Money and Finance

Halloween just passed us by, and if you have children, you likely still have piles of candy in your house: Jolly Ranchers, Payday bars, Kit Kats, Hershey's bars, or my personal favorite Reese's peanut butter cups. These are just some of the great brands that are all made by The Hershey Company (NYSE:HSY). It's these great brands that have given the company a dominant 45% share of the domestic confectionery market and allows it pricing power. I don't know about you, but I've had the non-name brand versions of some of these and they are a far cry from being the same.

Due to its dominant position, brand power, and pricing power, the shares of The Hershey Company typically trade for a premium which is well deserved. The company has grown revenue every single year since 2002 with solid total returns. Over the last decade, total returns have amounted to 7.2% annually. The annual returns jump to 11.7% for the last 20 years and 13.2% over the last 30 years. Put another way, every dollar invested 30 years ago is worth $41.54 now.

I think The Hershey Company gets overlooked by dividend growth investors due to its shorter dividend growth streak. The company kept the dividend the same for 10 straight quarters while the financial crisis was playing out, which was a prudent move at the time. However, in its history, it hasn't decreased the dividend once.

The Hershey Company has delivered excellent returns for shareholders over the years but what could they potentially look like going forward?

Continue reading The Hershey Company quick analysis on Seeking Alpha.

Also, in case you missed it this morning make sure you check out the PepsiCo quick analysis as well.

Check out my Stock Analysis page to find other stock analyses.

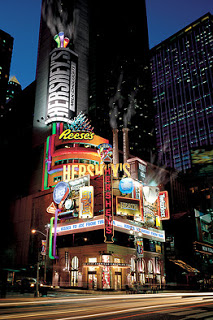

Image source

- Pepsico Inc.: You're Paying Up For This Consumer Staple

Consumer staples companies are the bread and butter of the dividend growth philosophy. The biggest reason for that is the consistency in their operations. In general they have rather inelastic demand compared to other sectors of the economy and for the...

- After The Run Up There's Still Double Digit Return Potential For Johnson & Johnson

When you think of some of the greatest companies in the world one name that is sure to come up is Johnson & Johnson (NYSE:JNJ). What's not to like about a company that has earned investors 8.0% annualized total returns over the last decade, 10.8%...

- You Can't Clean Up A Messy Valuation: The Clorox Company Dividend Stock Analysis

Consumer staple companies make for excellent defensive investments and dividend growth candidates due to the rather inelastic demand for their products. For those companies that have established brands and market share they can typically pass along input...

- Building An Empire With Pepsico Inc.

Earlier this month, PepsiCo Inc. (NYSE:PEP) announced Q2 earnings which they knocked out of the park with a beat on both the top and bottom line. PepsiCo has 22 different brands that generate over a billion dollars in annual revenue. Even better is that...

- Now's Not The Time For Mccormick & Company, Inc.

I mentioned in my dividend growth checkup that my plan for the year was to allocate less capital to the consumer staples due to their general overvaluation. However, that doesn't mean that I won't identify excellent companies with large moats...

Money and Finance

The Hershey Company: Sweet Dividends With Consistent Growth

Halloween just passed us by, and if you have children, you likely still have piles of candy in your house: Jolly Ranchers, Payday bars, Kit Kats, Hershey's bars, or my personal favorite Reese's peanut butter cups. These are just some of the great brands that are all made by The Hershey Company (NYSE:HSY). It's these great brands that have given the company a dominant 45% share of the domestic confectionery market and allows it pricing power. I don't know about you, but I've had the non-name brand versions of some of these and they are a far cry from being the same.

Due to its dominant position, brand power, and pricing power, the shares of The Hershey Company typically trade for a premium which is well deserved. The company has grown revenue every single year since 2002 with solid total returns. Over the last decade, total returns have amounted to 7.2% annually. The annual returns jump to 11.7% for the last 20 years and 13.2% over the last 30 years. Put another way, every dollar invested 30 years ago is worth $41.54 now.

I think The Hershey Company gets overlooked by dividend growth investors due to its shorter dividend growth streak. The company kept the dividend the same for 10 straight quarters while the financial crisis was playing out, which was a prudent move at the time. However, in its history, it hasn't decreased the dividend once.

The Hershey Company has delivered excellent returns for shareholders over the years but what could they potentially look like going forward?

Continue reading The Hershey Company quick analysis on Seeking Alpha.

Also, in case you missed it this morning make sure you check out the PepsiCo quick analysis as well.

Check out my Stock Analysis page to find other stock analyses.

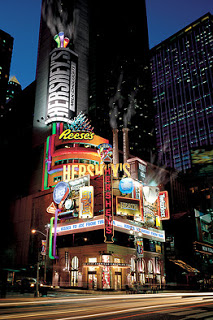

Image source

- Pepsico Inc.: You're Paying Up For This Consumer Staple

Consumer staples companies are the bread and butter of the dividend growth philosophy. The biggest reason for that is the consistency in their operations. In general they have rather inelastic demand compared to other sectors of the economy and for the...

- After The Run Up There's Still Double Digit Return Potential For Johnson & Johnson

When you think of some of the greatest companies in the world one name that is sure to come up is Johnson & Johnson (NYSE:JNJ). What's not to like about a company that has earned investors 8.0% annualized total returns over the last decade, 10.8%...

- You Can't Clean Up A Messy Valuation: The Clorox Company Dividend Stock Analysis

Consumer staple companies make for excellent defensive investments and dividend growth candidates due to the rather inelastic demand for their products. For those companies that have established brands and market share they can typically pass along input...

- Building An Empire With Pepsico Inc.

Earlier this month, PepsiCo Inc. (NYSE:PEP) announced Q2 earnings which they knocked out of the park with a beat on both the top and bottom line. PepsiCo has 22 different brands that generate over a billion dollars in annual revenue. Even better is that...

- Now's Not The Time For Mccormick & Company, Inc.

I mentioned in my dividend growth checkup that my plan for the year was to allocate less capital to the consumer staples due to their general overvaluation. However, that doesn't mean that I won't identify excellent companies with large moats...