Money and Finance

Hi Everyone,

Hope all is well. I've been really embracing the blogging world this past week and man, it is time consuming.... but I love it! Commenting on others posts and getting more involved requires a big commitment but it makes me want to continue to push myself to greater heights. With that being said, I have finally gotten around to making a new page for the 401K! This is one of the last financial tidbits that I have needed to get onto the blog for a while now and I am happy I can share it with all of you.

At the present time, I view my 401K Portfolio as an added bonus to my path to financial independence. The overall goal of my investing journey is to retire at an age much younger than most which is why I am mostly invested in a taxable account. I need to be able to retrieve those funds and more importantly, the dividends that are generated to support our family when the time comes. I am interested in starting an IRA but I have not taken the jump yet. I call my 401K an added bonus because from what I have read, I cannot touch that money until at least age 55 (depending on stipulations that I may or may not be able to take part in) but most likely 59.5 without incurring penalties. Therefore, this money will sit in my account just compounding away for the next 32.5 Years!

At the current time, I have roughly $30,000 in total. If my portfolio grows at an average of 7% per year, I am looking at about $275,000 with zero additional contributions. That's compound growth at its finest.

It is amazing to think that without doing any more work I could potential have quarter of a million dollars in 32 years. That will not be the case though. If I stayed at my job until age 60, contributing the same amount I do now will yield about $1,000,000. Pretty sweet to think about. Working for a government contractor there is added stress that the contracts you work on will expire/end and you have to go looking for a new job. Currently, my job is steady and I still have about 5 years left on the contracts I work on which is a lifetime in the contracting world. Many contracts nowadays come out for 1 or 2 years and need to be re-competed very often which leads to uncertainty. With that being said, even if I only work for those 5 years, investing the way I do, my total at age 60 will be about $500,000... that right there is a nice retirement for most people and that's why I call this an added bonus! The money comes straight out of my paycheck and I barely notice it is gone but those little additions add up to a lot of stability in the future!

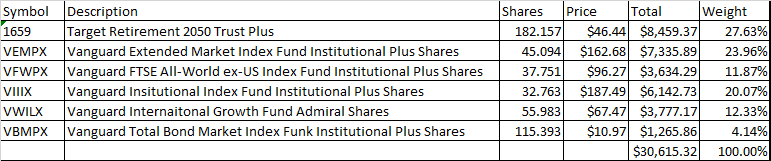

I have 6 different funds that I am invested in and I do not think that will ever change. I adjust the contribution percentages from time to time depending how I think the macro picture is looking. For instance, I have been investing more money towards the domestic funds rather than international because I believe the domestic companies will fair better, which they have. I might change over to more international now that the domestics have rallied hard and are more overpriced than international. I have a small allocation towards bonds just because I like to see a little bit of dividends coming through every month. Also, it will be easy to transfer money into that fund if I feel the market is going to pullback hard. My biggest fund is the retirement 2050 fund which will mean I would be 73 years old at that time. I figured to push back that fund because it automatically adjusts your account to safer funds when you age. I like being in stocks and feel the longer I stay in them, the greater my overall portfolio will perform. We will see how it goes, but there you have it. My 401K is all yours to dissect!

Combining both my 401K and my taxable account, I hold roughly $100,000 in investmests!

So what do you think? Good, Bad, anything I should change?

Thanks,

Scott

- Financial Changes To Help With Taxes

Good Afternoon Everyone! In the past, my wife and I have done quite well with regards to our taxes at the end of the year. I do not think either of us have ever had to pay taxes at the end of the year. Well, this year is no different. ...

- 401k Update - January 2016

Hi Everyone, So a follow up post to the Dividend Income - the 401K Portfolio update. I said that I would post about the 401K when big changes were made or about twice a year in July and January. Usually in June and December, some of my...

- 401k Update - February 2015

Hi Everyone, Hope all is well. I continue to embrace the blogging community and I continue to love it. Just a quick post tonight about my 401K Portfolio. I said that I would post about the 401K when big changes were made and I'm...

- Dividend Income - December 2014 Update

Hi Everyone, It's that time again when I get to post about a favorite topic of mine, dividends! I hope this post inspires other investors out there to start saving and investing as soon as they can. The power you feel knowing that you...

- Savings Rate And Monthly Investing

Hi Everyone, Hope you all have had a nice couple of weeks. I have been incredibly busy with work and as such, haven’t had much time to write. With July 4th write around the corner, we are over half way through 2014 and the year is just flying...

