Money and Finance

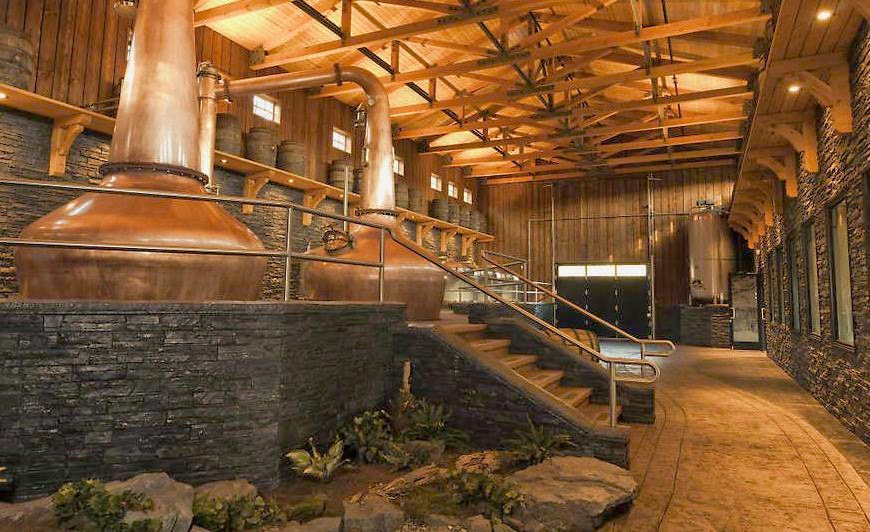

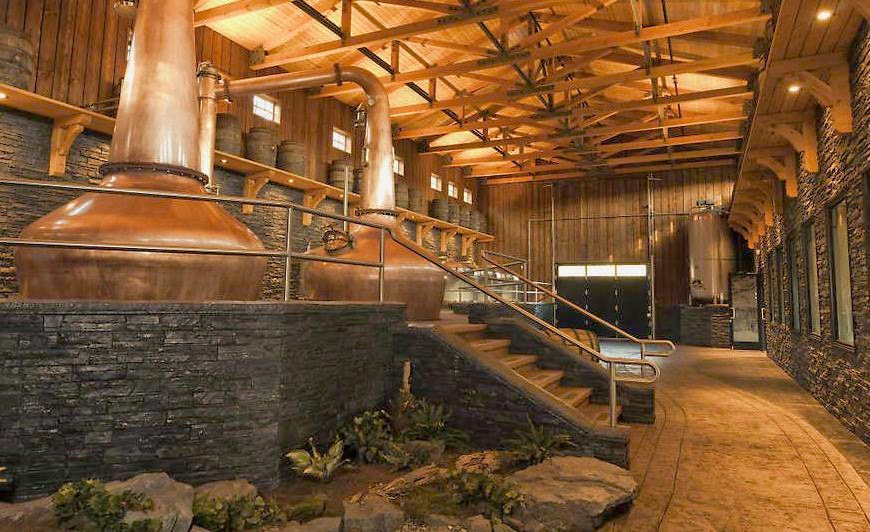

Screens are an essential tool. I think of them like the distillation process. Just like a master distiller working at Caol Ila takes in the fermented grains, and engineers the distillation process to screen out the water and leaves only the most highly prized flavors at the end of the run.

My favorite screens are simple screen with a specific purpose for each metric. Simplicity does not have to mean unbalanced. One of my favorite screens, which was not designed specifically more income investing but works well, is Jim Grant's Safer than a Ten Year Screen. Its described here under "There'll always be a J&J." In his 2010 article, Mr. Grant posits that not only will companies found in this screen perform better than cash, but they are as income producing, quality companies, safer than cash as well. Those insights were very valuable to me.

The Safer than a Ten Year screen filters are:

- Screen

Over the years, I've found it useful when James Montier (writing from wherever he was at the time) would run a value screen and show the number of names that came up. It gave another data point to compare the attractiveness of ideas in the market...

- How I Work: Bill Gates

Found via Simoleon Sense. NEW YORK (FORTUNE) - It's pretty incredible to look back 30 years to when Microsoft (Research) was starting and realize how work has been transformed. We're finally getting close to what I call the digital workstyle....

- A World Of Winners, Warren's Way

How does he do it? Author Robert Hagstrom tried to compile Buffett's key investing strategies in his 1994 best-seller, The Warren Buffett Way: Investment Strategies of the World's Greatest Investor. With Hagstrom's book as a source, we at...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...

Money and Finance

Jim Grant's Safer Than a Ten Year Screen

Screens are an essential tool. I think of them like the distillation process. Just like a master distiller working at Caol Ila takes in the fermented grains, and engineers the distillation process to screen out the water and leaves only the most highly prized flavors at the end of the run.

