Money and Finance

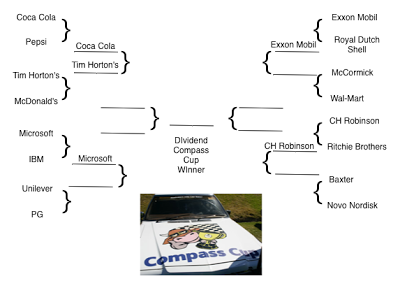

In Match 4, we had two smaller, lesser known companies meet up - CH Robinson (CHRW) defeated Ritchie Brothers Auctioneers (RBA).

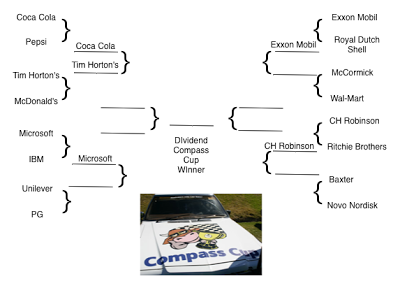

Match 5 is all about international icons - McDonald's (MCD) versus Tim Horton's (THI) two franchises with moats that stretch from one ocean to another.

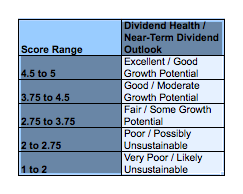

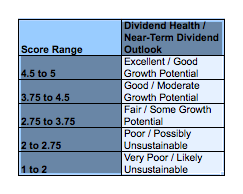

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

McDonald's has paid a dividend continuously since 1976. Tim Horton's started paying its dividend more recently in 2006.

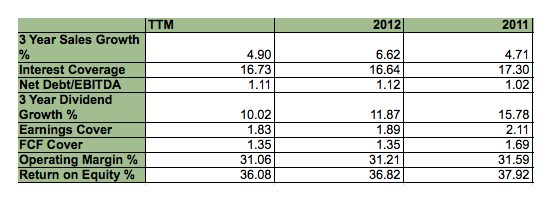

McDonald's main weakness is FCF cover it also shows some very mild slow down, likely from Europe. Other than that its a compelling set of metrics across the board

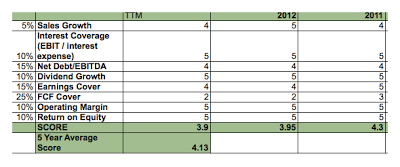

McDonald's Metrics:

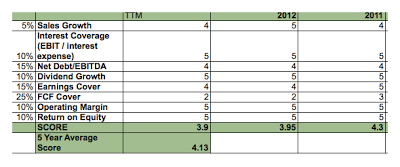

McDonald's puts up a strong 5 year average score but some slow down is evident in 2012 and TTM scores. Note that most companies would be very happy with McDonald's "bad" scores. One problem for McDonald's is their weakest area - FCF Cover - is the one that's most important to income investors in general and the Dividend Compass specifically.

McDonald's score:

Next up, from the great white north, featuring breakfast, lunch, dinner, coffee and Timbits - Tim Horton's.

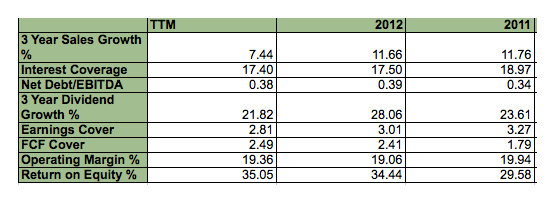

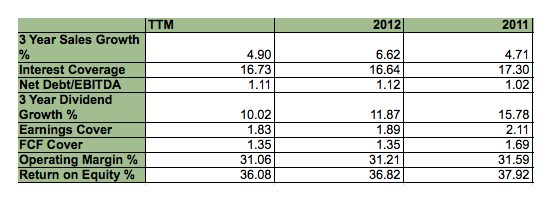

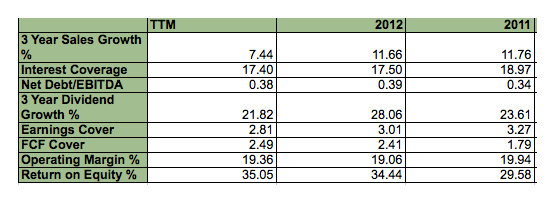

Hang on to your hats, these metrics are hotter than a large cup of coffee. Very low debt, high ROE, and lots of FCF/Earnings cover.

Tim Horton's metrics:

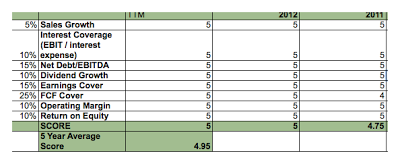

That is all good for a near perfect 4.95 five year average score from the Dividend Compass

Tim Horton's score:

Tim Horton may have been only an average pro hockey player, but Tim Horton's Dividend Compass score is in the upper echelon. What is not to like? Just this - Tim Horton's pays only a 1.8% dividend yield versus McDonald's stout 3.4% yield. The lower yield is offset partially by excellent (though relatively recent) dividend growth. Even if Tim Horton's paid a higher dividend, its coverage metrics would hold, so given that that is good enough to get TIm Horton's through to the second round to square off with Coca Cola.

