Hussman Weekly Market Comment: Preparing for a Greek Default

The yield on 1-year Greek government debt ended last week at 110%, down slightly from a mid-week peak of 130%. Even with the pullback, the Greek yield structure continues to imply default with certainty. All the markets are really quibbling about here is the recovery rate - what percentage of face value investors can expect to obtain post-default. That figure was still hovering near 50% as of Friday, but was a bit higher than we saw a few days earlier.

Despite a Greek 1-year yield that is already over 100%, it is still possible to kick the can down the road for another few months with another bailout, but the costs of that would now be extraordinarily high because of the low expected recovery rate. Much better to provide the funds to a post-default Greece, or to use them to recapitalize the banking system after losses that now appear inevitable.

…

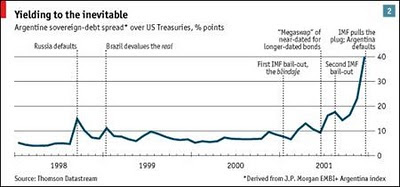

As a refresher on how all of this works, the following chart appeared years ago in the Economist, a chronicle of the frantic bail-outs in the months preceding the default of Argentine debt (which amounted to about $81 billion. Needless to say, the numbers involved in a potential Greek default are much larger, but the pattern we are seeing in Greece is identical to the signature of other historical sovereign defaults (see Uruguay, Russia and other countries as well ) - a sustained rise in yields, coupled with official statements about the "impossibility" of default, multiple bailout efforts that quickly fail, culminating in a vertical spike in yields (toward the inverse of the expected recovery rate, minus 1).

The case of Argentina is instructive because it was in a situation much like that of Greece. Argentina's currency was both pegged and officially convertible into the U.S. dollar, and most of Argentina's debt was denominated in U.S. dollars, creating a situation where its debt burden was in the form of a currency that it effectively could not print. The subsequent default was accompanied first by an abrupt devaluation of the peso to a new peg, and eventually to complete abandonment of the pegged exchange rate.

- Links

Back from vacation with some links... Memo to China: You Are Doomed to Fail - by Jason Zweig (LINK) Sanjay Bakshi: SEVEN INTELLIGENT FANATICS FROM INDIA (LINK) Wilbur Ross: Here's the real goal of Greek deal (LINK) Barry Ritholtz talks to Leon...

- John Mauldin: There Will Be Contagion

… (December 11, 2009) – Greece's prime minister, George Papandreou, told reporters in Brussels on Friday that European Central Bank President Jean-Claude Trichet and Luxembourg Prime Minister Jean-Claude Juncker see "no possibility" of a Greek...

- Greece Bank Creditor Group Says Talks ‘paused For Reflection’

Greece’s creditor banks broke off talks after failing to agree with the government about how much money investors will lose by swapping their bonds, increasing the risk of the euro-area’s first sovereign default. Proposals put forward by a committee...

- John Mauldin: Kicking The Can Down The Road One More Time

My friends at GaveKal point out that this is “… the sixth time in 18 months European leaders have announced a definitive solution to the Euro crisis. Should this version of the final bailout be taken any more seriously than the first and second solutions...

- Debt And Delusion - By Robert J. Shiller

Economists like to talk about thresholds that, if crossed, spell trouble. Usually there is an element of truth in what they say. But the public often overreacts to such talk. Consider, for example, the debt-to-GDP ratio, much in the news nowadays in Europe...