Money and Finance

Today I added to my position in General Mills (GIS). I purchased another 22 shares at $49.12 raising my total shares to 55. General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company also supplies branded and unbranded food products to the foodservice and commercial baking industries. This dividend achiever has paid dividends since 1898, and has increased them for ten years in a row.

Today I added to my position in General Mills (GIS). I purchased another 22 shares at $49.12 raising my total shares to 55. General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company also supplies branded and unbranded food products to the foodservice and commercial baking industries. This dividend achiever has paid dividends since 1898, and has increased them for ten years in a row.

It was a difficult task trying to find an undervalued stock for the month of August. I had some other stocks on my watch list I thought about buying but those seemed a bit overpriced (CLX for example). I don't believe GIS is undervalued at this price by any means but I don't think I will look back and regret this trade in 20 years. I have given up on trying to time the market.

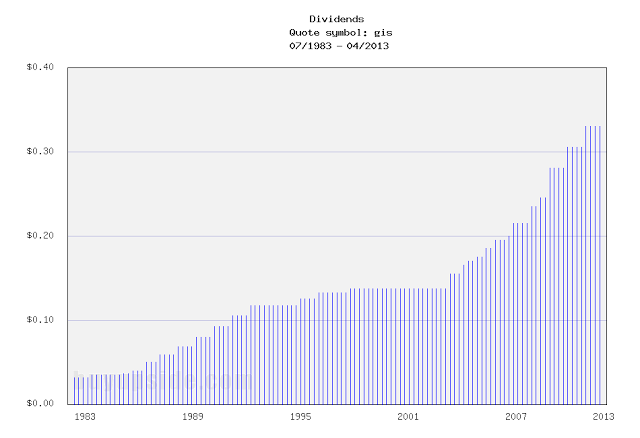

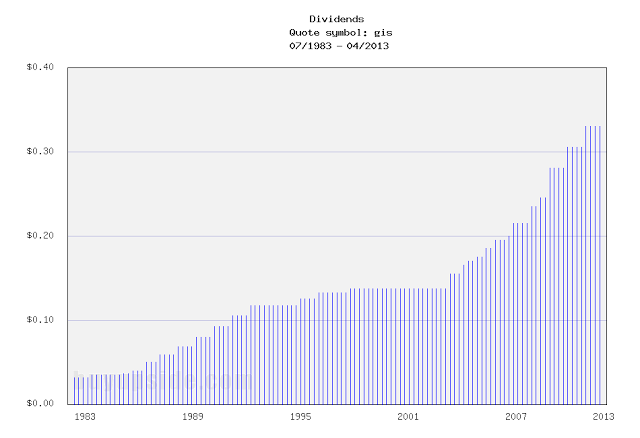

The annual dividend payment has increased by 8.70% per year over the past decade, which is slightly higher than the growth in EPS. A 9% growth in distributions translates into the dividend payment doubling almost every eight years on average. If we look at historical data, going as far back as 1986, one would notice that the company has managed to double distributions every eight and a half years on average. GIS recently approved a 15% increase in the dividend rate effective with the August 1, 2013 payment. The increase will bring the payments up from $.33 to $.38 per share.

- General Mills: Buy The Products Not The Stock

Consumer staples companies make for excellent dividend growth investments due to their steady nature. I mean we're all going to continue to eat even if the economy isn't exactly firing on all cylinders. That's why you see some pretty hefty...

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - General Mills (gis)

Wow, it seems like I just bought Unilever and here I am again purchasing another consumer giant General Mills (GIS). General Mills really needs no introduction if your like me and grew up eating Cheerios and Trix cereal. While I enjoy their cereals in...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...

Money and Finance

Recent Buy - General Mills (GIS)

It was a difficult task trying to find an undervalued stock for the month of August. I had some other stocks on my watch list I thought about buying but those seemed a bit overpriced (CLX for example). I don't believe GIS is undervalued at this price by any means but I don't think I will look back and regret this trade in 20 years. I have given up on trying to time the market.

GIS Basic Statistics

- Ticker Symbol: GIS

- PE Ratio: 17.54

- Yield: 3.1%

- Dividend Growth 10yr: 8.7%

- Payout Ratio: 47%

- Market cap: $31.46 B

- Website: www.generalmills.com

GIS VS S&P 500

The annual dividend payment has increased by 8.70% per year over the past decade, which is slightly higher than the growth in EPS. A 9% growth in distributions translates into the dividend payment doubling almost every eight years on average. If we look at historical data, going as far back as 1986, one would notice that the company has managed to double distributions every eight and a half years on average. GIS recently approved a 15% increase in the dividend rate effective with the August 1, 2013 payment. The increase will bring the payments up from $.33 to $.38 per share.

- General Mills: Buy The Products Not The Stock

Consumer staples companies make for excellent dividend growth investments due to their steady nature. I mean we're all going to continue to eat even if the economy isn't exactly firing on all cylinders. That's why you see some pretty hefty...

- Harris Corporation (hrs) Increases The Dividend

This morning Harris Corporation (HRS) announced an increase in the quarterly dividend. The payment increased from $0.42 to $0.47 or 11.9%. The new dividend rate is payable on September 23rd to shareholders of record as of September 9th. This...

- Recent Purchase - Piedmont Natural Gas (pny)

I think that most dividend investors try and seek out the most undervalued dividend stocks to add to their portfolios when the money becomes available. While I think that is a fantastic idea I'm a bit different in that I like to keep my payments balanced...

- Recent Buy - General Mills (gis)

Wow, it seems like I just bought Unilever and here I am again purchasing another consumer giant General Mills (GIS). General Mills really needs no introduction if your like me and grew up eating Cheerios and Trix cereal. While I enjoy their cereals in...

- Recent Dividend Increases

Dividend investors would be wise to focus not just on a stock's current yield, but also on the long-term growth potential of its dividends. That's because strong businesses that consistently raise their dividend payouts reward shareholders with...