Money and Finance

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- B&g Foods, Inc: A Risky Food Company

In my search for safety I found this interesting stock; BGS. B&G Foods Inc & its subsidiaries manufacture, sell & distribute a portfolio of branded shelf-stable foods across the United States, Canada & Puerto Rico. The Company's brands...

- Recent Buy: Flowers Foods

On February 18, 2016, I bought 64 shares of Flowers Foods (FLO) at 16.15 per share for a total of $1040.6. This will add $37.12 to my forward dividends. Rationale: To be honest I wasn't looking to make a buy in February. This was...

Money and Finance

Flowers Foods: Wait for the pullback

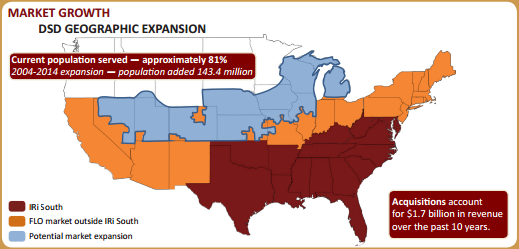

Flowers Foods produces and markets bakery products in the United States. It operates through two segments, Direct-Store-Delivery (DSD) and Warehouse Delivery. Take a look above. You might know some of these brands. My favorite is the tastykakes.

As of this article FLO is $22.24, with a PE of 25.56x, forward PE of 20.40x, and yield of 2.65%. All data below are provided by Morningstar.

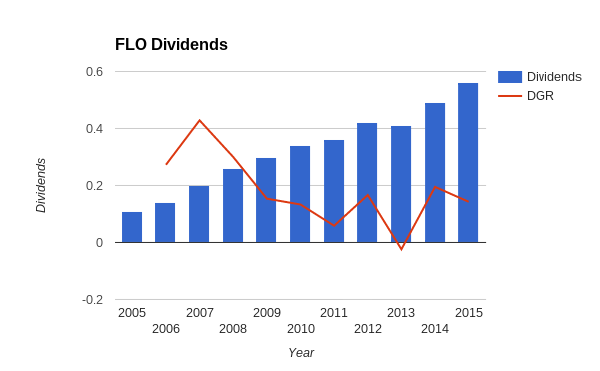

Dividends

FLO has increased its dividends for the last 13 years. On its surface FLO looks like it cut its dividends in 2005 and 2011. According to split history, FLO did a 2:3 stock split in each of those years and David Fish DRiP confirms that FLO did not cut its dividends in either year. FLO is still on a 13 year streak.

FLO highest dividend increase occurred in 2007 when it jumped by 40% and lowest was in 2013 when it decreased by negative -2.38%. Again this was caused by the stock split. FLO did increase its dividends that year.

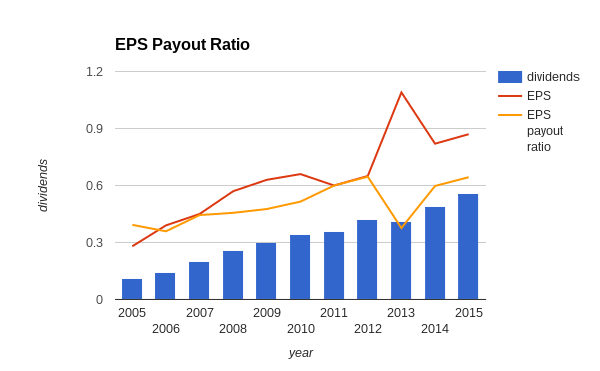

Dividends vs EPS

Historically FLO maintained its dividends in the 30-40% payout ratio. Recently it has moved up to the 50s and now 60s which is a bit disconcerting. If it goes any higher can FLO pay its dividends without sacrificing growth? Or will the dividend growth go stale? Its an interesting question. FLO lowest EPS payout ratio was 2013 when it paid out 37.61% and its highest was 2012 when it paid out 64.62%. TTM FLO has paid 64.37% of its EPS.

