Money and Finance

In Part 1 of The Beginning of YOUR Investment Journey,

http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-teenage-investing.html

I mentioned that the cheapest fund tracking the STI (Straits Times Index) was Nikko AM which would have cost you $339 ++ instead of SPDR $3340+.

That's a huge difference I must say. The Singapore Government has dictated that stocks will be sold in 100 or 1000 shares / lot. That's not giving much choice to us young investors. No wonder everyone thinks that the stock market or buying shares is only for the rich and wealthy.

Why SHOULD they be the only one allowed? What about the rest of us? Don't WE get a choice to take control of our own future?

So today, I'm about to show you how you can take the first step into beginning your journey.

Firstly, you know the basic ETFs you're going to buy. Let's presume you have an monthly allowance of say, between $300 - 400. Let's also presume that you can afford at least $100 a month for your investment.

Good so far? Note: If you cannot afford $100/month, get a part time job that supplements your allowance. Remember, it's your future. What you do now in preparation, dictates what you future will be like. Most part time jobs pay between $7-9/hour.

Say you work 6 hours a day during weekends, with a pay of $7 / hour for at LEAST one day.

That's an extra $42/week. In a month, you'd get $168.

Ok moving on.

Now you want to begin your investing, as I said previously you can't just buy stocks off the shelves like you do in Supermarkets. You need to select your brokerage. What's a brokerage?

In short, a brokerage brings buyers and sellers together.

There are several brokerages in Singapore that you can purchase shares from.

But, I'm going to make a bet here that you WILL NOT buy your shares from any of them. Because the fees that they charge for your investments change accordingly to your investment value. We're talking at least $50,000 - $100,000. For a monthly investment of $100, you'd see your money getting eaten up by fees so fast you don't even have the chance to say "What?".

No, instead we want to invest a small sum of money every month without worrying too much about fees and charges.

Well, there are 2 Banks in Singapore that offer the most well known options to invest in blue chip shares without the hassle of opening security trading accounts and all that other stuff.

Remember, we want simplicity. The following options are good IF you'd rather not DIY.

1. OCBC

2. POSB/DBS

Let's begin with OCBC, where you can begin investing with $100 (minimum amount) monthly.

