Charlemagne Capital Limited: A way to play emerging markets?

In the latest 7-Year Asset Class Return Forecast that gets produced every month by GMO, the highest forecasted asset class over the next 7 years is emerging market stocks (6.8% per year). One could try and capture some of this tailwind by buying indices of emerging markets, buying individual stocks, investing with a manager that focusing on emerging markets, or investing in a manager that focuses on those markets. Charlemagne Capital Limited may fit that latter category.

Through its subsidiaries, Charlemagne focuses on managing mutual funds, hedge funds, and specialist funds. The group invests in the public equity, and alternative markets across the globe with a focus on emerging markets, including Asia, Eastern Europe, and Latin America. It describes its investment process as seeking “to profit from inefficiencies in emerging markets to generate returns for clients across its product range using a rigorous, bottom-up stockpicking process combined with disciplined risk management and portfolio construction.” The company’s main listing is on the AIM under the symbol CCAP, but it also trades on the Pink Sheets under the symbol CNLMF.

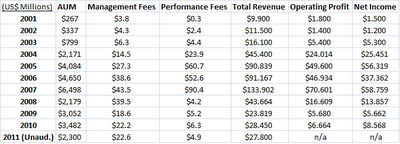

To use an idea from Nassim Taleb, Charlemagne (and most money management businesses in general) operates in Extremistan, by which I’m referring to the observation that its results are much more subject to randomness than many other businesses. This can be shown by looking at a table of their results over the last several years:

The last trade on the Pink Sheets ($0.16) puts the market cap of the company at about $44.3 million. Yesterday's close on the AIM (£0.13), where the stock is more liquid, would value the company at about $52.5 million. Charlemagne has no debt and ended 2011 with about $25 million in cash. The company has shown a continued effort to return capital to shareholders by paying out earnings in the form of dividends (since they are comfortable with the current position of the balance sheet) and occasionally repurchasing shares.

As one can see from the table above, total assets under management declined quite sharply over the past year. This was due both to client redemptions and performance as, unlike the major U.S. Markets, many of the emerging markets suffered significant declines last year, of which Charlemagne’s holdings were not spared. The OCCO hedge fund managed by the company did produce a positive performance in 2011 though. Of Charlemagne’s 5 categories of assets that it manages, OCCO produced the sole increase to its AuM total for the year by ending 2011 with $444 million under management (up 44.2% vs. 2010).

So is Charlemagne worth investing in? At its current market cap, the company is trading at about 2x tangible book value and about 10x what they should earn in 2011. It is a great, high return on capital business, but it is also very unpredictable. The company has an experienced management team that owns a decent number of shares and should continue to pay out earnings in the form of dividends. There’s certainly the risk that a slower growing Europe and/or China could slow these markets and businesses down further, but should they recover and Charlemagne capitalize on the recovery, the current market cap is standing at about 1 or 2 times what the company was earning at its peak. All in all, there are things to like and I think there is a lot of upside, but I don’t think it is one of those stocks you want to want to buy and not look at for the next five years. So if has a place in a portfolio, it is probably as a smaller-than-normal position.

Disclosure: Neither I nor any investment product I co-manage at Chanticleer have an investment the stock(s) mentioned in this article at the time of posting. This is not a recommendation to buy or sell a security. Please do your own research before making an investment decision.

- A Few Good Reasons To Hoard Some Cash Now - By Jason Zweig

The stock market is near record highs. More money came into U.S. stock mutual funds the week of Oct. 23 than during any other week since 2007. Initial public offerings like Twitter are booming. So have you considered keeping more of your assets in cash?...

- Gmo: Capturing Domestic Demand In Emerging Markets: Neither Small Caps Nor Multinationals Are A Good Proxy - By Arjun Divecha

As a complement to his article published in the FT on Jan. 4, Arjun Divecha fleshes out more fully his argument that buying emerging small cap stocks or large multinationals is not the best way to tap into domestic demand in emerging markets......Excerpt:...

- Lemarne

Lemarne is one of the newer positions in the fund I co-manage. Besides being a potentially attractive idea for readers, they also have a corporate philosophy that I think may be of interest to value investors. Lemarne Corporation Limited (ASX:LMC) engages...

- 3m Is A Wonderful Company But Not A Buy Here

The economy is on stable ground but is far from growing by leaps and bounds. Even worse the volatility in the stock markets are playing with investors minds. Back in August and September the stock markets declined significantly, but shot up 10% in October...

- How Do You Solve A Problem Like Emerging?

That was fast - Emerging Markets went from everyone's darling to everyone's whipping boy. One of the main points of agreement for the last five years or so is that maybe the US would struggle, maybe Europe would struggle but Emerging Markets would...