Money and Finance

I've decided to do some in-depth research into the steps needed and criterias a Singaporean like myself has to meet before we can purchase our first home.

Therefore for this post, I would focus more for Singaporean couples that are planning to get married / already married and intending to purchase their first HDB flat.

1. Do You Have Enough Money?

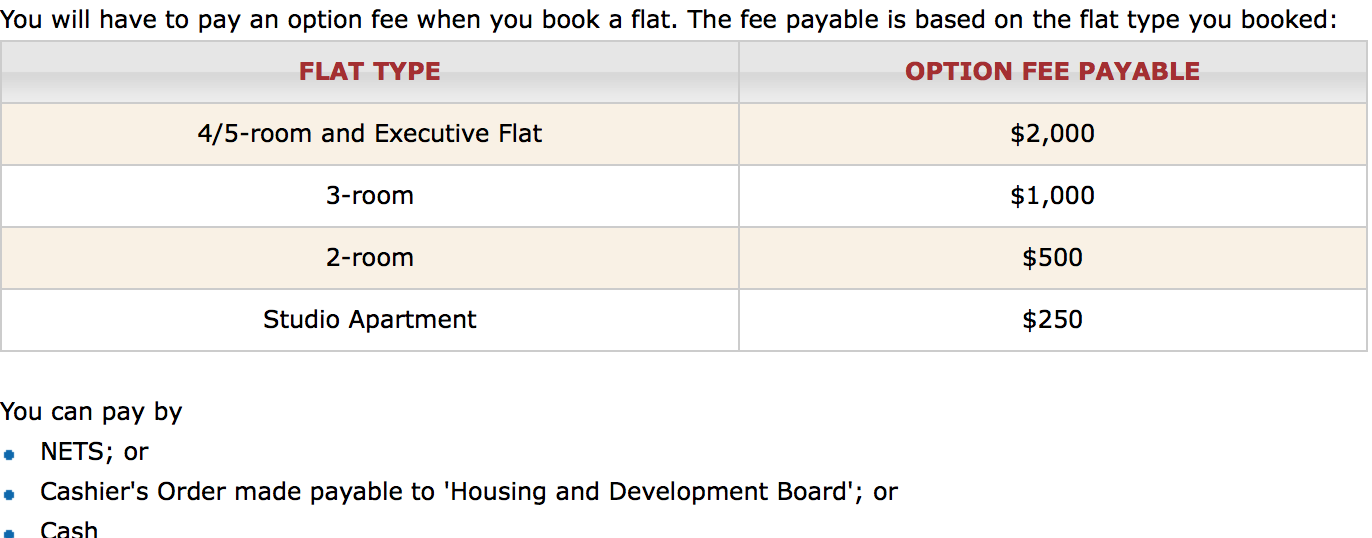

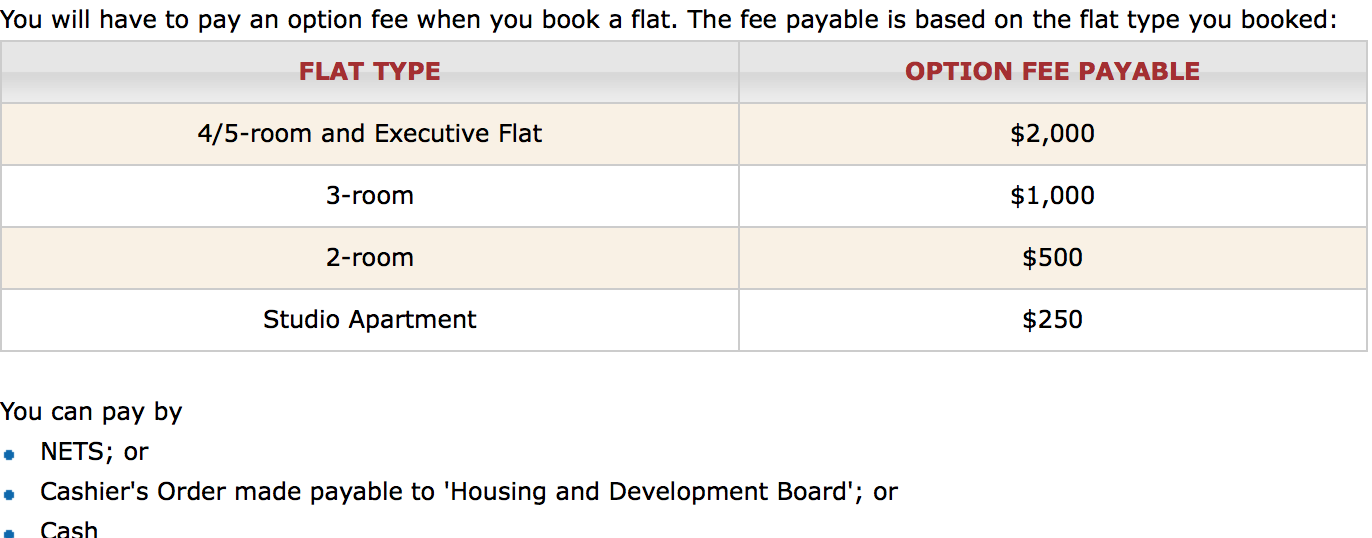

The different option fee payable.

Do note that the option fee is refundable if you meet the following criteria:

Once informed of your balloted queue position, you'll receive an invitation package with an appointment to select your flat. Time to begin the dreaded task of shortlisting 20-40 units a day, praying hard that nobody will select the unit(s) that you have selected.

2-room or bigger

Balance of the purchase price of the flat booked, by Cash or CPF or a combination of both.

Studio Apartment

The HDB will not grant loan for the purchase of the Studio Apartment. Applicants are required to pay the remaining 95% of the purchase price of the Studio Apartment in full before they can take possession of the flat.

Applicants who are owners of HDB flats may request for contra facility to offset the payment for the purchase of the Studio Apartment from the proceeds held by the HDB pending the completion of resale of their existing flat. The keys to the Studio Apartment will be issued after the completion of the resale of the existing flat.

HDB Concessionary Loan

If you are eligible for an HDB concessionary rate loan, you may be given a loan up to the housing loan ceiling, subject to full usage of funds from your CPF Ordinary Account and credit assessment.

GIRO Application For Paying Monthly Instalments by Cash

If you intend to pay the monthly instalments partially or fully by cash, you will have to submit a completed GIRO application form before we grant you a loan. If we do not receive the completed GIRO application form on or before the appointment for keys collection, we may withdraw the letter of offer and you will have to find alternative financing for the purchase.

Bank Loans in Case of Non-eligibility for HDB Concessionary Loan

If you are not eligible for an HDB concessionary rate loan, you may approach the banks or financial institution (licensed by MAS) to obtain a mortgage loan.

- Wells Fargo And The Rousseau Story

Found via Naked Capitalism. In March 2000, Norman and Oriane Rousseau put 30 percent down to buy a house at 580 Wilshire Place, Newbury Park, CA. In the following years they were solicited to refinance their loan. In October 2007 they met with the loan...

- Latest Mortgage Scandal: Force-placed Insurance

From The Big Picture.American Banker’s Jeff Horwitz has a spectacular piece of reporting today about goings on in an obscure corner of the mortgage-servicing world: Losses from Force-Placed Insurance Are Beginning to Rankle Investors.What is force-placed...

- Hussman Weekly Market Comment: The Second Wave Begins

I should also note some features of the resets we are now beginning to observe. It is tempting to think that with Treasury yields fairly low, mortgage resets might be fairly benign in terms of their impact. The problem is that these Option ARM and Alt-A...

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....

Money and Finance

Buying Your First HDB Flat in Singapore

I've decided to do some in-depth research into the steps needed and criterias a Singaporean like myself has to meet before we can purchase our first home.

Therefore for this post, I would focus more for Singaporean couples that are planning to get married / already married and intending to purchase their first HDB flat.

Things To Note:

Buying a home is probably the biggest financial commitment for most Singaporeans. It is a long-term commitment which should be carefully planned upfront.

Before you start looking for a home to buy, first work out what you can afford as well as find out what you need to pay for. What you can afford depends on your current income, existing debt obligations and expenses, available savings as well as the loan amount you are eligible for.

Buying a home involves making some upfront payments, as well as monthly payments such as your housing loan instalments and conservancy charges.

So, knowing this and assuming you're still prepared to buy a house, what's next?

Before you start looking for a home to buy, first work out what you can afford as well as find out what you need to pay for. What you can afford depends on your current income, existing debt obligations and expenses, available savings as well as the loan amount you are eligible for.

Buying a home involves making some upfront payments, as well as monthly payments such as your housing loan instalments and conservancy charges.

So, knowing this and assuming you're still prepared to buy a house, what's next?

Some Things to Consider before Buying a House:

1. Do You Have Enough Money?

This is perhaps the most obvious, but sometimes obvious is not enough. Why waste times looking at hundreds of homes only to realize you cannot afford them?

Don't get trapped in the house of your dreams only to suffer for the next half of your lives. Would it be very romantic and feasible to live in an amazing apartment and not be able to enjoy it?

If you're getting an agent, check with them on their fees and charges so that you would have a more accurate concept of the total budget required.

Do you want to get a flat near your parents?

Would you be getting a bank loan? HDB loan?

With the above in mind, let's progress to the steps needed to apply for your first HDB flat, usually a Build-To-Order (BTO) flat.