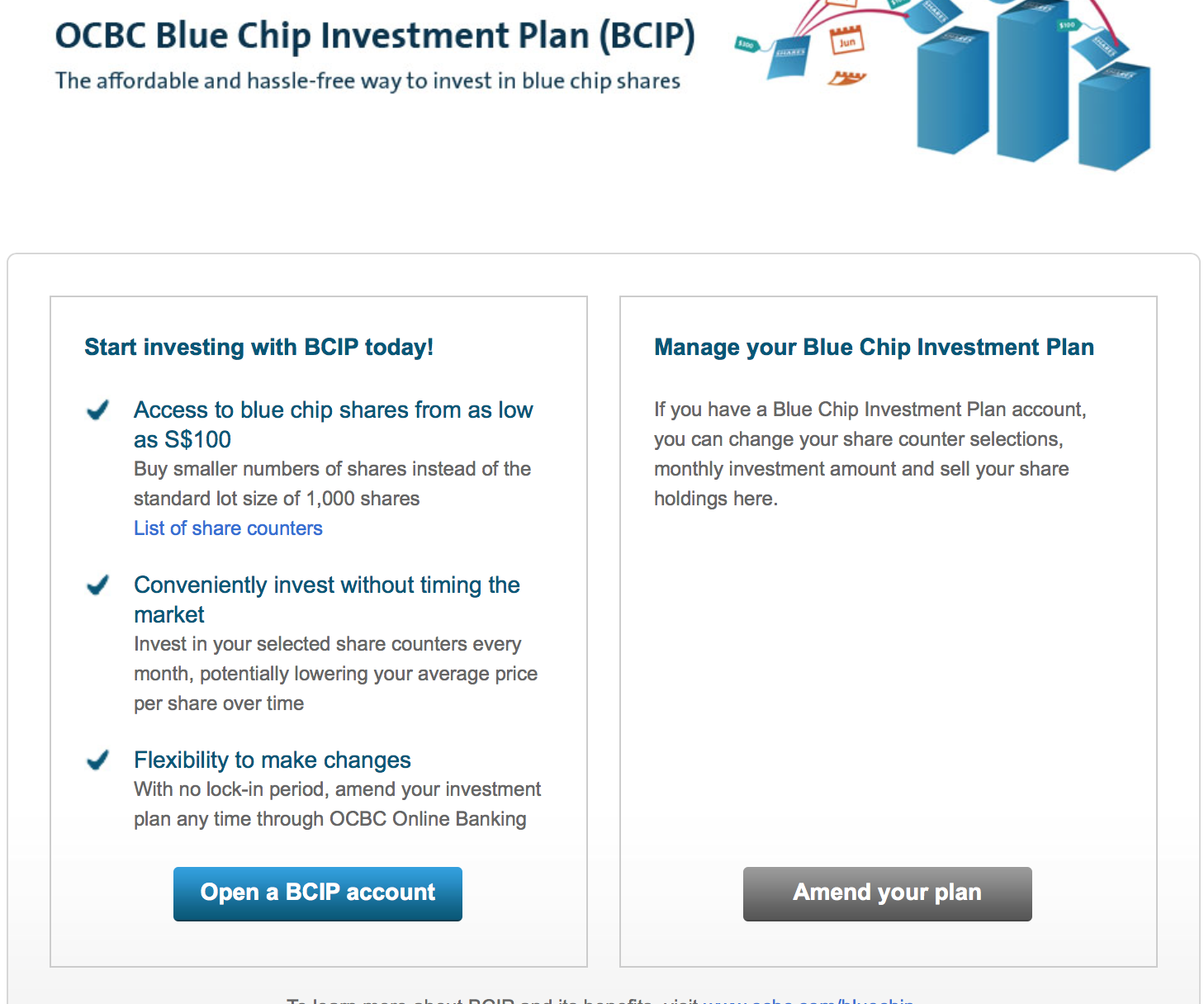

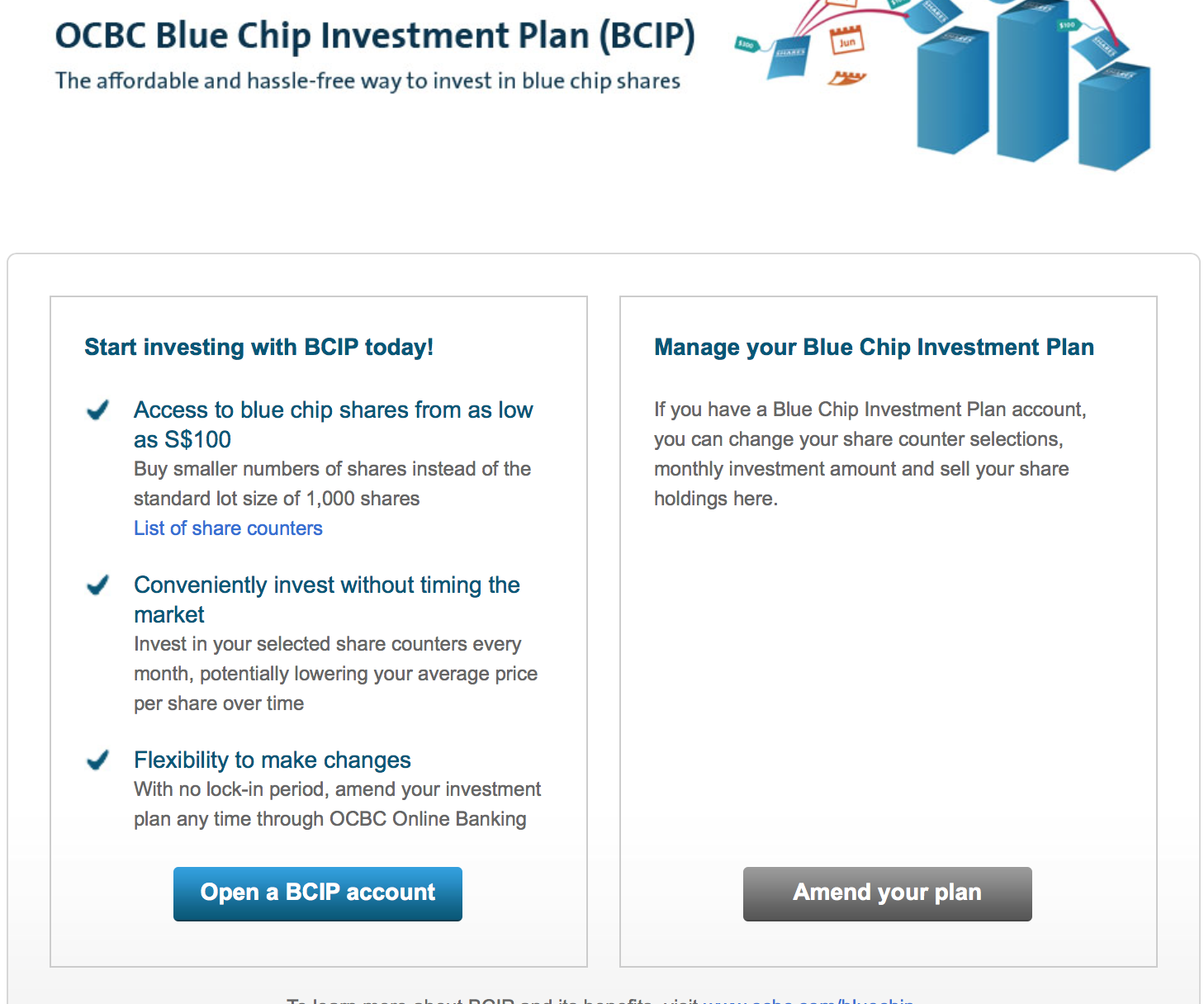

They offer you the OCBC Blue Chip Investment Plan (BCIP).

In short, they offer you the opportunity to accumulate odd lots of shares over time instead of having to purchase 100 - 1000 at a time.