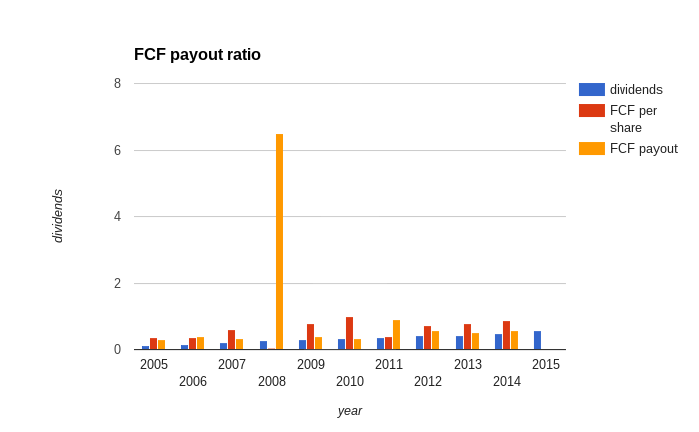

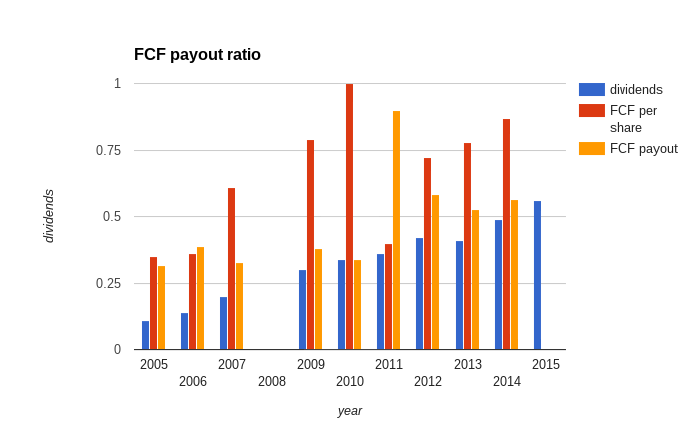

Dividend vs FCF

Some people like EPS payout ratio and some people like free cash flow (FCF) payout ratio. In 2008 FLO free cash flow was $0.04 per share giving FLO a payout of 650% of its FCF/share. I think it would be fair to toss out 2008 and look at the rest of the data. Assume that in 2008 FLO has 0 dividend, 0 FCF per share, and 0 FCF payout.

Historically FLO paid 30-40% of its free cash flow. In recent years FLO has moved its FCF payout to the mid to high 50 percentile. FLO lowest FCF payout was in 2005 when it paid out 31.43%. FLO highest FCF payout was in 2011 when it paid out 90% of its FCF. I did not add anything for 2015 since M* has yet to calculate FCF/share for the year.

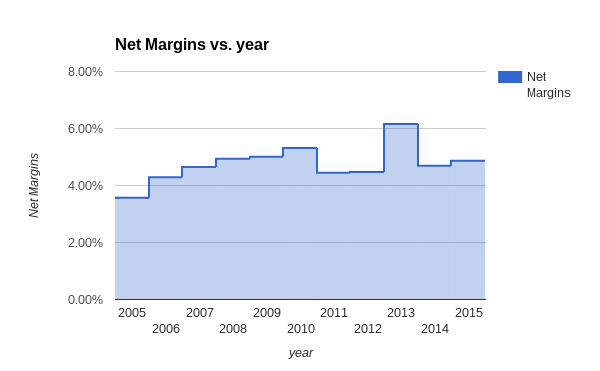

Profit margin

After paying off its expenses, taxes, and preferred stocks FLO net margin is around 5%. In the past FLO had a 3-4% margin but recently it moved to the high 4s and into the 5s. FLO highest net margin was in 2013 (6.16%) and lowest was in 2005 (3.57%). FLO has a thin margin but it’s growing.

Debt

Let’s talk about a fun subject. At this very moment FLO can cover its short term debt with its assets but not its long term debt. Over the past 10 years FLO has been aggressively buying market shares as seen in the above picture. As such FLO currently has a 73% debt to asset ratio. Five years ago FLO’s debt was 20% and now it’s 73%. It’s not uncommon for a high acquisition food company to have high level of debt. It’s just something to keep watch of.

