Money and Finance

What makes a perfect investment? First off, the business should be in an excellent sector, and ideally it should control a niche in that sector.

What makes a perfect investment? First off, the business should be in an excellent sector, and ideally it should control a niche in that sector.

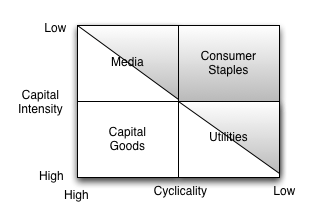

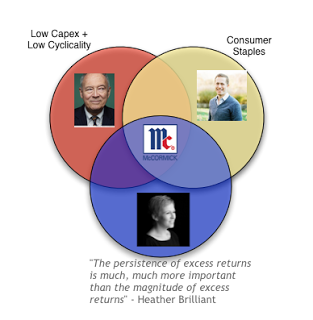

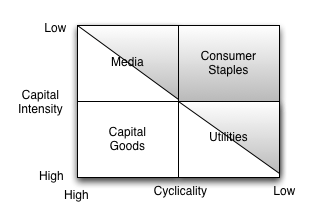

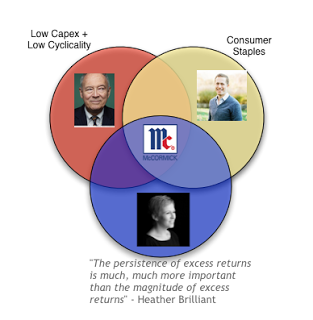

For sectors, I like how Don Yacktman looks for low cyclicality and low capex.

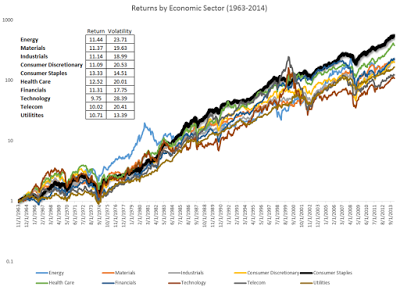

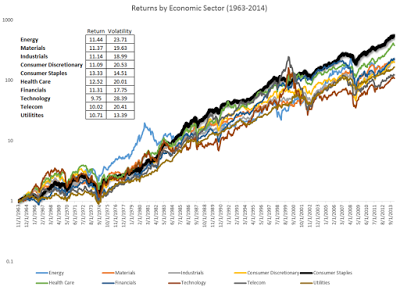

Getting more specific, let's check historical data - Consumer staples beats pretty much all sectors hands down. Which proves out Yacktman's most favored quadrant

Next drilling down from the sector and niche should have the ability to deliver excess returns over a very long period of time to let compounding do its work. Consumer staples is filled with lots of interesting companies and niches. But how many will continue to generate excellent returns decade over decade? The companies that sell products from older generations like Wal-Mart Coke, General Mills, and Pepsi are finding some headwinds with new generations of consumers. The consumer companies that are more on point with current norms like Whole Foods or Monster are pretty expensive. Of course, the old school brands will probably muddle through but its not always clear the profitability will be as robust as today, for example profit margins on Coke where Coke controls the brand versus profit margins on water where the barrier to entry is way lower.

But there are some areas where growth appears sustainable, for example spice. McCormick Spice is over 125 years old, and as the largest manufacturer, it dominates the spice niche. McCormick estimates the global spice market at $10B, McCormick has a 22% share of the market and is 4 times larger than the nearest competitor. If you add in the fact that McCormick produces many store brands, the combined set of brands is pretty much the whole spice aisle.

Better still, you see McCormick's brands everywhere, you see them in Walmart, regular grocery stores, and unlike most Coke/Pepsi/General Mills products you see their brands on the shelves of Whole Foods with brands like Thai Kitchen and organic lines. McCormick has pyramid of profit that lets it sell from low end to high end, not many companies can pull that off. McCormick has a B2B unit as well and customizes spices for larger companies like Frito-Lay.

Better still, you see McCormick's brands everywhere, you see them in Walmart, regular grocery stores, and unlike most Coke/Pepsi/General Mills products you see their brands on the shelves of Whole Foods with brands like Thai Kitchen and organic lines. McCormick has pyramid of profit that lets it sell from low end to high end, not many companies can pull that off. McCormick has a B2B unit as well and customizes spices for larger companies like Frito-Lay.

How about durability of consumer demand? Well, the first IPO was a spice trading company. Don't let the IPO scare you off, gentle investor, the IPO was the Dutch East India company on September 9, 1606. The history of spice goes back to the origins of the stock market.

