Money and Finance

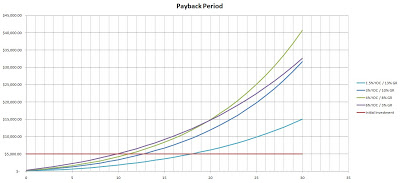

Another good thing to look at is the payback period which is how long it will take for the total dividends you've received to surpass the original investment amount. For the purposes of this exercise I've assumed a $5,000 initial investment. The stock will grow at 5% per annum. The dividends will grow at the following rates for 10 years and then 5% per year in perpetuity.

*The 6% YOC will grow at 3% for the whole period.

The quickest to payback the initial investment is the 6% YOC with the 3% growth rate right at year 10. The slowest which I expected was the 1.5% YOC with the 13% growth rate. I expected it to take longer to payback but not year 18. I was kind of surprised at how long it would for the 4% YOC to surpass the 6% in total dividends received. It won't pass it until year 20 which shocked me. But after that point the 4% YOC takes off and ends up paying over $8,000 extra in dividends for the 30 year period.

From looking at the above chart it seems like the best thing is the 3% or 4% if you have a long time horizon. It will maximize the income later if you have the time to continuously reinvest dividends for 30 years plus your payback period is only slightly longer than the 6% YOC with 3% growth.

- Why Dividends Matter: The Calm In The Storm

Dividends. I love them. One of the reasons that dividends are so awesome is that they provide a positive portion of return that can't be taken away. If you receive a $50 dividend in cash that's a positive return. Forever. The company...

- Dividend Update - May 2012

May was a so-so month but better than April with its 3 payouts. I had a total of 5 payouts across my accounts. My dividend payments will start to increase here over the rest of the year with lots of fresh capital being deployed to dividend growth stocks...

- Dividend Update - February 2012 *revised

*Well, I didn't check my brokerage account until today and just noticed that some of the dividends that are usually paid out in March were pushed foward to leap day on February 29th. So I've revised my February dividend update. February ended...

- Dividend Update - February 2012

February was a better month than January but still nothing great. Unfortunately since I'm really gungho about paying off debt I haven't been able to add to my brokerage account to increase my dividend income. That on top of work being slow meaning...

- Targeting A 10% Yoc

I like to try and target a 10% YOC in 10 years based on the previous 10-year annual dividend growth rate. For reference I've created some tables to show the required current dividends based off different dividend growth rates. I've cut the dividend...

Money and Finance

Payback Period

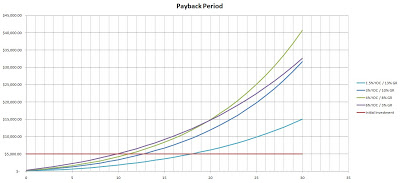

Another good thing to look at is the payback period which is how long it will take for the total dividends you've received to surpass the original investment amount. For the purposes of this exercise I've assumed a $5,000 initial investment. The stock will grow at 5% per annum. The dividends will grow at the following rates for 10 years and then 5% per year in perpetuity.

| Original YOC | Annual Dividend Growth Rate |

|---|---|

| 1.5% | 13% |

| 3% | 10% |

| 4% | 8% |

| 6% | 3% |

*The 6% YOC will grow at 3% for the whole period.

The quickest to payback the initial investment is the 6% YOC with the 3% growth rate right at year 10. The slowest which I expected was the 1.5% YOC with the 13% growth rate. I expected it to take longer to payback but not year 18. I was kind of surprised at how long it would for the 4% YOC to surpass the 6% in total dividends received. It won't pass it until year 20 which shocked me. But after that point the 4% YOC takes off and ends up paying over $8,000 extra in dividends for the 30 year period.

From looking at the above chart it seems like the best thing is the 3% or 4% if you have a long time horizon. It will maximize the income later if you have the time to continuously reinvest dividends for 30 years plus your payback period is only slightly longer than the 6% YOC with 3% growth.

- Why Dividends Matter: The Calm In The Storm

Dividends. I love them. One of the reasons that dividends are so awesome is that they provide a positive portion of return that can't be taken away. If you receive a $50 dividend in cash that's a positive return. Forever. The company...

- Dividend Update - May 2012

May was a so-so month but better than April with its 3 payouts. I had a total of 5 payouts across my accounts. My dividend payments will start to increase here over the rest of the year with lots of fresh capital being deployed to dividend growth stocks...

- Dividend Update - February 2012 *revised

*Well, I didn't check my brokerage account until today and just noticed that some of the dividends that are usually paid out in March were pushed foward to leap day on February 29th. So I've revised my February dividend update. February ended...

- Dividend Update - February 2012

February was a better month than January but still nothing great. Unfortunately since I'm really gungho about paying off debt I haven't been able to add to my brokerage account to increase my dividend income. That on top of work being slow meaning...

- Targeting A 10% Yoc

I like to try and target a 10% YOC in 10 years based on the previous 10-year annual dividend growth rate. For reference I've created some tables to show the required current dividends based off different dividend growth rates. I've cut the dividend...