Money and Finance

So, I was at the gym today and suddenly something occurred to me.

Yeah, I get weird random thoughts all the time, so sue me.

Anyway, I was wondering when would my dividends pay off, so I did a little research.

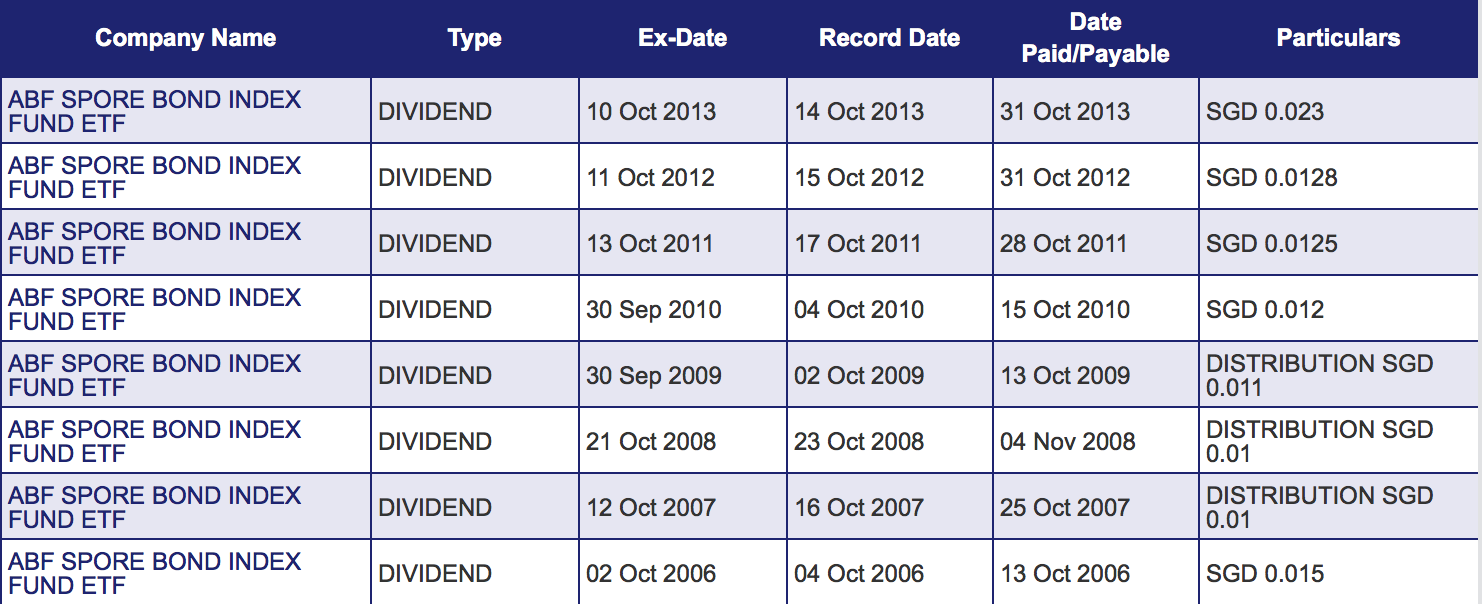

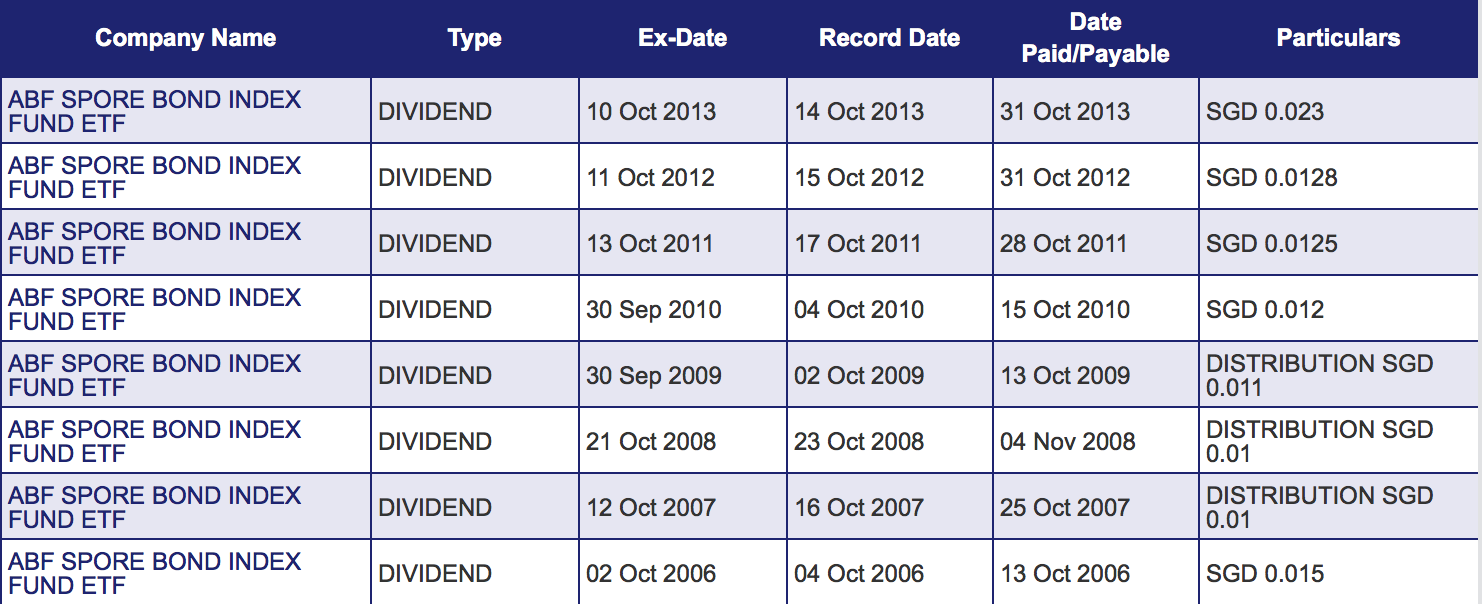

Well, I won't go into too much details, so basically I went to SGX website. I found the following information.

- Dividend Growth Investing At Work: Johnson & Johnson (jnj) Gives Owners A 7.1% Increase

Quick update today as I sit at the hospital with Luke! But it's one that I love, especially since Luke is doing better than last week. I love hearing about dividend increases. Like absolutely love them. There's few things that I like...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- Don't Expect Money To Fall In To Your Lap From Investing

Just a short post today, going to work at the Comex 2014 :) Lots of tech stuff, come down and have a look if you're interested! But the main point is though we all hope to receive a steady stream of dividends from our investments, that is for the...

- 80% Of Young Singaporeans Have Little To No Savings At All ; Are You One Of Them?

According to this link (http://sbr.com.sg/financial-services/news/disaster-in-making-4-out-5-young-singaporeans-have-no-savings) 4 out of 5 Singaporeans have little to no savings at all! True? Source: Singapore Business Review Now, firstly I would not...

Money and Finance

Calculating Your Dividends From Your Investments and Earning Better Interest on Your Savings?

So, I was at the gym today and suddenly something occurred to me.

Yeah, I get weird random thoughts all the time, so sue me.

Anyway, I was wondering when would my dividends pay off, so I did a little research.

Well, I won't go into too much details, so basically I went to SGX website. I found the following information.

Source: (http://sgx.com/wps/portal/sgxweb/home/company_disclosure/corporate_action)

In my previous blogpost, http://teenageinvesting.blogspot.sg/2014/08/index-investing-in-singapore-stock.html , I recommended that the average investor's portfolio should include a mixture of stocks and bonds. So naturally, I wouldn't recommend something that I wouldn't do myself.

As such, I had previously purchased 1 lot of ABF SINGAPORE BOND INDEX FUND ETF (A35) which is 1000 shares exactly. I have not yet received my dividends as you can see that they have not yet paid out the dividends.

If I should take last year dividend of SGD 0.023/share, I would roughly receive $23 in dividends this year if I'm lucky. (Senior Investors please correct me if I am wrong...) That's a whopping $23 in "interest". Could you earn $23 in interest if you place $1165 in the bank for a year? Even if I should take a dividend payout of 0.01, I would still receive $10 in that year.