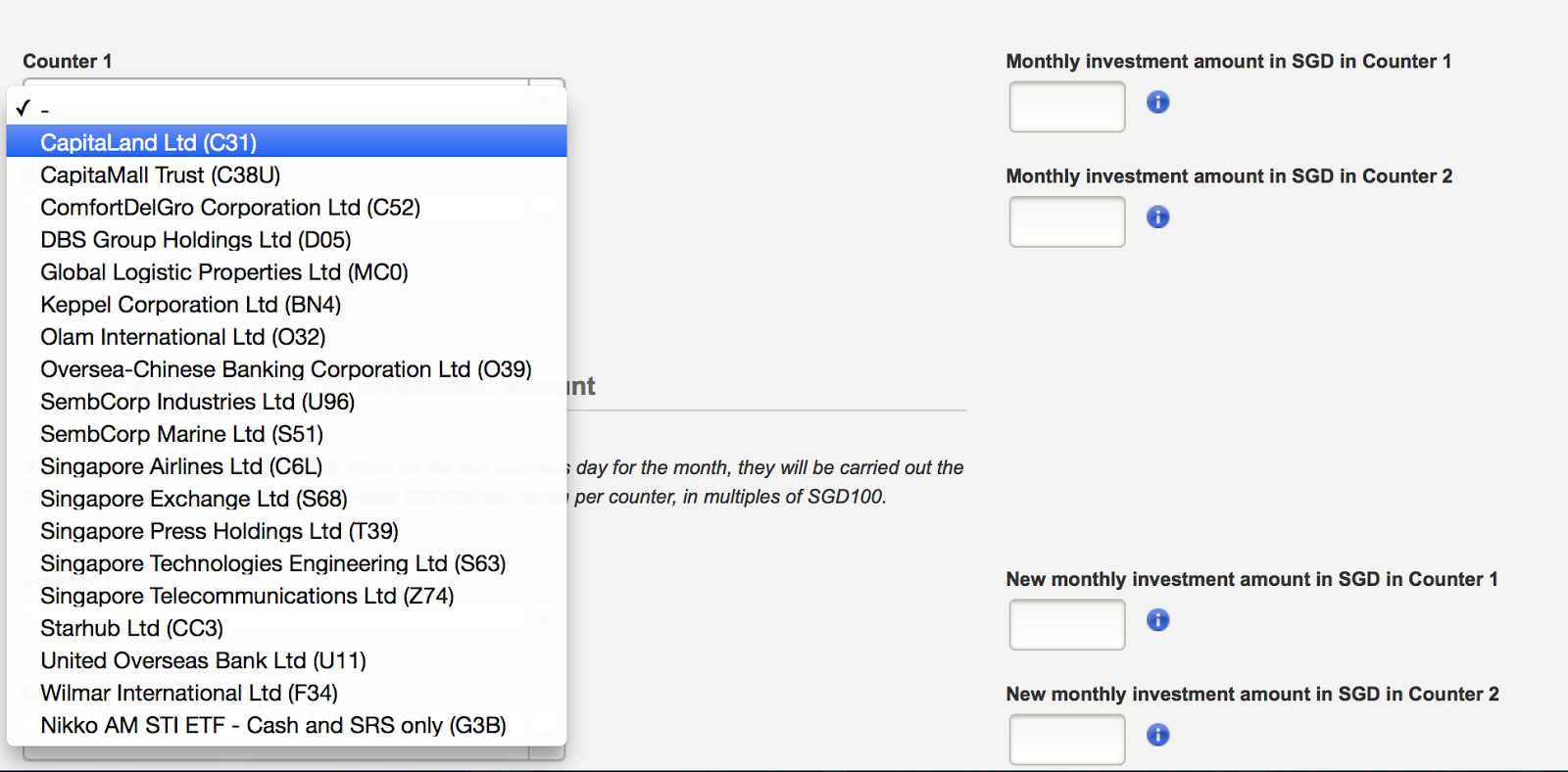

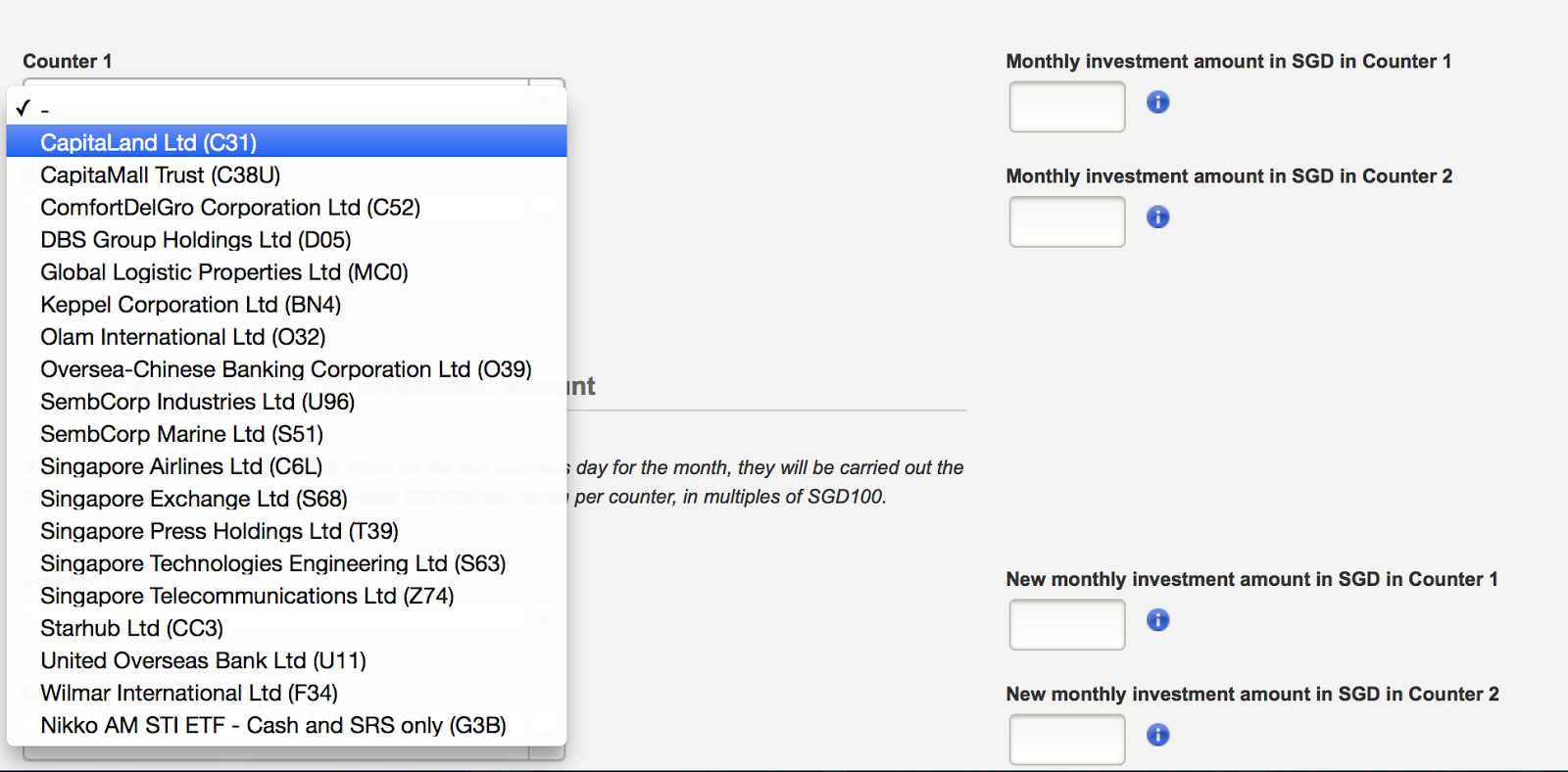

What are some of the blue chips does OCBC BCIP offer?

Notice the Nikko AM STI ETF? Yes there you go. You're welcome. Hahahaha.

