Money and Finance

- John Mauldin: Somewhere Over The Rainbow

We are 13 years into a secular bear market in the United States. The Nasdaq is still down 40% from its high, and the Dow and S&P 500 are essentially flat. European and Japanese equities have generally fared worse. The average secular bear market in...

- John Mauldin: Into The Matrix

What does the current environment of earnings and valuations tell us about the prospects for the US stock markets in general over the next 3-5-7-10 years? This week we have part two of "Bull's Eye Investing Ten Years Later," which we started last...

- John Mauldin's Outside The Box: Converging On The Horizon - By Ed Easterling

The end is near! Stock market history and earnings cycle history are converging. As a result, the market is likely to be down for the year 2011 or 2012. If not, then it will have been different this time. Crestmont’s research focuses primarily on long-term...

- John Mauldin's Outside The Box: Game Changer - By Ed Easterling

Investors are confronting the reality of the current secular bear market. It is both the consequence of the previous secular bull market and the precursor to the next secular bull. The duration of the current secular bear period is uncertain. Should inflation...

- John Mauldin: The Dark Side Of Deficits

Secular Bull and Bear Markets Market analysts (of which I am a minor variety) talk all the time about secular bull and bear cycles. I argued in this column in 2002 (and later in Bull's Eye Investing) that most market analysts use the wrong metric...

Money and Finance

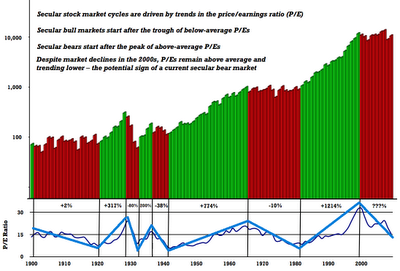

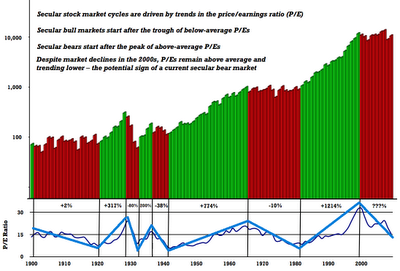

P/E Expansion & Contraction - Secular Stock Market Cycles

Good post from Barry Ritholtz.

Yesterday, Peter Boockvar referenced two WSJ articles on P/E: The Decline of the P/E Ratio and Is It Time to Scrap the Fusty Old P/E Ratio?

I believe these articles are asking the wrong question. Rather than wondering if the value of P/E ratio is fading, the better question is, “What does a falling P/E ratio mean?” The chart below will help answer that question.

We can define Bull and Bear markets over the past 100 years in terms of P/E expansion and contraction. I always show the chart below when I give speeches (from Crestmont Research, my annotations in blue) to emphasize the impact of crowd psychology on valuations.

………………..

Related book: Unexpected Returns: Understanding Secular Stock Market Cycles

- John Mauldin: Somewhere Over The Rainbow

We are 13 years into a secular bear market in the United States. The Nasdaq is still down 40% from its high, and the Dow and S&P 500 are essentially flat. European and Japanese equities have generally fared worse. The average secular bear market in...

- John Mauldin: Into The Matrix

What does the current environment of earnings and valuations tell us about the prospects for the US stock markets in general over the next 3-5-7-10 years? This week we have part two of "Bull's Eye Investing Ten Years Later," which we started last...

- John Mauldin's Outside The Box: Converging On The Horizon - By Ed Easterling

The end is near! Stock market history and earnings cycle history are converging. As a result, the market is likely to be down for the year 2011 or 2012. If not, then it will have been different this time. Crestmont’s research focuses primarily on long-term...

- John Mauldin's Outside The Box: Game Changer - By Ed Easterling

Investors are confronting the reality of the current secular bear market. It is both the consequence of the previous secular bull market and the precursor to the next secular bull. The duration of the current secular bear period is uncertain. Should inflation...

- John Mauldin: The Dark Side Of Deficits

Secular Bull and Bear Markets Market analysts (of which I am a minor variety) talk all the time about secular bull and bear cycles. I argued in this column in 2002 (and later in Bull's Eye Investing) that most market analysts use the wrong metric...