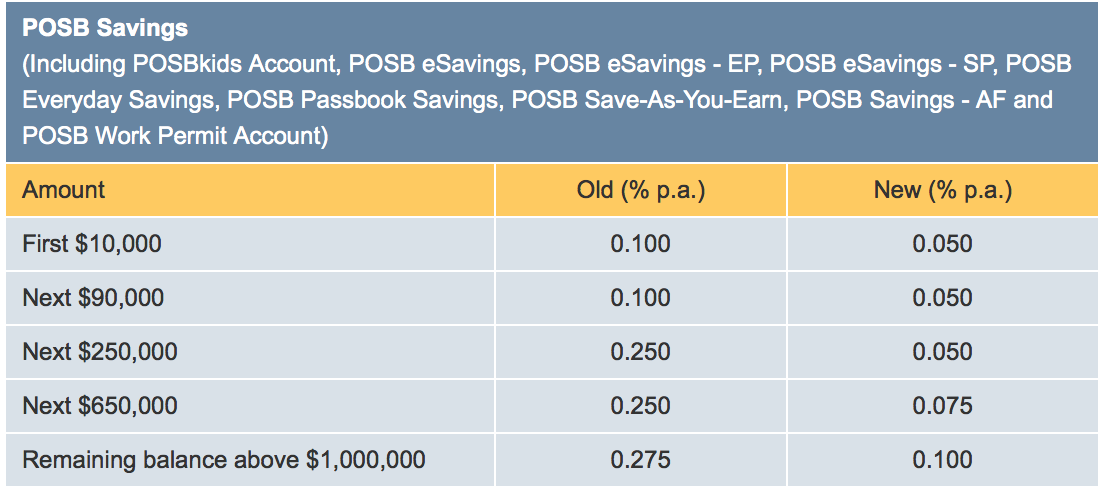

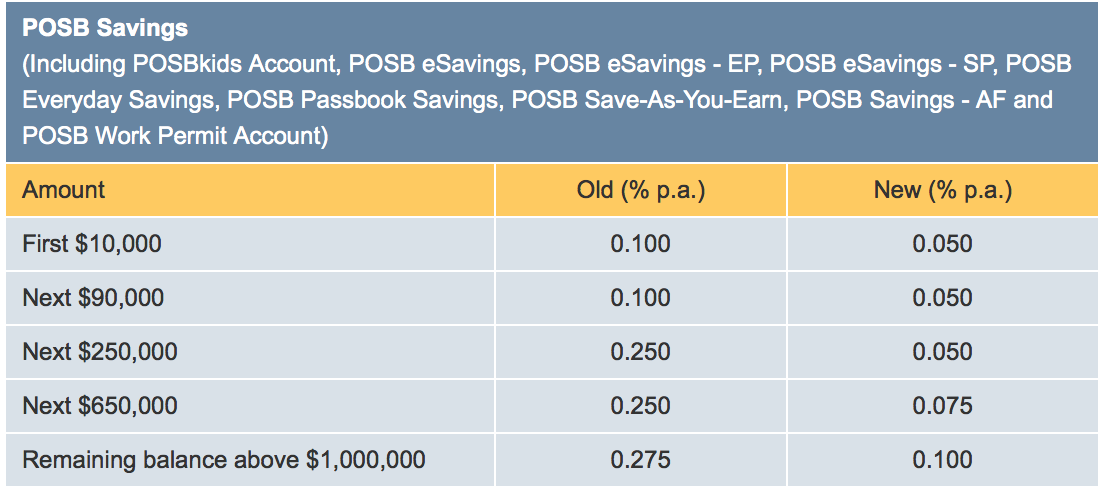

Source: http://www.posb.com.sg/personal/deposit/notice/revisedinterestrates/default.page

For argument sake, let's take POSB Savings at their revised interest rate per annum from the previous 0.100% to the current 0.050%..........

At $1165/ year you would receive an interest of $0.5825.... that's barely $0.60.

The point I'm trying to make here is I don't expect to get rich by investments. If i do, I'm lucky. I believe that what I'm doing now, is merely preparing for the future. I want my money to work harder for me. $10 is significantly more attractive than $0.60. But the $0.60 is safe. It's guaranteed interest. But there's no guarantee that the interest rate will not fall somemore. Ten years down the road, it may even be 0.030, or 0.025% p.a? That's $0.25 interest in a year.

Would I take that $23 or even $10 to spend? I doubt so. I would much rather take my dividends, combine it with my monthly fresh funds, and re-invest it. Why not use the power of compounding to our advantage?

By the way, Fun Fact. The Singapore Government has given us a free $100 to use at public gyms and swimming pools. Simply sign up for an ActiveSG membership. I got my $100 and signed up for one year worth of off peak gym membership at $80 leaving me with $20 worth to use for peak hour gym sessions. If the government hands out free stuff, use it. Why not?

Find out more here, http://www.myactivesg.com and http://www.sportsingapore.gov.sg/newsroom/media-releases/2014/4/activesg100-for-every-singaporean-to-play-sport as well as http://www.myactivesg.com/about-activesg/membership.

One thing's for sure, money is never enough. Everyone wants money. But money comes and go, your health is your own. As the saying by Jim Rohn goes, "Take care of your body, it's the only place you have to live."

See y'all soon. Take care.

Signing off,

Teenage Investor

- Dividend Growth Investing At Work: Johnson & Johnson (jnj) Gives Owners A 7.1% Increase

Quick update today as I sit at the hospital with Luke! But it's one that I love, especially since Luke is doing better than last week. I love hearing about dividend increases. Like absolutely love them. There's few things that I like...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....

- Investments, Money + Teenage Investor's Q & A

Hello, recently I received emails from new readers of my blog after my post was shared on Facebook. Honestly, I was quite shocked and a little gratified that readers found my blog post interesting and relatable enough to share on their Facebook page....

- Don't Expect Money To Fall In To Your Lap From Investing

Just a short post today, going to work at the Comex 2014 :) Lots of tech stuff, come down and have a look if you're interested! But the main point is though we all hope to receive a steady stream of dividends from our investments, that is for the...

- 80% Of Young Singaporeans Have Little To No Savings At All ; Are You One Of Them?

According to this link (http://sbr.com.sg/financial-services/news/disaster-in-making-4-out-5-young-singaporeans-have-no-savings) 4 out of 5 Singaporeans have little to no savings at all! True? Source: Singapore Business Review Now, firstly I would not...