Money and Finance

One of the traits shared by the investors I admire is an insatiable thirst for a wide range of knowledge. (Look no further than Charlie Munger on this point.) For every investing book they read, they might read two or three non-investing books if not more.

While it's absolutely critical to understand the science of investing -- accounting, valuation, analysis, etc. -- ultimately, the numbers reflected in a company's financial statement and the ones that go into our spreadsheets are by-products of human behavior. Without context, the numbers don't amount to much.

The art of investing is understanding why people do the things they do, especially the things we ourselves do. The better control we have over our own emotions and actions when other investors lack control, the better our returns should be in the long run. Further, it's important to read on a variety of topics as the market is a complex system and the more strings we can tie together, the greater our potential for identifying value-creating opportunities.

I'm curious to know what non-investing books you've read that have made a big impact on your investing strategy. You can let me know on Twitter @toddwenning or in the comments section below.

One of my recommendations is Tao Te Ching by Laozi (Lao Tzu), which has had a tremendous impact on my philosophy on patience, even if I don't always practice it as well as I should.

What I've been reading and listening to this week:

- Gurufocus Interviews Tom Gayner

How did you get started with value investing? TG: Well, I started out life as an accountant, from the University of Virginia. Then a CPA, working at PriceWaterhouseCoopers. I found as I got into accounting that I was more interested in dollars than numbers,...

- Interview By Kanwal From Simply Investing

The following is an excerpt from the interview that I had with Kanwal. The full interview can be found at the Simply Investing website. I recently had the honour of interviewing the blogger behind the awesome blog Passive-Income-Pursuit! Passive...

- Weekly Reading List 5/10/2015

What I've been reading and listening to - May 10, 2015 There are many ways to be an investor - MonevatorCharlie Munger and the art of stock picking - John Huber, Base Hit InvestingBuffett and Vanguard: different paths to the same destination...

- Has Long-term Investing Become Too Popular?

Long-term investing has gotten so popular it's easier to admit you're a crack addict than to admit you're a short-term investor. - Peter Lynch in 2000Having publicly written about investing since 2006, it's been interesting to observe...

- Preparing For The Next Bear Market

The opportunity to secure ourselves against defeat lies in our own hands, but the opportunity of defeating the enemy is provided by the enemy himself. - Sun TzuEarlier this week, a friend asked me what I thought could end this bull market. I searched...

Money and Finance

The Art and Science of Investing

Stockpicking is both an art and a science, but too much of either is a dangerous thing...If you could tell the future from a balance sheet, then mathematicians and accountants would be the richest people in the world by now. - Peter Lynch, Beating the Street

|

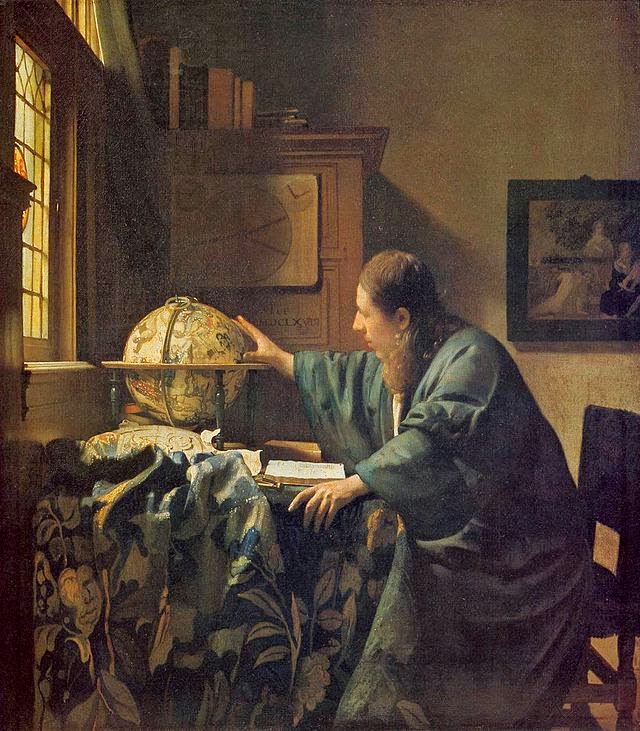

| The Astronomer, Vermeer |

While it's absolutely critical to understand the science of investing -- accounting, valuation, analysis, etc. -- ultimately, the numbers reflected in a company's financial statement and the ones that go into our spreadsheets are by-products of human behavior. Without context, the numbers don't amount to much.

The art of investing is understanding why people do the things they do, especially the things we ourselves do. The better control we have over our own emotions and actions when other investors lack control, the better our returns should be in the long run. Further, it's important to read on a variety of topics as the market is a complex system and the more strings we can tie together, the greater our potential for identifying value-creating opportunities.

I'm curious to know what non-investing books you've read that have made a big impact on your investing strategy. You can let me know on Twitter @toddwenning or in the comments section below.

One of my recommendations is Tao Te Ching by Laozi (Lao Tzu), which has had a tremendous impact on my philosophy on patience, even if I don't always practice it as well as I should.

What I've been reading and listening to this week:

- Value investing myths - Oddball Stocks

- Share Radio - a new U.K.-based investing-focused radio station

- A dozen things I've learned from John Malone - 25iq

- How to think like Sherlock Holmes - an older post from Farnam St.

- The value of "I don't know" - A Wealth of Common Sense

- A medal of honor awarded 151 years later - NY Times

Stay patient, stay focused.

Best,

Todd

- Gurufocus Interviews Tom Gayner

How did you get started with value investing? TG: Well, I started out life as an accountant, from the University of Virginia. Then a CPA, working at PriceWaterhouseCoopers. I found as I got into accounting that I was more interested in dollars than numbers,...

- Interview By Kanwal From Simply Investing

The following is an excerpt from the interview that I had with Kanwal. The full interview can be found at the Simply Investing website. I recently had the honour of interviewing the blogger behind the awesome blog Passive-Income-Pursuit! Passive...

- Weekly Reading List 5/10/2015

What I've been reading and listening to - May 10, 2015 There are many ways to be an investor - MonevatorCharlie Munger and the art of stock picking - John Huber, Base Hit InvestingBuffett and Vanguard: different paths to the same destination...

- Has Long-term Investing Become Too Popular?

Long-term investing has gotten so popular it's easier to admit you're a crack addict than to admit you're a short-term investor. - Peter Lynch in 2000Having publicly written about investing since 2006, it's been interesting to observe...

- Preparing For The Next Bear Market

The opportunity to secure ourselves against defeat lies in our own hands, but the opportunity of defeating the enemy is provided by the enemy himself. - Sun TzuEarlier this week, a friend asked me what I thought could end this bull market. I searched...