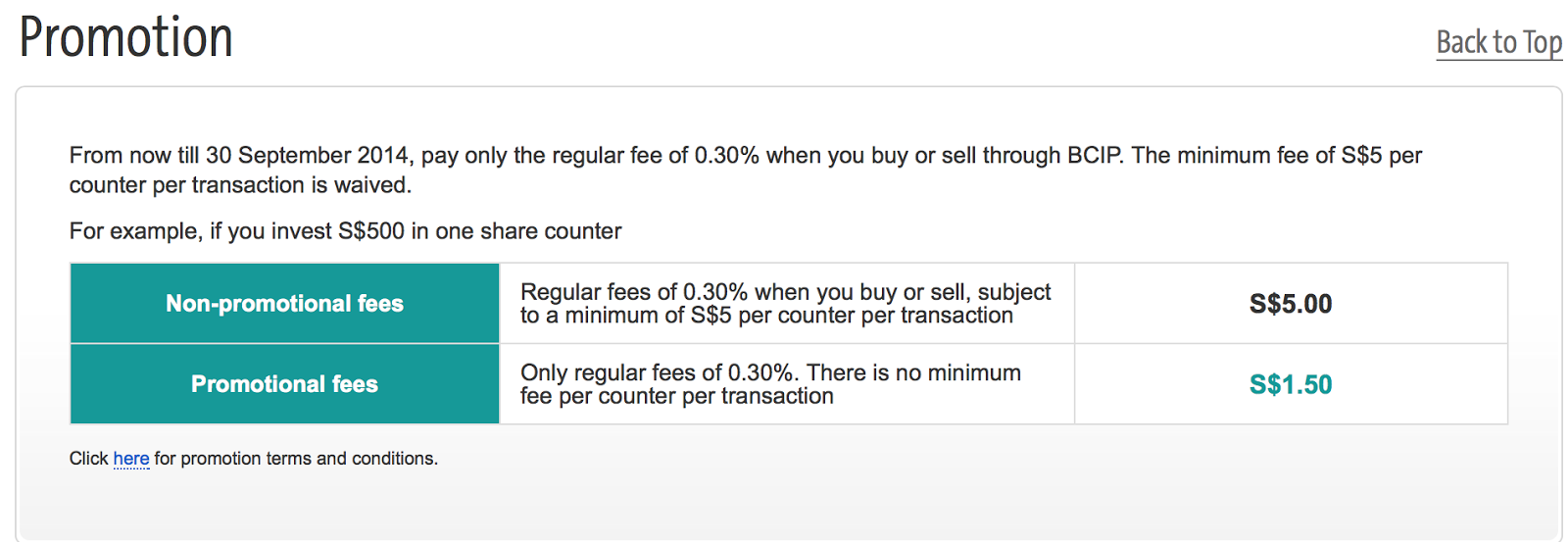

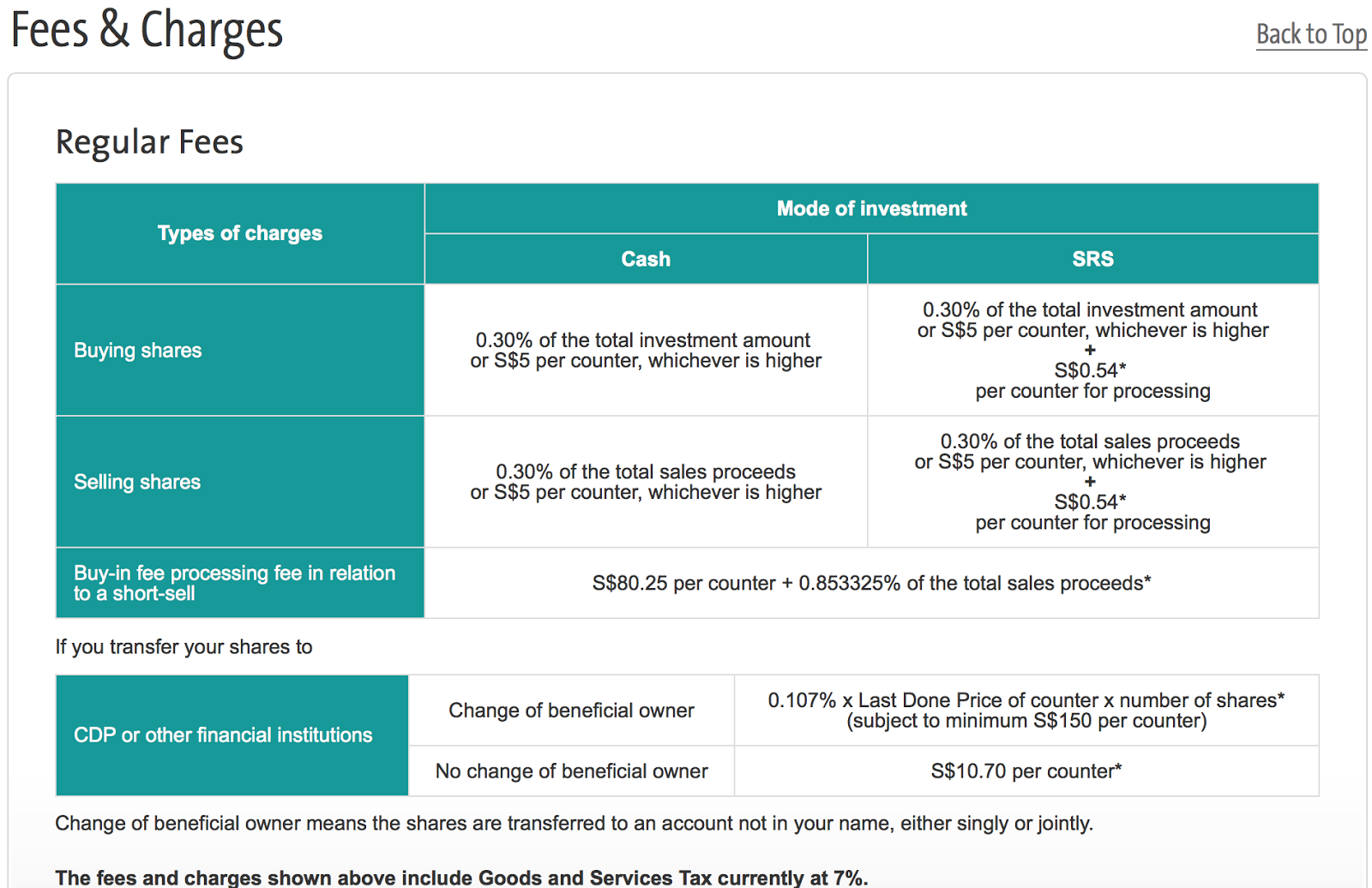

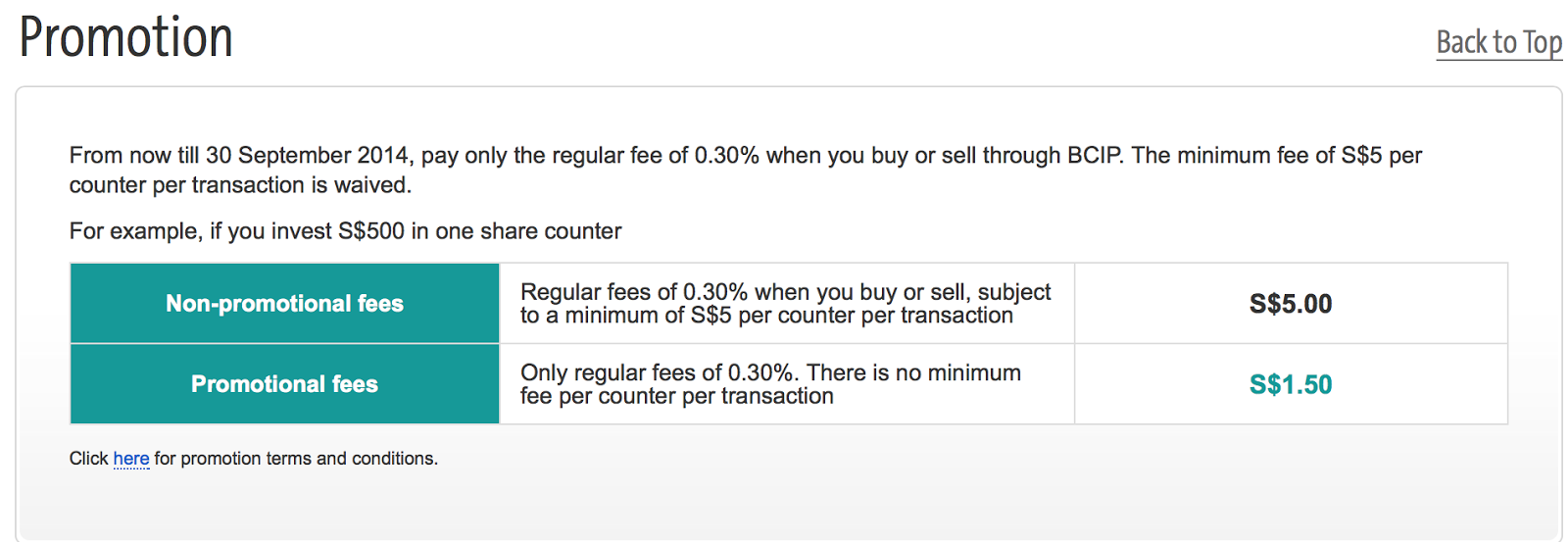

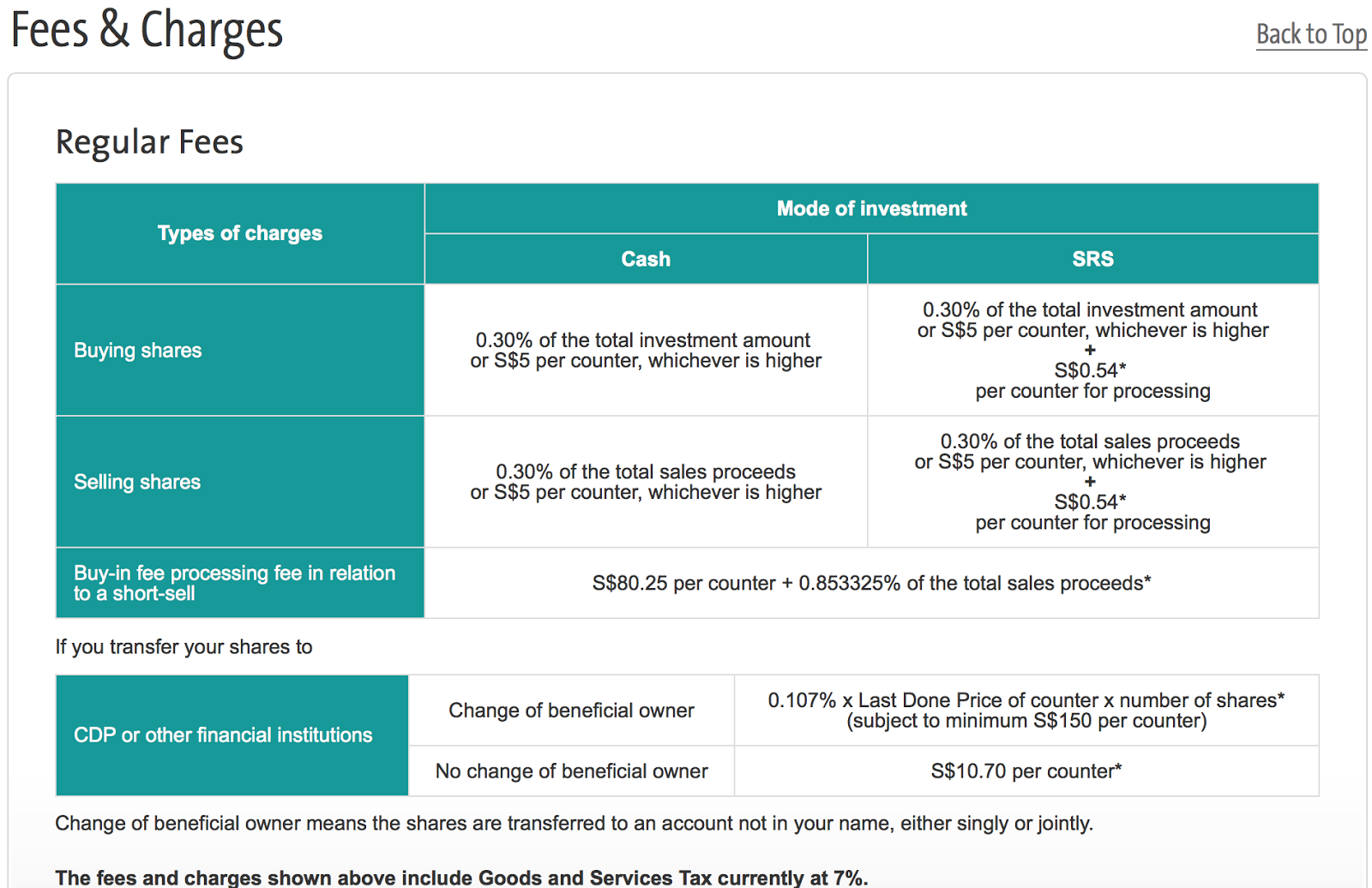

Now, I'm aware of the existing fee of minimum $5 transaction fees that has many people afraid to invest because it is simply not worth it. That's almost a 5% transaction fee with $100. However, the current promotion of only 0.3% and $5 transaction fee waived will give many newbie investors an opportunity to take the first step and purchase a few counters. There's always a chance that OCBC will extend the promotion. It has done so before.