Next up, Match 6 - McCormick Spice versus Wal-mart

- Dividend Compass Cup Final Four - Tim Horton's V Microsoft

We started with sixteen companies competing for the Dividend Compass Cup. We are now down to the Final Four. Expect two competitors to bring their A game to this match between Tim Horton's and Microsoft. Both have faced stiff resistance to make it...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

- Dividend Compass Match 4- Ch Robinson Vs Ritchie Brothers Auctioneers

In Match 3 of the Dividend Compass Cup, Microsoft narrowly defeated IBM. In Match 4, we have two smaller companies going head to head - CH Robinson (CHRW) vs Ritchie Brothers Auctioneers (RBA). The Dividend Compass Cup rules are straightforward, we run...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...

Money and Finance

Dividend Compass Match 5- McDonald's vs Tim Horton's

In Match 4, we had two smaller, lesser known companies meet up - CH Robinson (CHRW) defeated Ritchie Brothers Auctioneers (RBA).

Match 5 is all about international icons - McDonald's (MCD) versus Tim Horton's (THI) two franchises with moats that stretch from one ocean to another.

The Dividend Compass Cup rules are straightforward, we run the two quality, wide moat companies through the Dividend Compass to analyze which is the more interesting investing candidate. Todd Wenning's Dividend Compass scores them 1-5.

McDonald's main weakness is FCF cover it also shows some very mild slow down, likely from Europe. Other than that its a compelling set of metrics across the board

McDonald's Metrics:

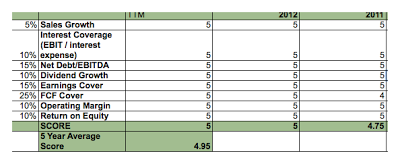

McDonald's puts up a strong 5 year average score but some slow down is evident in 2012 and TTM scores. Note that most companies would be very happy with McDonald's "bad" scores. One problem for McDonald's is their weakest area - FCF Cover - is the one that's most important to income investors in general and the Dividend Compass specifically.

McDonald's score:

Next up, from the great white north, featuring breakfast, lunch, dinner, coffee and Timbits - Tim Horton's.

Hang on to your hats, these metrics are hotter than a large cup of coffee. Very low debt, high ROE, and lots of FCF/Earnings cover.

Tim Horton's metrics:

That is all good for a near perfect 4.95 five year average score from the Dividend Compass

Tim Horton's score:

Tim Horton may have been only an average pro hockey player, but Tim Horton's Dividend Compass score is in the upper echelon. What is not to like? Just this - Tim Horton's pays only a 1.8% dividend yield versus McDonald's stout 3.4% yield. The lower yield is offset partially by excellent (though relatively recent) dividend growth. Even if Tim Horton's paid a higher dividend, its coverage metrics would hold, so given that that is good enough to get TIm Horton's through to the second round to square off with Coca Cola.

Next up, Match 6 - McCormick Spice versus Wal-mart

- Dividend Compass Cup Final Four - Tim Horton's V Microsoft

We started with sixteen companies competing for the Dividend Compass Cup. We are now down to the Final Four. Expect two competitors to bring their A game to this match between Tim Horton's and Microsoft. Both have faced stiff resistance to make it...

- Dividend Compass Cup Match 7 - Procter & Gamble Versus Unilever

In the last match of the Dividend Compass Cup, Walmart eked out a win over McCormick Spice. In this match we are sticking with the store shelves theme - Procter & Gamble (PG) versus Unilever (UL). The Dividend Compass Cup rules are straightforward,...

- Dividend Compass Match 6- Mccormick Spice Vs Wal-mart

In Match 5 is TIm Horton's squeaked by McDonald's. In Match 6, we have to answer the question - is it better to invest in a company with products sold at Wal-mart or invest in Wal-mart directly? The answer will determine who goes on to the next...

- Dividend Compass Match 4- Ch Robinson Vs Ritchie Brothers Auctioneers

In Match 3 of the Dividend Compass Cup, Microsoft narrowly defeated IBM. In Match 4, we have two smaller companies going head to head - CH Robinson (CHRW) vs Ritchie Brothers Auctioneers (RBA). The Dividend Compass Cup rules are straightforward, we run...

- Dividend Compass Cup October 2013 - Sweet Sixteen

Thanks to DC shenanigans, deeply immoral and irresponsible though they may be, there's starting to be some better prices on interesting companies. This seems like a good time to run Todd Wenning's Dividend Compass. Todd explains the tool here,...