Money and Finance

The conventional definition of yield-on-cost (YOC)is to take the current annual dividend payment from a company and divide that by the original purchase price, rather than the current price, to determine the yield-on-cost. As a company raises it's dividend your yield-on-cost would rise whether the stock price goes up or down. It's a good way to look at the actual yield that you are receiving on your money rather than the current market determined amount for the current yield.

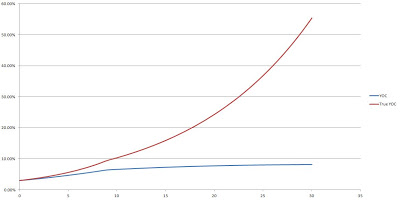

Another way to calculate it that I like to use just as a reference is the total annual payout that you would receive divided by the original investment amount. I like to call this the YOP. While this sounds the same what I do is factor in dividends that have already been reinvested and count the dividends that those shares payout as additional yield on the original investment. You can see the divergence in the following chart.

This isn't useful for determining future purchases but I do like to look at it this way since I consider the original investment as my only cost basis. It's good to see the YOP that I'm receiving and helps to reinforce the slow process that is dividend growth investing.

- Recent Sell

This afternoon I decided to go on and sell out of my position in Pfizer (PFE). I sold all shares at a price of $23.79 which netted a gain of $114.24 on the position. The shares had a YOC of 4.71% which was nice and they were due for a dividend increase...

- Conocophillips Spinoff

Yesterday the ConocoPhillips spinoff into two companies went through. Phillips 66 (PSX) was spunoff from the parent company of Conoco (COP) to create value for shareholders. Phillips 66 is now comprised of the refining and pipeline business while Conoco...

- Recent Transactions

Today I sold 2 option contracts in an attempt to add some more income. The first contract that I sold was the BAC Jan 18 2014 $7 Put for $1.73. If the option gets exercised then my cost basis for this transaction will be $5.27. If the option expires then...

- Buy A High Yield Portfolio And Hold Forever

In a October 2008 article, Todd Wenning described the High Yield Portfolio approach this way - "Buy 10 to 15 high-yielding large-cap stocks today and hold them -- forever." Todd Wenning used a ruleset from Stephen Bland writing at the Motley Fool UK back...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

Money and Finance

Another look at yield-on-cost

The conventional definition of yield-on-cost (YOC)is to take the current annual dividend payment from a company and divide that by the original purchase price, rather than the current price, to determine the yield-on-cost. As a company raises it's dividend your yield-on-cost would rise whether the stock price goes up or down. It's a good way to look at the actual yield that you are receiving on your money rather than the current market determined amount for the current yield.

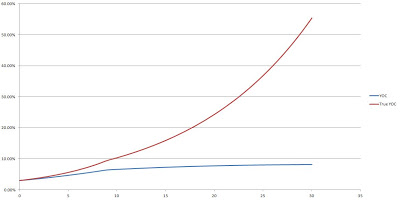

Another way to calculate it that I like to use just as a reference is the total annual payout that you would receive divided by the original investment amount. I like to call this the YOP. While this sounds the same what I do is factor in dividends that have already been reinvested and count the dividends that those shares payout as additional yield on the original investment. You can see the divergence in the following chart.

This isn't useful for determining future purchases but I do like to look at it this way since I consider the original investment as my only cost basis. It's good to see the YOP that I'm receiving and helps to reinforce the slow process that is dividend growth investing.

- Recent Sell

This afternoon I decided to go on and sell out of my position in Pfizer (PFE). I sold all shares at a price of $23.79 which netted a gain of $114.24 on the position. The shares had a YOC of 4.71% which was nice and they were due for a dividend increase...

- Conocophillips Spinoff

Yesterday the ConocoPhillips spinoff into two companies went through. Phillips 66 (PSX) was spunoff from the parent company of Conoco (COP) to create value for shareholders. Phillips 66 is now comprised of the refining and pipeline business while Conoco...

- Recent Transactions

Today I sold 2 option contracts in an attempt to add some more income. The first contract that I sold was the BAC Jan 18 2014 $7 Put for $1.73. If the option gets exercised then my cost basis for this transaction will be $5.27. If the option expires then...

- Buy A High Yield Portfolio And Hold Forever

In a October 2008 article, Todd Wenning described the High Yield Portfolio approach this way - "Buy 10 to 15 high-yielding large-cap stocks today and hold them -- forever." Todd Wenning used a ruleset from Stephen Bland writing at the Motley Fool UK back...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...