Money and Finance

Any time you would spend seeking patterns in the newspaper quotes page or developing automatic trading formulas would be much better spent pursuing another type of formula, like the one Buffett outlined in the 1994 Berkshire letter:

What do you think? Let me know on Twitter @toddwenning.

What I've been reading this week:

Stay patient, stay focused.

Best,

Todd

@toddwenning

- Peter Thiel Quote

From Zero to One: But while I have noticed many patterns, and I relate them here, this book offers no formula for success. The paradox of teaching entrepreneurship is that such a formula necessarily cannot exist; because every innovation is new and...

- Weekly Reading List 5/10/2015

What I've been reading and listening to - May 10, 2015 There are many ways to be an investor - MonevatorCharlie Munger and the art of stock picking - John Huber, Base Hit InvestingBuffett and Vanguard: different paths to the same destination...

- Weekly Reading List - 3/25/2015

What I've been reading - March 25, 2015 The formula for excess returns - Michael MauboussinToward a taxonomy of stock market winners - Ed Croft via StockopediaMarkel's 2014 shareholder letter - MarkelWhat's wrong with finance - Morgan HouselWhat's...

- A Fresh Look At The Simple Formula

Earlier this week, a reader* of the blog had a look at the formula I laid out in "A Simple Formula for Investing Success" and cleverly suggested that the formula should be rearranged from: Investment + Good Company + Right Price +...

- Some Investing Advice For My Son

My wife and I recently welcomed our son into the world and, like any new parent, I've been thinking about all the things I'll need to teach him as he grows up -- how to ride a bike, how to read, and, of course, how to invest. So with a few minutes...

Money and Finance

This is the Opposite of Real Investing

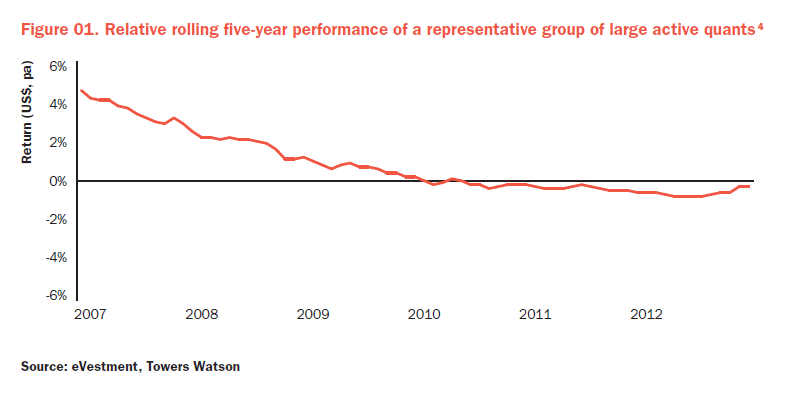

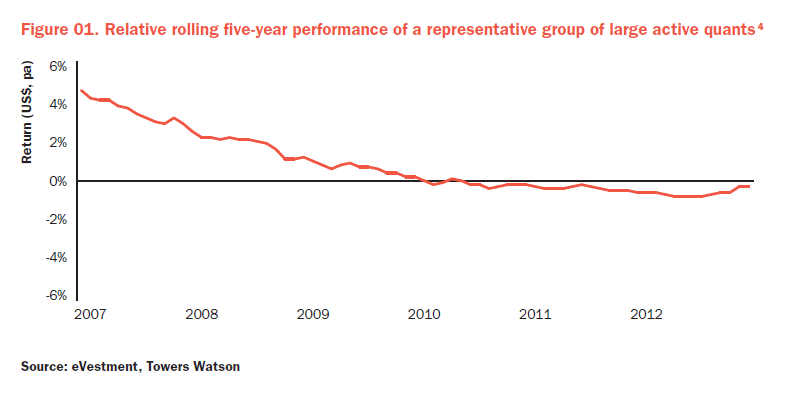

Innovation in finance is designed largely to benefit those who create the complex new products, rather than those who own them. - Jack BogleEarlier this week, I came across an article about "math nerds taking over Wall Street" and thought it must have been republished from 2006 when quantitative strategies were in their heyday.

Nope. A few years after the financial crisis broke their old can't-miss algorithims, the quants have returned with a new set of proprietary trading formulas that will work until they don't anymore.

