Money and Finance

Taking the (E)motions out of Investments?

Easier said than done. When you invest your money, I'm assuming you're investing after a thorough thought process. One does not simply invest his/her money based on the "TOP 20 SHARES TO INVEST IN 2015" or "BEST STOCK TO INVEST 2014" that you see on Google or financial magazines.

So when the market is going through a rough patch, should you sell to minimise your loss, or hold onto your investments hoping for the best?

The emotions that guide you through every decision has been there since Day 1. But if you're in this for the long term, is the best decision to sell now and wait for the price to increase before buying again really the "best" decision?

There will always be emotions attached to money making decisions.

Fourteen Emotional Stages An Investor Goes Through

- The Cost Of Self-indulgence...

From Phil Fisher in Common Stocks and Uncommon Profits: ...there is a complicating factor that makes the handling of investment mistakes more difficult. This is the ego in each of us. None of us likes to admit to himself that he has been wrong. If we...

- Some Investing Advice For My Son

My wife and I recently welcomed our son into the world and, like any new parent, I've been thinking about all the things I'll need to teach him as he grows up -- how to ride a bike, how to read, and, of course, how to invest. So with a few minutes...

- What To Do When Your Stock Plunges

Invest long enough and one morning you'll open your browser to check your stocks only to find that one of them is down 20% or more in pre-market trading. Fortunately, this sinking feeling doesn't happen often, but shareholders in a number of popular...

- Be Prepared To Lose All Your Money In The Stock Market.

(You can read my post here if you haven't already @ Standard Chartered is closing its' equity business. What a way to start 2015!) Continuing from the events of yesterday, a sudden thought occurred to me. While I was wondering what would...

- 5 Reasons Why You Shouldn't Be Investing

How weird, why am I posting about this when I'm into investments myself? Read on :) So, I've been at work, trying to introduce Investing techniques to my friends without being too obvious. I am trying to keep my identity as private as possible...

Money and Finance

Taking the E-motions out of Investments

Taking the (E)motions out of Investments?

Easier said than done. When you invest your money, I'm assuming you're investing after a thorough thought process. One does not simply invest his/her money based on the "TOP 20 SHARES TO INVEST IN 2015" or "BEST STOCK TO INVEST 2014" that you see on Google or financial magazines.

So when the market is going through a rough patch, should you sell to minimise your loss, or hold onto your investments hoping for the best?

The emotions that guide you through every decision has been there since Day 1. But if you're in this for the long term, is the best decision to sell now and wait for the price to increase before buying again really the "best" decision?

There will always be emotions attached to money making decisions.

