Money and Finance

Hi Everyone,

Hi Everyone,

- Recent Buy - Walgreens Boots Alliance Inc (wba)

Hi Everyone, Another building block to the American Dividend Dream has been bought. This time, a little bit smaller of a purchase than some of the previous ones but a purchase nonetheless. Personally, these buy posts make me hungrier than ever...

- Recent Buy - Exxon Mobil (xom)

Hi Everyone, The buys keep piling up this month. This is the last buy post I have right now so next post will be the dividend income for August post... just a tad bit behind. Personally, these buy posts make me hungrier than ever...

- Recent Buy - Apple (aapl)

Hi Everyone, The buys keep piling up this month. For all you readers out there waiting for the dividend income post, I've got bad news... you are going to have to wait a bit longer. I have another buy post coming after this one...

- Recent Buy - Parker-hannifin Corp.

Hi Everyone, I fell behind a little bit with getting this post out, but its been a busy couple weeks. This purchase actually occurred on June 6th. It looks as if I'll make another purchase here pretty quickly because of the RAI/LO merger....

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...

Money and Finance

Recent Buy - Boeing (BA)

My wife and I continue to be blessed with the way this year has shaped up. Personally, these buy posts make me hungrier than ever to keep saving, keep making money and keep investing. The income that we are starting to make every month is could put a significant dent into our expenses. If you jump over to our Portfolio page, you can see that we almost have an entire month of expenses taken care of if we so choose to quit our day jobs. Eleven more months to go and we are home free!!

The next couple of months are going to be extremely busy with activities and such going on just about every single weekend. Between weddings, birthdays, parties, etc. hopefully we will still be able to keep saving at the pace we have been the past 2 months.

In my last post, I asked you readers what company I should buy after the RAI/LO merger gave me about $1,700 of capital to work with. I received quite a few comments but ultimately I decided to buy Boeing (BA).

With this purchase, my wife and I have put a total of around $28,000 to work since the beginning of 2015. My goal of investing roughly $40,000 is coming ever so close! We are about half way through the year and our total is 70% of the way to our goal. So now for the numbers...

The next couple of months are going to be extremely busy with activities and such going on just about every single weekend. Between weddings, birthdays, parties, etc. hopefully we will still be able to keep saving at the pace we have been the past 2 months.

In my last post, I asked you readers what company I should buy after the RAI/LO merger gave me about $1,700 of capital to work with. I received quite a few comments but ultimately I decided to buy Boeing (BA).

With this purchase, my wife and I have put a total of around $28,000 to work since the beginning of 2015. My goal of investing roughly $40,000 is coming ever so close! We are about half way through the year and our total is 70% of the way to our goal. So now for the numbers...

We purchased 14 shares of Boeing (BA) at $144.16. This purchase adds $50.96 of annual dividends to our account.

We now own 14 shares of BA as this was a new addition. We are now invested in 37 individual companies.

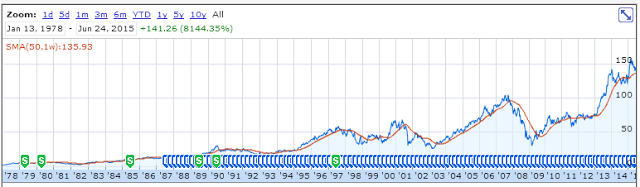

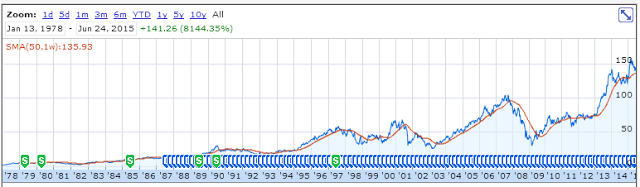

BA Chart:

Statistics:

P/E: 18

Yield: 2.90%

Market Cap: 100B

Dividend Growth Rate (3yr): 20%

Dividend Growth: 3 years

Dividend Growth: 3 years

Payout Ratio: 43%

As you can see from the stats above, BA has not had the long streak of dividend growth like our last pick Parker Hannifin but, they have been paying dividends since 1937. In a cyclical business like the one BA is in, that's a major positive. An even better positive is that BA has a backlog of planes to produce that goes out for 7 years! Barring another recession and companies pulling out of these orders before the planes are delivered, investors have a long runway (pun intended) ahead to estimate earnings effectively.

With BA priced at just 18 times earnings and a nice showing at the Paris Air Show, I see no reason why this stock is not worthy of a purchase. There has been speculation that BA might buy UTX's helicopter business so this could be a future catalyst to propel earnings a bit higher as well.

BA doesn't quite have the 3.65% yield that LO did at the time they merged, but if BA keeps growing the dividend as fast as it has been the last few years, the yield on cost will catch up rather quickly. The payout ratio is favorable at below 50% so there is definitely room to grow.

You can check out all the other purchases we have made for the year on my Stock Purchases and Sells page.

With BA priced at just 18 times earnings and a nice showing at the Paris Air Show, I see no reason why this stock is not worthy of a purchase. There has been speculation that BA might buy UTX's helicopter business so this could be a future catalyst to propel earnings a bit higher as well.

BA doesn't quite have the 3.65% yield that LO did at the time they merged, but if BA keeps growing the dividend as fast as it has been the last few years, the yield on cost will catch up rather quickly. The payout ratio is favorable at below 50% so there is definitely room to grow.

You can check out all the other purchases we have made for the year on my Stock Purchases and Sells page.

So there you have it, the next building block on the path to the American Dividend Dream! What do you think, good purchase, bad purchase? What are you looking to buy next?

ADD

- Recent Buy - Walgreens Boots Alliance Inc (wba)

Hi Everyone, Another building block to the American Dividend Dream has been bought. This time, a little bit smaller of a purchase than some of the previous ones but a purchase nonetheless. Personally, these buy posts make me hungrier than ever...

- Recent Buy - Exxon Mobil (xom)

Hi Everyone, The buys keep piling up this month. This is the last buy post I have right now so next post will be the dividend income for August post... just a tad bit behind. Personally, these buy posts make me hungrier than ever...

- Recent Buy - Apple (aapl)

Hi Everyone, The buys keep piling up this month. For all you readers out there waiting for the dividend income post, I've got bad news... you are going to have to wait a bit longer. I have another buy post coming after this one...

- Recent Buy - Parker-hannifin Corp.

Hi Everyone, I fell behind a little bit with getting this post out, but its been a busy couple weeks. This purchase actually occurred on June 6th. It looks as if I'll make another purchase here pretty quickly because of the RAI/LO merger....

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...