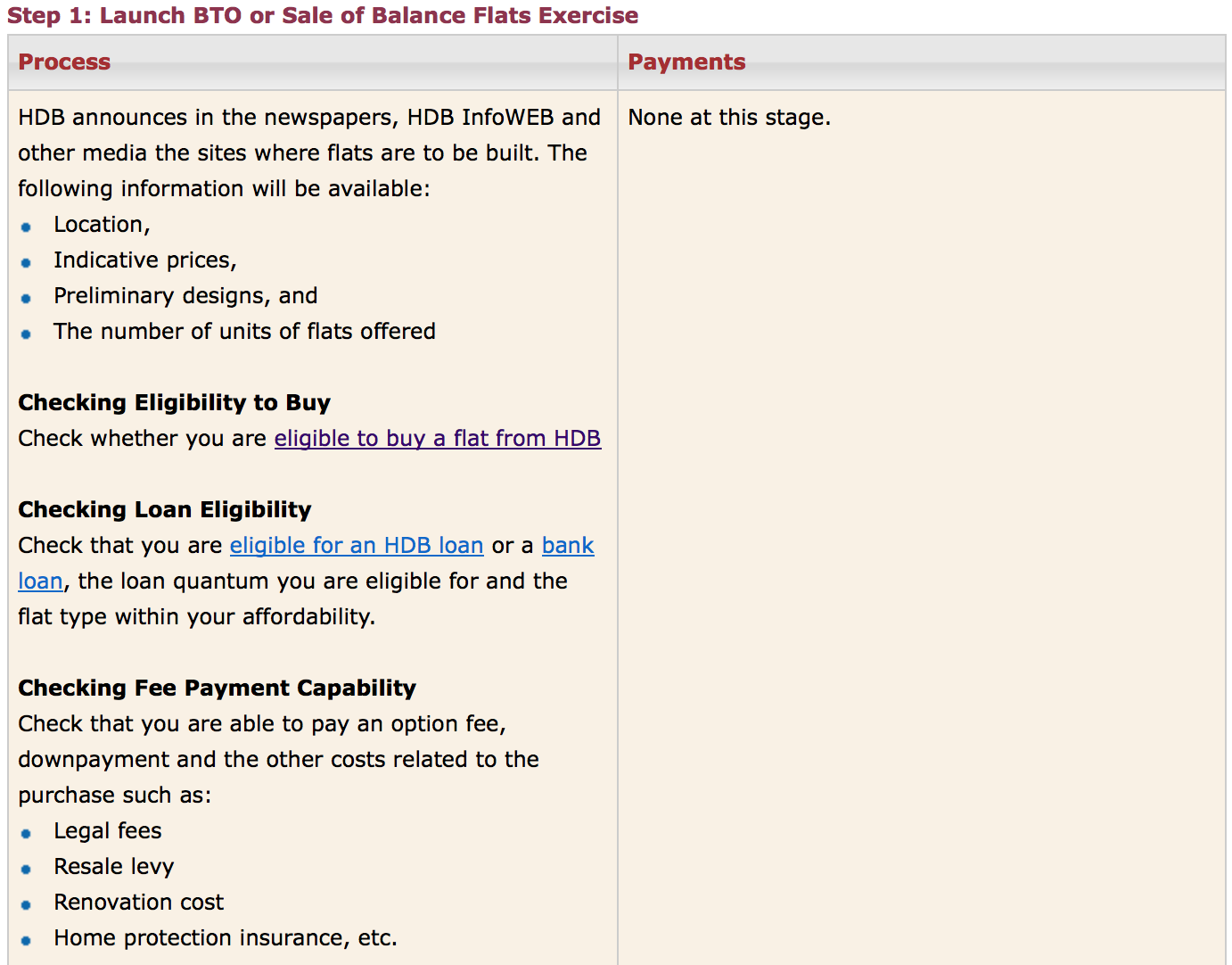

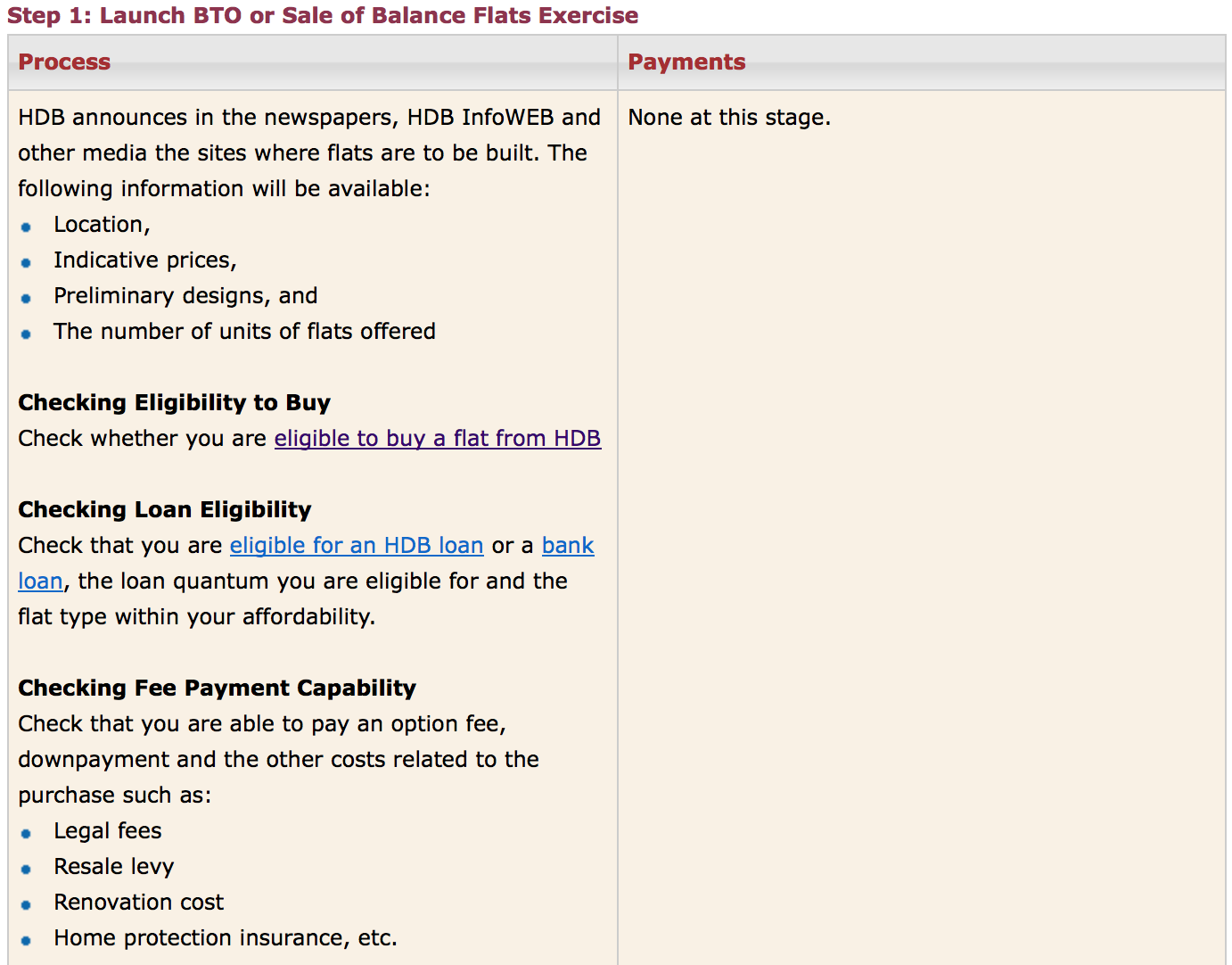

Step 1: The Launch of BTO Exercise.

When announced, information like location/prices/designs and number of units will be provided. Check first, if you're eligible to buy a flat from HDB.

Eligibility Requirements include being a Singaporean Citizen / be at least 21 years old at time of application.

