John Mauldin: Preparing for a Credit Crisis

This week we turn our eyes first to Europe and then the US, and ask about the possibility of a yet another credit crisis along the lines of late 2008. I then outline a few steps you might want to consider now rather than waiting until the middle of a crisis. It is possible we can avoid one but, as I admit, whether we do (and the extent of such a crisis) depends on the political leaders of the developed world (the US, Europe, and Japan) making the difficult choices and doing what is necessary. And in either case, there are some areas of investing you clearly want to avoid. Finally, I turn to that watering-hole favorite, the weather, and offer you a window into the coming seasons. Can we catch a break here? There is a lot to cover, so we will jump right in.

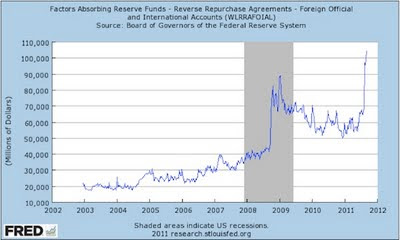

.....Look at the following graph from the St. Louis Fed. It is the amount of deposits at the US Fed from foreign official and international accounts, at rates that are next to nothing. It is higher now than in 2008. What do they know that you don’t?

First, think back to 2008. Were you liquid enough? Did you have enough cash? If not, then think about raising that cash now. When the crisis hits, you have to sell what you can for what you can get, not what you want for reasonable prices.

I am personally raising more cash in my business. I usually invest money as soon as I can. Now, I am still investing, and you too should still put money to work in places that you think have the potential to do well in a crisis. Go back and see what worked in 2008 and buy more of it! Long-only funds did not work. Those that were more nimble did.

In the next crisis, opportunities to buy assets on the cheap will grow, so having some cash will make it easier to buy things you want to own for the next 10-20 years, whether income-producing or just something you want for fun.

- John Mauldin: The Beginning Of The Endgame

About this time two years ago I began to seriously work with Jonathan Tepper on our book Endgame: The End of the Debt Supercycle and How It Changed Everything. It came out the following March. I remember vividly that in November of that year, as crisis...

- Hussman Weekly Market Comment: A Brief Primer On The European Crisis

With regard to the problems in Europe, investors have taken a great deal of hope from the promise of coordinated central bank "liquidity" operations in the event of deterioration. The problem here, in my view, is that whatever amount of liquidity central...

- John Mauldin: Unintended Consequences

Let me introduce Mauldin's Rule of Thumb Concerning Unintended Consequences: For every government law hurriedly passed in response to a current or recent crisis, there will be two or more unintended consequences, which will have equal or greater negative...

- John Mauldin: Time To Bring Out The Howitzers

It is now common to use the term bazooka when referring the actions of governments and central banks as they try to avert a credit crisis. And this week we saw a coordinated effort by central banks to use their bazookas to head off another 2008-style...

- First Eagle Funds Conference Call - May 6, 2008

Jean-Marie Eveillard: Now, let me move to an update to the current investment scene as we see it. I think investing is a matter of trying to balance what I would call circumstances and prices. In terms of circumstances, we have been, for a while, in a...