So McCormick operates in a sector with demand measured in centuries, dominates its niche in the favorable consumer staples sector. Further, its got a safe balance sheet with a Debt/Equity ratio at 0.5. So why almost perfect not perfect? Well, by now you guessed it - price.

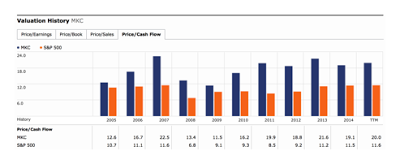

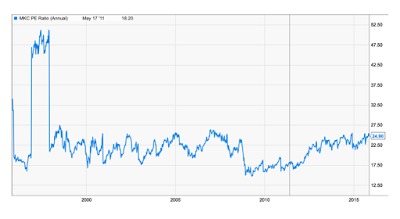

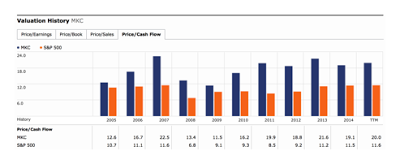

McCormick is a premium company and its priced accordingly (source- Morningstar). Its excellence is not subjective, but valuation is. its current P/E of 30 is too high for a low growth company, but at the same time even in 2008-09 McCormick still traded in the 16-17 range for P/E. There is downside protection in pepper, basil, and mayo.

What if we use sustainable growth rate as a measure to approximate future returns? The Sustainable growth rate for McCormick can be estimated using its current 56.1% Dividend Payout ratio, and a 5 year average ROE of 24.1% which yields a Sustainable Growth rate of 10.6%. That projection dovetails pretty nice with McCormick's actual 10 year average dividend growth rate which is 10%. Assuming, McCormick can continue to deliver that dividend growth even with an expensive entry point it can work out fine for investors over long time frames. If you invested in McCormick in Nov 1, 1995 and held through to now, you earned 12.4% annualized return, and $1,000 turned into over $10,000. Run it yourself on LongRunData.

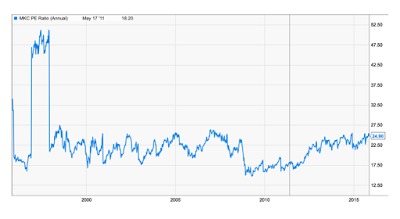

So that 1995 McCormick investor earned a tenbagger over 20 years. I would submit that investor did not take much risk at the time, no dotcom, no tech, just time. But here is an interesting side note, what do you suppose the 1995 investor paid? As we have discussed, McCormick is a stock that is never really cheap, and in 1995 the P/E was 33 which is 10% higher than today (source YCharts).

So while its difficult for a cheapskate like myself to work up much enthusiasm over a current P/E of 30, and a low current yield at 1.9%, the reality is that in the past McCormick has been able to deliver stellar long run returns even with high multiple. If long run consumer trends on spice and flavor seem durable, and if the Sustainable Growth Rate is close to what the company can deliver, then a low double digit return seems reasonably likely if you take the long view.

Personally, I would still hold out for a discount from today's price, but what is interesting to me in this analysis is that my gut reaction to a 30 P/E is to say well I guess I need to wait for a big 40% pullback or something. The history shows that instead a pretty small reduction could still potentially offer long run excellent returns. Note, this is not buy, sell or any other kind of guidance just a thought experiment on valuation and the impact of quality over the long run.

"Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result." – Charlie Munger

- 6 Months Later, Still Not The Time For Mccormick

Consumer staples companies typically make for excellent dividend growth candidates. In general, they have rather inelastic demand that doesn't see operations fluctuate with the health of the economy, at least not to the degree that other sectors...

- General Mills: Buy The Products Not The Stock

Consumer staples companies make for excellent dividend growth investments due to their steady nature. I mean we're all going to continue to eat even if the economy isn't exactly firing on all cylinders. That's why you see some pretty hefty...

- You Can't Clean Up A Messy Valuation: The Clorox Company Dividend Stock Analysis

Consumer staple companies make for excellent defensive investments and dividend growth candidates due to the rather inelastic demand for their products. For those companies that have established brands and market share they can typically pass along input...

- To Sleep Well At Night Buy Businesses Not Sardines

The wild gyrations in markets brought to mind a mindless species - sardines. Specifically, the story that Seth Klarman shared: “There is an old story about the market craze in sardine trading when the sardines disappeared from their traditional waters...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

Money and Finance

McCormick Spice - Almost Perfect

For sectors, I like how Don Yacktman looks for low cyclicality and low capex.