However, these information are only partial and may not be complete. I would advise anyone who is planning to try the OCBC BCIP plan to always do their own research and call the bank itself to check on the existing costs.

All that said and done, I have used the OCBC BCIP personally to gain a little experience. In short, OCBC allows you to invest in the Nikko AM STI ETF, or invest in individual blue chip companies. It's entirely up to you.

What about POSB/DBS?

Well, POSB Invest Saver also allows you exposure to blue chips. However, while similar they also have extreme differences. Why do I say that? POSB Invest Saver only allows you to purchase the STI ETF ONLY. They do not offer any individual companies. Therefore do consider the difference according to your personal preference.

It also allows a $100 monthly investment with a 1% sales charge which is about $1.

I hope that this has helped you. Some people may ask why I have not included the Philip Sharebuilders Plan. Simply put, the management fees and other fees will kill you. Similarly, it is not for when you want to invest $100 monthly.

With this 2 plans, $100 will be deducted automatically every month on the dot. This helps if you do not want to log in every month, and make a transaction. You are paying for the automated services they provide. Best of all, you do not need a certain age unlike DIY strategies which usually require you to be 21 and above.

With the current promotion, OCBC fees of 0.3% IS cheaper than POSB 1%. However, when the promotion ends and the $5 minimum fee / transaction kicks in it would be better to invest a larger amount to even it out. At the end of the day, both options offer you the chance to invest in blue chip shares without having to spend $300++ to $3000 at a go.

Do check out these 2 links. They are filled with various information and questions. When I first began, I studied these two websites too :)

http://forums.hardwarezone.com.sg/stocks-shares-indices-92/posb-invest-saver-4309151.html

http://forums.hardwarezone.com.sg/stocks-shares-indices-92/blue-chip-investment-plan-bcip-ocbc-4271264.html

Investing over a long period of time through the market fluctuations will eventually bring you decent returns as the stock market always go up in the long run.

Hope the information helps you! What should I post about next? Any ideas? Feel free to email me :)

Signing off,

Teenage Investor

Twitter: Teenageinvestor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- How To Invest In The Stock Market With Just $100 Every Month?

As passive investors, many of us including myself invest regularly on a monthly basis. Additionally, some of us are investing for long term goals that includes retirement. However, how much can most of us afford to invest every month? The numbers may...

- Someone To Accompany You On Your Investment Journey

Today, I was texting a friend of mine. Turns out he has been investing with POSB Invest Saver for 8 months already. Seems like we were on the same journey of figuring out the confusing world of Stocks, Bonds and Shares but we didn't know it then....

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- Investing In Actively Managed Funds

I've been reading a couple of Finance blogs mostly by Singaporeans, and I noticed that one of them (name shall not be mentioned) has chosen to invest with OCBC Blue Chip Investment Plan (BCIP) I did also talk about OCBC BCIP on a previous blogpost, http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-investment.html...

Money and Finance

The Beginning of YOUR Investment Journey [ Part 2 ]

In Part 1 of The Beginning of YOUR Investment Journey,

http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-teenage-investing.html

I mentioned that the cheapest fund tracking the STI (Straits Times Index) was Nikko AM which would have cost you $339 ++ instead of SPDR $3340+.

That's a huge difference I must say. The Singapore Government has dictated that stocks will be sold in 100 or 1000 shares / lot. That's not giving much choice to us young investors. No wonder everyone thinks that the stock market or buying shares is only for the rich and wealthy.

Why SHOULD they be the only one allowed? What about the rest of us? Don't WE get a choice to take control of our own future?

So today, I'm about to show you how you can take the first step into beginning your journey.

Firstly, you know the basic ETFs you're going to buy. Let's presume you have an monthly allowance of say, between $300 - 400. Let's also presume that you can afford at least $100 a month for your investment.

Good so far? Note: If you cannot afford $100/month, get a part time job that supplements your allowance. Remember, it's your future. What you do now in preparation, dictates what you future will be like. Most part time jobs pay between $7-9/hour.

Say you work 6 hours a day during weekends, with a pay of $7 / hour for at LEAST one day.

That's an extra $42/week. In a month, you'd get $168.

Ok moving on.

Now you want to begin your investing, as I said previously you can't just buy stocks off the shelves like you do in Supermarkets. You need to select your brokerage. What's a brokerage?

In short, a brokerage brings buyers and sellers together.

There are several brokerages in Singapore that you can purchase shares from.