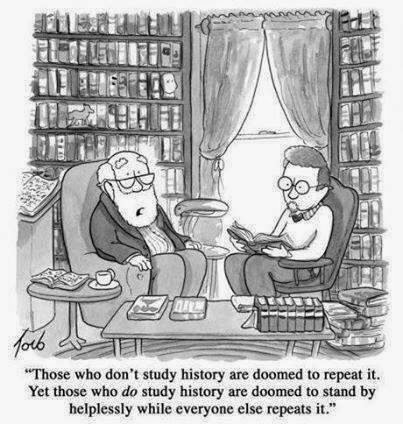

No one ever said Wall Street had a long memory.

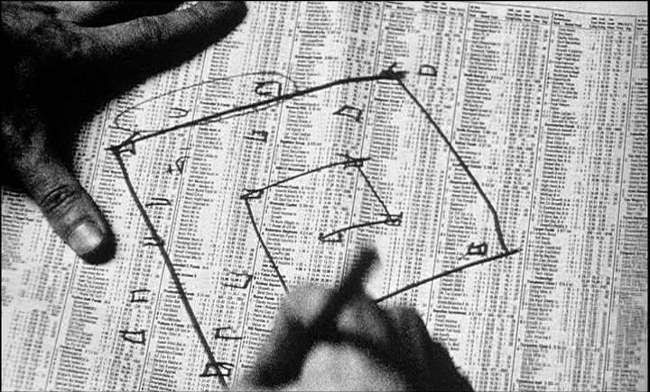

The article highlights a quantitative software program that "uses historical data and analysis to predict price movements in various assets."

This line made me think of Buffett's commentary in the 2008 Berkshire letter:

I don't mean to come down too hard on the quants -- they're clearly bright people and there's apparently demand for what they're doing, but their approach is the complete opposite of what we should be trying to do as investors.Investors should be skeptical of history-based models. Constructed by a nerdy-sounding priesthood using esoteric terms such as beta, gamma, sigma and the like, these models tend to look impressive. Too often, though, investors forget to examine the assumptions behind the symbols. Our advice: Beware of geeks bearing formulas. (my emphasis)

|

| Seeking patterns where none exist. (Pi) |

We believe that our formula - the purchase at sensible prices of businesses that have good underlying economics and are run by honest and able people - is certain to produce reasonable success.This simple formula isn't easy to implement, of course, but it beats using a complex formula that is easy to implement.

What do you think? Let me know on Twitter @toddwenning.

What I've been reading this week:

- The 12 rules of successful investing according to John Lee -- Monevator

- How earnings reports reshape narratives -- Aswath Damodaran

- Masters in Business: Michael Mauboussin (podcast) -- Barry Ritholz

- The best time to invest (video) -- Loring Ward

- Peter Lynch on stock market losses -- A Wealth of Common Sense

- Buy a high yield portfolio and hold forever -- Total Return Investor

Stay patient, stay focused.

Best,

Todd

@toddwenning

- Peter Thiel Quote

From Zero to One: But while I have noticed many patterns, and I relate them here, this book offers no formula for success. The paradox of teaching entrepreneurship is that such a formula necessarily cannot exist; because every innovation is new and...

- Weekly Reading List 5/10/2015

What I've been reading and listening to - May 10, 2015 There are many ways to be an investor - MonevatorCharlie Munger and the art of stock picking - John Huber, Base Hit InvestingBuffett and Vanguard: different paths to the same destination...

- Weekly Reading List - 3/25/2015

What I've been reading - March 25, 2015 The formula for excess returns - Michael MauboussinToward a taxonomy of stock market winners - Ed Croft via StockopediaMarkel's 2014 shareholder letter - MarkelWhat's wrong with finance - Morgan HouselWhat's...

- A Fresh Look At The Simple Formula

Earlier this week, a reader* of the blog had a look at the formula I laid out in "A Simple Formula for Investing Success" and cleverly suggested that the formula should be rearranged from: Investment + Good Company + Right Price +...

- Some Investing Advice For My Son

My wife and I recently welcomed our son into the world and, like any new parent, I've been thinking about all the things I'll need to teach him as he grows up -- how to ride a bike, how to read, and, of course, how to invest. So with a few minutes...