Money and Finance

As you might imagine, Barry got a few laughs and taunts from fans, competitors, and the media when he began shooting this way. He did look a little ridiculous, after all.

Barry got the last laugh, however, making 90% of his career free throws while the NBA average hovers around 75%. That may not sound like a huge difference, but over the course of a season and career, the difference adds up.

On the opposite end of the career free throw accuracy spectrum was Shaq, who made just 52% of his free throws over a 20 year career. At one point, Barry offered to teach Shaq how to shoot underhand, but Shaq flatly rejected the offer, saying: "I will shoot negative-30 percent before I shoot underhanded."

In other words, Shaq would've rather harmed his career and hurt his team -- and looked cool while doing it -- than look ridiculous and be a better teammate and player. He'd rather fail conventionally than succeed unconventionally.

This attitude is found in investing, too, as Howard Marks spells out in his most recent memo (a must read):

Now, you don't necessarily need to make off-the-wall investment choices just for the sake of making them, but in order to achieve superior returns you do need to get comfortable with looking stupid every so often. In my experience, there is an inverse relationship between the praise you receive from an investment decision and your returns from that investment. No guts, no glory.

Stay patient, stay focused.

Best,

Todd

Follow @ToddWenning

*H/t to Tadas at Abnormal Returns

- Howard Marks Memo: Inspiration From The World Of Sports

Link to Memo: Inspiration from the World of Sports I’m constantly intrigued by the parallels between investing and sports. They’re illuminating as well as fun, and thus they’ve prompted two past memos: “How the Game Should Be Played” (May 1995)...

- Howard Marks Memo: Dare To Be Great Ii

Link to: Howard Marks Memo: Dare to Be Great IIIn September 2006, I wrote a memo entitled Dare to Be Great, with suggestions on how institutional investors might approach the goal of achieving superior investment results. I’ve had some additional...

- The Right Way To Approach New Investment Ideas

With most situations in life it pays to go into them expecting the best outcome. No one would take a Hawaiian vacation if they thought it would rain every day during their stay, no one would buy a house if their first thought was all the repairs they'd...

- Keys To Writing About Investing

Substitute 'damn' every time you're inclined to write 'very;' your editor will delete it and the writing will be just as it should be. - Mark TwainWhether you're just starting out or are a seasoned vet, I can think of no better...

- Are You A Better Investor Than Fund Managers?

Earlier this week, I came across an interesting study by Andriy Bodnaruk of the University of Notre Dame and Andrei Simonov of Michigan State University, entitled "Do Financial Experts Make Better Investment Decisions?" The pair analyzed the personal...

Money and Finance

Get Comfortable With Looking Stupid as an Investor

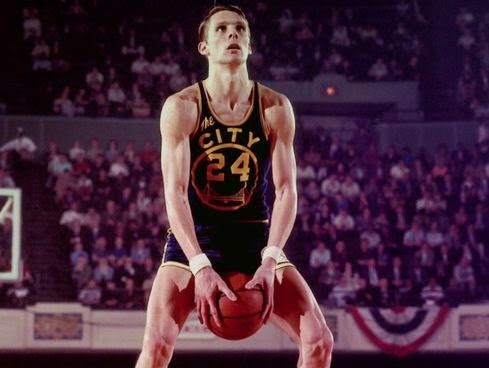

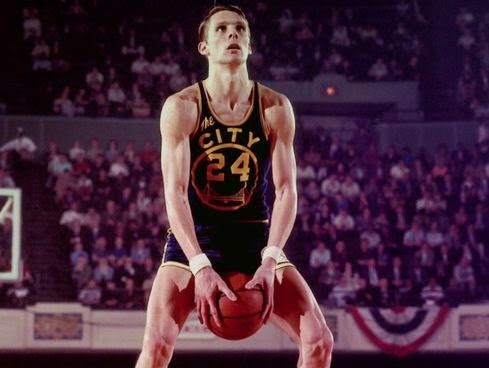

Worldly wisdom teaches that it is better for reputation to fail conventionally than to succeed unconventionally. - John Maynard KeynesA few weeks ago, I came across a video* about basketball legend Rick Barry who had a rather unorthodox way of shooting free throws. He shot them underhanded, or as we called them on the playground, "granny style."

As you might imagine, Barry got a few laughs and taunts from fans, competitors, and the media when he began shooting this way. He did look a little ridiculous, after all.

Barry got the last laugh, however, making 90% of his career free throws while the NBA average hovers around 75%. That may not sound like a huge difference, but over the course of a season and career, the difference adds up.

On the opposite end of the career free throw accuracy spectrum was Shaq, who made just 52% of his free throws over a 20 year career. At one point, Barry offered to teach Shaq how to shoot underhand, but Shaq flatly rejected the offer, saying: "I will shoot negative-30 percent before I shoot underhanded."

In other words, Shaq would've rather harmed his career and hurt his team -- and looked cool while doing it -- than look ridiculous and be a better teammate and player. He'd rather fail conventionally than succeed unconventionally.

This attitude is found in investing, too, as Howard Marks spells out in his most recent memo (a must read):

This is really the bottom line: not whether you dare to be different or to be wrong, but whether you dare to look wrong.Making a big call in public view or in front of a smaller group of esteemed peers isn't easy and it's often safer for your reputation to make a less consequential bet. As Marks notes, though, this is a recipe for average returns.

Now, you don't necessarily need to make off-the-wall investment choices just for the sake of making them, but in order to achieve superior returns you do need to get comfortable with looking stupid every so often. In my experience, there is an inverse relationship between the praise you receive from an investment decision and your returns from that investment. No guts, no glory.

Stay patient, stay focused.

Best,

Todd

Follow @ToddWenning

*H/t to Tadas at Abnormal Returns

- Howard Marks Memo: Inspiration From The World Of Sports

Link to Memo: Inspiration from the World of Sports I’m constantly intrigued by the parallels between investing and sports. They’re illuminating as well as fun, and thus they’ve prompted two past memos: “How the Game Should Be Played” (May 1995)...

- Howard Marks Memo: Dare To Be Great Ii

Link to: Howard Marks Memo: Dare to Be Great IIIn September 2006, I wrote a memo entitled Dare to Be Great, with suggestions on how institutional investors might approach the goal of achieving superior investment results. I’ve had some additional...

- The Right Way To Approach New Investment Ideas

With most situations in life it pays to go into them expecting the best outcome. No one would take a Hawaiian vacation if they thought it would rain every day during their stay, no one would buy a house if their first thought was all the repairs they'd...

- Keys To Writing About Investing

Substitute 'damn' every time you're inclined to write 'very;' your editor will delete it and the writing will be just as it should be. - Mark TwainWhether you're just starting out or are a seasoned vet, I can think of no better...

- Are You A Better Investor Than Fund Managers?

Earlier this week, I came across an interesting study by Andriy Bodnaruk of the University of Notre Dame and Andrei Simonov of Michigan State University, entitled "Do Financial Experts Make Better Investment Decisions?" The pair analyzed the personal...