Money and Finance

One of the main things I am using the blog for is an ongoing notebook of my favorite insights on investing. The Wine Cellar is the ideas, papers and analysis that are most useful and informs my perspective over the long haul.

So the first one to be added to the Wine Cellar of ideas is from James Montier's August 2010 paper "A Man from a Different Time"

Having a long term orientation is fundamental for individual investors. I think the ability to have a longer time horizon is our single biggest advantage over the pros, we can be patient and wait out 3 years, 5 years for things to play out. Pros have a bad quarter and then they are updating theirresume LinkedIn. They cannot wait it out.

But the time horizon advantage is amplified if we focus on approaches that unfold (albeit slowly) over time. This insight highlighted for me the importance not just of dividends, but dividend growth as the overriding factor in long term returns. If you are measuring your investing lifecycle in years and decades, not mouse clicks, milliseconds, and Cramerisms, then dividend growth is like having the wind at your back.

Dividend growth investing moves the focus from not just preferring higher yielding companies over those with low or no dividends, but more in the direction of companies that can grow their dividend by meaningful percentages year after year. Time is the friend of the dividend growth investor.

- Little Green George Washingtons

I believe that in the long term dividend growth stocks will provide solid returns while being less volatile than the market in general. It's not flashy and it's not a get rich quick scheme. However, when 40% of the long term total return on stocks...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Moats Matter For Dividend Investors

"Why Moats Matter for Equity Income" Josh Peters, Morningstar "The first thing you have to remember about dividend investing is that dividends are paid out slowly, though, relentlessly, and they really add up over time. But if you're going to actually...

- One Reason Dividend Investing Works So Well

I am sure there are a number of reasons why dividend investing works, not the least of which is dividends role in long term total returns. I see another factor that dividend investing one reason why dividend investing works so well, and it has to...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...

Money and Finance

The Wine Cellar - James Montier: Dividends Still Matter

One of the main things I am using the blog for is an ongoing notebook of my favorite insights on investing. The Wine Cellar is the ideas, papers and analysis that are most useful and informs my perspective over the long haul.

So the first one to be added to the Wine Cellar of ideas is from James Montier's August 2010 paper "A Man from a Different Time"

- Dividends still matter

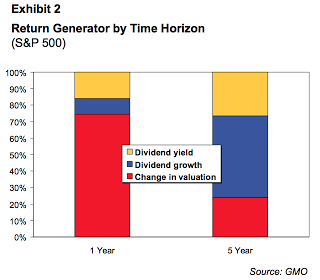

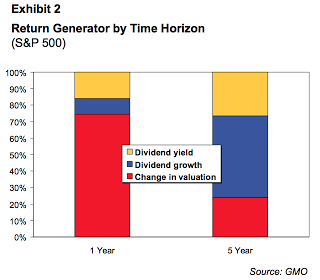

To those who charge around in markets trying to guess

the next quarter’s make-believe earnings number, the

concept of dividends seems wholly irrelevant. However,

to those with an attention span measured in longer than

milliseconds – who are few and far between, to judge

from today’s markets – dividends are a vital element

of return. Exhibit 2 illustrates this point graphically.

Looking at the U.S. market since 1871, on a 1-year time

horizon, nearly 80% of the return has been generated by

fl uctuations in valuation. However, as the time horizon

is extended, “fundamentals” play an increasing role in

return generation. For example, at a 5-year time horizon,

dividend yield and dividend growth account for almost

80% of the return.

Having a long term orientation is fundamental for individual investors. I think the ability to have a longer time horizon is our single biggest advantage over the pros, we can be patient and wait out 3 years, 5 years for things to play out. Pros have a bad quarter and then they are updating their

But the time horizon advantage is amplified if we focus on approaches that unfold (albeit slowly) over time. This insight highlighted for me the importance not just of dividends, but dividend growth as the overriding factor in long term returns. If you are measuring your investing lifecycle in years and decades, not mouse clicks, milliseconds, and Cramerisms, then dividend growth is like having the wind at your back.

Dividend growth investing moves the focus from not just preferring higher yielding companies over those with low or no dividends, but more in the direction of companies that can grow their dividend by meaningful percentages year after year. Time is the friend of the dividend growth investor.

- Little Green George Washingtons

I believe that in the long term dividend growth stocks will provide solid returns while being less volatile than the market in general. It's not flashy and it's not a get rich quick scheme. However, when 40% of the long term total return on stocks...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Moats Matter For Dividend Investors

"Why Moats Matter for Equity Income" Josh Peters, Morningstar "The first thing you have to remember about dividend investing is that dividends are paid out slowly, though, relentlessly, and they really add up over time. But if you're going to actually...

- One Reason Dividend Investing Works So Well

I am sure there are a number of reasons why dividend investing works, not the least of which is dividends role in long term total returns. I see another factor that dividend investing one reason why dividend investing works so well, and it has to...

- The Wine Cellar - The Remarkable True Story Of A $146,194-per-year Income Portfolio

Brian Richards reports on the science fiction writer Hayford Peirce's $146,194 per year Income portfolio. It is a concentrated high yield portfolio: Three common stocks (Altria, J&J, Philip Morris International)Nine master limited partnerships...