Money and Finance

- John Mauldin: France: On The Edge Of The Periphery

Recently there have been a spate of horrific train wrecks in the news. Almost inevitably we find out there was human error involved. Almost four years ago I began writing about the coming train wreck that was Europe and specifically Greece. It was clear...

- Doom Heralded At Hayman By Widening Trade Deficit: Japan Credit

Thanks to Will for passing this along. Going back and reviewing an investor letterfrom Kyle Bass dated November 30, 2011, Bass wrote “We believe that Japan would have a bond crisis of its own within the next two years without the current European debt...

- Satyajit Das: Why Germany Can't Bail Out Europe

Germany is indirectly exposed through its support of various official institutions like the European Union (EU), the European Central Bank (ECB), the International Monetary Fund (IMF) and special bail-out funds. As of April 2012, the exposure of ECB alone...

- New Preface To Charles Kindleberger, The World In Depression 1929-1939

Found via Calculated Risk. The parallels between Europe in the 1930s and Europe today are stark, striking, and increasingly frightening. We see unemployment, youth unemployment especially, soaring to unprecedented heights. Financial instability and distress...

- John Mauldin: Waving The White Flag

For quite some time in this letter I have been making the case that for the eurozone to survive, the European Central Bank would have to print more money than any of us can now imagine. That the sentiment among European leaders was that they were prepared...

Money and Finance

Beijing’s new leaders are right to hold back - By Michael Pettis

The world is struggling to rebalance its great savings imbalances and is not advancing much. In Europe, and as I discussed in my very long May 11 blog entry, it seems that Germany is still unable to force though the adjustments needed in internal demand and is hoping to foist its imbalances onto the rest of the world now that the rest of Europe is too sick to absorb them.

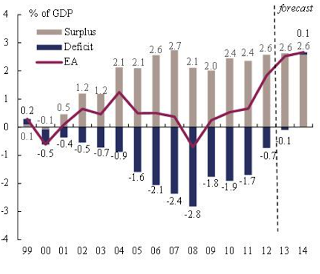

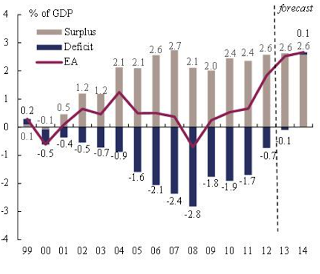

Germany is currently running the largest trade surplus in the world, while the deficits of peripheral Europe are being squeezed down through unemployment – which is certain to remain high for many more years. Two weeks ago a couple of economists from the EU spoke at my central bank seminar, and among other things they presented us with what I would call the scariest graph in the world. Here it is:

The scariest graph in the world

The graph makes it pretty clear that the surge in European surpluses, which was largely matched before the crisis by the surge in deficits in peripheral Europe, is expected to be maintained even as surpluses in China and Japan, the other leading surplus nations, have dropped dramatically, but since these northern European surpluses can no longer be counterbalanced by deficits within peripheral Europe given how indebted and troubled are their European trade partners, the hope is simply to force them abroad. In a world with weak demand and deteriorating trade relationships, in other words, the northern Europeans have decided that rather than boost domestic demand they will resolve their domestic problems by absorbing far more than their share of global demand, to the tune of 2-3% of Europe’s GDP.

This is absurd. If they succeed it will only be temporarily and at the expense of their already-suffering trade partners, and as a consequence it will just be a question of time before global trade relationships get even nastier than they have been. Of course if trade relationships deteriorate enough, and so force the imbalances back onto Europe, the result will be a surge in German unemployment with no corresponding relief in unemployment in the periphery.

- John Mauldin: France: On The Edge Of The Periphery

Recently there have been a spate of horrific train wrecks in the news. Almost inevitably we find out there was human error involved. Almost four years ago I began writing about the coming train wreck that was Europe and specifically Greece. It was clear...

- Doom Heralded At Hayman By Widening Trade Deficit: Japan Credit

Thanks to Will for passing this along. Going back and reviewing an investor letterfrom Kyle Bass dated November 30, 2011, Bass wrote “We believe that Japan would have a bond crisis of its own within the next two years without the current European debt...

- Satyajit Das: Why Germany Can't Bail Out Europe

Germany is indirectly exposed through its support of various official institutions like the European Union (EU), the European Central Bank (ECB), the International Monetary Fund (IMF) and special bail-out funds. As of April 2012, the exposure of ECB alone...

- New Preface To Charles Kindleberger, The World In Depression 1929-1939

Found via Calculated Risk. The parallels between Europe in the 1930s and Europe today are stark, striking, and increasingly frightening. We see unemployment, youth unemployment especially, soaring to unprecedented heights. Financial instability and distress...

- John Mauldin: Waving The White Flag

For quite some time in this letter I have been making the case that for the eurozone to survive, the European Central Bank would have to print more money than any of us can now imagine. That the sentiment among European leaders was that they were prepared...