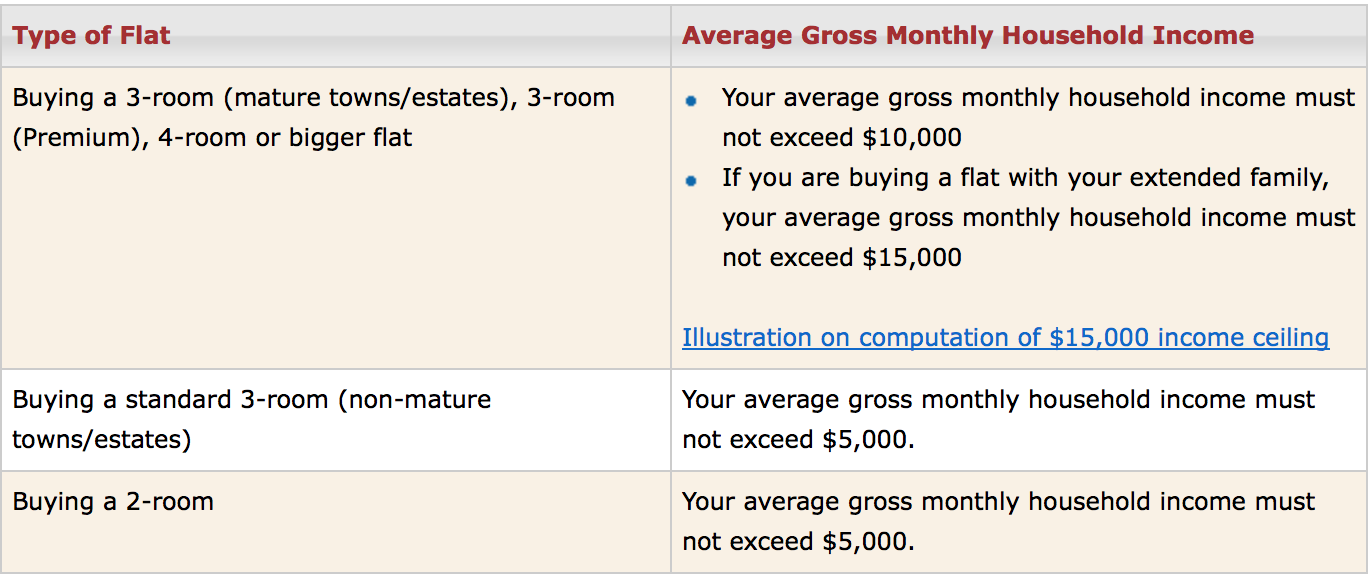

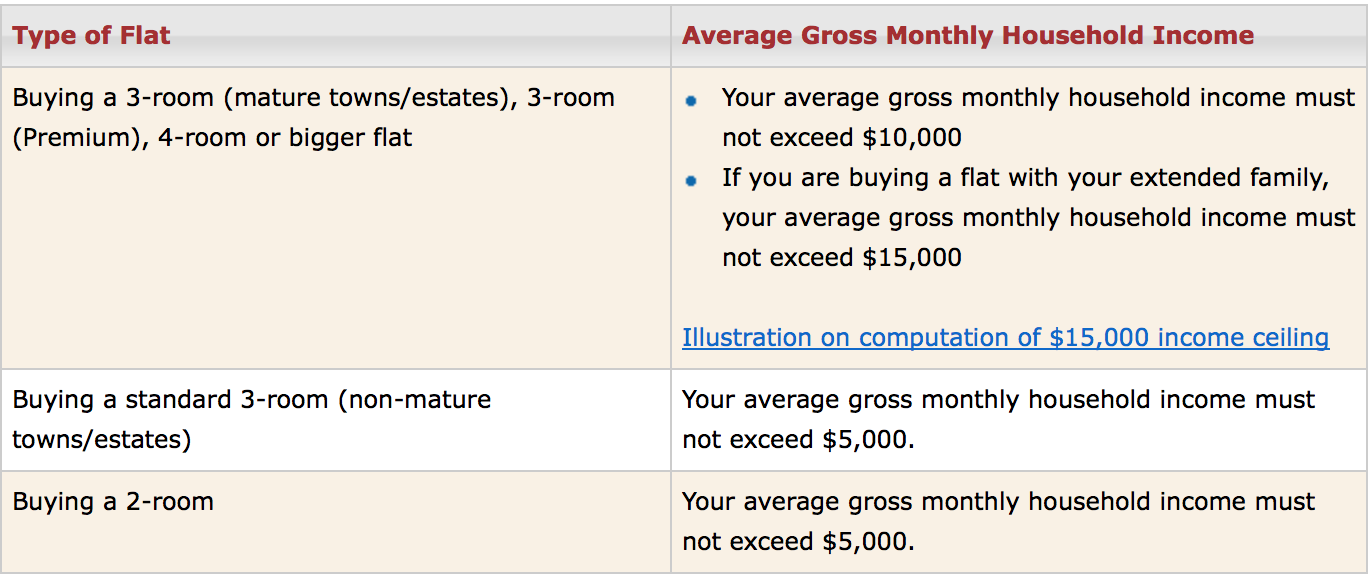

Income ceiling is also important and taken into consideration.

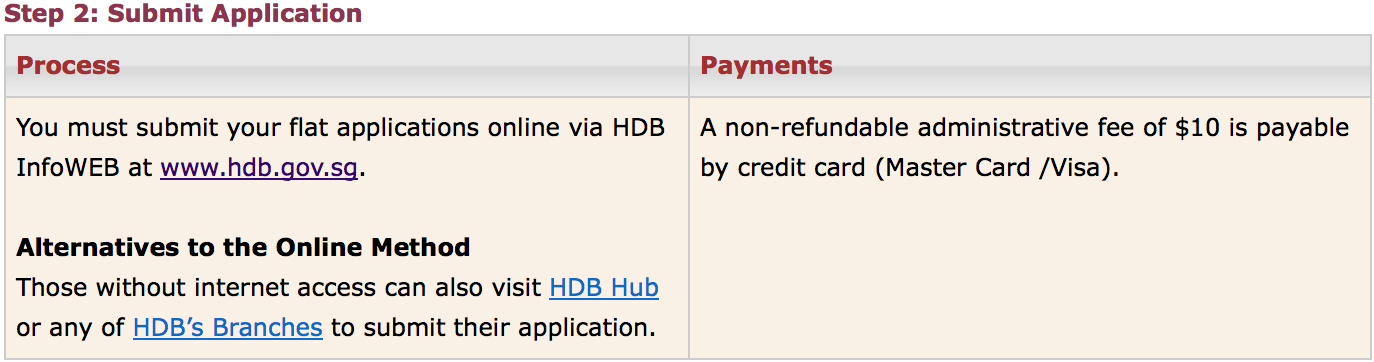

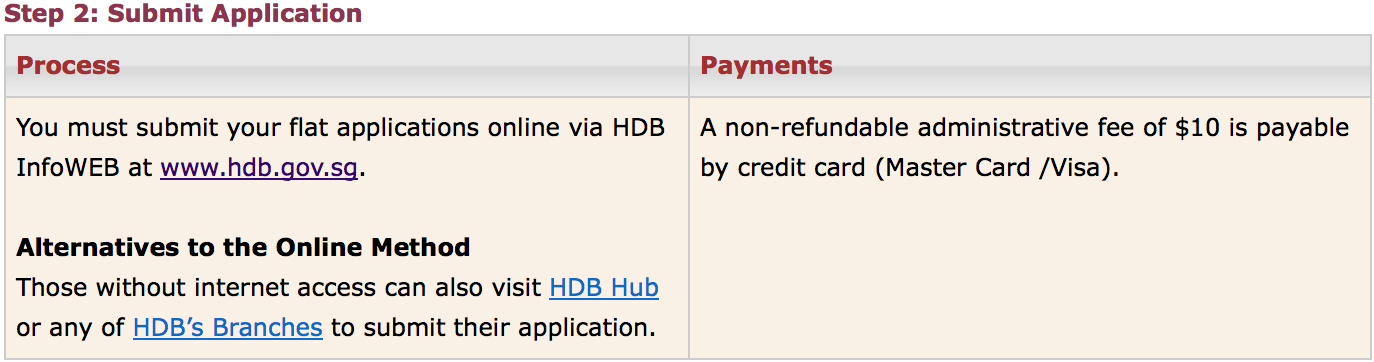

Step 2: Submit Your Application

Fill in the lengthy form online / do it in person at HDB's Branches. A non-refundable administration fee of $10 must be paid.

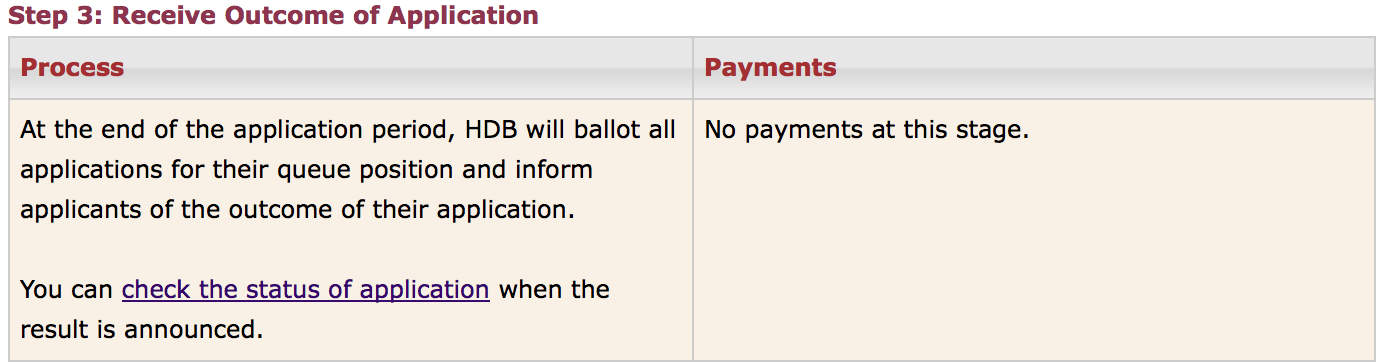

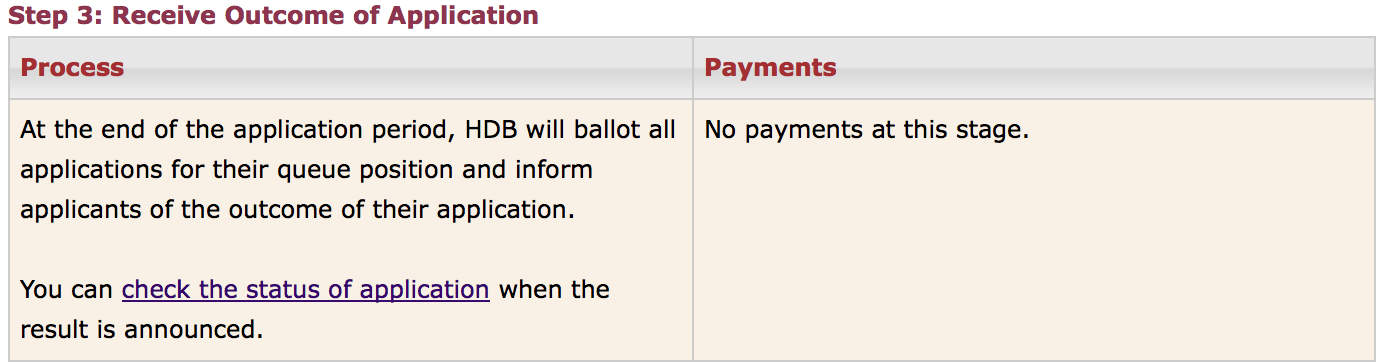

Step 3: Receive Outcome of Application

After the sale closes, you are able to check the status of application / receive a letter from HDB with regards to the results. If unsuccessful, apply again. People have tried 9 times before they got in. Perseverance is key here.

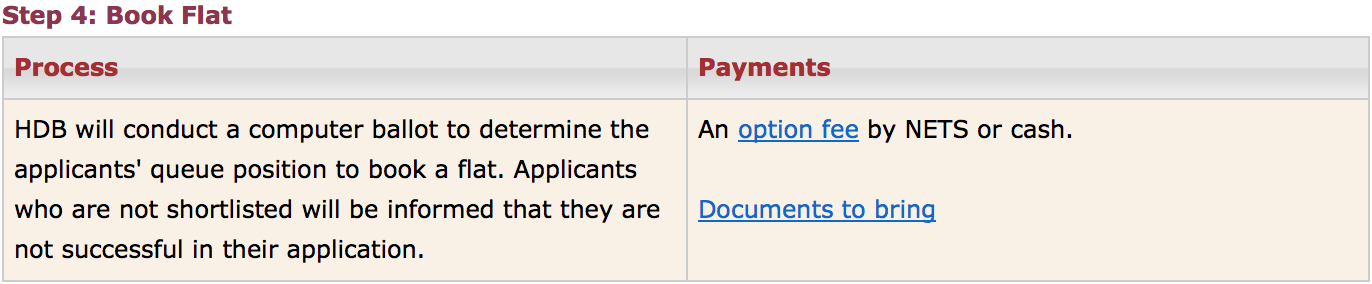

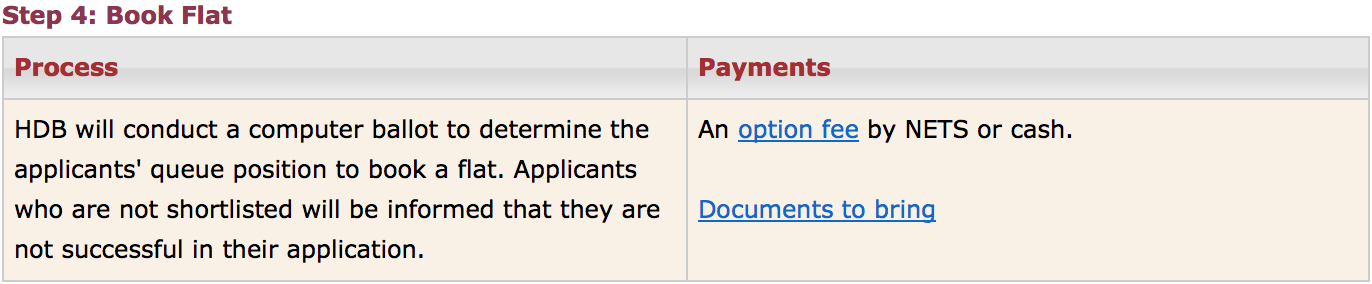

Step 4: Book Your Flat

Do note that the option fee is refundable if you meet the following criteria:

If you cancel your application after the selection of your flat, the money will be forfeited.

