Money and Finance

In his 1979 letter to shareholders, Warren Buffett wrote:

And in case anyone has missed it, the more recent set of Marathon letters is available in the book Capital Returns: Investing Through the Capital Cycle: A Money Manager's Reports 2002-15.

- Fade Rates And The Capital Cycle...

From Capital Returns (the excerpt below was from a Marathon letter in March 2014):Marathon looks to invest in two phases of an industry’s capital cycle. From what is misleadingly labelled the “growth” universe, we search for businesses...

- Avoiding Promotional Management...

From Capital Account (and written by Marathon in December 2002): We suspect that business leaders who are busy promoting themselves or their stock are not properly focused on running their companies. We go out of our way to look for management that cares...

- Bill Ackman’s Q3 Letter

Via ValueWalk. We chose to exit our entire stock and total return swap position in J.C. Penney at the end of August and incurred a loss of approximately 50% of our original investment. We did so because of a disagreement with the board about the timing...

- "if At First You Do Succeed, Quit Trying."

As re-read in the newly released third edition of Lawrence Cunningham’s The Essays of Warren Buffett: Lessons for Corporate America. This excerpt is from Warren Buffett’s 1991 shareholder letter:We continually search for large businesses with understandable,...

- A Few Lessons For Investors And Managers - By Peter Bevelin

As Warren Buffett mentioned in his Letter to Shareholders, Peter Bevelin has put together a new book explaining Berkshire’s investment and operating principles. I’ve interview Peter twice on this blog (HERE and HERE) and those interviews are probably...

Money and Finance

The Characteristics of Easy and Difficult Turnarounds

In his 1979 letter to shareholders, Warren Buffett wrote:

Both our operating and investment experience cause us to conclude that “turnarounds” seldom turn, and that the same energies and talent are much better employed in a good business purchased at a fair price than in a poor business purchased at a bargain price.In 1990, he also wrote:

Charlie and I frequently get approached about acquisitions that don’t come close to meeting our tests: We’ve found that if you advertise an interest in buying collies, a lot of people will call hoping to sell you their cocker spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: “When the phone don’t ring, you’ll know it’s me.”

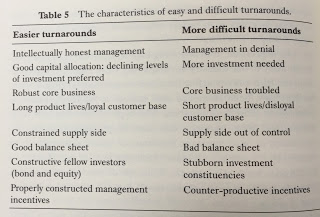

And while they seldom turn, and it may in general be best to avoid them, there are certain characteristics that may make the likelihood of success increase should you find yourself looking at or involved in a turnaround. I think the excerpt below, from the book Capital Account, captures those characteristics about as well as anything, and it makes a great addition to any kind of turnaround checklist:

Evaluating the likely success of a corporate turnaround is a notoriously difficult activity for investors. They need to distinguish between easy and difficult turnarounds. In almost every case, however, they must start by understanding how the firm got into trouble in the first place. Most troubled companies can only hope to recover once management open-mindedly appraises the situation -- when there is a mood of denial, turnarounds are unlikely. This explains why successful new starts are so often associated with fresh management, usually from outside the industry.

In Table 5 we rank the factors to be considered when evaluating corporate turnarounds by importance. After the honesty with which management addresses the problem, we consider the second most important issue is the level of investment. A successful turnaround should not need large levels of new investment. After all, why risk throwing good money after bad?

… There is no shortage of poorly performing companies that appear cheap on paper. But it’s how management allocates capital that determines the success or failure of any turnaround.

… Firms with short product lives, such as speciality retailers and technology firms, face an uphill battle. Miss a fashion trend or a technology leap and it is very difficult to catch up.

……………….… To sum up, the three most favourable characteristics for identifying the probability of success in a corporate turnaround are: intellectually honest management, good capital allocation (preferably declining levels of investment) and a robust core business.

And in case anyone has missed it, the more recent set of Marathon letters is available in the book Capital Returns: Investing Through the Capital Cycle: A Money Manager's Reports 2002-15.

- Fade Rates And The Capital Cycle...

From Capital Returns (the excerpt below was from a Marathon letter in March 2014):Marathon looks to invest in two phases of an industry’s capital cycle. From what is misleadingly labelled the “growth” universe, we search for businesses...

- Avoiding Promotional Management...

From Capital Account (and written by Marathon in December 2002): We suspect that business leaders who are busy promoting themselves or their stock are not properly focused on running their companies. We go out of our way to look for management that cares...

- Bill Ackman’s Q3 Letter

Via ValueWalk. We chose to exit our entire stock and total return swap position in J.C. Penney at the end of August and incurred a loss of approximately 50% of our original investment. We did so because of a disagreement with the board about the timing...

- "if At First You Do Succeed, Quit Trying."

As re-read in the newly released third edition of Lawrence Cunningham’s The Essays of Warren Buffett: Lessons for Corporate America. This excerpt is from Warren Buffett’s 1991 shareholder letter:We continually search for large businesses with understandable,...

- A Few Lessons For Investors And Managers - By Peter Bevelin

As Warren Buffett mentioned in his Letter to Shareholders, Peter Bevelin has put together a new book explaining Berkshire’s investment and operating principles. I’ve interview Peter twice on this blog (HERE and HERE) and those interviews are probably...