Money and Finance

Hi Everyone,

Hi Everyone,

- Archer Daniels Midland Co. Is Approaching Buy Territory

Oftentimes it's the behind-the-scenes companies that make investors rich. The companies that the average person might have never heard of, but use some form of their products every day. Archer Daniels Midland Company (NYSE:ADM) is one such company...

- Recent Buy

Earlier this morning I made 2 purchases. I bought 35 shares of Archer Daniels Midland (ADM) for $25.73 per share. My YOC for this position is 2.70% based on the current $0.70 annual payout. I also purchased 35 shares of Walgreens (WAG) $35.85 per share....

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...

- Recent Buy - Dover Corp (dov)

Hi Everyone, February is half way over and I put quite a good bit of money to work in the past week. The only way to get closer to the American Dividend Dream is to keep buying high quality companies and letting the portfolio compound for years...

- Recent Buy - Travelers Companies Inc (trv)

Hi Everyone, January continues to be a busy month in terms of buying companies for the American Dividend Dream portfolio. With the market staying around all time highs I continue to look for companies that are attractively valued. With that...

Money and Finance

Recent Buy - Archer Daniels Midland Company (ADM)

Another purchase is in the books! Like I said in the last post, I put a good chunk of change to work in the past week. The only way to get closer to the American Dividend Dream is to keep buying high quality companies and letting the portfolio compound for years to come. With the market staying around all time highs I continue to look for companies that are attractively valued. It gets harder and harder every day as the market keeps going up but I think I found a few good ones. My next purchase was Archer Daniels Midland Company (ADM) so without further adieu...

I purchased 43 shares of Archer Daniels Midland Company (ADM) at $47.50. This purchase adds $48.16 of annual dividends to my account.

I now own 43 shares of Archer Daniels as this was a new purchase which means I have 32 individual companies that I am invested in. The number continues to grow! I may add to this position in the future, or I might just let the position compound for years to come, either way I'm happy. Forward dividends now stand at around $3,662 for the next 12 months and but I just happened to miss Archer before the ex-dividend date so I will miss one of their payouts for the year. The portfolio will be updated to reflect this purchase.

From Google Finance: Archer-Daniels-Midland-Company is engaged in the processing of oilseeds, corn, wheat, cocoa, and other agricultural commodities. The Company’s operations are classified into three business segments: Oilseeds Processing, which includes activities related to the origination, merchandising, crushing, and further processing of oilseeds, such as soybeans and soft seeds (cottonseed, sunflower seed, canola, rapeseed, and flaxseed) into vegetable oils and protein meals; Corn Processing, which is engaged in corn wet milling and dry milling activities, primarily located in the United States, and Agricultural Services, which utilizes its United States grain elevator and global transportation network to buy, store, clean, and transport agricultural commodities, such as oilseeds, corn, wheat, milo, oats, rice, and barley, and resells these commodities primarily as food and feed ingredients and as raw materials for the agricultural processing industry.

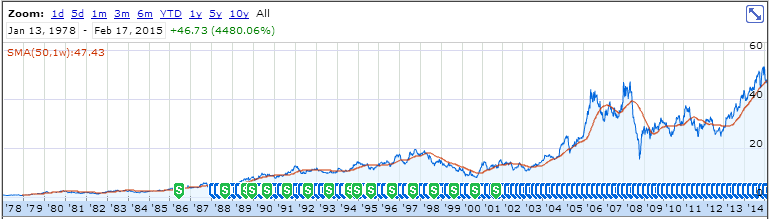

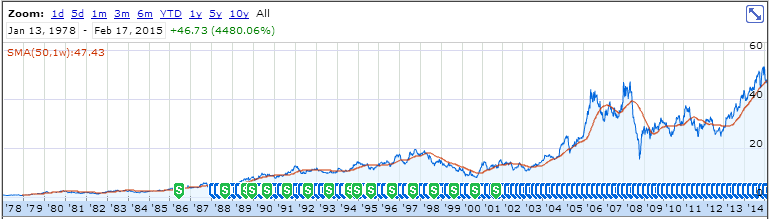

ADM Chart:

Statistics:

P/E: 14

Yield: 2.30%

Market Cap: 30.5B

Dividend Growth Rate (5yr): 12%

Payout Ratio: 33%

Years of Dividend Growth: 39 years

Main reason for the purchase... More people in the world and those people need to eat! The stock has pulled back roughly 10% from highs most likely due to the fact that oil has pulled back. One of ADM's business segments is to provide corn for ethanol to be put into gasoline. With the recent pullback in oil, their earnings are not set to grow as much as predicted and therefore the market is pricing the shares a bit cheaper. I just missed the dividend payout but no worries, the company is planning to pay out 30-40% of its earnings, up from the historical payout ratio of 20-25%. Therefore, the dividend should grow quite well in the next few years as evidenced by the 26% increase in 2013 and the 16.6% increase in the dividend this year. The payout is only 33% so there is room to grow at a faster clip than the increase in earnings to get closer to the 40% target payout. Finally, they are planning to repurchase $1.5-2B worth of stock in 2015. I love companies that buyback shares, especially when it appears their company is at fair value or even slightly undervalued. Lets just hope that ADM meanders around this price for the next year or two so the buyback is more effective and the dividends can get reinvested at cheaper prices!

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

You can check out all the other purchases I have made for the year on my Stock Purchases and Sells page.

So there you have it, the next building block on the path to the American Dividend Dream! What do you think, good purchase, bad purchase? What are you looking to buy next?

- Archer Daniels Midland Co. Is Approaching Buy Territory

Oftentimes it's the behind-the-scenes companies that make investors rich. The companies that the average person might have never heard of, but use some form of their products every day. Archer Daniels Midland Company (NYSE:ADM) is one such company...

- Recent Buy

Earlier this morning I made 2 purchases. I bought 35 shares of Archer Daniels Midland (ADM) for $25.73 per share. My YOC for this position is 2.70% based on the current $0.70 annual payout. I also purchased 35 shares of Walgreens (WAG) $35.85 per share....

- Recent Buy - W. P. Carey Inc. (wpc)

Hi Everyone, Well, the year has slowed down a bit with regards to buys, but the savings account has been built back up after I used them all up to pay off the student loans so hopefully I can get back to putting more money to work. With this...

- Recent Buy - Dover Corp (dov)

Hi Everyone, February is half way over and I put quite a good bit of money to work in the past week. The only way to get closer to the American Dividend Dream is to keep buying high quality companies and letting the portfolio compound for years...

- Recent Buy - Travelers Companies Inc (trv)

Hi Everyone, January continues to be a busy month in terms of buying companies for the American Dividend Dream portfolio. With the market staying around all time highs I continue to look for companies that are attractively valued. With that...