Money and Finance

This week's market dip got me thinking about the right temperament -- that is, the proper mental approach -- for buying stocks at various points in the market cycle.

We've already established some strategies for selling stocks that are consistent with a patient, long-term strategy, but what about strategies for buying stocks?

Knowing when to pounce

In my experience, having the right buying temperament is just as important as your research and valuation process. If you aggressively bought stocks in early 2009, convinced that the market's pessimism was near its nadir, that action likely mattered more than any DCF models you built at the time. Conversely, an expertly-researched investment made in late 2007 near the last market high may still be underperforming your expectations.

I don't mean to diminish the importance of doing your homework, but only to illustrate how critical temperament is in the buying process. Though patience is the best default approach to buying, there are points in the market cycle where it pays to be more aggressive.

The following quote from Machiavelli's The Prince illustrates the point quite well:

- A Fine Line Between Patience And Laziness

"Perhaps the strongest feature in his character was prudence, never acting until every circumstance, every consideration was maturely weighed; refraining if he saw a doubt, but, when once decided, going through with his purpose, whatever obstacles opposed."...

- 3 Ways To Get Better At Selling Stocks

Show me somebody that has a stop-loss order of 10% below their purchase price, and I'll show you someone that's guaranteed to lose 10%. - Peter LynchIn many ways, selling a stock is a tougher decision than buying one. A quick look around Google,...

- A Simple Guide To Selling Stocks

Last weekend, a good friend came to town for a visit. We both started our financial careers on the same day -- and in the same training room, in fact -- but our career paths diverged a few years ago when he went the financial planning route and I went...

- What To Do When A Sell-off Strikes Your Stock

We've all been there. You check your stocks in the morning, take a sip of coffee, only to find -- spppittt! -- one of your stocks is down big, real big. At this point many questions begin to race through your mind -- What happened? Did I miss something?...

- A Great Time To Go Hunting For Dividends

The market downturn this past week -- indeed, over the past month -- has reignited my interest in buying stocks, and particularly dividend payers. Stocks were in general looking a bit expensive earlier in 2012 and I struggled to find many good opportunities....

Money and Finance

The Right Temperament for Buying Stocks

This week's market dip got me thinking about the right temperament -- that is, the proper mental approach -- for buying stocks at various points in the market cycle.

We've already established some strategies for selling stocks that are consistent with a patient, long-term strategy, but what about strategies for buying stocks?

Knowing when to pounce

In my experience, having the right buying temperament is just as important as your research and valuation process. If you aggressively bought stocks in early 2009, convinced that the market's pessimism was near its nadir, that action likely mattered more than any DCF models you built at the time. Conversely, an expertly-researched investment made in late 2007 near the last market high may still be underperforming your expectations.

I don't mean to diminish the importance of doing your homework, but only to illustrate how critical temperament is in the buying process. Though patience is the best default approach to buying, there are points in the market cycle where it pays to be more aggressive.

The following quote from Machiavelli's The Prince illustrates the point quite well:

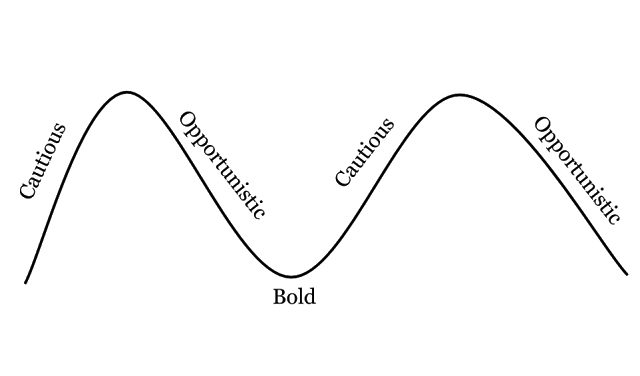

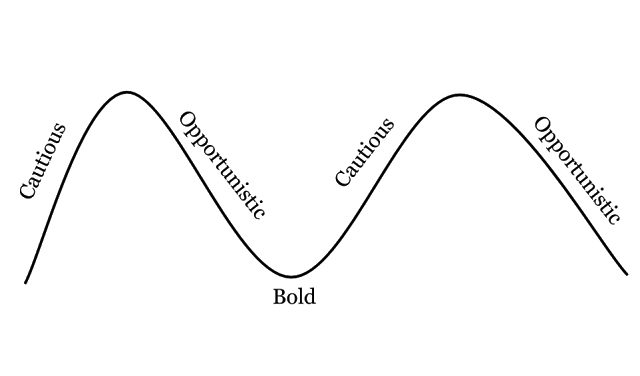

If one is cautious and patient in his method of proceeding and the times lend themselves to this kind of policy, he will prosper. But if the times and circumstances change, he will fail, for he will not alter his policy.In this spirit, I've put together a rough sketch for what I consider the right buying approach at various points in the market cycle:

