to the VIX. Wait for the VIX to come to you.

- If the VIX breaches 20, the market starts to get jittery. You can test the waters now searching for the bottom but watch out for value traps.

- If VIX breaches 30, get greedy. People are fearful now. Feast on their fears.

- this is when I start using the consecutive days test. I'm looking for two consecutive red VIX decline.

- I make a small order in my Loyal3 and wait and see how the market reacts.

- If the decline in VIX continues, I make a large buy.

- If VIX breaches 40, I check my bank accounts.

- If VIX breaches 45, I stop investing.

- Remember when I said the VIX's has support at 50? From 45-50 is a tough struggle. If 50 breaks, then we are into a 2008-ish recession. From 45-50, it should give me plenty of time to hoard some cash just in case anything bad happens

- If VIX breaches 50, I hold on to my pants.

- If VIX doesn't stop at around 50, i stop all activities and wait. This is the point of no return.

Don't take this as I'm some paranoid guy that stalks the VIX. If I notice a large flood of negative articles in my twitter feed, I look at the VIX closing price for a couple of days. VIX 20 rarely happens and leaves as quickly as it comes. But it's best to know that VIX 20 is not a recession. The highest VIX ever got in 2016 January-February was 28.

VIX is good to determine dips but not very good for determining recession. I'll write another article on that later on this week.

*these are my opinions. don't you dare rely on them!

- A Great Time To Go Hunting For Dividends

The market downturn this past week -- indeed, over the past month -- has reignited my interest in buying stocks, and particularly dividend payers. Stocks were in general looking a bit expensive earlier in 2012 and I struggled to find many good opportunities....

- Question: Can You Blindly Buy Stocks And Retire?

Here's an interesting question. Let's say you're not a skilled or experienced investor. You don't know all the lingo and still look up words to read balance sheet. But you don't want to pay somebody a good portion of your paycheck...

- B&g Foods, Inc: A Risky Food Company

In my search for safety I found this interesting stock; BGS. B&G Foods Inc & its subsidiaries manufacture, sell & distribute a portfolio of branded shelf-stable foods across the United States, Canada & Puerto Rico. The Company's brands...

- Recent Buy: Wmt & Vfc

Market is going up again. Amazon is trading at 900x PE, Peter Schiff thinks the market is overvalued, and daily hit piece by yahoo calling for an epic crash in December. In other news .... On November 20, 2015, I added $250 at $61.02 per share or 4.0970...

- My Stock Picking Strategy

When I describe my stock picking strategy, many people think it's weird. I wrote about my Stock picking strategy before, you can read it here. Here is my updated list: 1. The stock should pay dividends. I added it as a rule. I still...