Money and Finance

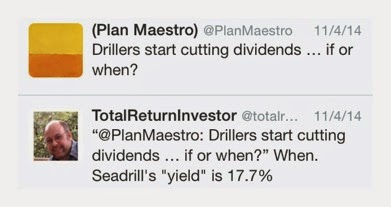

Given the grim near term outlook in energy, @PlanMaestro asked a prescient question a few weeks back:

This story has a personal angle for me, because some years ago I used to own Seadrill shares. I liked the overall business model which was the leader in off shore drill rigs. They were very shareholder friendly, paid a huge dividend around 7% at the time. It seemed the demand for oil rigs would go on and on. Problem is they borrowed from existing rigs future to fund the next rigs. Turtle stacking exercise that works until it doesn't.

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Recent Buy

Earlier this afternoon I purchased 45 shares of Aflac (AFL) for a $50.15 each. After commission, my cost basis is $50.33 per share. These shares will provide an extra $63 in annual dividends before reinvestment or future dividend increases. Aflac...

- Weekly Roundup - September 8, 2012

I figured that I would start a Weekly Roundup of my own for posts that I read from other dividend growth and personal finance blogs that got me thinking. Here's this week's posts. The Next Bubble is in Canada, and It Will Affect Everybody...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

Money and Finance

You don't know who is drilling naked until the tide goes out

Given the grim near term outlook in energy, @PlanMaestro asked a prescient question a few weeks back:

This story has a personal angle for me, because some years ago I used to own Seadrill shares. I liked the overall business model which was the leader in off shore drill rigs. They were very shareholder friendly, paid a huge dividend around 7% at the time. It seemed the demand for oil rigs would go on and on. Problem is they borrowed from existing rigs future to fund the next rigs. Turtle stacking exercise that works until it doesn't.

The lesson to me is about process. I could not have predicted the level and pace of both increasing oil supply combined with the slackening of demand of this year. In fact, were I to bet a few years back, I would have bet the other way on at least one of those. However, I avoid betting on future, macro events as much as possible. What I could do and luckily did, was just snap the chalkline against Seadrill's leverage and say - no matter how wonderful the dividend appears (remember not many 7% payers), no matter how much I think being a leading driller will matter, I just do not want to own a cyclical company with that much debt. Luckily I sold at a small profit.

Today Seadrill suspended their dividend. That sent the shares down 17% for the day so far. The shares are down 50% for the year. Also the appeal was the dividend, and that is gone.

The big lesson here is quality matters - especially in dividend investing. You do not get the 10x kind of growth that growth investors may see in a Tesla. If you are buying McCormick Spice and Unilever, its way more about mistake avoidance, grinding out great results over decades.

Mistakes always hurt in investing, but for dividend investors they matter way more. For dividend investors it has to be don't lose first, because you do not have the 10 baggers to make up the difference for the flameouts. Growth investors can swing for the fences, whiff on 7 out of 10, and crush a couple out of the park and have a great overall result. Dividend investors have to look more like George Brett - hit .380, get on base, bang out some doubles.

One thing I learned programming computers is that order of operations matters a lot. Its not just what you do, but in what order of execution. The motto of this blog is Safety, Dividends, Growth in that order. The dividend investing process has to set a bar that ensures the overall safety of the company before you consider the dividend and the growth, because otherwise its too easy to get swept away by an eye popping, yet illusory yield.

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Recent Buy

Earlier this afternoon I purchased 45 shares of Aflac (AFL) for a $50.15 each. After commission, my cost basis is $50.33 per share. These shares will provide an extra $63 in annual dividends before reinvestment or future dividend increases. Aflac...

- Weekly Roundup - September 8, 2012

I figured that I would start a Weekly Roundup of my own for posts that I read from other dividend growth and personal finance blogs that got me thinking. Here's this week's posts. The Next Bubble is in Canada, and It Will Affect Everybody...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...