Cautious

At this stage in the market, investors are becoming increasingly optimistic about stocks, so it's important to be on guard when buying. Good long-term buying opportunities can certainly exist at this point in the cycle (especially early on), but before buying ask yourself how much of the optimism is already priced-in.

As a side note: when building forecasts in a rising market, beware of recency bias and avoid projecting continued above-average margins unless you have good reason to do so. This will inflate your fair value estimate and might encourage you to buy when it is not prudent. Instead, use normalized margins -- an industry average, a trailing five year average for the company, etc. -- as reversion to the mean will eventually occur.

Opportunistic

Investors have begun to sell stocks for any number of reasons and enthusiasm for equities has turned into skepticism. Armed with a good watchlist and spare cash, patient investors with a long-term perspective will find buying opportunities when short-term minded investors are selling.

Even though better buying opportunities are presenting themselves at this stage in the market, it's still important to be selective. After all, investors could be selling a particular stock for a good reason. As such, have a thesis about why investors are selling and why your approach is better.

Bold

In late February 2009, I distinctly remember grabbing a coffee with an investing partner and remarking that the market pessimism was almost palpable. All the news stories seemed to be about rampant foreclosures, stocks being dead, the coming dominance of gold, the end of fiat currency, etc. Anyone on live television with a positive or optimistic thing to say about the markets was ridiculed.

That was the time to be a bold buyer of stocks -- "the point of maximum pessimism" to borrow a phrase from Templeton. Here action is paramount and it's the ideal time to buy the stocks on your watchlist and perhaps a few others.

Of course being a buyer at this point is easier said than done. It's psychologically very difficult to do and you're often in "preservation of capital mode". If you have the means and fortitude to be a buyer, however, there's no better time to put money to work in the market.

Bottom line

As you consider the three phases of buying temperament, don't think of them as three distinct phases -- rather, that they flow into one another. At the market peak, caution is paramount, but as the market falls, the time for being cautious subsides and the time for being opportunistic grows. And so on.

The important thing to remember is that your approach to buying should be the inverse of the market's overall emotions at a given point in the cycle. If you can consistently practice this along with doing solid research, your long-term returns should be very satisfying.

Good reads this week:

- Vanguard founder Jack Bogle's speech for The Wellington Fund's 75th anniversary in 2004. (One of my all-time favorite investing reads.)

- The DIY Income Investor's "Evolving Strategy"

- Monevator's "How to Spot a Bull Market Top"

Have a great weekend!

Best,

Todd

@toddwenning

- A Fine Line Between Patience And Laziness

"Perhaps the strongest feature in his character was prudence, never acting until every circumstance, every consideration was maturely weighed; refraining if he saw a doubt, but, when once decided, going through with his purpose, whatever obstacles opposed."...

- 3 Ways To Get Better At Selling Stocks

Show me somebody that has a stop-loss order of 10% below their purchase price, and I'll show you someone that's guaranteed to lose 10%. - Peter LynchIn many ways, selling a stock is a tougher decision than buying one. A quick look around Google,...

- A Simple Guide To Selling Stocks

Last weekend, a good friend came to town for a visit. We both started our financial careers on the same day -- and in the same training room, in fact -- but our career paths diverged a few years ago when he went the financial planning route and I went...

- What To Do When A Sell-off Strikes Your Stock

We've all been there. You check your stocks in the morning, take a sip of coffee, only to find -- spppittt! -- one of your stocks is down big, real big. At this point many questions begin to race through your mind -- What happened? Did I miss something?...

- A Great Time To Go Hunting For Dividends

The market downturn this past week -- indeed, over the past month -- has reignited my interest in buying stocks, and particularly dividend payers. Stocks were in general looking a bit expensive earlier in 2012 and I struggled to find many good opportunities....