Money and Finance

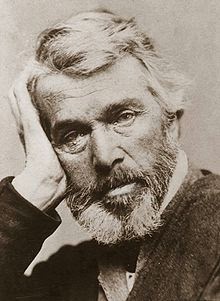

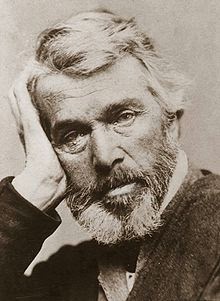

Today is Thomas Carlyle's birthday. Charlie Munger cites his philosophy and its influence on operations at Berkshire Hathaway.

Today is Thomas Carlyle's birthday. Charlie Munger cites his philosophy and its influence on operations at Berkshire Hathaway.

From Charlie Munger's comments the Wesco 2004 annual meeting

"And there has never been a master plan. Anyone who wanted to do it, we fired because it takes on a life of its own and doesn’t cover new reality. We want people taking into account new information.

It wasn’t just Berkshire Hathaway that had this attitude about master plans. The modern Johns Hopkins [hospital and medical school] was created by Sir William Osler. He built it following what Carlyle said: “Our main business is not to see what lies dimly in the distance but to do what lies clearly at hand.”

Look at the guy who took over the company that became IBM. At the time, it had three equal sized business: [a division that made] scales, like those a butcher uses; one that made time clocks (they bought this for a block of shares, making an obscure family very rich); and the Hollerith Machine Company, which became IBM. He didn’t know this would be the winner, but when it took off, he had the good sense to focus on it. It was enlightened opportunism, not some master plan.

I happen to think great cities develop the way IBM or Berkshire did. I think master plans do more harm than good. Anyway, we don’t allow them at Berkshire, so you don’t have to worry about them."

There are plenty of people who invest with the hope of finding the next big, disruptive thing. Or playing some big investment "theme." But there is more than one way to invest. The Carlyle/Munger approach.

As to themes, the top down mentality has its limits, it can work for certain people, but macro tends to be pretty unpredictable. Just in the last couple of years we have heard peak oil, the decline of the dollar, the decline of US economy, rise of the BRICs and numerous other plausible sounding grand theories offered by smart people, but none of these have really played out as predicted. I prefer a bottom up approach. It may not be as neat and orderly appearing as a top down approach where you allocate 10% to ten different industry sectors or countries or some such, but if each company in your portfolio has sustainable earnings power does it matter if there are 25% more consumer defensive stocks than energy? I do not think so.

The other dimension this brings to mind is a quote from Howard Marks "If we avoid the losers, the winners will take care of themselves." Notice the shift in mindset from how many investors work. Many investor look for the next Tesla, but that assumes you can predict a long list of things that will happen. It also assumes that you go in with a big enough purchase to make a real difference. If instead you assume that its not practical to guess the winner 10 years down the road and just focus on looking at dealing with the risks clearly at hand, you end up with a fundamentally different portfolio.

- David Winters: Annual Letter To Investors

Found via GuruFocus. I am a success today because I had a friend who believed in me and I didn’t have the heart to let him down. -Abraham Lincoln Perhaps no company is more closely associated with its CEO than Berkshire Hathaway. When people think of...

- Warren Buffett Quote On Filters

As I've previously mentioned (HERE) how important I think filters are in deliberate practice and achieving expertise in investing, this quote from Warren Buffett during yesterday's Berkshire Hathaway Annual Meeting really struck a chord with me:"Charlie...

- Warren Buffett Takes Charge

(Fortune Magazine) -- Warren Buffett is famous for his rules of investing: When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is usually the reputation of the business that remains intact. You...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...

- Markets Are Made Up Of People

If you've followed up on Charlie Munger's book recommendations, then you'll know Robert Cialdini. Cialdini is most famous for "Influence", and he joins a cavalcade of authors at the big book signing every year in Omaha at the annual Berkshire...

Money and Finance

Investing in what lies clearly at hand

From Charlie Munger's comments the Wesco 2004 annual meeting

"And there has never been a master plan. Anyone who wanted to do it, we fired because it takes on a life of its own and doesn’t cover new reality. We want people taking into account new information.

It wasn’t just Berkshire Hathaway that had this attitude about master plans. The modern Johns Hopkins [hospital and medical school] was created by Sir William Osler. He built it following what Carlyle said: “Our main business is not to see what lies dimly in the distance but to do what lies clearly at hand.”

Look at the guy who took over the company that became IBM. At the time, it had three equal sized business: [a division that made] scales, like those a butcher uses; one that made time clocks (they bought this for a block of shares, making an obscure family very rich); and the Hollerith Machine Company, which became IBM. He didn’t know this would be the winner, but when it took off, he had the good sense to focus on it. It was enlightened opportunism, not some master plan.

I happen to think great cities develop the way IBM or Berkshire did. I think master plans do more harm than good. Anyway, we don’t allow them at Berkshire, so you don’t have to worry about them."

There are plenty of people who invest with the hope of finding the next big, disruptive thing. Or playing some big investment "theme." But there is more than one way to invest. The Carlyle/Munger approach.

As to themes, the top down mentality has its limits, it can work for certain people, but macro tends to be pretty unpredictable. Just in the last couple of years we have heard peak oil, the decline of the dollar, the decline of US economy, rise of the BRICs and numerous other plausible sounding grand theories offered by smart people, but none of these have really played out as predicted. I prefer a bottom up approach. It may not be as neat and orderly appearing as a top down approach where you allocate 10% to ten different industry sectors or countries or some such, but if each company in your portfolio has sustainable earnings power does it matter if there are 25% more consumer defensive stocks than energy? I do not think so.

The other dimension this brings to mind is a quote from Howard Marks "If we avoid the losers, the winners will take care of themselves." Notice the shift in mindset from how many investors work. Many investor look for the next Tesla, but that assumes you can predict a long list of things that will happen. It also assumes that you go in with a big enough purchase to make a real difference. If instead you assume that its not practical to guess the winner 10 years down the road and just focus on looking at dealing with the risks clearly at hand, you end up with a fundamentally different portfolio.

- David Winters: Annual Letter To Investors

Found via GuruFocus. I am a success today because I had a friend who believed in me and I didn’t have the heart to let him down. -Abraham Lincoln Perhaps no company is more closely associated with its CEO than Berkshire Hathaway. When people think of...

- Warren Buffett Quote On Filters

As I've previously mentioned (HERE) how important I think filters are in deliberate practice and achieving expertise in investing, this quote from Warren Buffett during yesterday's Berkshire Hathaway Annual Meeting really struck a chord with me:"Charlie...

- Warren Buffett Takes Charge

(Fortune Magazine) -- Warren Buffett is famous for his rules of investing: When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is usually the reputation of the business that remains intact. You...

- Omaha Trip Report

The Berkshire Hathaway weekend is a lot of fun, its great to hang out with friends and talk and learn together. Every year there is something new. This year, I completed what I call the Omaha Triathlon part 1 - Berkshire Hathaway meeting, part 2- the...

- Markets Are Made Up Of People

If you've followed up on Charlie Munger's book recommendations, then you'll know Robert Cialdini. Cialdini is most famous for "Influence", and he joins a cavalcade of authors at the big book signing every year in Omaha at the annual Berkshire...