Once informed of your balloted queue position, you'll receive an invitation package with an appointment to select your flat. Time to begin the dreaded task of shortlisting 20-40 units a day, praying hard that nobody will select the unit(s) that you have selected.

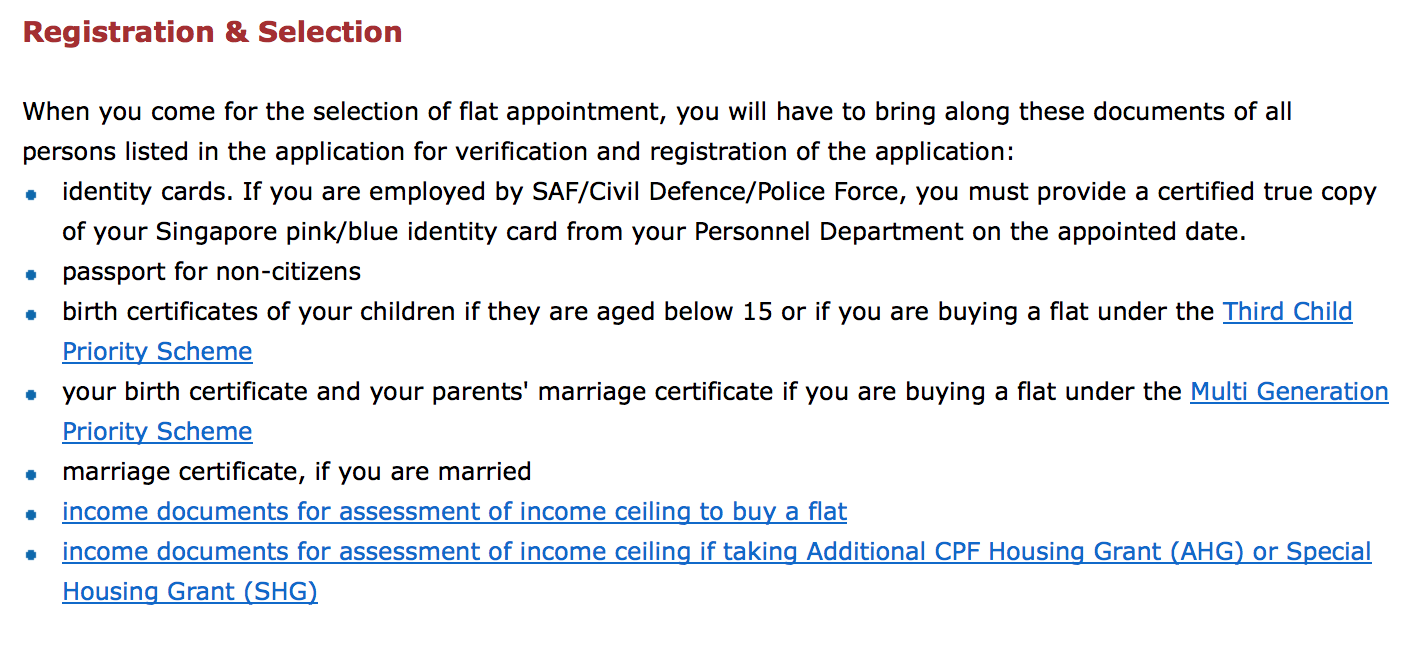

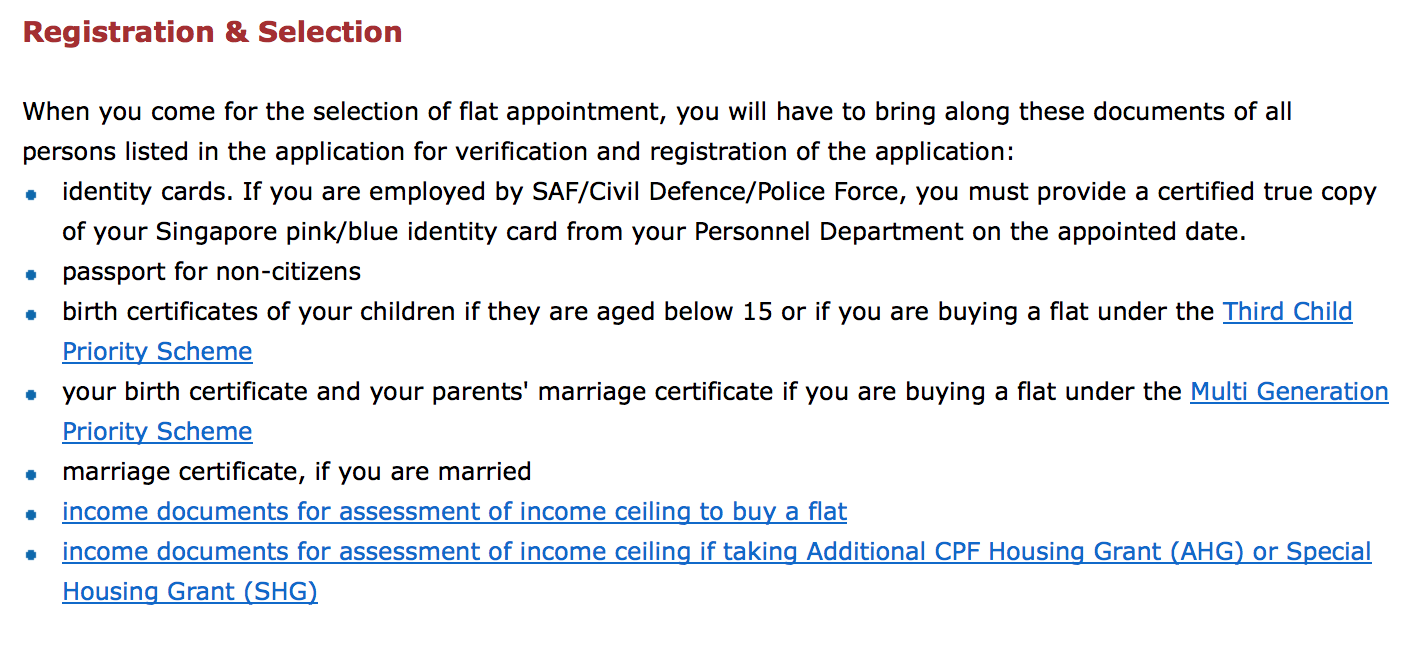

Documents to bring:

Refer to the letter from HDB for a list of documents that you will need to bring on the day of flat selection. If you are applying for AHG, do ensure that you meet the criteria and bring along the required documents.

