Money and Finance

Things changed with the financial crisis, as we know. Interest rates plunged and dividend stocks rapidly became an attractive alternative for income-seeking investors.

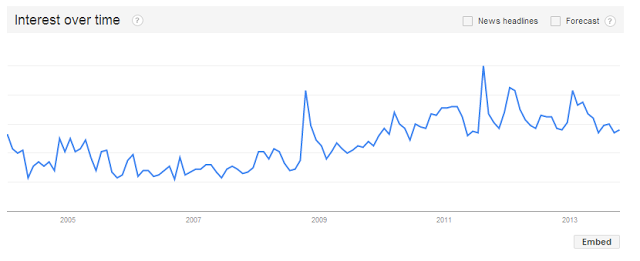

Indeed, the Google Trends chart for the search term “dividend stocks” illustrates the changes in sentiment from 2004 to present quite nicely:

Naturally, the financial services industry responded to strong investor demand for dividends by launching dividend-themed ETFs, ETNs, and funds to attract assets. Some are more creative than others, but when there's a revenue-weighted dividend ETF (not kidding), you know folks are running out of ideas.

Though low interest rates may be around a little longer, the prospect of rising interest rates in the coming years should at least limit further multiple expansion for higher-yielding dividend stocks. In the event of a market pull-back and considering the robust dividend growth we've seen in the last three years, I would expect to see more quality 3% to 5% yields coming available.

Stay focused and patient out there.

Best,

Todd

@toddwenning

Good reads this week

Quote of the Week

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- Where To Find Value In The Dividend Market Today

There's no question that dividend-paying stocks have become more popular in recent years as interest rates on fixed income and savings products declined. Indeed, dividend-focused ETFs and mutual funds have experienced strong inflows, some higher-yielding...

- Captain's Picks

Captain's Picks is a collection of various articles that have caught my eye recently. I think you may find them interesting. Here's this weeks crop .... Your Retirement Income Is On Sale - Dividend Growth Investor Three High Quality Dividend...

- Top 35 Dividend Growth Stocks E-book Realeased

Dan Mac over at Dividend Stock Investing has released his new E-book on Amazon and is available for FREE for the next 3 days (June 16,17 and 18)! It's definitely worth a look. The book is available in Kindle format. Don't have a Kindle ? Don't...

Money and Finance

Better Buying Opportunities Coming for Dividend Investors

In 2005, I distinctly recall perusing the Barnes & Noble business section for a book on dividend investing, only to find just one book that specifically addressed the topic. (There are, um, quite a few more available today on Amazon.com.)

Things changed with the financial crisis, as we know. Interest rates plunged and dividend stocks rapidly became an attractive alternative for income-seeking investors.

Indeed, the Google Trends chart for the search term “dividend stocks” illustrates the changes in sentiment from 2004 to present quite nicely:

|

| Source: Google Trends |

Fortunately, it seems we're past the "peak" for dividend valuations, investor interest appears to be turning elsewhere, and more long-term buying opportunities could thus present themselves.

Just this week, in fact, I started a position in Coca-Cola -- my first buy this year for the dividend sleeve of my portfolio -- and found it interesting that the stock was yielding over 3% for the first time since 2010."Non-dividend stocks have outperformed dividend stocks in the S&P 500 over a one year timeframe. Prior to this period, nonpayers had underperformed dividend stocks since late 2009." - FactSet Dividend Quarterly, September 2013

Though low interest rates may be around a little longer, the prospect of rising interest rates in the coming years should at least limit further multiple expansion for higher-yielding dividend stocks. In the event of a market pull-back and considering the robust dividend growth we've seen in the last three years, I would expect to see more quality 3% to 5% yields coming available.

Stay focused and patient out there.

Best,

Todd

@toddwenning

Good reads this week

- "Living in a Low Return World" -- Abnormal Returns

- "Buffett's Folly: The Downside of Compound Interest" -- Monevator

- "Dividend Compass Cup" -- Total Return Investor

- "What Ponds are You Fishing In?" -- Oddball Stocks

Quote of the Week

"My father was very sure about certain matters pertaining to the universe. To him, all good things -- trout as well as eternal salvation -- come by grace and grace comes by art and art does not come easy." -- Norman Maclean, "A River Runs Through It"

- The Evidence For Dividend Growth Investing

This following post is written by Ben Reynolds, who runs the Sure Dividend site. Sure Dividend focuses on high quality dividend growth stocks suitable for long-term investing. Dividend growth stocks are an excellent vehicle to build passive income over...

- Weekly Roundup - September 15, 2012

Well another week is in the books so that means it's time for another weekly roundup of blog links and articles that got me thinking. So here goes. Trading Vs. Investing Dividend Mantra wrote about the difference between trading and investing...

- Where To Find Value In The Dividend Market Today

There's no question that dividend-paying stocks have become more popular in recent years as interest rates on fixed income and savings products declined. Indeed, dividend-focused ETFs and mutual funds have experienced strong inflows, some higher-yielding...

- Captain's Picks

Captain's Picks is a collection of various articles that have caught my eye recently. I think you may find them interesting. Here's this weeks crop .... Your Retirement Income Is On Sale - Dividend Growth Investor Three High Quality Dividend...

- Top 35 Dividend Growth Stocks E-book Realeased

Dan Mac over at Dividend Stock Investing has released his new E-book on Amazon and is available for FREE for the next 3 days (June 16,17 and 18)! It's definitely worth a look. The book is available in Kindle format. Don't have a Kindle ? Don't...