Money and Finance

I am going on a two week business trip so I took an advance on my paycheck for some fun (meaning I took money from my savings and will add back to it this Saturday when I receive my paycheck). As a side note I hate big rigs. I hate how they drive up to me on the highway during rush hour and how they refuse to let anyone pass them. On that note

article from SA here

*you know the rule. I'm not a lawyer, financial adviser, etc. Don't follow my advice.

- Caterpillar Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Caterpillar Inc. (CAT). Caterpillar was...

- Recent Buy: Wmt; Watchlist For November-december

It feels good to get back into the buying game. On November 10, 2015, I bought 8.5339 shares of WMT at $58.59 for a total of $500.00 in my Loyal3 Account. Instead of explaining my rationale I am going to plagiarize Div4Son checklist...

- Loyal3 $500 Buy

In the past week I bought the following stocks in my Loyal3 account. Ticker $ invested Cost WalMart ...

- Recent Buy

I just added 14 shares of BAX for a grand cost of $1001.00 ($71/share+7 trading fee). This adds $29.12 to my forward annual dividend. I am still strengthening the core of my portfolio as this is my one and only health care (until JNJ comes down to earth)....

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

Money and Finance

Recent Buy: CMI

I am going on a two week business trip so I took an advance on my paycheck for some fun (meaning I took money from my savings and will add back to it this Saturday when I receive my paycheck). As a side note I hate big rigs. I hate how they drive up to me on the highway during rush hour and how they refuse to let anyone pass them. On that note

On October 19, 2015, I bought 10 shares of Cummins (CMI) at $108.70. Total cost + fee is $1094.00. This will add $39 dollars to my dividend fund.

Fundamental

1. What is a Cummins?

Cummins Inc. designs, manufactures, distributes, and services diesel and natural gas engines, and engine-related components. It operates in four segments: Engine, Distribution, Components, and Power Generation.

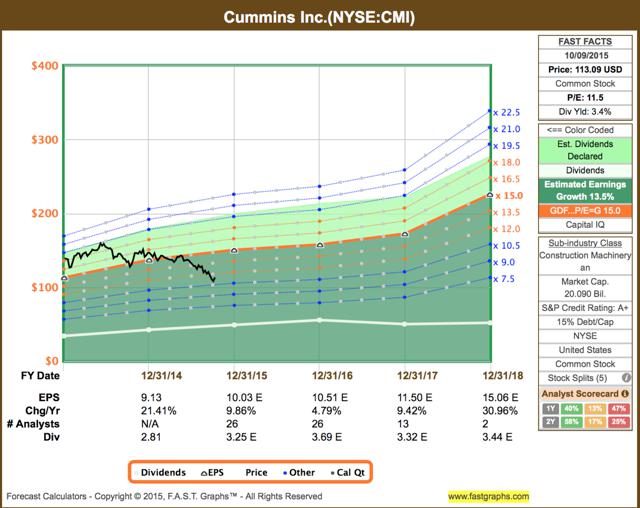

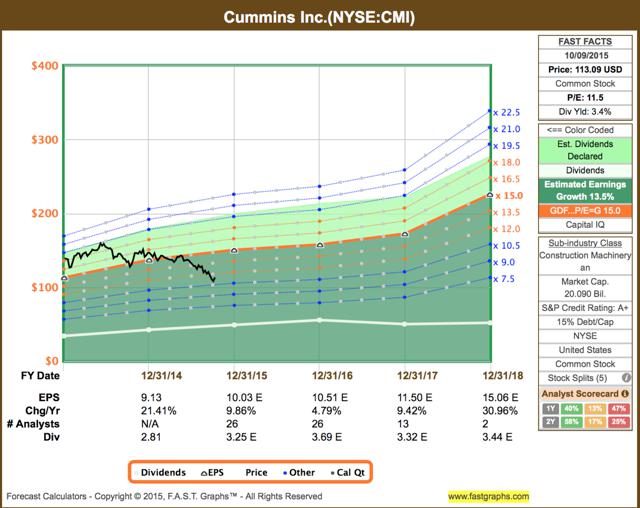

2) Valuation

- P/E: 11.52x ttm;

