Money and Finance

- John Mauldin: Uncertainty And Risk In The Suicide Pool

For the past 80 years, we have created ever more sophisticated models of risk in the economic and investment worlds. With each new tool we create to measure risk, we seem to think we have somehow gained more control over our future. Paradoxically, we...

- Howard Marks Quote (risk And High Prices)

“The greatest risk doesn’t come from low quality or high volatility. It comes from paying prices that are too high. This isn’t a theoretical risk; it’s very real.” –Howard Marks, The Most Important Thing Illuminated ...

- A Value Investor's Perspective On Tail Risk Protection: An Ode To The Joy Of Cash - By James Montier

In this white paper, James Montier, a member of GMO's Asset Allocation team, examines tail risk protection and how many of the principles of disciplined value investing can be helpful in first identifying tail risk and then choosing the best insurance...

- The Absolute Return Letter - April 2011: Confessions Of An Investor

I have been thinking a great deal about risk over the past couple of years. The depth of the financial crisis took many of us by surprise. I made mistakes. I am sure you made mistakes. In fact, the whole industry made mistakes, from which we should all...

- Digging For Value In The Real Estate Rubble By Zeke Ashton

It has been a long time since we’ve had extreme fear in the U.S. equity markets, an observation supported by the historically low volatility in recent years and the low prices one could pay for disaster protection in various forms (U.S. equity index...

Money and Finance

Miguel Barbosa Interviews James Montier

My friend Miguel with another great interview, this time with James Montier:

Part 1

Part 2

....................

I really liked this particular Q&A exchange between Miguel and James. Volatility = Opportunity , it does not equal risk.

Miguel: Interestingly you connect the dangers of irrelevant information to modern risk management. I’m referring to your comments on Value at Risk – “VAR is fundamentally flawed after all it cuts off the very it of the distribution that we are interested in: the tails! This is akin to buying a car with an airbag that is guaranteed to work unless you have a crash…” Can you tell us more?

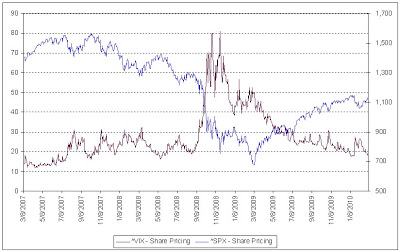

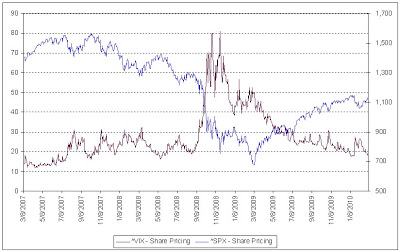

James Montier: Sure. Modern risk management is a farce; it is pseudoscience of the worst kind. The idea that the risk of an investment, or indeed, a portfolio of investments can be reduced to a single number is utter madness. In essence, the problem with risk management is that is assumes that volatility equals risk. Nothing could be further from the truth. Volatility creates opportunity. For instance, was the stock market more risky in 2007 or 2009? According to views of risk managers, 2007 was the less risky year, it had low volatility, which they happily fed into their risk models and concluded (falsely) that the world was a safe place to take risk. In contrast, these very same risk managers were staying that the world was exceptionally risky in 2009, and that one should be cutting back on risk. This is, of course, the complete opposite to what one should have been doing. In 2007, the evidence of a housing/credit bubble was plain to see, this suggested risk, valuations were high, it was time to scale back exposure. In 2009, bargains abounded, this was the perfect time to take ‘risk’ on, not to run away. Risk managers are the sorts of fellows that lend out umbrellas on fine days, and ask for them back when it starts to rain.

I made a chart (below) to emphasize the point made by Mr. Montier in his response Miguel’s question. It compares the VIX (volatility index) with the S&P 500 over the last 3 years. If low volatility = low risk, then the least risky time to invest would have been in the first half of 2007. With the benefit of hindsight, we can see that was actually the riskiest time to invest, as the market had just about reached its peak.

- John Mauldin: Uncertainty And Risk In The Suicide Pool

For the past 80 years, we have created ever more sophisticated models of risk in the economic and investment worlds. With each new tool we create to measure risk, we seem to think we have somehow gained more control over our future. Paradoxically, we...

- Howard Marks Quote (risk And High Prices)

“The greatest risk doesn’t come from low quality or high volatility. It comes from paying prices that are too high. This isn’t a theoretical risk; it’s very real.” –Howard Marks, The Most Important Thing Illuminated ...

- A Value Investor's Perspective On Tail Risk Protection: An Ode To The Joy Of Cash - By James Montier

In this white paper, James Montier, a member of GMO's Asset Allocation team, examines tail risk protection and how many of the principles of disciplined value investing can be helpful in first identifying tail risk and then choosing the best insurance...

- The Absolute Return Letter - April 2011: Confessions Of An Investor

I have been thinking a great deal about risk over the past couple of years. The depth of the financial crisis took many of us by surprise. I made mistakes. I am sure you made mistakes. In fact, the whole industry made mistakes, from which we should all...

- Digging For Value In The Real Estate Rubble By Zeke Ashton

It has been a long time since we’ve had extreme fear in the U.S. equity markets, an observation supported by the historically low volatility in recent years and the low prices one could pay for disaster protection in various forms (U.S. equity index...