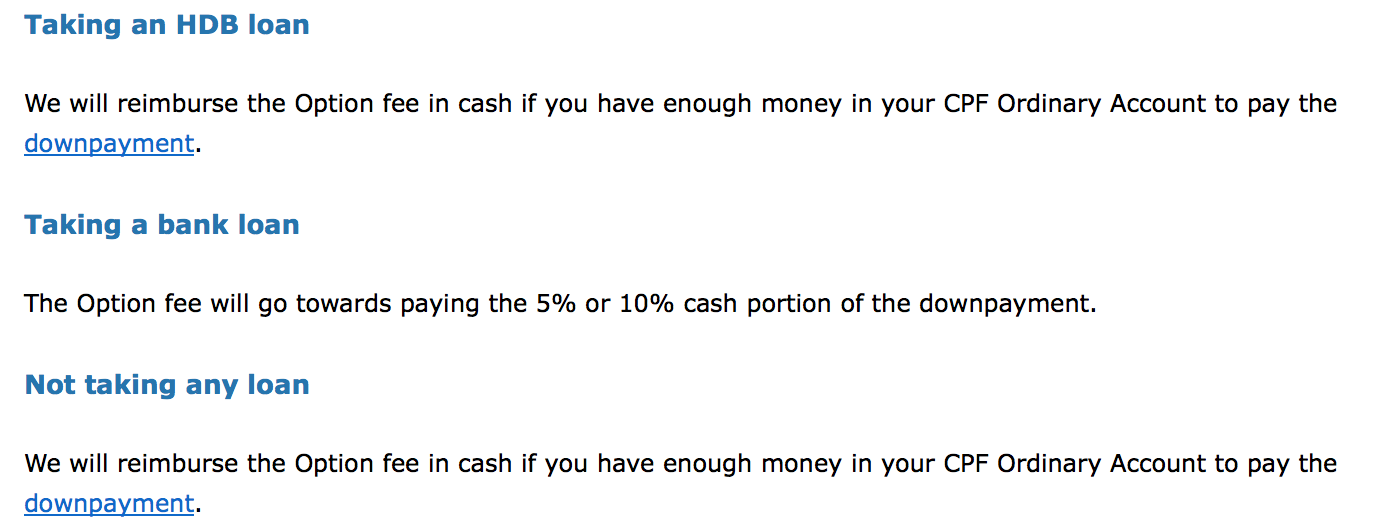

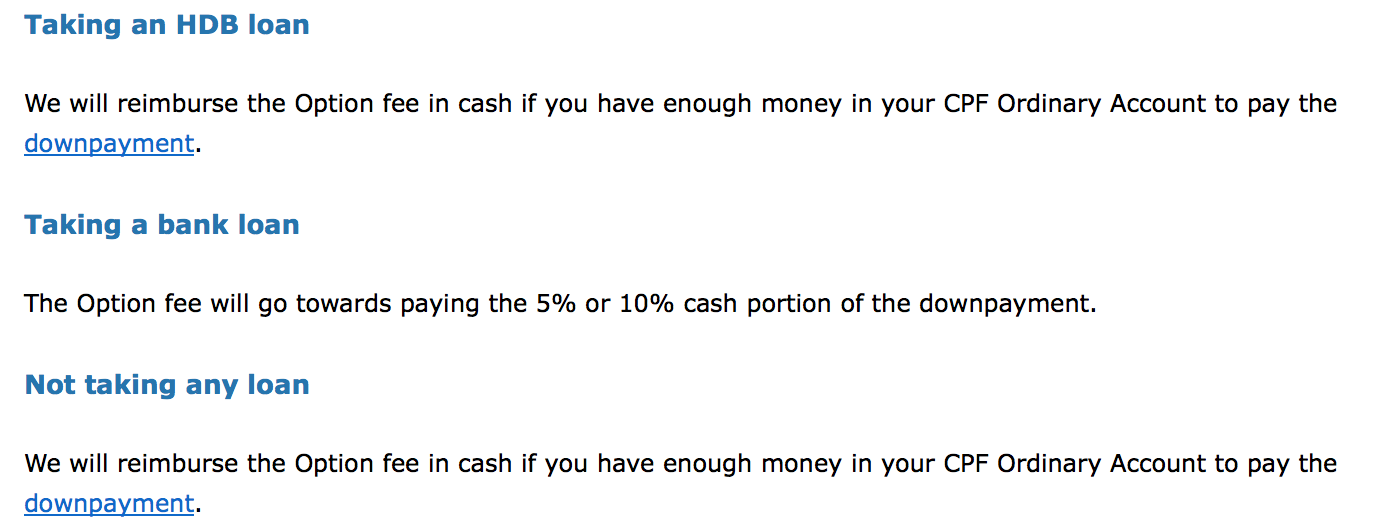

You are required to pay 10% of the purchase price of the flat as downpayment if you are taking a housing loan from theHDB or not taking any loan. You can use your CPF savings to make the downpayment. If your CPF savings are not enough, you will have to pay the balance in cash.

You may request reimbursement of the option fee after you have paid the 10% downpayment using your CPF savings.

If you are eligible for a loan ceiling of 80%, you will have to pay the initial payment of

20% in cash and another 5% in cash when they are invited to collect the keys to the new flat.

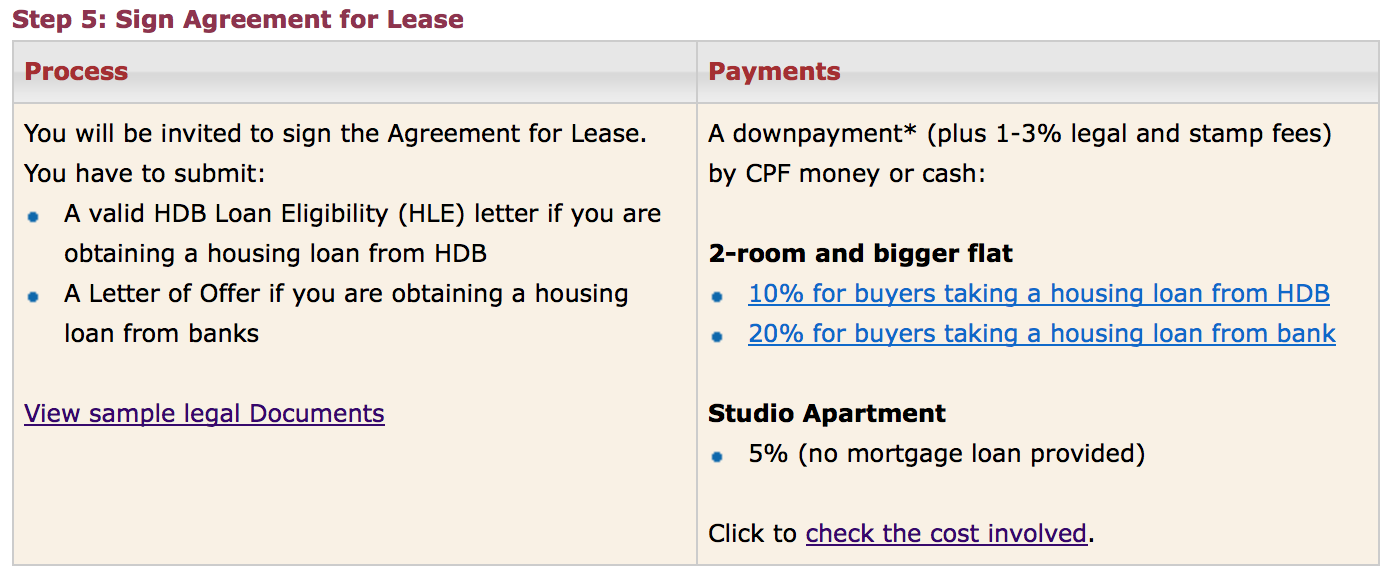

Step 5: Apply for Your Mortgage Loan

Before signing the Agreement for Lease, you will need to obtain either 1)HDB Loan Eligibility Letter (HLE) if you're getting a loan from HDB or 2)Letter of Offer from Bank/Financial Institution if you're getting a bank loan.

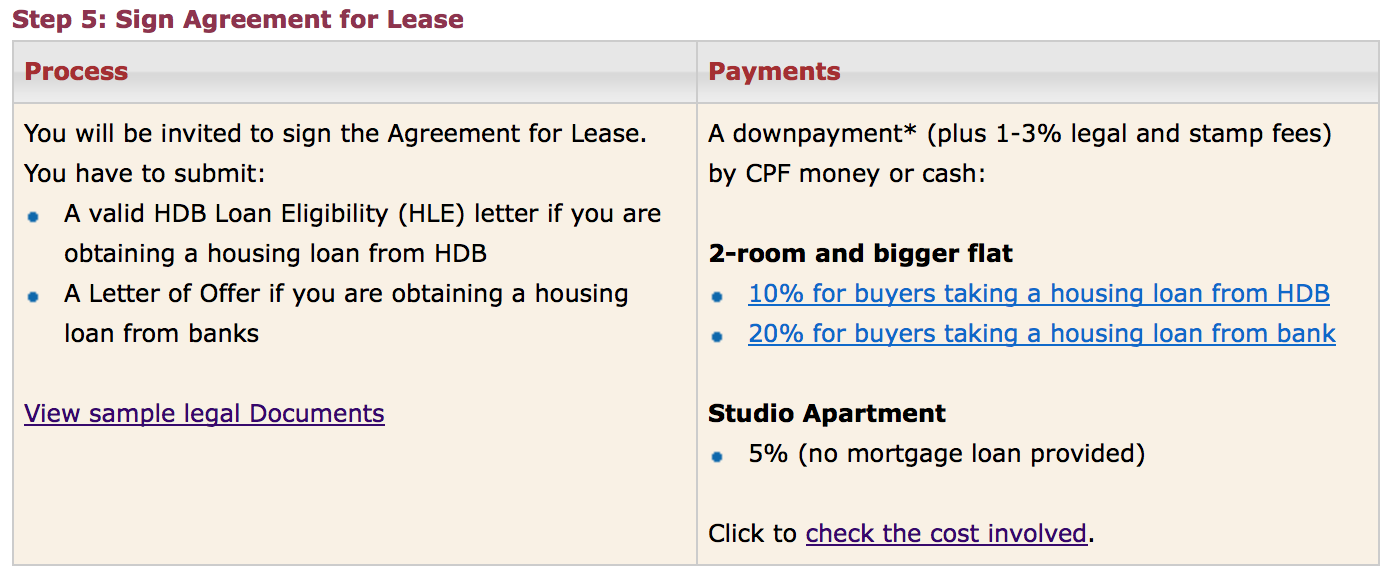

Step 6: Sign Agreement for Lease

Hang in there, Dear Reader. This painful process is almost over. Almost.

Downpayment if you're getting a loan from HDB. (10%)

You may request reimbursement of the option fee after you have paid the 10% downpayment using your CPF savings.

Downpayment if you're getting a loan from a bank. (20%)

- 5% in cash

- Balance 15% using CPF savings, CPF Housing Grant or cash

- 10% in cash

- Balance using CPF savings, CPF Housing Grant or cash

20% in cash and another 5% in cash when they are invited to collect the keys to the new flat.