Fourteen Emotional Stages An Investor Goes Through

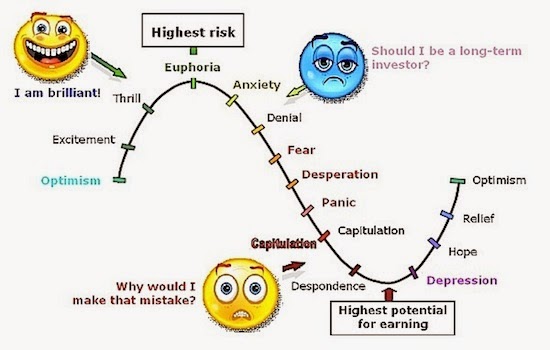

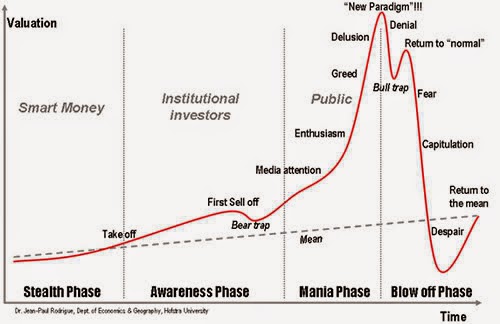

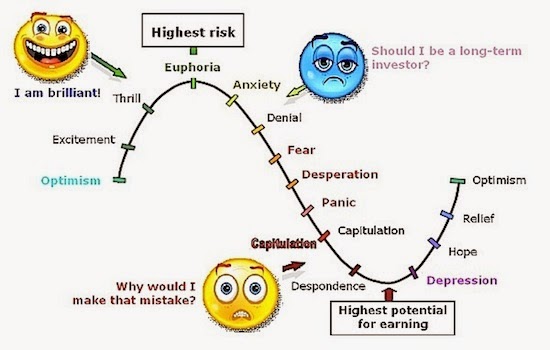

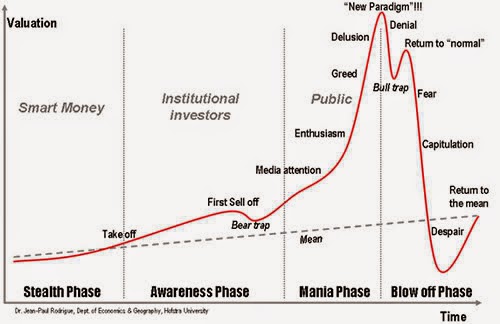

Much like the boom-slump cycle that is common to all markets, investors’ emotions play out with a similar rise to a peak before declining to a trough, followed by a recovery, where they typically go through 14 emotional stages.

- Optimism normally characterises the start of the cycle as investors buy their stocks, naturally with a positive outlook for the future and anticipation of potential gains.

- Excitement is quick to follow after some initial success, as we begin looking for new ways to accomplish more based on what we already achieved.

- Thrill comes after yet more success, as investors begin to delight in their wins and congratulate themselves for their smart decisions.

- Euphoria sets in as wins come quick and fast, bringing in a stream of easy profits and pushing investor sentiment to dizzying heights.

- Anxiety inevitably interrupts the climb, as the market surprises us by moving downwards. Faced with their first potential loss, investors reassure themselves that their well-calculated strategy will deliver in the long term.

- Denial takes this to the next level, when markets still show no signs of a rebound. At this stage, the investor begins to deny that he made a poor choice, clinging on to the belief that things are set to improve.

- Fear finally takes hold when the market realities set in. Amidst the confusion of getting things wrong, it is easy for sentiment to drop drastically, and for doubt to set in as fears that the market will never move in our favour escalate.

- Desperation sees a frantic attempt to salvage the situation with any idea that might have a chance of helping us break even.

- Panic follows when all options are exhausted and the road downhill is imminent.

- Capitulation sees the tormented investor admitting defeat and giving up hope of things turning around, shifting his focus from recovery to damage control, and exiting in order to avoid making further losses.

- Despondency is the lowest point of the emotional roller coaster. Investors cash out whatever remaining stocks they have, having given up hope of the markets ever recovering. With the wounds still raw and stinging, they vow never to buy stocks again to avoid getting burnt a second time.

- Depression sinks in as the fallen investors ruminate on their failure and the regrettable decisions that contributed to their predicament.

- Hope returns slowly after investors notice that the markets are picking up, realizing that movements are cyclical. This is when they cautiously begin to look out for the next opportunity.

- Relief is when faith is renewed after their next buy has turned profitable, setting the stage for sentiment to turn optimistic once more.

Assuming that you don't have the time, hiring someone to manage your funds for you doesn't take the responsibility of doing research away.

When in stocks, losing money will always have a bigger impact than earning the same amount.

What are some popular tips?

1. Don't try to Time the Market.

2. Dollar Cost Averaging- Investing through all kinds of weather conditions.

Till next time!

Signing off,

Teenage Investor

Posts you might be interested in:

1. Does Having A Perfect Wedding means spending Thousands?

2. Investing without your Parent's knowledge?

3. 80% of young Singaporeans have little to no savings at all ; are you one of them?

- The Cost Of Self-indulgence...

From Phil Fisher in Common Stocks and Uncommon Profits: ...there is a complicating factor that makes the handling of investment mistakes more difficult. This is the ego in each of us. None of us likes to admit to himself that he has been wrong. If we...

- Some Investing Advice For My Son

My wife and I recently welcomed our son into the world and, like any new parent, I've been thinking about all the things I'll need to teach him as he grows up -- how to ride a bike, how to read, and, of course, how to invest. So with a few minutes...

- What To Do When Your Stock Plunges

Invest long enough and one morning you'll open your browser to check your stocks only to find that one of them is down 20% or more in pre-market trading. Fortunately, this sinking feeling doesn't happen often, but shareholders in a number of popular...

- Be Prepared To Lose All Your Money In The Stock Market.

(You can read my post here if you haven't already @ Standard Chartered is closing its' equity business. What a way to start 2015!) Continuing from the events of yesterday, a sudden thought occurred to me. While I was wondering what would...

- 5 Reasons Why You Shouldn't Be Investing

How weird, why am I posting about this when I'm into investments myself? Read on :) So, I've been at work, trying to introduce Investing techniques to my friends without being too obvious. I am trying to keep my identity as private as possible...