Getting more specific, let's check historical data - Consumer staples beats pretty much all sectors hands down. Which proves out Yacktman's most favored quadrant

Next drilling down from the sector and niche should have the ability to deliver excess returns over a very long period of time to let compounding do its work. Consumer staples is filled with lots of interesting companies and niches. But how many will continue to generate excellent returns decade over decade? The companies that sell products from older generations like Wal-Mart Coke, General Mills, and Pepsi are finding some headwinds with new generations of consumers. The consumer companies that are more on point with current norms like Whole Foods or Monster are pretty expensive. Of course, the old school brands will probably muddle through but its not always clear the profitability will be as robust as today, for example profit margins on Coke where Coke controls the brand versus profit margins on water where the barrier to entry is way lower.

But there are some areas where growth appears sustainable, for example spice. McCormick Spice is over 125 years old, and as the largest manufacturer, it dominates the spice niche. McCormick estimates the global spice market at $10B, McCormick has a 22% share of the market and is 4 times larger than the nearest competitor. If you add in the fact that McCormick produces many store brands, the combined set of brands is pretty much the whole spice aisle.

How about durability of consumer demand? Well, the first IPO was a spice trading company. Don't let the IPO scare you off, gentle investor, the IPO was the Dutch East India company on September 9, 1606. The history of spice goes back to the origins of the stock market.

McCormick is a premium company and its priced accordingly (source- Morningstar). Its excellence is not subjective, but valuation is. its current P/E of 30 is too high for a low growth company, but at the same time even in 2008-09 McCormick still traded in the 16-17 range for P/E. There is downside protection in pepper, basil, and mayo.

What if we use sustainable growth rate as a measure to approximate future returns? The Sustainable growth rate for McCormick can be estimated using its current 56.1% Dividend Payout ratio, and a 5 year average ROE of 24.1% which yields a Sustainable Growth rate of 10.6%. That projection dovetails pretty nice with McCormick's actual 10 year average dividend growth rate which is 10%. Assuming, McCormick can continue to deliver that dividend growth even with an expensive entry point it can work out fine for investors over long time frames. If you invested in McCormick in Nov 1, 1995 and held through to now, you earned 12.4% annualized return, and $1,000 turned into over $10,000. Run it yourself on LongRunData.

So that 1995 McCormick investor earned a tenbagger over 20 years. I would submit that investor did not take much risk at the time, no dotcom, no tech, just time. But here is an interesting side note, what do you suppose the 1995 investor paid? As we have discussed, McCormick is a stock that is never really cheap, and in 1995 the P/E was 33 which is 10% higher than today (source YCharts).

So while its difficult for a cheapskate like myself to work up much enthusiasm over a current P/E of 30, and a low current yield at 1.9%, the reality is that in the past McCormick has been able to deliver stellar long run returns even with high multiple. If long run consumer trends on spice and flavor seem durable, and if the Sustainable Growth Rate is close to what the company can deliver, then a low double digit return seems reasonably likely if you take the long view.

Personally, I would still hold out for a discount from today's price, but what is interesting to me in this analysis is that my gut reaction to a 30 P/E is to say well I guess I need to wait for a big 40% pullback or something. The history shows that instead a pretty small reduction could still potentially offer long run excellent returns. Note, this is not buy, sell or any other kind of guidance just a thought experiment on valuation and the impact of quality over the long run.

"Over the long term, it’s hard for a stock to earn a much better return that the business which underlies it earns. If the business earns six percent on capital over forty years and you hold it for that forty years, you’re not going to make much different than a six percent return – even if you originally buy it at a huge discount. Conversely, if a business earns eighteen percent on capital over twenty or thirty years, even if you pay an expensive looking price, you’ll end up with one hell of a result." – Charlie Munger

- 6 Months Later, Still Not The Time For Mccormick

Consumer staples companies typically make for excellent dividend growth candidates. In general, they have rather inelastic demand that doesn't see operations fluctuate with the health of the economy, at least not to the degree that other sectors...

- General Mills: Buy The Products Not The Stock

Consumer staples companies make for excellent dividend growth investments due to their steady nature. I mean we're all going to continue to eat even if the economy isn't exactly firing on all cylinders. That's why you see some pretty hefty...

- You Can't Clean Up A Messy Valuation: The Clorox Company Dividend Stock Analysis

Consumer staple companies make for excellent defensive investments and dividend growth candidates due to the rather inelastic demand for their products. For those companies that have established brands and market share they can typically pass along input...

- To Sleep Well At Night Buy Businesses Not Sardines

The wild gyrations in markets brought to mind a mindless species - sardines. Specifically, the story that Seth Klarman shared: “There is an old story about the market craze in sardine trading when the sardines disappeared from their traditional waters...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...