My favorite screens are simple screen with a specific purpose for each metric. Simplicity does not have to mean unbalanced. One of my favorite screens, which was not designed specifically more income investing but works well, is Jim Grant's Safer than a Ten Year Screen. Its described here under "There'll always be a J&J." In his 2010 article, Mr. Grant posits that not only will companies found in this screen perform better than cash, but they are as income producing, quality companies, safer than cash as well. Those insights were very valuable to me.

The Safer than a Ten Year screen filters are:

- MarketCap > $5B (Big companies only)

- ROE > 15% (high quality companies)

- Dividend yield > 2% (recurring income stream to you the investor)

- Debt to Assets Ratio < 35% (sane Balance Sheet)

- P/E < 15 (Cheap)

Like single malt, screens are subjective, but in my opinion, that's a pretty effective way to capture the essence of what a successful long term investment candidate should be. Some of the most important quality, safety, and value metrics are there.

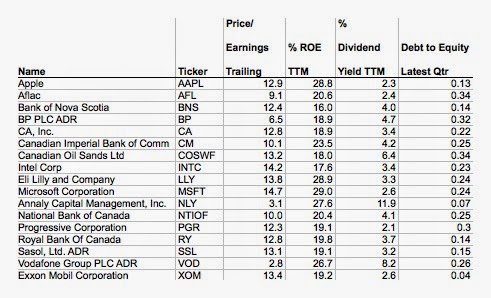

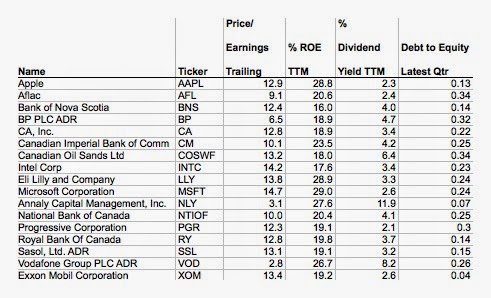

I ran Grant's screen on Morningstar that yields 17 companies. Note, that I used Debt/Equity ratio, because Morningstar's screener does not have Debt to Assets ratio. I think this still captures the spirit of safety that Mr. grant was after in his screen. One other modification is that I included some results from companies headquartered in non US countries, whereas the original published article excludes non US companies.

Any screen is a starting point, not an end. This list could be further refined. Annaly Capital's absurd yield is cause for major concern, so it can be removed. Looking outside the screen, payout ratio and coverage metrics can be used to further assess safety. Canadian Oil Sands payout ratio stands at 81% which could be cause for to leave that out. What you are left with then is 15 companies with some interesting characteristics.

Compared to most dividend investing screens which usually set a low bar at 3% yield, the list of companies includes some companies that are not regulars on most income investing screens. Apple and Progressive have relatively low current yields, but they both hold substantial interest as low leverage, high quality companies at cheap prices.

That's the value of screens in a nutshell, you go in expecting to find an Exxon (and do), but looking objectively also turns up some that you did not expect that are worth further investigation, distilling for dividends.

After all this talk about dividends and distilling, you might reasonably ask - where's Diageo? Its yield (2.5%) and ROE (38%) qualify it, however its P/E (18) and balance sheet (Debt/Equity 0.9) disqualify it. At least, they still have Caol Ila.

Here is a version of the screen on Google Finance.

- Screen

Over the years, I've found it useful when James Montier (writing from wherever he was at the time) would run a value screen and show the number of names that came up. It gave another data point to compare the attractiveness of ideas in the market...

- How I Work: Bill Gates

Found via Simoleon Sense. NEW YORK (FORTUNE) - It's pretty incredible to look back 30 years to when Microsoft (Research) was starting and realize how work has been transformed. We're finally getting close to what I call the digital workstyle....

- A World Of Winners, Warren's Way

How does he do it? Author Robert Hagstrom tried to compile Buffett's key investing strategies in his 1994 best-seller, The Warren Buffett Way: Investment Strategies of the World's Greatest Investor. With Hagstrom's book as a source, we at...

- Second & Third Picks In Wmd Portfolio - Glaxosmithkline & Ibm

The more real they are, the more fun blogs are to follow. So in that spirit, rather than talking about ideas in the abstract I maintain a hypothetical portfolio to track ideas where I'll semi-regularly (and hypothetically) invest and track buying...

- Todd Wenning On Finding Differentiated Dividend Ideas

One of the good things about dividend investing is also a challenge. Dividend investing forces you to screen out many stocks, because they do not pay a dividend at all. And really, for most dividend investors, you are going to want at least a 2 or 3%...