RISK:

1) People not eating that much bread anymore.

To be honest I’m not sure if this is true or not. I have seen these comments in a lot of FLO articles on SA and other places but I have yet to see a study indicating this. Yes the atkins diet/whatever fad does not allow for bread, people see bread as “sugar” or “empty carbohydrates”, and bread allergies have risen 600% (?) but the question is will people stop eating bread? FLO has gluten free breads but the main question is whether people will just quit eating bread opposed to finding a gluten free brand. It’s an interesting question. Just my opinion but I believe most of us grew up on bread. We will try and past those memories down to our children and their children. The PB&J and grilled cheese are the american classic. As a side note bread is not really that expensive if you know where to look. One of my favorite store is Dollar Tree. They sell Wonderbread for $1 a loaf...downside is I have to consume this bread within a week...but I’m still buying it. $1 bread, $1 PB&J, and $1 orange marmalade = $3 of pure goodness. DON’T JUDGE ME!

2) Debt

I believe this poses a bigger risk than food diet. That 73% debt to asset ratio is problematic. FLO has been able to grow by buying out other companies. The big question is whether after buying those companies can it grow organically or will it have to keep buying to make more money. This is a big question that I can’t find an answer to.

Fair Value:

FLO receives so little attention that there is not much to based my fair value calculations on.

SimplyWallst FV is $23.31.

Yahoo Finance is $24.40.

M* does not cover FLO.

The street gives it a 3.67 out of 5 with a Buy rating...whatever that means

S&P capital does not cover FLO

Thompson Reuters gives Flo with a Low of $10, High of $30, and mean of $28.

In my opinion FLO fair value is $17.4 giving it a P/E of 20x using its EPS ttm of $0.87. If you look at FLO’s historic PE charts you will notice that FLO goes through a period of high P/E and then drops like a rock. Only in 2006, 2008, and 2015 did FLO not hit its 20x PE mark. With net revenue and margins falling this year I have absolutely no idea why people are paying 25x for FLO. It’s 20, 50, and 100 are all bearish while its 200 is bullish. There seems to be some resistance at $21.87 but maybe a good china slow down or brexit will….

The last time FLO hit $17.4 was January of 2013. If you are hungry for some bread and don’t mind paying a premium, $19-20 would be a good initial position but that’s just my opinion and I’m just some guy on the internet.

Conclusion: I like bread but not at these prices.

* You know the drill. I’m not a financial advisor, lawyer, or basically anybody you should trust with money or advice on money (look at my BBL, ARCP, and KMI investments). I’m just some guy on the internet saying crazy stuff.

- Mcdonald's Stock Analysis

It's about time for another stock analysis. This time I decided to take a look atMcDonalds (MCD). McDonalds closed on Thursday 5/17/12 at $89.62. Company Background: McDonalds Corporation, together with its subsidiaries, franchises and operates...

- Jnj Stock Analysis

I've started to try and consolidate my stock analysis spreadsheets to make it easier for myself to cruch numbers. I like JNJ and would love to get in but right now it seems that it's a little overvalued and there's just too many question marks...

- The Most Important Metric For Dividend Investors

While researching a dividend paying stock should be a holistic process and buying decisions shouldn't be based on any single metric, if there's one metric that every dividend investor should know, it's free cash flow cover. After all, an income...

- B&g Foods, Inc: A Risky Food Company

In my search for safety I found this interesting stock; BGS. B&G Foods Inc & its subsidiaries manufacture, sell & distribute a portfolio of branded shelf-stable foods across the United States, Canada & Puerto Rico. The Company's brands...

- Recent Buy: Flowers Foods

On February 18, 2016, I bought 64 shares of Flowers Foods (FLO) at 16.15 per share for a total of $1040.6. This will add $37.12 to my forward dividends. Rationale: To be honest I wasn't looking to make a buy in February. This was...