Money and Finance

I wrote up my notes for the Omaha trip to Berkshire annual meeting yesterday. The event is a lot of fun, and they ham it up pretty good. Warren and Charlie had a contest to see who could sell the most Heinz ketchup, complete with price war.

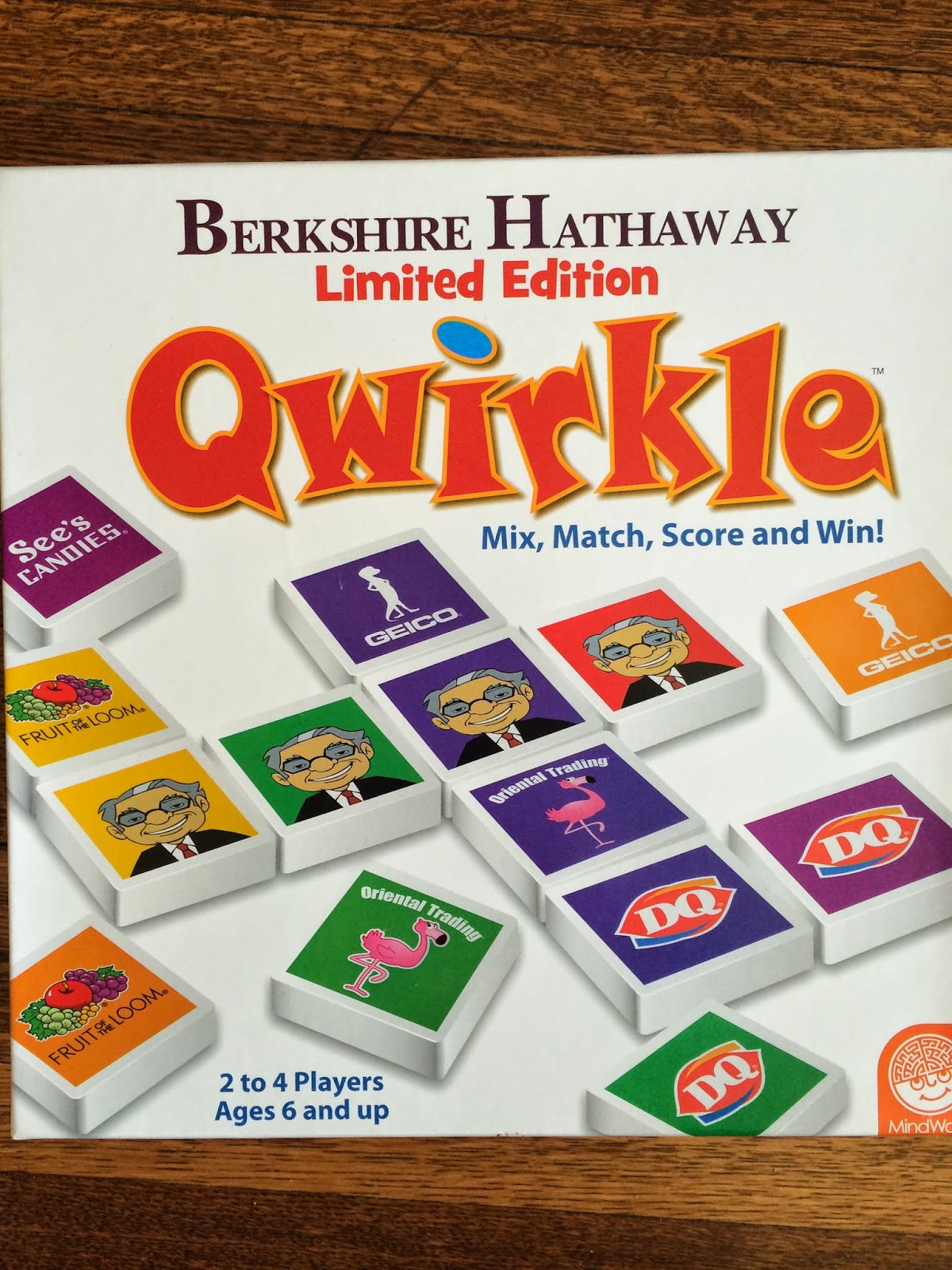

Along those lines a lot of the companies have Berkshire themed products. The game company, Mindware, had a Berkshire Hathaway themed version of Qwirkle with different companies like See's, GEICO and Dairy Queen represented.

Brooks running shoes got into the act last year, hosting the Invest in yourself 5k. This year there were two guys running dressed up like Warren and Charlie. The "Warren" guy ran with a 12 pack of Coke and handed cans out to cops who were working the event. This is probably the only 5k where the goodie bags they give the runners contain candy (See's lollipop). It was funny to see after the event these uber in shape people walking around after the finish sucking on a lollipop.

My friend Adrian Lane made the trip to Omaha again this year, he reminded me of one the factors that Munger listed as a key to Berkshire's success - "ignorance removal." That got me thinking, how manybillionaires people self administer the hair shirt, talk publicly all about their mistakes and what they learned from them in great detail? Not many that I can think of.

I think the light, fun side of Berkshire serves a purpose too. Both Warren and Charlie have great senses of humor, and they use it to their advantage in getting points across. The basic points they are making are very old fashioned, I mean Buffett basically considers Aesop the definitive investing text for crying out loud. If you just drilled through these old yarns then it would be a yawn for most, but the same message delivered with fun and humor its a totally different story.

A good example was Buffett's response to a question on Forest River RV, which Berkshire bought in 2005. The questioner wanted to know why Forest RIver outperformed its competition. Buffett said he had no idea.