Money and Finance

401K Update - January 2015

Hi Everyone,

Hope all is well. I've been really embracing the blogging world this past week and man, it is time consuming.... but I love it! Commenting on others posts and getting more involved requires a big commitment but it makes me want to continue to push myself to greater heights. With that being said, I have finally gotten around to making a new page for the 401K! This is one of the last financial tidbits that I have needed to get onto the blog for a while now and I am happy I can share it with all of you.

At the present time, I view my 401K Portfolio as an added bonus to my path to financial independence. The overall goal of my investing journey is to retire at an age much younger than most which is why I am mostly invested in a taxable account. I need to be able to retrieve those funds and more importantly, the dividends that are generated to support our family when the time comes. I am interested in starting an IRA but I have not taken the jump yet. I call my 401K an added bonus because from what I have read, I cannot touch that money until at least age 55 (depending on stipulations that I may or may not be able to take part in) but most likely 59.5 without incurring penalties. Therefore, this money will sit in my account just compounding away for the next 32.5 Years!

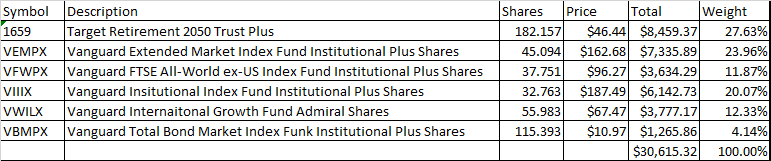

At the current time, I have roughly $30,000 in total. If my portfolio grows at an average of 7% per year, I am looking at about $275,000 with zero additional contributions. That's compound growth at its finest.

It is amazing to think that without doing any more work I could potential have quarter of a million dollars in 32 years. That will not be the case though. If I stayed at my job until age 60, contributing the same amount I do now will yield about $1,000,000. Pretty sweet to think about. Working for a government contractor there is added stress that the contracts you work on will expire/end and you have to go looking for a new job. Currently, my job is steady and I still have about 5 years left on the contracts I work on which is a lifetime in the contracting world. Many contracts nowadays come out for 1 or 2 years and need to be re-competed very often which leads to uncertainty. With that being said, even if I only work for those 5 years, investing the way I do, my total at age 60 will be about $500,000... that right there is a nice retirement for most people and that's why I call this an added bonus! The money comes straight out of my paycheck and I barely notice it is gone but those little additions add up to a lot of stability in the future!

I have 6 different funds that I am invested in and I do not think that will ever change. I adjust the contribution percentages from time to time depending how I think the macro picture is looking. For instance, I have been investing more money towards the domestic funds rather than international because I believe the domestic companies will fair better, which they have. I might change over to more international now that the domestics have rallied hard and are more overpriced than international. I have a small allocation towards bonds just because I like to see a little bit of dividends coming through every month. Also, it will be easy to transfer money into that fund if I feel the market is going to pullback hard. My biggest fund is the retirement 2050 fund which will mean I would be 73 years old at that time. I figured to push back that fund because it automatically adjusts your account to safer funds when you age. I like being in stocks and feel the longer I stay in them, the greater my overall portfolio will perform. We will see how it goes, but there you have it. My 401K is all yours to dissect!

Combining both my 401K and my taxable account, I hold roughly $100,000 in investmests!

So what do you think? Good, Bad, anything I should change?

Thanks,

Scott

- Financial Changes To Help With Taxes

Good Afternoon Everyone! In the past, my wife and I have done quite well with regards to our taxes at the end of the year. I do not think either of us have ever had to pay taxes at the end of the year. Well, this year is no different. ...

- 401k Update - January 2016

Hi Everyone, So a follow up post to the Dividend Income - the 401K Portfolio update. I said that I would post about the 401K when big changes were made or about twice a year in July and January. Usually in June and December, some of my...

- 401k Update - February 2015

Hi Everyone, Hope all is well. I continue to embrace the blogging community and I continue to love it. Just a quick post tonight about my 401K Portfolio. I said that I would post about the 401K when big changes were made and I'm...

- Dividend Income - December 2014 Update

Hi Everyone, It's that time again when I get to post about a favorite topic of mine, dividends! I hope this post inspires other investors out there to start saving and investing as soon as they can. The power you feel knowing that you...

- Savings Rate And Monthly Investing

Hi Everyone, Hope you all have had a nice couple of weeks. I have been incredibly busy with work and as such, haven’t had much time to write. With July 4th write around the corner, we are over half way through 2014 and the year is just flying...