- AMFRASER SECURITIES PTE LTD

- CIMB SECURITIES PTE LTD

- DBS VICKERS SECURITIES (S) PTE LTD

- DMG&PARTNERS SECURITIES PTE LTD

- KIM ENG SECURITIES PTE LTD

- LIM & TAN SECURITIES PTE LTD

- OCBC SECURITIES PTE LTD

- PHILLIP SECURITIES PTE LTD

- UOB KAY HIAN PTE LTD

But, I'm going to make a bet here that you WILL NOT buy your shares from any of them. Because the fees that they charge for your investments change accordingly to your investment value. We're talking at least $50,000 - $100,000. For a monthly investment of $100, you'd see your money getting eaten up by fees so fast you don't even have the chance to say "What?".

No, instead we want to invest a small sum of money every month without worrying too much about fees and charges.

Well, there are 2 Banks in Singapore that offer the most well known options to invest in blue chip shares without the hassle of opening security trading accounts and all that other stuff.

Remember, we want simplicity. The following options are good IF you'd rather not DIY.

1. OCBC

2. POSB/DBS

Let's begin with OCBC, where you can begin investing with $100 (minimum amount) monthly.

They offer you the OCBC Blue Chip Investment Plan (BCIP).

In short, they offer you the opportunity to accumulate odd lots of shares over time instead of having to purchase 100 - 1000 at a time.

What are some of the blue chips does OCBC BCIP offer?

CapitaLand Limited

CapitaMall Trust

CapitaMalls Asia Limited

ComfortDelGro Corporation Limited

DBS Group Holdings Limited

Global Logistic Properties Limited

Singapore Airlines Limited

Nikko AM Singapore STI ETF

Notice the Nikko AM STI ETF? Yes there you go. You're welcome. Hahahaha.

Now, I'm aware of the existing fee of minimum $5 transaction fees that has many people afraid to invest because it is simply not worth it. That's almost a 5% transaction fee with $100. However, the current promotion of only 0.3% and $5 transaction fee waived will give many newbie investors an opportunity to take the first step and purchase a few counters. There's always a chance that OCBC will extend the promotion. It has done so before.

However, these information are only partial and may not be complete. I would advise anyone who is planning to try the OCBC BCIP plan to always do their own research and call the bank itself to check on the existing costs.

All that said and done, I have used the OCBC BCIP personally to gain a little experience. In short, OCBC allows you to invest in the Nikko AM STI ETF, or invest in individual blue chip companies. It's entirely up to you.

What about POSB/DBS?

Well, POSB Invest Saver also allows you exposure to blue chips. However, while similar they also have extreme differences. Why do I say that? POSB Invest Saver only allows you to purchase the STI ETF ONLY. They do not offer any individual companies. Therefore do consider the difference according to your personal preference.

It also allows a $100 monthly investment with a 1% sales charge which is about $1.

I hope that this has helped you. Some people may ask why I have not included the Philip Sharebuilders Plan. Simply put, the management fees and other fees will kill you. Similarly, it is not for when you want to invest $100 monthly.

With this 2 plans, $100 will be deducted automatically every month on the dot. This helps if you do not want to log in every month, and make a transaction. You are paying for the automated services they provide. Best of all, you do not need a certain age unlike DIY strategies which usually require you to be 21 and above.

With the current promotion, OCBC fees of 0.3% IS cheaper than POSB 1%. However, when the promotion ends and the $5 minimum fee / transaction kicks in it would be better to invest a larger amount to even it out. At the end of the day, both options offer you the chance to invest in blue chip shares without having to spend $300++ to $3000 at a go.

Do check out these 2 links. They are filled with various information and questions. When I first began, I studied these two websites too :)

http://forums.hardwarezone.com.sg/stocks-shares-indices-92/posb-invest-saver-4309151.html

http://forums.hardwarezone.com.sg/stocks-shares-indices-92/blue-chip-investment-plan-bcip-ocbc-4271264.html

Investing over a long period of time through the market fluctuations will eventually bring you decent returns as the stock market always go up in the long run.

Hope the information helps you! What should I post about next? Any ideas? Feel free to email me :)

Signing off,

Teenage Investor

Twitter: Teenageinvestor

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- How To Invest In The Stock Market With Just $100 Every Month?

As passive investors, many of us including myself invest regularly on a monthly basis. Additionally, some of us are investing for long term goals that includes retirement. However, how much can most of us afford to invest every month? The numbers may...

- Someone To Accompany You On Your Investment Journey

Today, I was texting a friend of mine. Turns out he has been investing with POSB Invest Saver for 8 months already. Seems like we were on the same journey of figuring out the confusing world of Stocks, Bonds and Shares but we didn't know it then....

- How To Invest In Shares [part 1]

I've received a few emails from different readers of my blog. One thing I noticed about was a very common question. "How do I invest in Shares?" Well, I shall try to explain in a way that's as easy to understand as possible over the space of a...

- Investing In Actively Managed Funds

I've been reading a couple of Finance blogs mostly by Singaporeans, and I noticed that one of them (name shall not be mentioned) has chosen to invest with OCBC Blue Chip Investment Plan (BCIP) I did also talk about OCBC BCIP on a previous blogpost, http://teenageinvesting.blogspot.sg/2014/08/the-beginning-of-your-investment.html...