Money and Finance

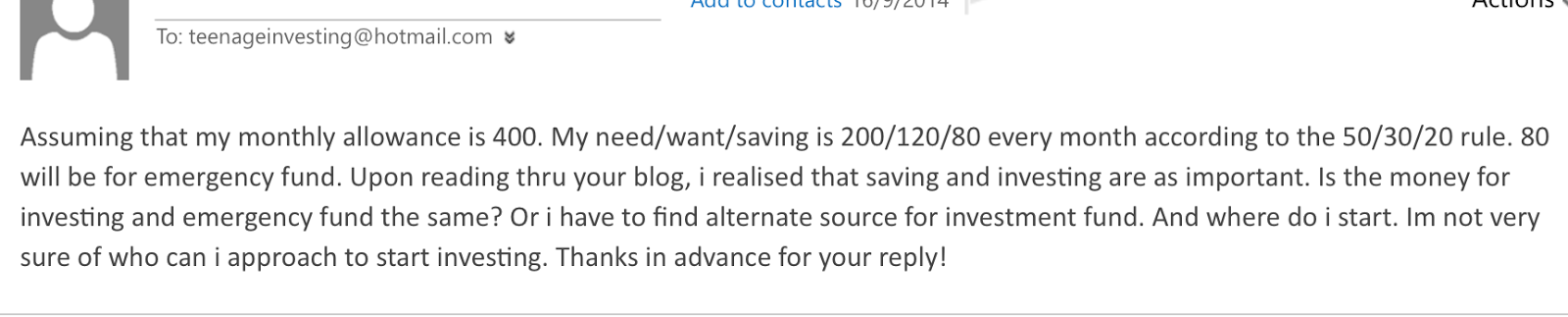

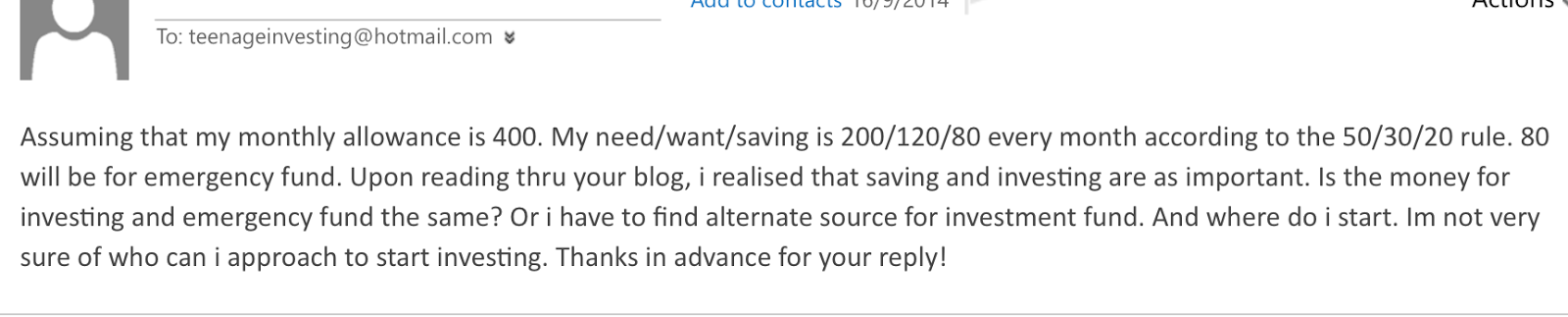

Today, I received an email from a reader of my blog. His questions were very good, and so I'd thought I share it, but however keeping his identity secret of course!

Signing off,

Teenage Investor

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- What Does Investors Have To Say About This?

Today, I received a short email. Upon reading, I was again struck with the realisation that I am not always the best person to come to for advice. Therefore, I'm putting this out there so that financial bloggers and readers of my blog may give...

- The Journey Of A Budding Investor; When Actions Speak Louder Than Words

As some readers may recall, I previously received an email from "Reader A" who wanted to begin investing. When I asked how did he find me, he replied and I quote word by word: "Currently, i am 18. Just last Saturday, i went to a wedding of my relative....

- Why 90% Of Young Singaporeans Are Worried About Their Financial Future ; Singapore Is The Most Expensive Country To Live In

It's pretty simple. I refer to a post from The Real Singapore (TRS) http://therealsingapore.com/content/survey-90-young-singaporeans-are-worried-about-their-future-finances 90% of 1000+ youths is an alarming number of over 900+ teenagers and...

- Why Every Singaporean Should Have An Emergency Fund ; Especially Teenagers.

Emergency Funds.... what are they? Why should we have them? Many reasons. In the basic sense of the word, Emergency Funds are for emergencies. Let's say, you currently only have your savings. And suddenly, an unexpected expense occurs. Maybe you got...

Money and Finance

The First Step is Always The Hardest

Today, I received an email from a reader of my blog. His questions were very good, and so I'd thought I share it, but however keeping his identity secret of course!

Let's refer to him as Reader A. Now, he shared with me that his monthly allowance was $400 which I believe is the average allowance of most Singaporean teens (correct me if I'm wrong)

He is also clear on his needs/wants/savings and allocates $200 for his needs, $120 for his wants and $80 for his emergency fund.

However, he had a question on emergency funds. Therefore, to clarify, emergency funds should never be used for investing. However, there are a few extreme cases that you can do so. Maybe the share price fell, or you see a good stock but do not yet have enough cash. Therefore you use your emergency fund with the mindset that you'll pay it back. (This scenario has happened before to a fellow blogger)

I'm quite happy that Reader A has taken the first step on his journey. The information I provided him however, is strictly personal and therefore I will not share it on the blog!

However, I realized that there were several things that he can tweak in his allocations to increase his savings. For example $120/month for wants might be too much.

Here, I'm assuming that the average needs already includes lunch/dinner/transportation. Therefore wants could include movies, clothes, bags etc etc. My advice would be to spend less on wants, and save it instead! Maybe $120 on savings and $80 for wants. But that's just me :)

The first step is always the hardest. But it's the only way to reach the second. I'm glad that my blog has managed to help at least one person. And I wish him all the best in his journey.

Teenage Investor

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- What Does Investors Have To Say About This?

Today, I received a short email. Upon reading, I was again struck with the realisation that I am not always the best person to come to for advice. Therefore, I'm putting this out there so that financial bloggers and readers of my blog may give...

- The Journey Of A Budding Investor; When Actions Speak Louder Than Words

As some readers may recall, I previously received an email from "Reader A" who wanted to begin investing. When I asked how did he find me, he replied and I quote word by word: "Currently, i am 18. Just last Saturday, i went to a wedding of my relative....

- Why 90% Of Young Singaporeans Are Worried About Their Financial Future ; Singapore Is The Most Expensive Country To Live In

It's pretty simple. I refer to a post from The Real Singapore (TRS) http://therealsingapore.com/content/survey-90-young-singaporeans-are-worried-about-their-future-finances 90% of 1000+ youths is an alarming number of over 900+ teenagers and...

- Why Every Singaporean Should Have An Emergency Fund ; Especially Teenagers.

Emergency Funds.... what are they? Why should we have them? Many reasons. In the basic sense of the word, Emergency Funds are for emergencies. Let's say, you currently only have your savings. And suddenly, an unexpected expense occurs. Maybe you got...