CBO Report: Trends in the Distribution of Household Income Between 1979 and 2007

From 1979 to 2007, real (inflation-adjusted) average household income, measured after government transfers and federal taxes, grew by 62 percent. During that period, the evolution of the nation’s economy and the tax and spending policies of the federal government and state and local governments had varying effects on households at different points in the income distribution: Income after transfers and federal taxes (denoted as after-tax income in this study) for households at the higher end of the income scale rose much more rapidly than income for households in the middle and at the lower end of the income scale. In particular:

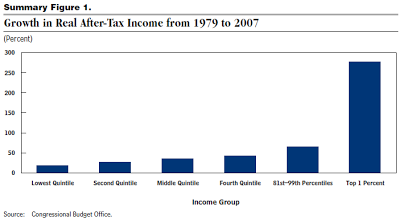

- For the 1 percent of the population with the highest income, average real after-tax household income grew by 275 percent between 1979 and 2007 (see Summary Figure 1).

- For others in the 20 percent of the population with the highest income (those in the 81st through 99th percentiles), average real after-tax household income grew by 65 percent over that period, much faster than it did for the remaining 80 percent of the population, but not nearly as fast as for the top 1 percent.

- For the 60 percent of the population in the middle of the income scale (the 21st through 80th percentiles), the growth in average real after-tax household income was just under 40 percent.

- For the 20 percent of the population with the lowest income, average real after-tax household income was about 18 percent higher in 2007 than it had been in 1979.

Does Inequality Make Us Unhappy - By Jonah Lehrer

Fault Lines: The Top 1%

TED Talk - Richard Wilkinson: How economic inequality harms societies

Capital versus Talent: Discussion between Malcolm Gladwell and Roger Martin

How Inequality Fueled the Crisis - By Raghuram Rajan

Amy Chua: World on Fire

- Hussman Weekly Market Comment: Do Foreign Profits Explain Elevated Profit Margins? No.

Link to: Do Foreign Profits Explain Elevated Profit Margins? No.The bottom line is simple. Corporate after-tax profits as a share of GDP, GNP (or even net national product if one wishes to use that number) are steeply above historical norms. This fact...

- Richard Duncan Quotes

Another longer excerpt from The New Depression (taken from my Kindle highlights, so the excerpts aren’t necessarily the paragraphs I have put them in below, and there may be things in between that I didn’t highlight). I've been posting a lot of...

- Inequality 101: The Picket Fence And The Staircase - By John Cassidy

Found via The Big Picture. When a group of millionaires appear onstage with a Democratic President to call for higher taxes on people like them, you know one of two things: either the President is in Hollywood, or something interesting is happening in...

- How Inflation Swindles The Equity Investor - By Warren E. Buffett, Fortune May 1977

It is no longer a secret that stocks, like bonds, do poorly in an inflationary environment. We have been in such an environment for most of the past decade, and it has indeed been a time of troubles for stocks. But the reasons for the stock market's...

- Weekly Roundup - February 23, 2013

It's been a while since I've posted a roundup and I really need to get back into it. Here's some articles that caught my eye from this past week. A Primer on Federal Income and Investment Taxes - MyFIJourney has a great overview of the 2013...