- Warren Buffett On Cnbc

Links to videos: Berkshire Hathaway celebrates 50 years Who will succeed Warren Buffett? #Ask Warren: Charlie Munger No surprises at IBM: Buffett Deere's long term attraction: Buffett #Ask Warren: Glenn Close What's inside Berkshire Hathaway?...

- A Rising Star Emerges At Berkshire

When Tracy Britt arrived in Omaha, Neb., in 2009 to meet with Warren Buffett, she brought a Harvard M.B.A., a glittering resume and a boatload of ambition. But she also brought the famed investor a gift to highlight their shared Midwestern roots: a bushel...

- Berkshire's No. 2 Man Helps From The Background

Buffett's No. 2 man Charlie Munger plays his role at Berkshire mostly in private The two men who run Berkshire Hathaway Inc. have an arrangement: Warren Buffett is the face of the company and Charlie Munger stays mainly in the shadows. That works...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...

- Markets Are Made Up Of People

If you've followed up on Charlie Munger's book recommendations, then you'll know Robert Cialdini. Cialdini is most famous for "Influence", and he joins a cavalcade of authors at the big book signing every year in Omaha at the annual Berkshire...

Money and Finance

Investor Syntactic Sugar - The Lighter Side of Berkshire

I wrote up my notes for the Omaha trip to Berkshire annual meeting yesterday. The event is a lot of fun, and they ham it up pretty good. Warren and Charlie had a contest to see who could sell the most Heinz ketchup, complete with price war.

Along those lines a lot of the companies have Berkshire themed products. The game company, Mindware, had a Berkshire Hathaway themed version of Qwirkle with different companies like See's, GEICO and Dairy Queen represented.

Brooks running shoes got into the act last year, hosting the Invest in yourself 5k. This year there were two guys running dressed up like Warren and Charlie. The "Warren" guy ran with a 12 pack of Coke and handed cans out to cops who were working the event. This is probably the only 5k where the goodie bags they give the runners contain candy (See's lollipop). It was funny to see after the event these uber in shape people walking around after the finish sucking on a lollipop.

My friend Adrian Lane made the trip to Omaha again this year, he reminded me of one the factors that Munger listed as a key to Berkshire's success - "ignorance removal." That got me thinking, how many

I think the light, fun side of Berkshire serves a purpose too. Both Warren and Charlie have great senses of humor, and they use it to their advantage in getting points across. The basic points they are making are very old fashioned, I mean Buffett basically considers Aesop the definitive investing text for crying out loud. If you just drilled through these old yarns then it would be a yawn for most, but the same message delivered with fun and humor its a totally different story.

A good example was Buffett's response to a question on Forest River RV, which Berkshire bought in 2005. The questioner wanted to know why Forest RIver outperformed its competition. Buffett said he had no idea.

"Pete Liegl is not an MBA type at all. He's a terrific guy. I've never been to Forest River. It's based in Elkhart, Ind. I hope it's there! It's now a $4 billion business. I've probably had four or five phone calls with him the whole time. It's his company. I couldn't run an RV company. We don't have anybody at headquarters who could run one."

That answer to me encapsulates what is great about the weekend and about Warren and Charlie's style. Its one thing to espouse principles, you can talk about decentralization or buy smart or delegation or people matter in the abstract, but its way more fun and interesting to hear the context and learn from examples, and a little fun (at the expense of MBAs) is a nice bonus.

Some people dismiss all the hokey stuff and custom products as gimmicks. Of course they are. That's the whole point! When your basic message is - buy simple companies with great products/services, run by high caliber people at a good price, well it could not be much simpler. How do you get 38,000 people to fly in to Omaha to listen to that?

But there's a lot of value in the great crowd that assembles to hear the fundamentals. In computer programming there is a concept called syntactic sugar, the basic premise is to make complex things simpler, easier for humans to understand. Buffett and Munger are great teachers and they know how to use all the tools including humor, stories, examples, Ketchup sales contests, some See's and an overall fun event atmosphere to get their simple message across and to make it resonate with a wide cross section of people.

Some people dismiss all the hokey stuff and custom products as gimmicks. Of course they are. That's the whole point! When your basic message is - buy simple companies with great products/services, run by high caliber people at a good price, well it could not be much simpler. How do you get 38,000 people to fly in to Omaha to listen to that?

But there's a lot of value in the great crowd that assembles to hear the fundamentals. In computer programming there is a concept called syntactic sugar, the basic premise is to make complex things simpler, easier for humans to understand. Buffett and Munger are great teachers and they know how to use all the tools including humor, stories, examples, Ketchup sales contests, some See's and an overall fun event atmosphere to get their simple message across and to make it resonate with a wide cross section of people.

- Warren Buffett On Cnbc

Links to videos: Berkshire Hathaway celebrates 50 years Who will succeed Warren Buffett? #Ask Warren: Charlie Munger No surprises at IBM: Buffett Deere's long term attraction: Buffett #Ask Warren: Glenn Close What's inside Berkshire Hathaway?...

- A Rising Star Emerges At Berkshire

When Tracy Britt arrived in Omaha, Neb., in 2009 to meet with Warren Buffett, she brought a Harvard M.B.A., a glittering resume and a boatload of ambition. But she also brought the famed investor a gift to highlight their shared Midwestern roots: a bushel...

- Berkshire's No. 2 Man Helps From The Background

Buffett's No. 2 man Charlie Munger plays his role at Berkshire mostly in private The two men who run Berkshire Hathaway Inc. have an arrangement: Warren Buffett is the face of the company and Charlie Munger stays mainly in the shadows. That works...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...

- Markets Are Made Up Of People

If you've followed up on Charlie Munger's book recommendations, then you'll know Robert Cialdini. Cialdini is most famous for "Influence", and he joins a cavalcade of authors at the big book signing every year in Omaha at the annual Berkshire...