Money and Finance

A friend asked me this week, given that you hold stocks how worried are you about a crash or major correction? Charlie Munger was asked a similar question during 2009, and his answer came to mind - "zero."

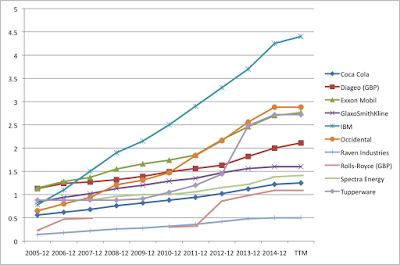

There is good evidence why that's the case. For investors who are heavy into cyclicals, biotechs, nanotech, tech tech, and all manner of flavor of the month (Michael Kors is hot, oh wait its not), there probably should be some concern. After all, there are plenty of risky stocks. Does that mean "the market" is risky? I do not think so, at least for some corners of the market where defense is prized over offense. So to the evidence, here is the ten year dividend returns for the WMD portfolio members.

Do I think the prices in the stock market are overdue to pull back by a double digit percentage? Sure. I thought it was overdue last year, too. But we just saw a massive pullback in 08-09, which was smack in the middle of the chart above. You know what? Its pretty hard to spot the impact looking at the dividend returns from wide moat companies.

The ability to pay dividends through a crisis like 08-09 is in itself a margin of safety, it shows the company's cash flows are stable, and the cash is useful to an investor who may be able to reinvest it at better prices. Its not to say that investors should be smug, the going in proposition with this type of investing is avoiding mistakes after all, its not swinging for the fences. Will the markets pull back? Sure, but like Buffett says - predicting rain doesn't count, building arks does. Wide moat dividend payers are as close to an ark that can weather 08-09 storm as an investor can reasonably expect to find. The quality companies not only manage through but come back even stronger, because they can reinvest through the crisis and take advantage of bargain prices.

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Dividends Give Management Discipline And You A Seat At The Table

A quote from Stephen Chazen the CEO of Wide Moat Dividend portfolio holding Occidental Petroleum underscores an important attribute for dividend investors. “I think dividends—if there is a religious activity here, I think that’s it. It provides...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Dividend Reinvesting Or Not?

I was thinking for a while to reinvest dividends automatically or not. I used to reinvest dividends automatically. Then I decided not to reinvest it automatically since I plan to sell stocks at some point and so I didn't want to have short term sale...

Money and Finance

How Worried Are You?

A friend asked me this week, given that you hold stocks how worried are you about a crash or major correction? Charlie Munger was asked a similar question during 2009, and his answer came to mind - "zero."

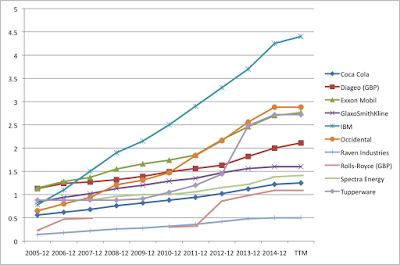

There is good evidence why that's the case. For investors who are heavy into cyclicals, biotechs, nanotech, tech tech, and all manner of flavor of the month (Michael Kors is hot, oh wait its not), there probably should be some concern. After all, there are plenty of risky stocks. Does that mean "the market" is risky? I do not think so, at least for some corners of the market where defense is prized over offense. So to the evidence, here is the ten year dividend returns for the WMD portfolio members.

Do I think the prices in the stock market are overdue to pull back by a double digit percentage? Sure. I thought it was overdue last year, too. But we just saw a massive pullback in 08-09, which was smack in the middle of the chart above. You know what? Its pretty hard to spot the impact looking at the dividend returns from wide moat companies.

The ability to pay dividends through a crisis like 08-09 is in itself a margin of safety, it shows the company's cash flows are stable, and the cash is useful to an investor who may be able to reinvest it at better prices. Its not to say that investors should be smug, the going in proposition with this type of investing is avoiding mistakes after all, its not swinging for the fences. Will the markets pull back? Sure, but like Buffett says - predicting rain doesn't count, building arks does. Wide moat dividend payers are as close to an ark that can weather 08-09 storm as an investor can reasonably expect to find. The quality companies not only manage through but come back even stronger, because they can reinvest through the crisis and take advantage of bargain prices.

- The Ten Points Of Income Investing

1. Income investing is a separate and distinct strategy It's not growth, it's not value -- income comes first. (See: The Income Investor's Manifesto) 2. Discipline and patience are behavioral prerequisites Great dividend-producing...

- Dividends Give Management Discipline And You A Seat At The Table

A quote from Stephen Chazen the CEO of Wide Moat Dividend portfolio holding Occidental Petroleum underscores an important attribute for dividend investors. “I think dividends—if there is a religious activity here, I think that’s it. It provides...

- Three Wise Men On Quality Income Investing

Charlie Munger is a guy who knows how to get to the point. I came to investing for dividends via value investing. It took me a long time to appreciate what the important differences are. Charlie Munger managed to sum it up in on paragraph: "If you buy...

- Wmd Portfolio

For tracking purposes, I am launching the WMD Portfolio - a journey in search of Wide Moat Dividends. This is an idea tracking portfolio, rather than just tracking ideas as tickers its more interesting to simulate the process to see weight and growth...

- Dividend Reinvesting Or Not?

I was thinking for a while to reinvest dividends automatically or not. I used to reinvest dividends automatically. Then I decided not to reinvest it automatically since I plan to sell stocks at some point and so I didn't want to have short term sale...