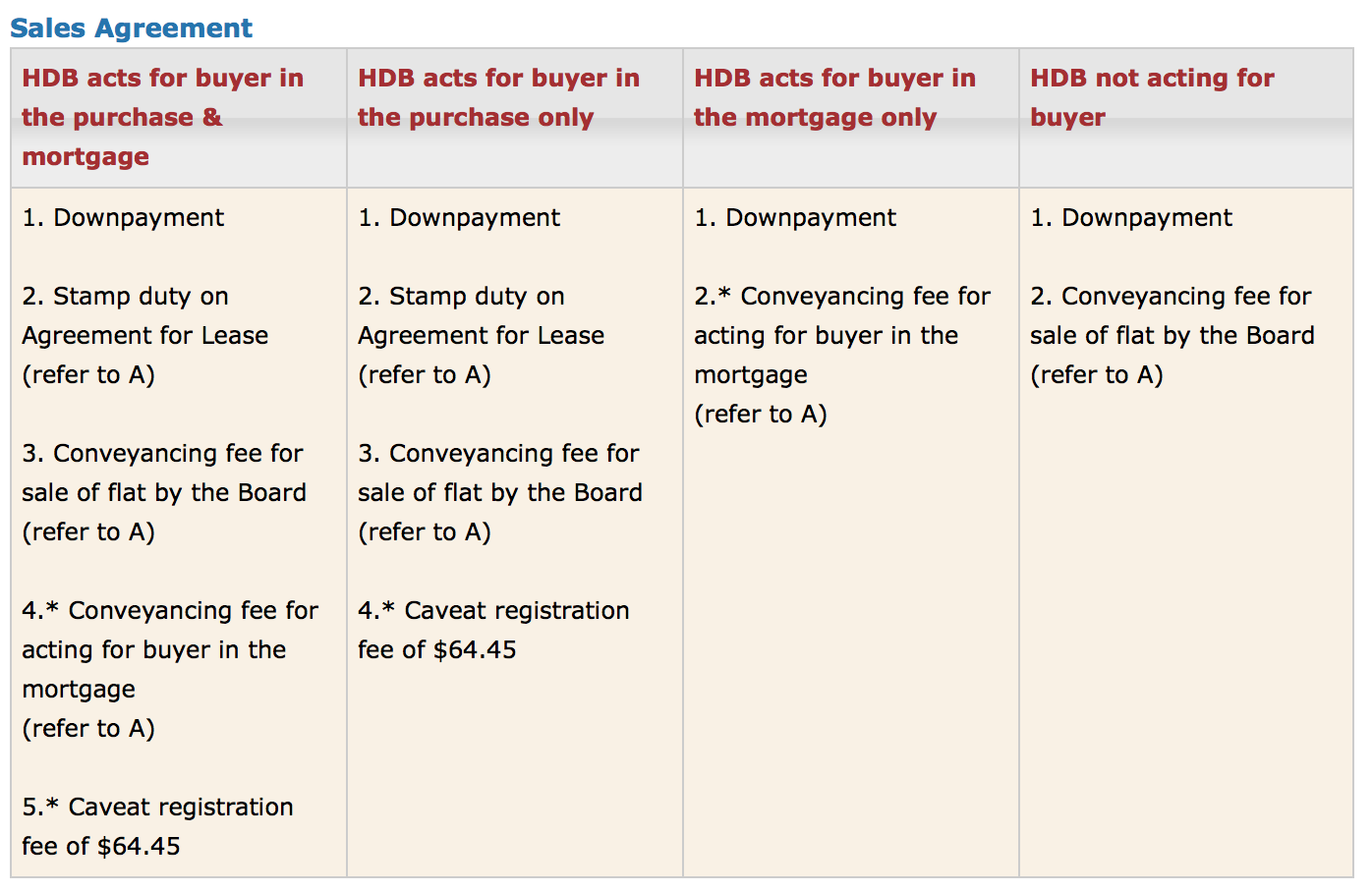

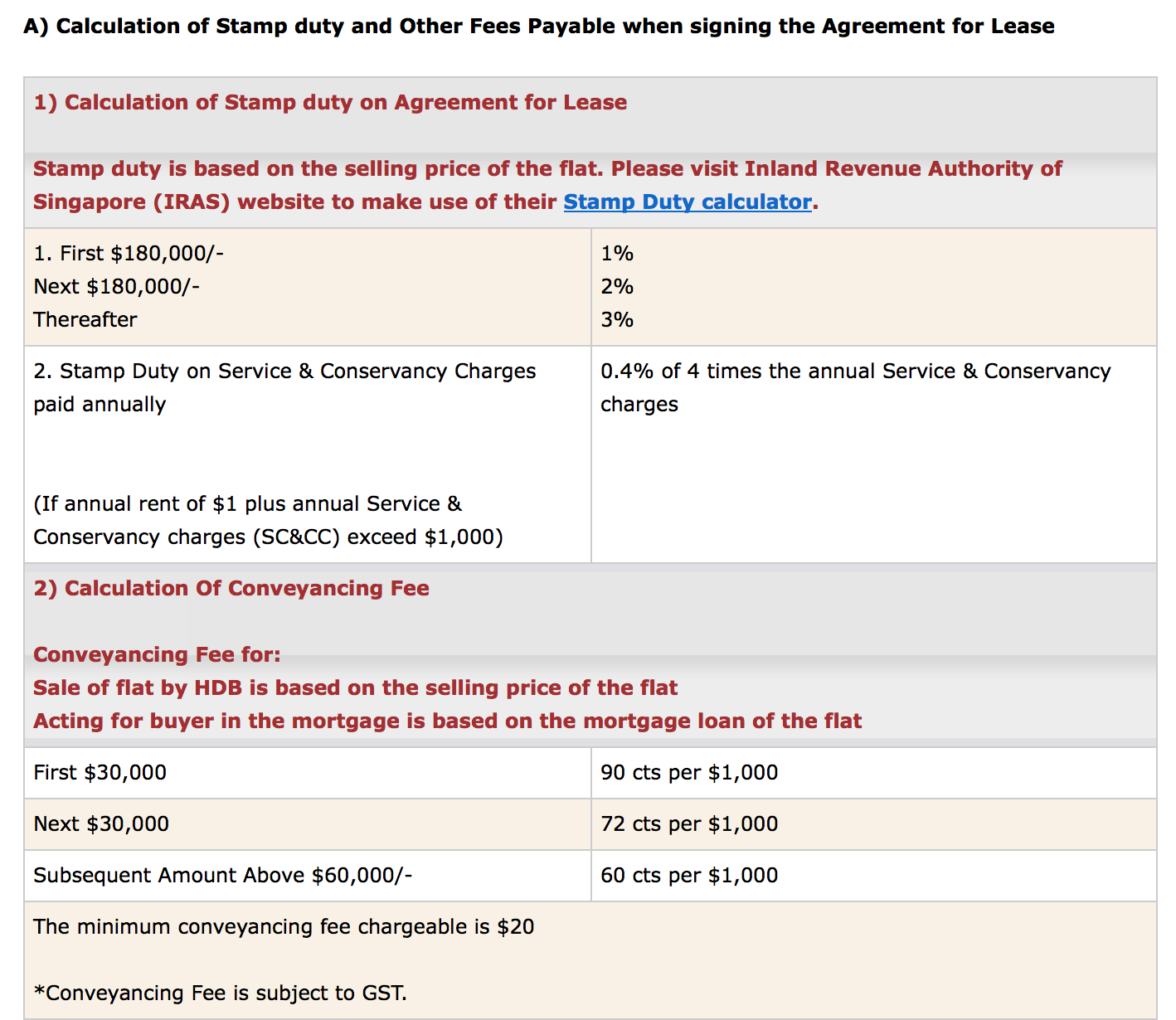

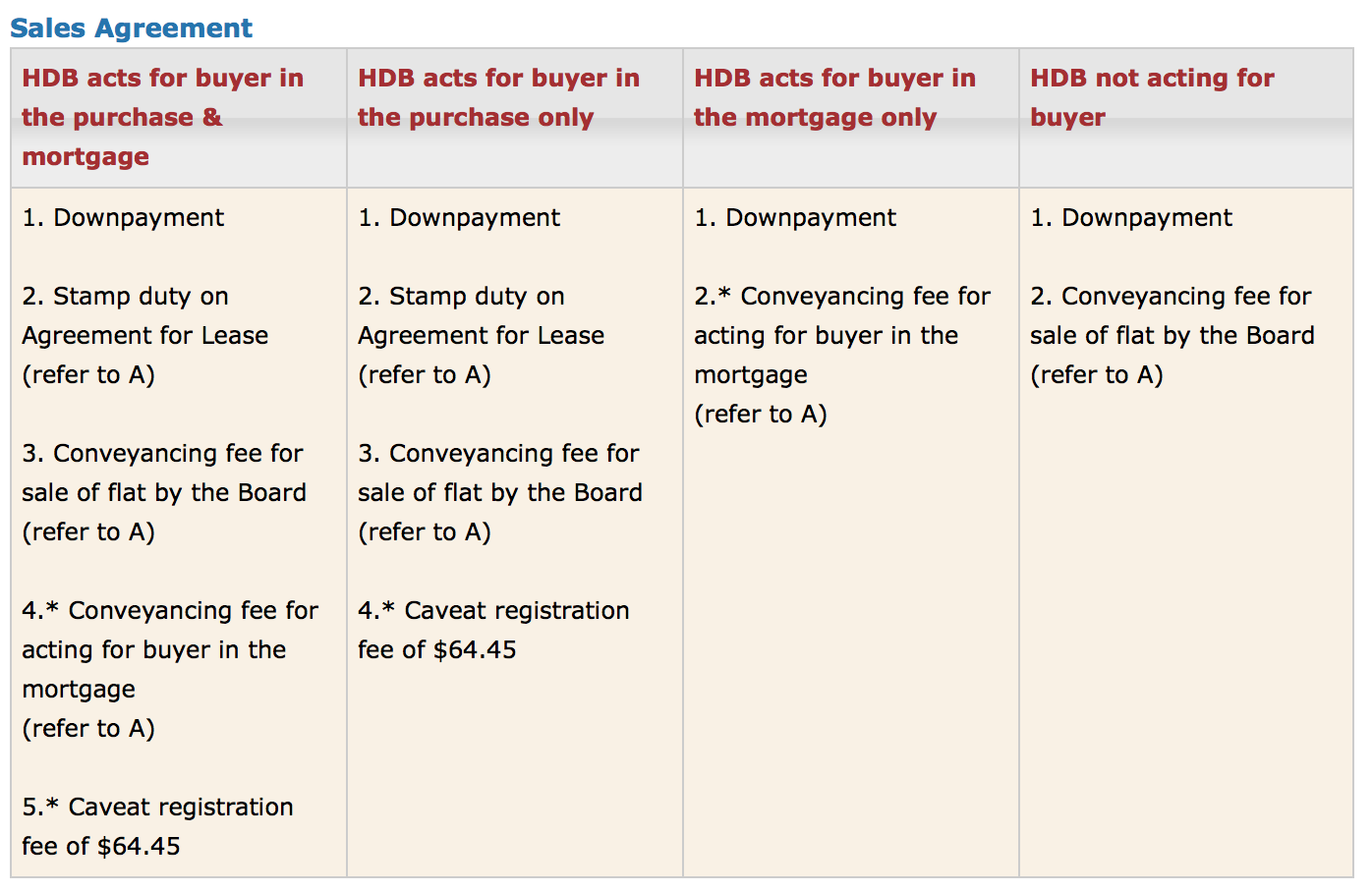

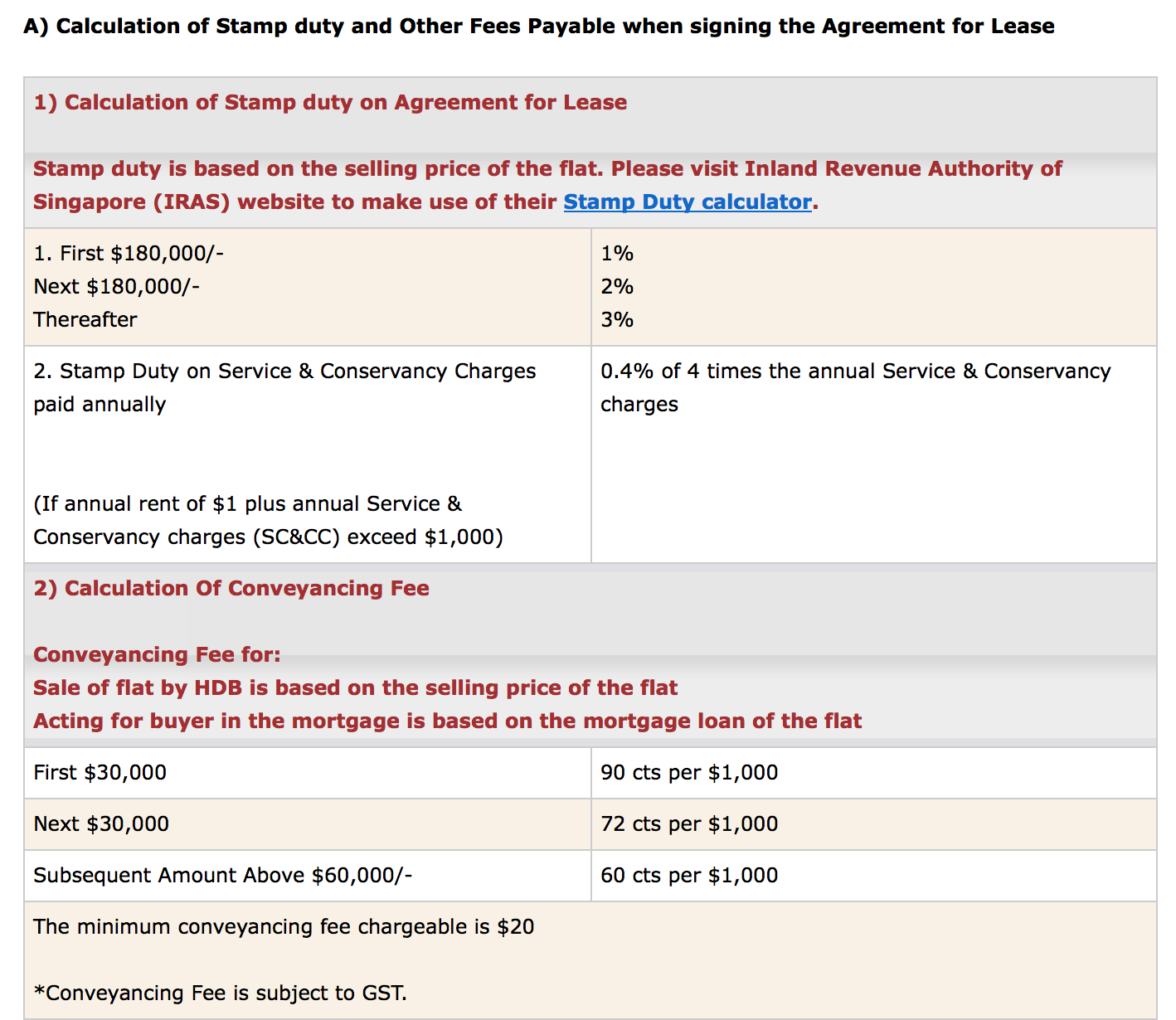

