Money and Finance

Hi Everyone,

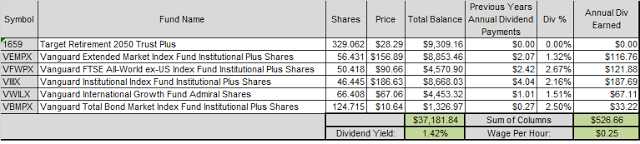

So a follow up post to the Dividend Income - the 401K Portfolio update. I said that I would post about the 401K when big changes were made or about twice a year in July and January. Usually in June and December, some of my funds pay some dividends and after 6 months of new capital, there are a decent amount of shares added. My company's 401K policy is that employees receive 3% company match throughout the year and then a bonus of 2% at the end of the year. The 2% doesn't hit until around the March timeframe so I'll probably have an update then. My portfolio now looks like this:

I said these exact words in my past post about the 401K -- "The overall goal of my investing journey is to retire at an age much younger than most which is why I am mostly invested in a taxable account. I need to be able to retrieve those funds and more importantly, the dividends that are generated to support our family when the time comes."

However, Blogger Retire29 has a great post about how to legally transfer your employers 401K to an IRA and then be able to retrieve those funds in 5 years to invest as you please. So I am leaning towards maxing out our 401K's. To be able to save money on taxes is a great thing!

I would love to max out our taxable account until we reach $11,000 in dividends per year, but that might take a little too long. I am now thinking of doing something like this: Continue to max out our taxable portfolio until the dividends reach $7,500 (hopefully end of this year). That would allow for one IRA to be completely funded at $5,500 and another one to be funded at $2,000 a year. We would come up with the other $3,500 per year to max out that IRA until dividends from taxable take over completely. Simultaneously I will begin to max out my 401K. I have already started the process of maxing out tax advantaged accounts with the HSA that is now completely funded.

My wife and I invested $47,000 last year in our taxable account alone. This does not include dividends because they are all on DRIP right now. Total, we put to work about $52,000 in our taxable account. Starting next year, $18,000 into 401K, $11,000 into IRA's and $3,500 into HSA leaves us with still $20,000 to invest into our taxable account (unless we have a baby and my wife quits her job!). Am I missing anything? Other than my wife's 401K?

Anyways, the whole reason I want to keep investing in our taxable account is that I would love for it to produce over $10,000 in dividends which is also enough money to lump sum pay off our mortgage and have a little bit left over if I was to lose my job. Those two totals go roughly hand in hand with a 4% yield. I like the security to be able to get to our money quickly.

So what do you all think about that plan? Good, bad? What are you doing?

Combining both my 401K and our taxable account, we hold roughly $160,000 in investments!

Thanks,

ADD

- 401k Contribution

I originally had a goal of maxing out my 401k this year but have since changed my goal and lowered my contribution rate. Since my ultimate goal is to retire by 40 I need as much cash available to invest in taxable accounts as possible. I was contributing...

- Financial Changes To Help With Taxes

Good Afternoon Everyone! In the past, my wife and I have done quite well with regards to our taxes at the end of the year. I do not think either of us have ever had to pay taxes at the end of the year. Well, this year is no different. ...

- 401k Update - February 2015

Hi Everyone, Hope all is well. I continue to embrace the blogging community and I continue to love it. Just a quick post tonight about my 401K Portfolio. I said that I would post about the 401K when big changes were made and I'm...

- 401k Update - January 2015

Hi Everyone, Hope all is well. I've been really embracing the blogging world this past week and man, it is time consuming.... but I love it! Commenting on others posts and getting more involved requires a big commitment but it makes me...

- Savings Rate And Monthly Investing

Hi Everyone, Hope you all have had a nice couple of weeks. I have been incredibly busy with work and as such, haven’t had much time to write. With July 4th write around the corner, we are over half way through 2014 and the year is just flying...