- Forward: 10.38x

- PEG: 0.60x

- P/S: 0.98x

- TTM ROE: 22.2%

- Debt/equity: 0.21%

- DGR:

- 1 yr: 24.9 %

- 3 yr: 28.5 %

- 5 yr: 32 %

- 10 yr: 25.1 %

- Dividend yield: 3.5%

- Dividend payout ratio: 33%

- Number of year dividend increased: 10 (CMI has split 2:1 twice in the past ten years)

CMI | MachineryAverage | Industry Percentile | ||

Market Cap | $21.53B | $6.91B | 99th | |

P/E (Trailing Twelve Months) | 12.66 | 15.61 | 29th | |

P/E (5-Year Average) | 14.46 | 20.05 | 18th | |

PEG Ratio (5-Year Projected) | 1.23 | -- | 29th | |

Enterprise Value | $21.35B | $22.57B | 97th | |

Price/Cash Flow (Most Recent Quarter) | 8.96 | 11.10 | 52nd | |

Price/Cash Flow | 9.81 | 11.77 | 41st | |

Price/Sales (Most Recent Quarter) | 1.07 | 1.36 | 55th | |

Price/Sales | 1.10 | 1.39 | 57th | |

Price/Book | 2.80 09/11/2015 | 3.04 | 71st | |

Book Value | 44.22 06/30/2015 | 21.18 | 100th | |

Growth Est | CMI | Industry | Sector | S&P 500 |

Current Qtr. | 13.40% | 1.50% | 79.90% | 4.80% |

Next Qtr. | 4.70% | 42.10% | 65.30% | 7.80% |

This Year | 10.10% | 13.60% | 30.70% | -0.10% |

Next Year | 8.70% | 16.70% | 25.70% | 10.60% |

Past 5 Years (per annum) | 7.02% | N/A | N/A | N/A |

Next 5 Years (per annum) | 10.30% | 13.09% | 13.11% | 6.89% |

Price/Earnings (avg. for comparison categories) | 11.84 | 12.23 | 14.97 | 12.12 |

PEG Ratio (avg. for comparison categories) | 1.15 | 1.47 | -2.36 | -1.26 |

3) Fair value

- Simply wall Street: $115

- S&P capital:

- $143.50 fair value;

- $180 12 month target ;

- 5 stars Strong Buy

- Yahoo: $131

4) Future Goals

CMI is working on and selling near zero emission natural gas engines which will help companies follow EPA and state clean air acts. Sales have been depressed because of the low cost of oil but natural gas engines are the future. I highly doubt there will ever be a solar powered big rig in my lifetime.

CMI also has a “hedgehog” in its pipeline for 2016. What is hedgehog? Imagine a really big engine that can be used for trains, boats, and basically anything not drivable on highways. More horsepower and efficient.

Weaknesses:

Every stock has weaknesses.

- Forex: 50% of CMI’s business is overseas.

- Economy: Slow downs destroy all industrial stocks.

If i happen to get more cash I'm hoarding CMI to make a full position of 50 shares. My dividend fund is now $2,135.65 + FCISX distribution. I updated my 2015 goals, forward dividends increase to $2,200.00. See you readers in 2 weeks.

*you know the rule. I'm not a lawyer, financial adviser, etc. Don't follow my advice.

- Caterpillar Stock Analysis

As mentioned in my previous post, I'm going to try and have 1 stock analysis report for some popular dividend growth stocks come out prior to their latest earnings release this week. Today we'll look at Caterpillar Inc. (CAT). Caterpillar was...

- Recent Buy: Wmt; Watchlist For November-december

It feels good to get back into the buying game. On November 10, 2015, I bought 8.5339 shares of WMT at $58.59 for a total of $500.00 in my Loyal3 Account. Instead of explaining my rationale I am going to plagiarize Div4Son checklist...

- Loyal3 $500 Buy

In the past week I bought the following stocks in my Loyal3 account. Ticker $ invested Cost WalMart ...

- Recent Buy

I just added 14 shares of BAX for a grand cost of $1001.00 ($71/share+7 trading fee). This adds $29.12 to my forward annual dividend. I am still strengthening the core of my portfolio as this is my one and only health care (until JNJ comes down to earth)....

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...