You would have noticed downpayment includes a (1-3% in legal and stamp fees) What are they?

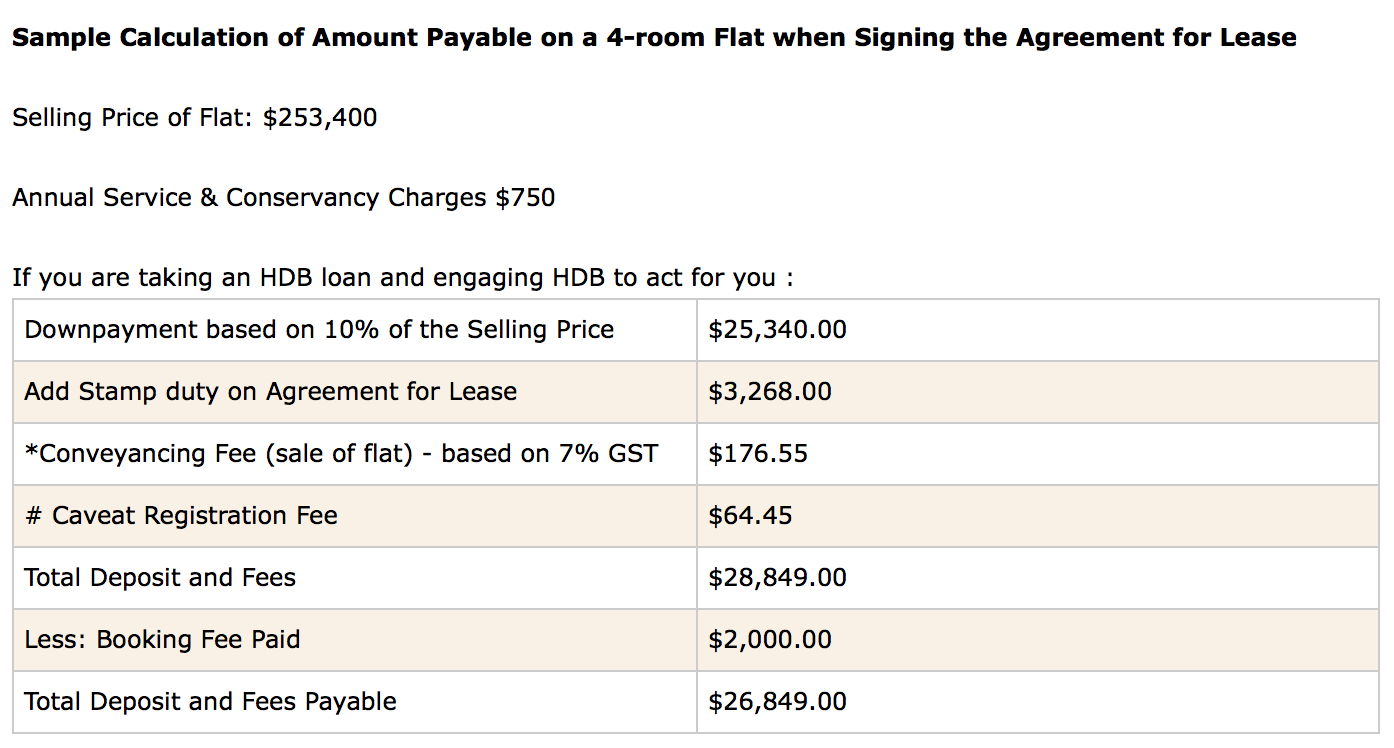

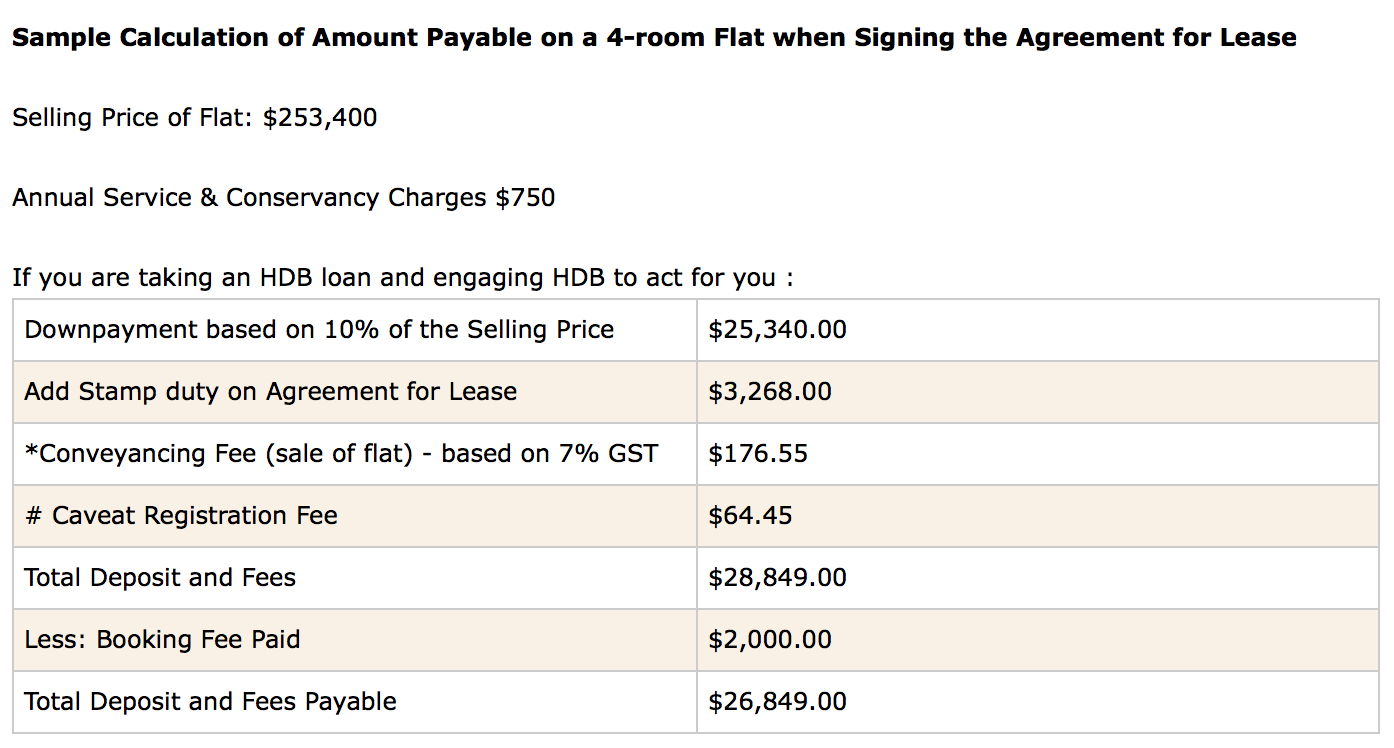

How much would you need to pay exactly?