Money and Finance

401K Update - January 2016

Hi Everyone,

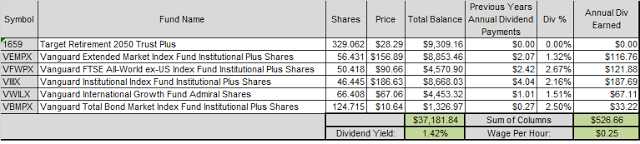

So a follow up post to the Dividend Income - the 401K Portfolio update. I said that I would post about the 401K when big changes were made or about twice a year in July and January. Usually in June and December, some of my funds pay some dividends and after 6 months of new capital, there are a decent amount of shares added. My company's 401K policy is that employees receive 3% company match throughout the year and then a bonus of 2% at the end of the year. The 2% doesn't hit until around the March timeframe so I'll probably have an update then. My portfolio now looks like this:

As of 1/5/2016:

At the present time, I view my 401K Portfolio as an added bonus to my path to financial independence but I might be rethinking my ways...

I said these exact words in my past post about the 401K -- "The overall goal of my investing journey is to retire at an age much younger than most which is why I am mostly invested in a taxable account. I need to be able to retrieve those funds and more importantly, the dividends that are generated to support our family when the time comes."

However, Blogger Retire29 has a great post about how to legally transfer your employers 401K to an IRA and then be able to retrieve those funds in 5 years to invest as you please. So I am leaning towards maxing out our 401K's. To be able to save money on taxes is a great thing!

I would love to max out our taxable account until we reach $11,000 in dividends per year, but that might take a little too long. I am now thinking of doing something like this: Continue to max out our taxable portfolio until the dividends reach $7,500 (hopefully end of this year). That would allow for one IRA to be completely funded at $5,500 and another one to be funded at $2,000 a year. We would come up with the other $3,500 per year to max out that IRA until dividends from taxable take over completely. Simultaneously I will begin to max out my 401K. I have already started the process of maxing out tax advantaged accounts with the HSA that is now completely funded.

My wife and I invested $47,000 last year in our taxable account alone. This does not include dividends because they are all on DRIP right now. Total, we put to work about $52,000 in our taxable account. Starting next year, $18,000 into 401K, $11,000 into IRA's and $3,500 into HSA leaves us with still $20,000 to invest into our taxable account (unless we have a baby and my wife quits her job!). Am I missing anything? Other than my wife's 401K?

Anyways, the whole reason I want to keep investing in our taxable account is that I would love for it to produce over $10,000 in dividends which is also enough money to lump sum pay off our mortgage and have a little bit left over if I was to lose my job. Those two totals go roughly hand in hand with a 4% yield. I like the security to be able to get to our money quickly.

So what do you all think about that plan? Good, bad? What are you doing?

Combining both my 401K and our taxable account, we hold roughly $160,000 in investments!

Thanks,

ADD

- 401k Contribution

I originally had a goal of maxing out my 401k this year but have since changed my goal and lowered my contribution rate. Since my ultimate goal is to retire by 40 I need as much cash available to invest in taxable accounts as possible. I was contributing...

- Financial Changes To Help With Taxes

Good Afternoon Everyone! In the past, my wife and I have done quite well with regards to our taxes at the end of the year. I do not think either of us have ever had to pay taxes at the end of the year. Well, this year is no different. ...

- 401k Update - February 2015

Hi Everyone, Hope all is well. I continue to embrace the blogging community and I continue to love it. Just a quick post tonight about my 401K Portfolio. I said that I would post about the 401K when big changes were made and I'm...

- 401k Update - January 2015

Hi Everyone, Hope all is well. I've been really embracing the blogging world this past week and man, it is time consuming.... but I love it! Commenting on others posts and getting more involved requires a big commitment but it makes me...

- Savings Rate And Monthly Investing

Hi Everyone, Hope you all have had a nice couple of weeks. I have been incredibly busy with work and as such, haven’t had much time to write. With July 4th write around the corner, we are over half way through 2014 and the year is just flying...