Therefore, based on selling price of $253,400 for a 4 room flat, you would pay a total downpayment of around $30,000.

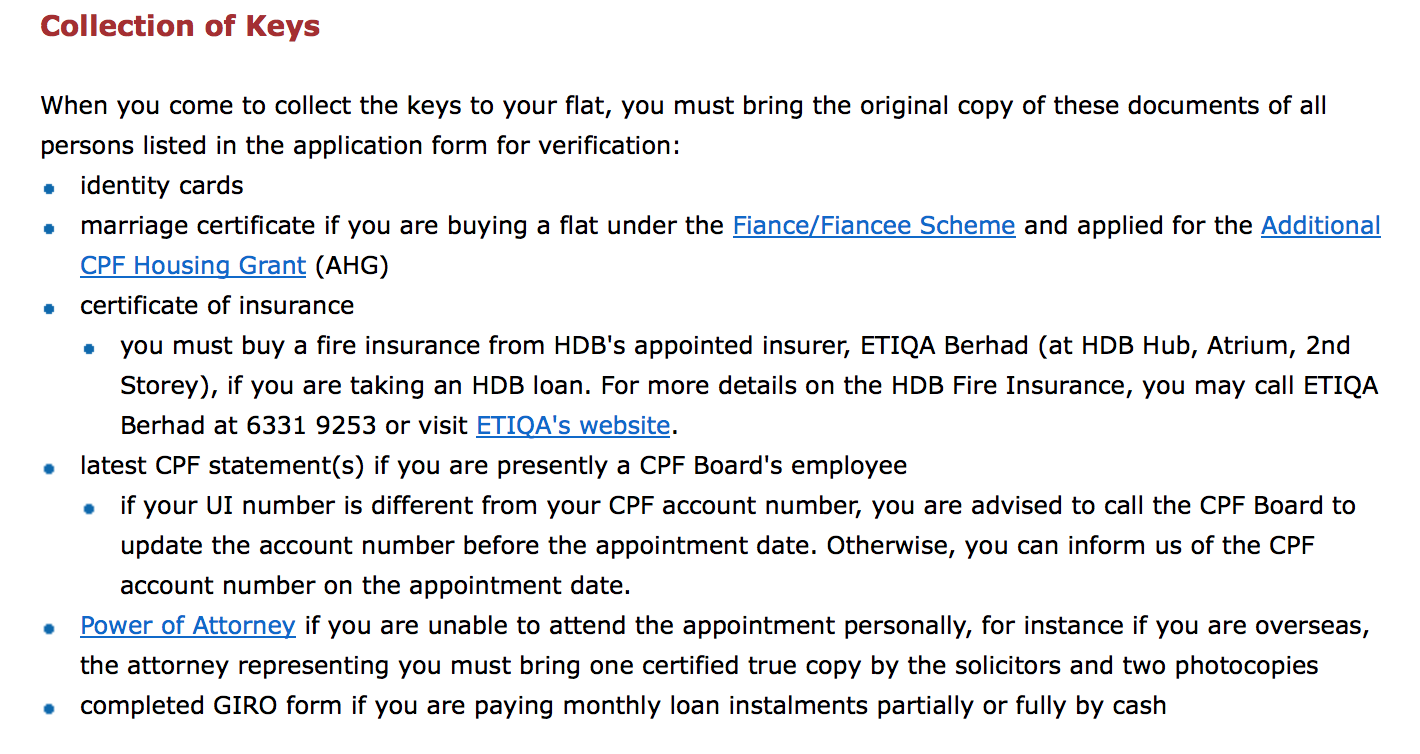

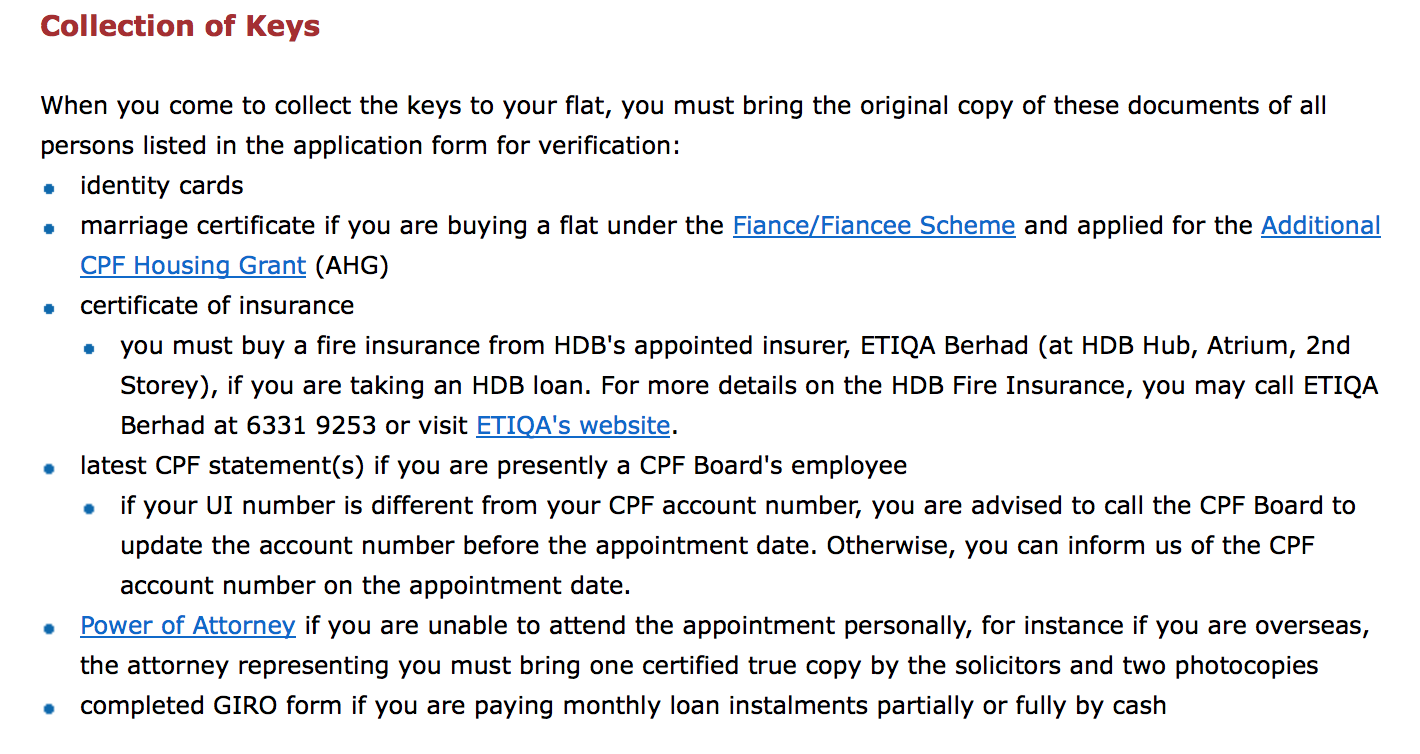

Step 7: FINAL STEP. Collection of Keys

After this long, difficult journey, it's at the last step. For BTO flats, you would be able to collect your keys in 3 years time. Waiting time varies.

Documents to prepare:

Paying the balance of the purchase fee.

Balance of the purchase price of the flat booked, by Cash or CPF or a combination of both.

Studio Apartment

The HDB will not grant loan for the purchase of the Studio Apartment. Applicants are required to pay the remaining 95% of the purchase price of the Studio Apartment in full before they can take possession of the flat.

Applicants who are owners of HDB flats may request for contra facility to offset the payment for the purchase of the Studio Apartment from the proceeds held by the HDB pending the completion of resale of their existing flat. The keys to the Studio Apartment will be issued after the completion of the resale of the existing flat.

HDB Concessionary Loan

If you are eligible for an HDB concessionary rate loan, you may be given a loan up to the housing loan ceiling, subject to full usage of funds from your CPF Ordinary Account and credit assessment.

GIRO Application For Paying Monthly Instalments by Cash

If you intend to pay the monthly instalments partially or fully by cash, you will have to submit a completed GIRO application form before we grant you a loan. If we do not receive the completed GIRO application form on or before the appointment for keys collection, we may withdraw the letter of offer and you will have to find alternative financing for the purchase.

Bank Loans in Case of Non-eligibility for HDB Concessionary Loan

If you are not eligible for an HDB concessionary rate loan, you may approach the banks or financial institution (licensed by MAS) to obtain a mortgage loan.

These are the major steps needed as you purchase your first home. It may be a painful process. The above information are gained from HDB website and updated as of 18 July 2014.

I'm writing this post to help myself be more aware of the costs involved. If my post has helped you in any way, it is my pleasure. Sourcing for all these information isn't easy. Information are all jumbled up.

Signing off,

Teenage Investor

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807

https://www.facebook.com/pages/Premium-Brands/707355762675807- Wells Fargo And The Rousseau Story

Found via Naked Capitalism. In March 2000, Norman and Oriane Rousseau put 30 percent down to buy a house at 580 Wilshire Place, Newbury Park, CA. In the following years they were solicited to refinance their loan. In October 2007 they met with the loan...

- Latest Mortgage Scandal: Force-placed Insurance

From The Big Picture.American Banker’s Jeff Horwitz has a spectacular piece of reporting today about goings on in an obscure corner of the mortgage-servicing world: Losses from Force-Placed Insurance Are Beginning to Rankle Investors.What is force-placed...

- Hussman Weekly Market Comment: The Second Wave Begins

I should also note some features of the resets we are now beginning to observe. It is tempting to think that with Treasury yields fairly low, mortgage resets might be fairly benign in terms of their impact. The problem is that these Option ARM and Alt-A...

- Debt Is Almost Gone

Earlier this month I charged almost the rest of the balance of our high interest debt off. This month I charged a total of $9.766.39 to my credit cards to pay off our debt. I left a little bit on for next payment so they take the full amount with the...

- Free At Last!

Hi Everyone, It's a big day for me today. I no longer have any student loans!! Way back in 2009 I graduated with a Bachelor of Science degree in Meteorology and with my 8 X 11 piece of paper, I had roughly $25,000 in student loan debt....